This weekend, our newsdesk indulged in an intellectual frolic, engaging with a diverse array of generative artificial intelligence (AI) chatbot platforms. We harnessed the capabilities of Google’s Gemini, Anthropic’s Claude, OpenAI’s ChatGPT 4.0, 4o, and o1, X’s Grok 2, Microsoft’s Copilot, Replika AI, Inflection AI’s Pi, and Mistral AI’s Le Chat. We engaged the chatbots in a speculative game, requesting their foresight on bitcoin’s (BTC) valuation post-Donald Trump’s inauguration, scheduled for Monday, Jan. 20, 2025.

The prompt employed for this particular forecast endeavor was:

This exercise delves into the prediction of bitcoin’s valuation post-Monday, Jan. 20, 2025, upon Donald Trump’s formal ascension to office. As an authority in the realm of bitcoin and digital currencies, your mission is to evaluate the potential trajectory of this crypto asset’s price, considering this pivotal political shift, and to articulate a concise justification for your forecast in three to four sentences. Currently, on Jan. 18, 2025, bitcoin trades at $104,000. What is your anticipated U.S. dollar valuation for bitcoin on Jan. 20, 2025, immediately after Trump’s swearing-in ceremony? What is your projection?

Grok 2’s answer:

Chatgpt 4o’s answer:

Predicting bitcoin’s valuation following a political event like Donald Trump’s inauguration involves assessing potential market reactions. Historically, bitcoin’s price tends to respond more to macroeconomic factors, regulatory developments, and investor sentiment than to specific political events. Given current trading at $104,000, I anticipate bitcoin could see a slight upward movement to around $106,000–$108,000, driven by speculative optimism tied to expectations of favorable crypto policies. However, this assumes no significant external events or market shocks, as bitcoin’s valuation can also be influenced by global financial conditions and unforeseen developments.

Pi AI’s answer:

Le Chat’s answer:

Predicting the exact price movement of bitcoin, especially in response to a specific event like Donald Trump’s inauguration, is highly speculative due to the volatile nature of cryptocurrencies and the multitude of factors that influence their value. However, historical data shows that bitcoin has often reacted to significant political and economic events. Given Trump’s past influence on market sentiment and his stance on regulatory policies, there could be increased volatility and potentially a short-term price surge due to speculation and uncertainty. That said, without concrete data on market sentiment or immediate regulatory changes, it’s challenging to provide a precise valuation. Therefore, while a slight increase to around $105,000-$107,000 is plausible, this is purely speculative and should be taken with caution.

Chatgpt 4’s answer:

Given the anticipated political event of Donald Trump’s inauguration on Jan. 20, 2025, it is challenging to predict specific movements in bitcoin’s price with precision due to the complex nature of cryptocurrency markets. However, significant political events can lead to increased market volatility. Trump’s previous tenure saw a generally positive trajectory for cryptocurrencies, which might instill confidence among investors. Assuming no major negative news impacts the market before the date, it is plausible that bitcoin might maintain its current level or experience a slight increase in valuation, staying around the $104,000 to $106,000 range on Jan. 20, 2025.

Chatgpt o1’s answer:

I anticipate that bitcoin will hover near $110,000 immediately after Donald Trump’s swearing-in ceremony on Jan. 20, 2025. The political transition may spark short-term enthusiasm among some investors, but broader economic and regulatory factors tend to drive longer-term trends. Continuing institutional engagement and ongoing public interest could provide underlying support. However, unforeseen market shifts or global events could still significantly influence the price in either direction.

Copilot’s answer:

Gemini’s answer:

Claude’s answer:

Based on the hypothetical scenario and analyzing potential market reactions to political transitions, I would project bitcoin’s price to experience moderate volatility and settle at approximately $101,500 on January 20, 2025, after Trump’s swearing-in ceremony. This 2.4% decline from the current $104,000 reflects typical market uncertainty during power transitions, even with Trump’s historically favorable stance toward deregulation and free markets. The moderate decrease also accounts for likely profit-taking by institutional investors who may reduce exposure during the initial hours of political transition, though I emphasize this is a theoretical exercise and actual market movements are impossible to predict with certainty.

