The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and refuse any market smoke bombs.

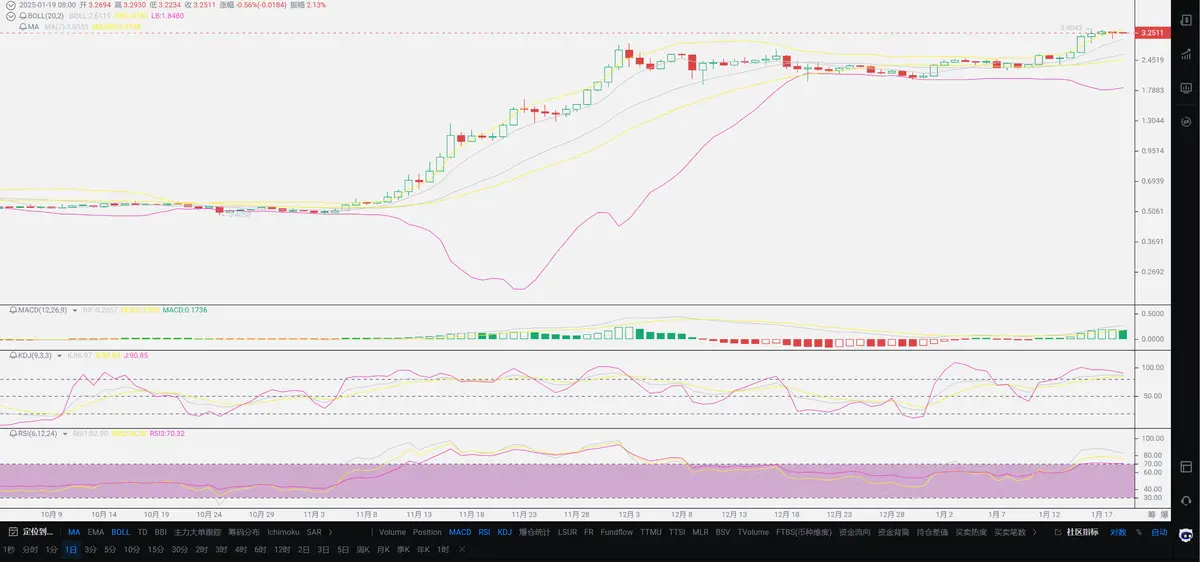

The market has been very volatile in the past week, and many friends have been questioning Lao Cui why the updates have been so slow. As the year comes to an end, many friends' visits and meetings have become a challenge. Additionally, with the year coming to a close, the verification of company operations and other aspects requires some time, so Lao Cui's articles will be written according to the overall trend of fluctuations. Normally, it is very difficult to break this range within a week; only after breaking the range will Lao Cui update the article again. Back to the point, Bitcoin broke the lower support level on the 13th, reaching the beginning of the eight-character, and many friends are very worried about whether the trend will reverse. At that time, I was meeting with clients and did not have time to update, only posting a dynamic to keep users calm, and the market trend had not reversed. I hope everyone can understand. Regarding this breaking of the range event, let's reassess the overall market.

With only one day left until the 20th, as mentioned in the previous dynamic, the sharp drop before the launch is a good thing for us. The major event we need to pay attention to is Trump's speech. From the previous series of actions, basic growth has become a conclusion, and there is no need to discuss the trend too much. The recent fluctuations are definitely extremely intense, whether it ultimately surges or plummets, a washout is necessary. Including the comparison of small coins' growth, it is clear that our previous view was correct; only Bitcoin and similar coins are worth holding. This also includes the recent comparison with Ethereum's growth, where the returns are minimal. At this stage, Bitcoin has once again reclaimed the 100,000 mark, but Ethereum's 4,000 still seems far away, and the recovery of ETH's 4,000 high point has become an important breakthrough for small coins. Especially the recently hot-performing Trump coin has driven SOL to break through. The previous article also mentioned Trump's coin, and those who did not get in on the first issuance are now starting to feel anxious.

Life is like this; one always regrets after losing or missing out. Lao Cui straightforwardly states that although I had advised everyone to pay attention to his coin and hold some, I personally did not get in. Many friends are now starting to care about whether they can get in. This type of coin is similar to FIL; it can be held for a while during Trump's term, but in the last year of the term, it will definitely be necessary to clear out related coins. If you have a speculative mindset, you can try it out, but Lao Cui's focus is not primarily on speculation; I still choose to hold Bitcoin, Ethereum, and SOL conservatively. An investment of less than ten million has directly reached a market value of over 20 billion, and this return rate is indeed considerable. At least this step lays the foundation for Trump's governance direction and gives everyone confidence that the strategy arrangements in the coin circle will definitely not just be talk. Compared to the previous bottom-seeking, the recent market reversal makes Lao Cui even more worried. According to predictions from major institutions, it is highly likely that Trump will strongly release favorable news for the coin circle within a month of taking office. This wave of newly launched coins can be seen as paving the way for the future. Those who should enter the market should take action; the current favorable news will be the strongest stimulus policy in history, and it must be seized well.

