Author: Frank, PANews

With the market heat generated by U.S. President Trump's issuance of the personal token TRUMP, the Solana ecosystem has become the biggest beneficiary. Not only did the DEX trading volume hit a historical high for two consecutive days, but the daily on-chain transaction fees also reached $33.3 million, setting a new record.

Looking closely at the changes within the Solana ecosystem, we can see that Jupiter and Meteora are the most direct beneficiaries. Jupiter has long been the most active aggregator on Solana, so it was expected to capitalize on this heat. What is slightly surprising is Meteora, which has remained relatively low-key during this cycle, with its previous data always ranking behind Raydium. In terms of growth rate, Meteora may actually be the biggest beneficiary of the TRUMP token craze, but is this windfall fleeting or the beginning of a change?

Riding the Wave of Presidential Token Issuance, Daily Trading Volume Increases Eightfold

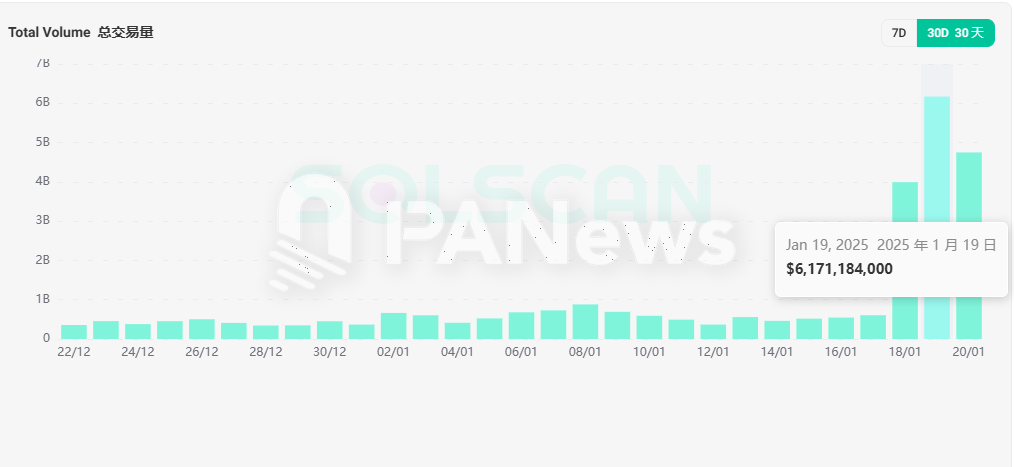

Before January 18, Meteora's daily trading volume was about $500 to $600 million, but on January 18, this figure surged to $3.99 billion, an increase of about eight times. The subsequent days, January 19 and 20, also broke new highs, recording trading volumes of $6.1 billion and $4.7 billion, respectively.

