Go with the flow, don't go against it.

Author: Route 2 FI, Kyle

Compiled by: Deep Tide TechFlow

Introduction

Crypto KOLs Route 2 FI and Kyle have published their thoughts on the current market state. They both believe that the current crypto market is in a unique phase, with market logic being drastically different from the bull market of 2021, and the market rhythms of Bitcoin and altcoins gradually diverging.

Route 2 FI focuses on the rapid turnover of market hotspots in the current cycle, comparing this year's situation with that of the 2021 market. Unlike before, players no longer enter CEX operations based on trending discussions but instead engage in PVP directly on-chain. The article also further explores the impact of the market's "reflexivity" on investment strategies. Kyle pays more attention to the logic of Bitcoin and altcoins having independent market trends, pointing out that Bitcoin is dominated by macroeconomic factors and capital flows, while altcoins are primarily driven by localized hotspots, spanning multiple "mini-cycles."

With rapid switching of hotspots and a surge in the number of tokens, it has become difficult to find true gems. The traditional HODL strategy seems less applicable in the current market environment, raising the bar for investors. The key to adapting to this new environment is flexibility; go with the flow, don't go against it. Learn to adjust strategies based on market fluctuations rather than clinging to past experiences.

Deep Tide TechFlow has compiled and translated the articles of these two crypto KOLs, and the following is the content of the articles.

1. Reflexivity in the Crypto Market: How the 2025 Crypto Market Differs from 2021

In this round of the cryptocurrency cycle, we have experienced several "mini altcoin seasons," during which most coins (including older coins from the previous cycle) have seen significant increases. Based on my observations, the following time periods can be noted:

January 2023 to March 2023

October 2023 to March 2024

September 2024 to December 2024

In addition, market hotspots have undergone multiple rotations. For example, from the popular gambling coins and Telegram bots in the summer of 2023 to the rise of AI entities and DeFAI (decentralized artificial intelligence) starting in the fourth quarter of 2023.

However, many investors are still hoping for a large-scale altcoin bull market, similar to the two frenzies of 2021. It is important to note that the current market environment has changed significantly. Compared to four years ago, there may be nearly 1,000 new altcoins with certain roadmaps in the market, making investment choices more complex.

The past investment strategy was typically to buy altcoins, expecting their gains to exceed Bitcoin (BTC), and then transfer the profits to Bitcoin or USD. But the current question is: which altcoins should you actually buy? With the sharp increase in market varieties, investors can easily choose the wrong coins—perhaps the coin you bought hasn't risen, while your friend is profiting from other coins.

Another major feature of this cycle is the significant increase in on-chain activity. Although there was also on-chain activity in 2021, compared to today, the scale and complexity of highly active areas in the Solana ecosystem (the so-called "trench") were far less.

In the early days, investors could easily log into Binance to purchase mainstream altcoins, and the investment logic was relatively simple: when Hsaka mentioned some "hot words," you knew to go long on $SOL, followed by $AVAX.

However, with the explosion of $PEPE in April 2023, the market landscape changed dramatically. Meme coins began to receive widespread attention, starting with $PEPE, followed by a series of meme coins like $BITCOIN, $WIF, $POPCAT, $GOAT, etc. The popularity of these coins not only reflects changes in market sentiment but also highlights the important role of social media in driving investment trends.

The current crypto market environment has undergone significant changes, shifting from a situation where most coins rose in sync to a market dominated by "meta cycles." For example, different types of tokens (such as utility tokens, animal coins, AI entity tokens, etc.) take turns becoming market hotspots during specific time periods. This change has left many investors confused, especially those accustomed to hoarding spot tokens—a strategy that was the main play for veteran players in 2017 and 2021. So, is this method still effective in the current market? The answer is that this strategy is clearly no longer applicable to all coins.

In fact, even those veteran players who performed well in the 2017 and 2021 cycles may not have a significant advantage in the 2024 market if they do not timely transition from perpetual contracts on centralized exchanges. In contrast, new players who are active in the Solana ecosystem and focus on meme and AI coins may be better able to adapt to the current market changes.

The current market sees a surge in the number of token varieties, with decentralization being particularly prominent. The past investment strategy—simply "buy and hold"—now only applies to a few assets, such as Bitcoin (BTC) and Solana (SOL). This forces investors to rotate assets more frequently to seize short-term opportunities in the market.

If you are a trader willing to operate on both centralized exchanges (CEX) and on-chain, this new environment shouldn't overly concern you. As long as there is market volatility, there will always be trading opportunities. My advice is not to limit yourself to just "going long." When the market is uncertain, you can choose to hedge risks, earn funding rates, short, or even try pair trading.

Flexibility in responding to market changes is the key to success in the current environment.