Compared to coins that have already shown results, everyone can pay attention to Ethereum. Our V God has finally shifted his focus from women back to the construction of Ethereum. Yesterday, he directly stated that he would rebuild the Ethereum team, dedicated to restoring Ethereum's glory, and will implement all previous frameworks and expectations. This wave of rebuilding Ethereum will bring about a complete change. As long as the promised things are completed before this bull market ends, Ethereum's growth will definitely return to the second position. At this stage, Ethereum is indeed underperforming. If the technical aspects are not easy for everyone to understand, just look at Trump; his issued coins completely follow the SOL channel, directly bypassing ETH, which is a clear distinction. This is also the reason for SOL's explosive growth yesterday; this kind of growth is almost of the same origin. As long as Trump's coin starts to rise, it will drive SOL's growth. Up to now, there has been no sign of decline, and this growth has exceeded expectations. For those who want to take over, Lao Cui also supports it, but in the long run, coins linked to personalities can only be approached with a speculative mindset. The logic is simple: if this presidential currency can see results, then the next president will definitely issue their own coin. Moreover, Trump seems a bit stingy; since building the coin ecosystem, it has only been three to four months, and the cost has not even reached the tens of millions level, nor has he developed his own channel. If it were an ordinary coin, it would be a high-risk investment option, relying solely on his fame to drive it, and there has been no revolutionary breakthrough in the technical aspects. Being able to last until the end of the term is already quite resilient.

Of course, Lao Cui is not dismissing this type of coin; I just hope everyone invests rationally. In terms of growth potential, it will definitely be greater than all coins within four years, making it worth engaging with for a while. I remind everyone not to deviate from the focus. From the current capital trends, the amount of funds withdrawn from Ethereum has almost all entered new coins, which has led to Ethereum's short-term performance not being strong, and even showing a decline. There is no need to worry too much; the growth of newly listed coins will definitely be more stable; it is just a matter of time. In investing, one must not look at one mountain while thinking another is higher. The current trend is most taboo to frequent trading; one must hold firmly. The time for Ethereum's growth has not truly arrived. The ancestor of all coins, Bitcoin, naturally needs no further explanation. It only has one path of growth, and with a certain amount of funds, it will definitely be primarily in Bitcoin. Regardless of the growth of any coin, the normal trend of the coin circle will drive Bitcoin's short-term growth. It is estimated that during Trump's presidency, it will definitely create a historic high for Bitcoin, and the overall high point of cryptocurrencies will definitely be born during Trump's term. After that, it is highly likely that this market will show a downturn. In the next four years, everyone must seize the opportunities in life; it is not about defying fate, but crossing classes in the coin circle can still be achieved.

At the end of the article, let's talk about the recent trends. In the short term, whether it is competition from other markets or new coins in the coin circle, they will absorb some funds for entry. Coins within Bitcoin will definitely focus on growth, while other coins will be under some pressure. With limited funds, plus the Federal Reserve's suppression, one thing to note recently is that the Federal Reserve is withdrawing regulation, which has basically become a clear sign of a falling out with Trump. Coupled with the highly centralized power of Trump, this influence will inevitably impact the market economy. The number of interest rate cuts will indeed have unclear phenomena; it all depends on the duel between the two. The best scenario is that interest rate cuts come as scheduled, combined with Trump's push, even allowing Bitcoin to stand in the 15-18 range is normal. If these two are clearly defined, Bitcoin will likely stop in the 12-15 range. It all depends on how the strategies are implemented later; Ethereum is the same, and this wave's high point should be around 5,000, with strong momentum possibly reaching the 8-10 range. The overall trend is already clear; those who are bearish can temporarily stop. If you must short, wait until the market reaches that position to discuss. As for the entry position for contract users, you can directly message Lao Cui; this article will not elaborate too much, aiming to clarify thoughts. If you want to invest in Trump's coin, just do a good job of psychological guidance for speculation!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three. The master considers the overall situation and plans for the big picture, not focusing on one piece or one territory, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。