The concept of a U.S. bitcoin reserve has drawn significant attention in recent months, with advocates arguing it could position the country as a leader in digital finance. Proposed under the BITCOIN Act, introduced by Senator Cynthia Lummis in 2024, the initiative calls for the government to accumulate up to one million bitcoins over five years, utilizing seized bitcoin and other resources. Proponents suggest the move could diversify national assets, hedge against inflation, and bolster the U.S. dollar’s status as the global reserve currency.

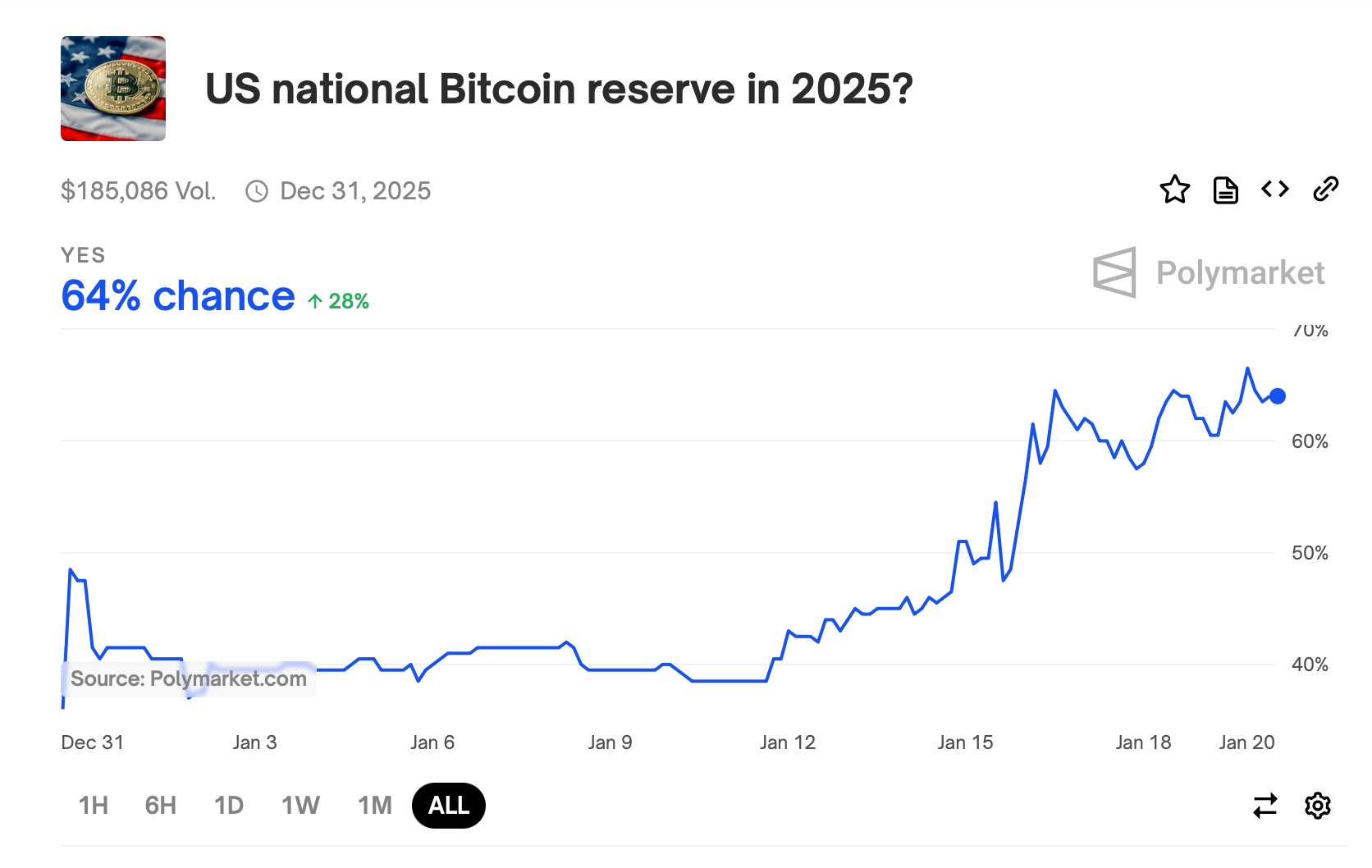

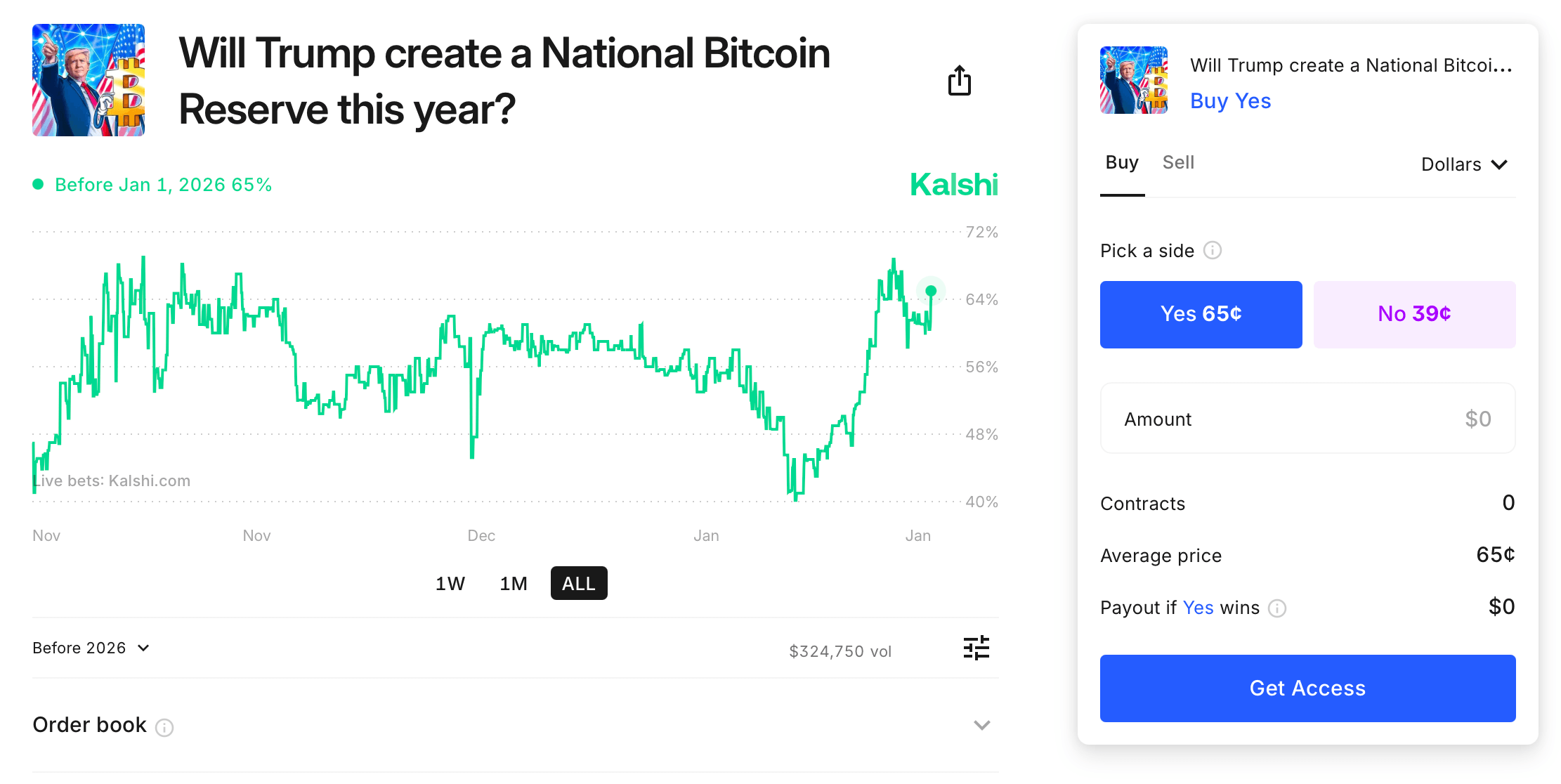

Polymarket, a popular prediction market, has shown increasing confidence in this proposal. Odds surged from below 50% earlier this month to 64%, reflecting growing sentiment that the Trump administration’s perceived pro-cryptocurrency stance will drive the initiative forward. The administration’s focus on financial innovation and digital asset adoption has been a recurring theme in recent policy discussions. The predictions marketplace Kalshi also has relatively similar odds for the BTC reserve standing at 65%.

Critics of the proposal, however, remain vocal. Concerns about bitcoin’s volatility, the logistical challenges of securing the reserve, and its potential impact on the decentralized ethos of cryptocurrencies have raised doubts. Skeptics also question whether diverting funds from gold reserves or Federal Reserve surpluses could create broader economic instability.

Despite these challenges, momentum for a U.S. bitcoin reserve mirrors the broader trend of governments exploring digital assets. China, for example, has advanced its own initiatives with a digital yuan, further fueling the urgency for U.S. policymakers to act. As Polymarket and Kalshi bettors continue to track developments, the initiative’s future could carry profound implications for the global financial landscape and the adoption of cryptocurrency as a national strategic asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。