So, has the market peaked? For Bitcoin, perhaps not yet. But I am confident that many altcoins have reached their historical highs and are unlikely to return to that level. This does not mean that altcoins won't experience multiple upward trends in 2025, but in the long run, the number of market buyers is insufficient to support the continuous selling pressure after unlocking tokens.

The "reflexivity" in the market is bidirectional. Just like a ball thrown into the air will eventually return to the ground, the fluctuations in market prices follow a similar logic.

2. Understanding the "Mixed Supercycle"

In the current crypto market, I believe we are in a phase of "Mixed Supercycle," and here are some of my insights.

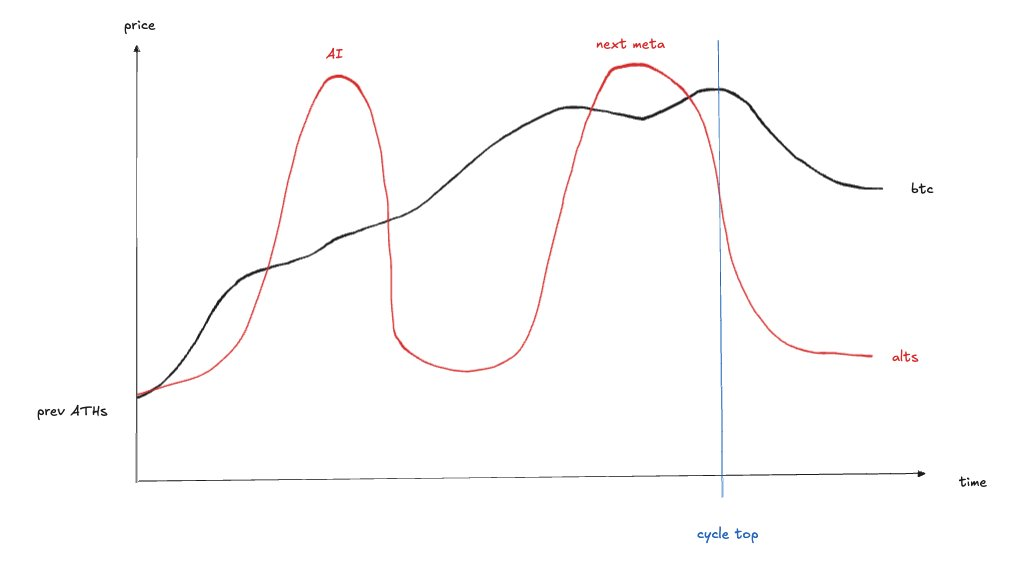

The market operation logic of Bitcoin (BTC) is independent of other assets; the market rhythms of Bitcoin and altcoins (alts) are completely different.

Altcoins typically reference Bitcoin's movements, but Bitcoin is more influenced by macroeconomic factors and capital flows, operating according to its own logic.

The traditional market cycle still exists, and the market will eventually reach a peak; however, during this period, we will experience many "mini altcoin cycles," which are localized hotspot rotation trends.

Judging whether the market has peaked based on the performance of altcoins is unreliable. For example, just like this past weekend, altcoins may experience extreme upward trends, but that does not mean the market cycle has ended.

This phenomenon has persisted throughout 2024—we have experienced multiple mini altcoin cycles (such as in the first and fourth quarters of 2024), while Bitcoin has its own independent market rhythm.

This trend has not fundamentally changed; the only difference is that Trump's policies may bring more favorable catalysts for Bitcoin (such as SBR), triggering more mini altcoin cycles.

This is also a key distinction between 2024 and 2025: the market operation mechanism is similar, but 2025 may be accompanied by more potential positive news, which could further catalyze localized trends in altcoins.

A common question in the crypto Twitter community (CT) is why many investors tend to hold altcoins rather than Bitcoin. If you observe the charts of other coins (OTHERS) in the market, you will find that their movements are filled with many "mini cycles," which are very similar to the charts I have drawn.

Therefore, even if Bitcoin's price remains stable, the mere fact that other coins are at low levels can trigger "extreme bearish sentiment" in the market.

In my view, it is currently difficult to find clear advantages in the market. Predicting which popular coins will attract capital is a highly challenging task. In contrast, a simpler strategy is to observe market hotspots, quickly follow trends as they begin, and go with the flow.

Alternatively, you can choose to buy Bitcoin directly.

Currently, the total market capitalization of other coins (OTHERS) is at a localized bottom, marking the end of the current market hotspots. While going long at low levels is a wise choice, it is difficult to predict which coins will attract capital based on the performance of some "top altcoins." In this environment, prioritizing risk control is more important than blindly pursuing returns.

After all, we have just experienced three months of market frenzy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。