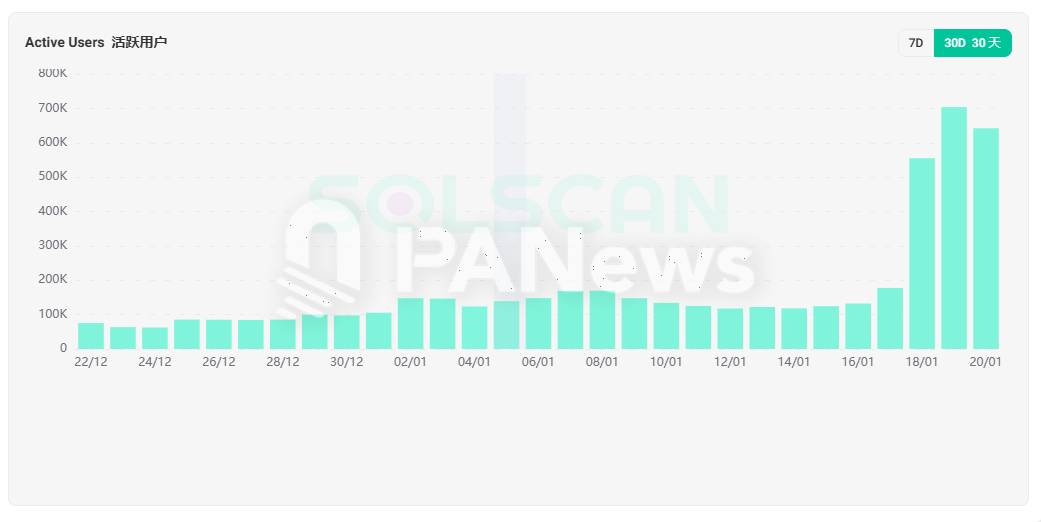

This change in data is also reflected in the significant increase in the number of active addresses. Generally, Meteora's active address count hovers between 120,000 and 130,000, with no significant changes. On January 18, this number grew to 550,000, and on the 19th and 20th, it reached 700,000 and 640,000, respectively, with the maximum increase reaching about 5.8 times.

Riding on Jupiter's Coattails?

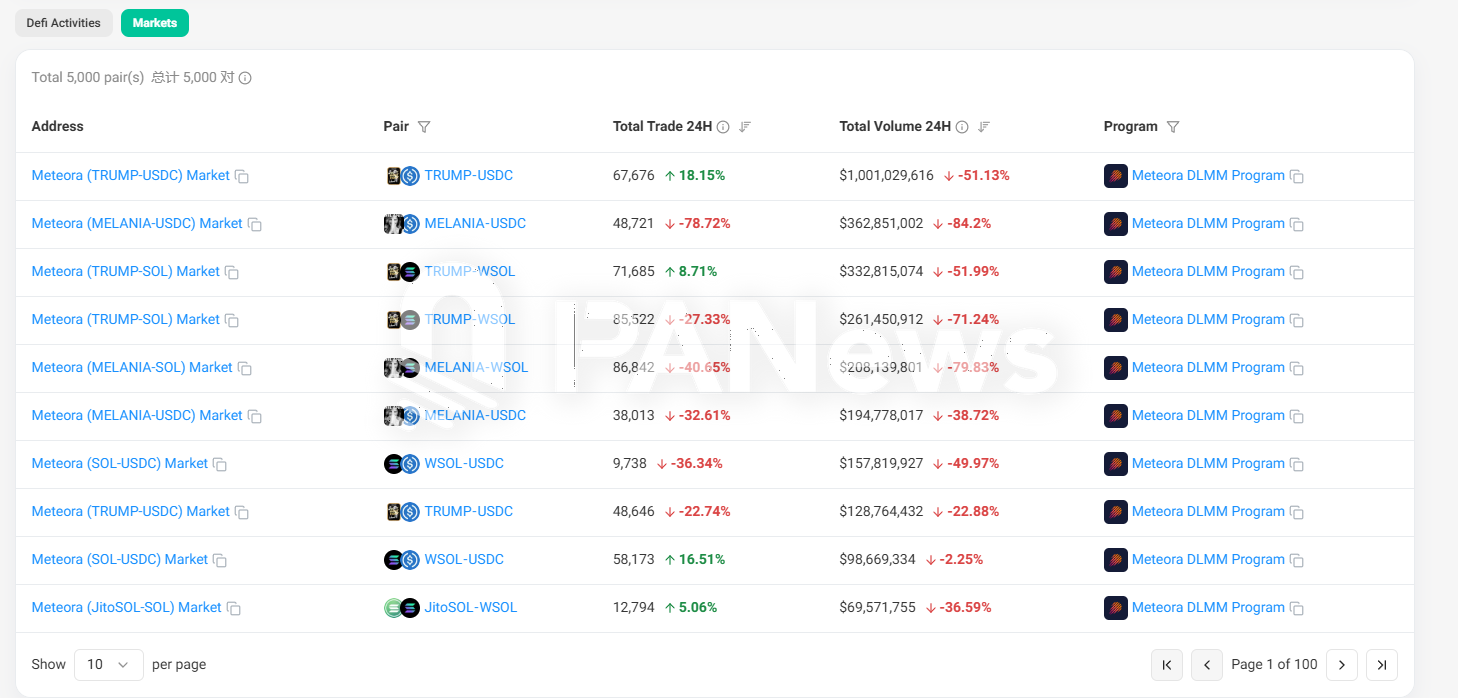

The main reason for these changes clearly stems from the trend of the Trump family issuing tokens. From the data, as of January 21, seven of the top ten most popular trading pairs on Meteora were related to the Trump tokens, primarily revolving around TRUMP and MELANIA.

