This column focuses on sharing major mainstream cryptocurrencies such as BTC/ETH/EOS/XRP/ETC/LTC/DOGE for a long time. Follow the public account "Yinbi" to avoid getting lost and enjoy more service guidance.

BTC:

Bitcoin has recently struggled to rise, and after the initial excitement of Trump's presidency, the upward momentum seems to have quickly dissipated.

The difficulty of rising has increased sharply. Although the rebound strength remains strong, it is unlikely to encounter significant breakthroughs in the near future based on the current trend.

In terms of thinking, we must maintain previous doubts. The events surrounding Trump's presidency merely heated up old news, and any breakthroughs are at most just a reheating process. However, after the breakthrough, the silence returned quickly, making it hard not to suspect that major institutions are using this rise to offload their positions.

This week's recent cycle resistance point remains at the 10.65 line. If it cannot stabilize soon, the upward trend will not exist in the short term.

Therefore, in terms of reference, we can focus on the cycle resistance at 10.6-10.65. If it cannot break through, we can consider positioning for a medium-term short, looking for opportunities for a deeper pullback.

The bottom cycle support is at the 9.7 line, with certain support at 10.2-10 along the way. For a medium-term downward view, we should focus on reducing positions in batches at 10.2-10-9.7.

However, it is crucial to note that if the 9.7 support is completely broken, it would indicate that the pullback phase is returning. If 9.7 support holds, it would merely be a deeper pullback.

ETH:

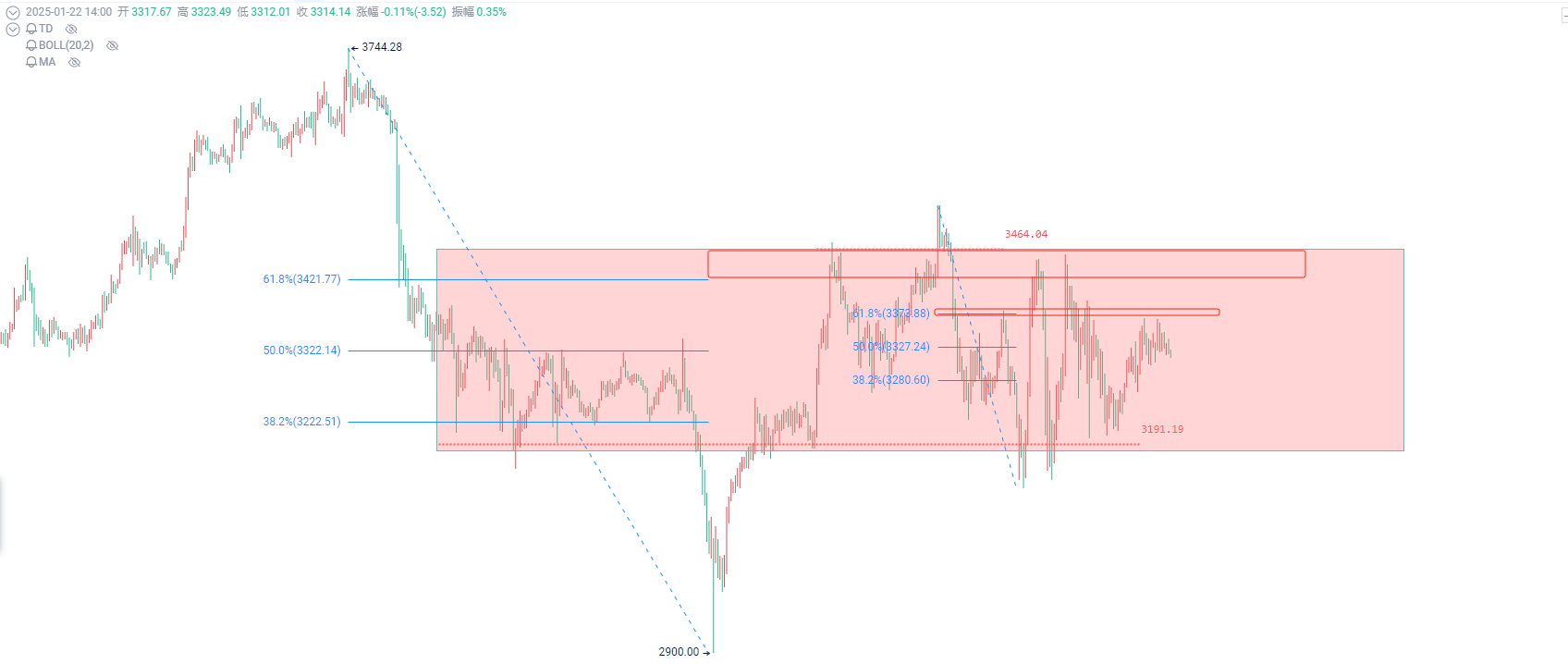

Ethereum has not fluctuated much recently and has begun to enter a consolidation zone around 3200-3400.

In recent trends, high selling and low buying within this range have yielded certain results.

The intraday trend is oscillating around the midpoint of 3300, with fluctuations both above and below, making it a poor time to seek entry.

Currently, we should further focus on the potential for a rebound, with the upper range resistance at 3370-3420.

The strategy can be to initially build a position at the top range of 3370, followed by additional purchases at 3420-3450, with the final cycle resistance to watch at 3500.

For potential pullbacks, we should focus on the bottom of this oscillation range—3200-3100—while simultaneously reducing positions in batches and moving our stop-loss.

SOL:

In yesterday's video, it was mentioned to adjust the strategy and appropriately increase positions after the price changed to 230, bringing the average price to around 240 (original entry point 250).

Subsequently, it was mentioned to reduce the portion added at the original entry point of 250, maintaining a defense at the 240 cost.

Currently, the overall market is facing significant upward challenges, with a considerable trend of retracement. Therefore, it is recommended to sell all positions in the 260-270 range today.

DOGE:

In yesterday's video, it was mentioned to seek entry opportunities again at the top around 0.38-0.39, and the highest rebound yesterday coincidentally reached the 0.4 line.

The short positions have been laid out, with defense focused around 0.41, and further retracement looking down to the 0.33-0.31 line.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。