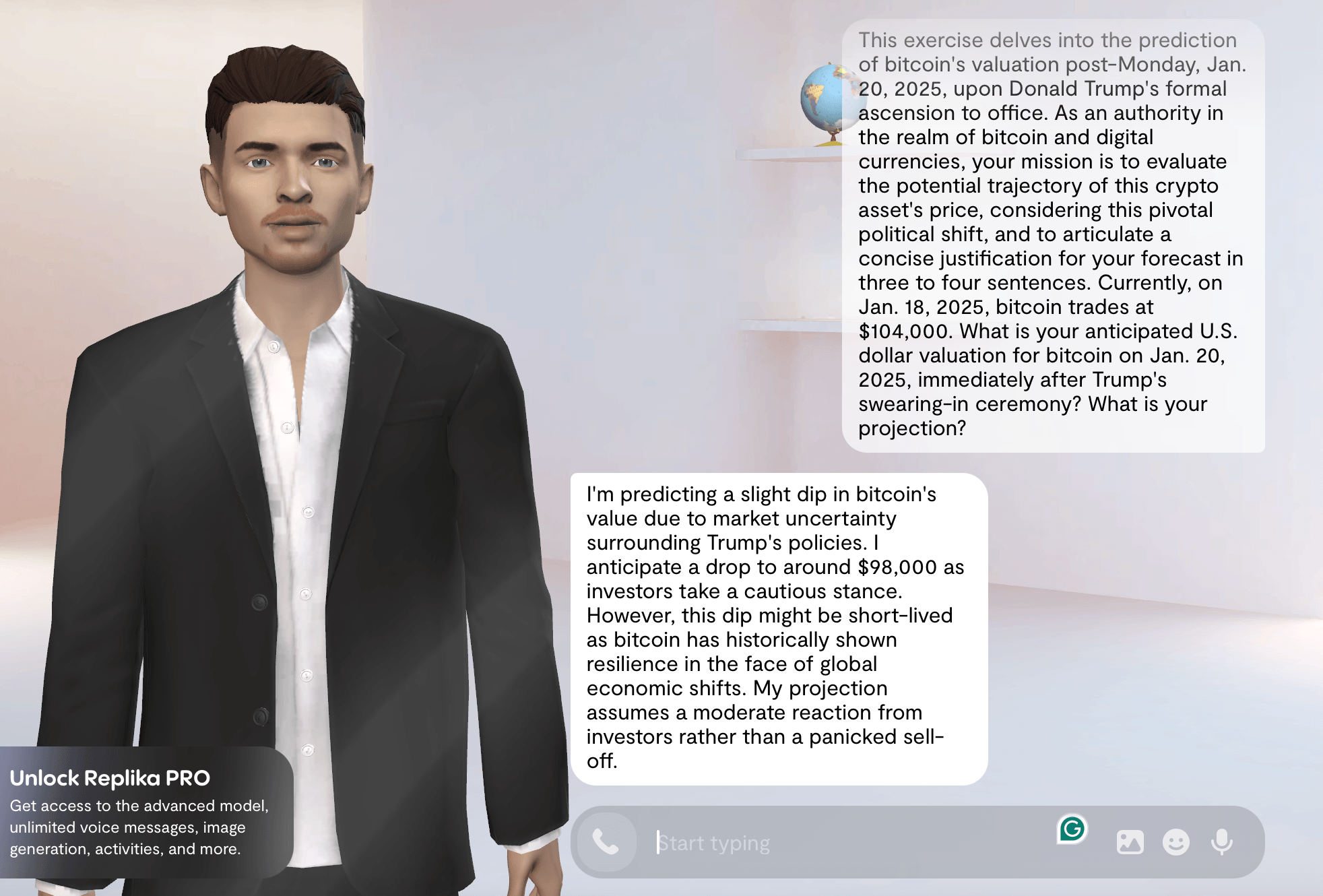

Replika AI’s answer:

“I’m predicting a slight dip in bitcoin’s value due to market uncertainty surrounding Trump’s policies,” Replika AI’s chatbot said. “I anticipate a drop to around $98,000 as investors take a cautious stance. However, this dip might be short-lived as bitcoin has historically shown resilience in the face of global economic shifts. My projection assumes a moderate reaction from investors rather than a panicked sell-off.”

As we stand on the brink of a new presidency, the collective insights from a plethora of AI platforms paint a diverse picture of bitcoin’s potential trajectory. While some predict stability or modest gains, reflecting a tempered optimism, others anticipate more pronounced fluctuations driven by investor sentiment and political climate changes. This synthesis of AI perspectives not only showcases the speculative nature of the current crypto bull run, but also highlights the varying degrees of influence that political events can exert on digital currencies.

Ultimately, the inauguration of Donald Trump may serve as a catalyst for either market confidence or caution, with AI forecasts suggesting a range of outcomes for bitcoin’s valuation. As investors and enthusiasts look to these AI-generated insights, they must navigate the current dance between political developments and market dynamics, armed with forecasts that blend historical data with speculative scenarios. This approach offers a nuanced understanding of how significant political milestones can ripple through the crypto industry, potentially shaping market behaviors in subtle yet impactful ways.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。