Of course, the above changes are all due to the benefits brought by the Trump family's token issuance. From an ecosystem perspective, what characteristics does Meteora have that made it a choice for the Trump family?

In fact, there is not much news about Meteora. The project was created in 2021 and is one of the earliest liquidity platforms on Solana. Meteora has two co-founders, Ben Chow and the well-known Meow, both of whom are also co-founders of Jupiter. It can be said that Meteora and Jupiter share the same origin; the original Meteora was named Mercurial Finance and issued the token MER in 2022, but due to the impact of the FTX incident, the team decided to rename the brand to Meteora, abandon MER, and plan to issue a new token MET. As of now, the new token MET has not yet been issued, and previous announcements indicate that the issuance date may be in February 2025.

By comparing the data of Meteora and Jupiter, it can be found that Meteora's user scale and capital flow volume are not as large as Jupiter's, but it has indeed seen a greater increase from the TRUMP token windfall. On January 18, Jupiter's daily trading volume surged to $16.8 billion, and on the 19th, it set a new record of $20.6 billion. Previously, its daily data scale generally maintained around $6 billion. From this perspective, the issuance of the TRUMP token mainly focused on Jupiter's user scale and liquidity. Meteora's inclusion seems more like a supportive move to boost expectations for Meteora's upcoming token issuance, given the similar team background.

Subtle Changes in the Solana Ecosystem's DeFi Landscape

In addition to Meteora and Jupiter as the primary partners for this issuance, other DEX products also saw significant data increases with the rise in trading heat. Raydium's trading volume also grew by more than 100% after the 18th, with the highest daily trading volume reaching $13.8 billion. However, the increase in active users was not substantial, rising about 30% compared to usual, peaking at around 4 million daily active users. Other protocols like lifinity, orca, and phoenix also experienced noticeable growth.

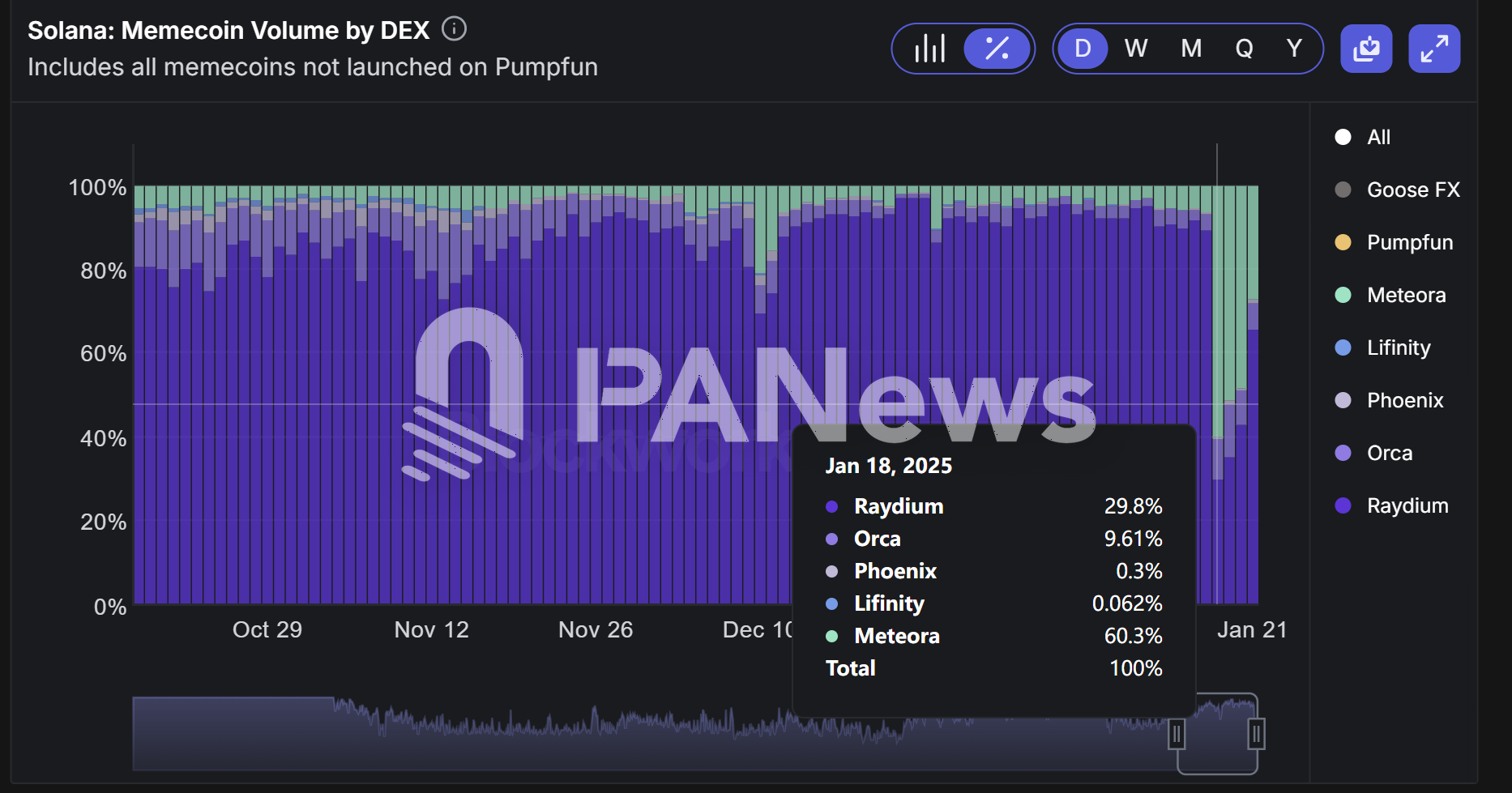

However, the biggest winner seems to be Meteora. According to Blockwork's data, Meteora's share of MEME token trading on Solana usually remains below 10%, but starting January 18, this ratio rose to 60%. The main market share being eaten away was that of Raydium, which previously held around 90% market share. After the issuance of the TRUMP token, this ratio dropped to below 30%.

In fact, as the most popular trading aggregator on Solana, Jupiter had previously launched the APE pro MEME launch platform in an attempt to break Pump.fun's monopoly, but the platform's development clearly did not meet expectations. As a product of the same ecosystem, Meteora also launched similar features but similarly failed to make an impact on social media.

Additionally, PANews has attempted to use this feature multiple times, but feedback consistently indicated that the server had crashed.

It is evident that as Solana's position in the MEME track becomes unshakable, competition within the Solana ecosystem has also become increasingly fierce. The Trump family's token issuance represents a historic opportunity for both Jupiter and Meteora. According to Jupiter and Meteora, the issuance of the TRUMP token is the largest release in the cryptocurrency field.

From the results, it is clear that Jupiter and Meteora seized this opportunity, bringing about significant changes. From the reasons behind it, compared to the combination of Pump.fun and Raydium, Jupiter and Meteora appear to be more aligned with the needs of presidential token issuance from a compliance or branding perspective.

It remains uncertain whether Trump's token issuance will indeed trigger more politicians or celebrities to follow suit, as the outside world anticipates. If a new trend can be formed, then the combination of Jupiter and Meteora seems to have more opportunities to completely seize market share from Pump.fun and Raydium through this planned token issuance.

After all, at present, it seems quite difficult for personally issued MEME tokens to become golden dogs, including the recently popular AI Agent-type tokens, which all have professional teams and organizations behind them. From Meteora's performance, it seems that Pump.fun's advantages are weakening. (Related reading: Estimating Pump.fun's Revenue: Issuing a Token Generates $68 in Official Income, with 70% of User Profits Going to Fees.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。