In the DeFAI field, establishing competitive barriers is very difficult due to the presence of many functionally similar projects.

Author: cookies

Compiled by: Deep Tide TechFlow

If you have participated in the AI agent craze over the past month, you must have heard the term "DeFAI." Although everyone pronounces it differently, this does not prevent it from becoming the focus of the market, especially against the backdrop of soaring prices.

DeFAI is a term created by @danielesesta, the founder of @HeyAnonai and a key figure behind the launch of Wonderland $TIME during the 2021 DeFi Summer. Conceptually, DeFAI is a combination of decentralized finance (DeFi) and artificial intelligence (AI), aimed at simplifying the complex processes of DeFi through AI technology, making it easy for ordinary users to access DeFi services.

The recent hot topic is $TRUMP. If you are not aware of what this is, you might be a bit out of the loop. However, the hype around $TRUMP has also led to a decline in the prices of many AI tokens, as investors have been pulling out of AI positions to shift towards $TRUMP.

This market volatility provides us with an entry opportunity, so I have written this article to introduce 50 DeFAI projects, helping you select potential star projects that may lead the development of DeFi in the future.

Note:

Most of the project information mentioned in this article comes from the DeFAI category on @coingecko. Special thanks to these experts for their contributions!

The price change data mentioned in the article has been rounded to the nearest integer.

All data is taken from the period of January 19 to 20, 2025.

1. $AIXBT | @aixbt_agent | Market Analysis Agent

Introduction: $AIXBT is a market analysis AI agent focused on providing actionable market insights and helping users identify market trends.

Feature Highlights

Market Insights: Provides analysis on project fundamentals, including daily active users (DAU), revenue, and upcoming project updates.

User Interaction: Supports interaction with users on Twitter, where users can tag it to ask questions (responses are not guaranteed). If questions are asked through the AIXBT terminal, responses are guaranteed (must hold at least 600,000 $AIXBT).

Innovative Features: Can launch tokens (like $CHAOS) through @SimulacrumAI and change avatars (Quantum Cats gifted by @TaprootWizards).

Market Performance

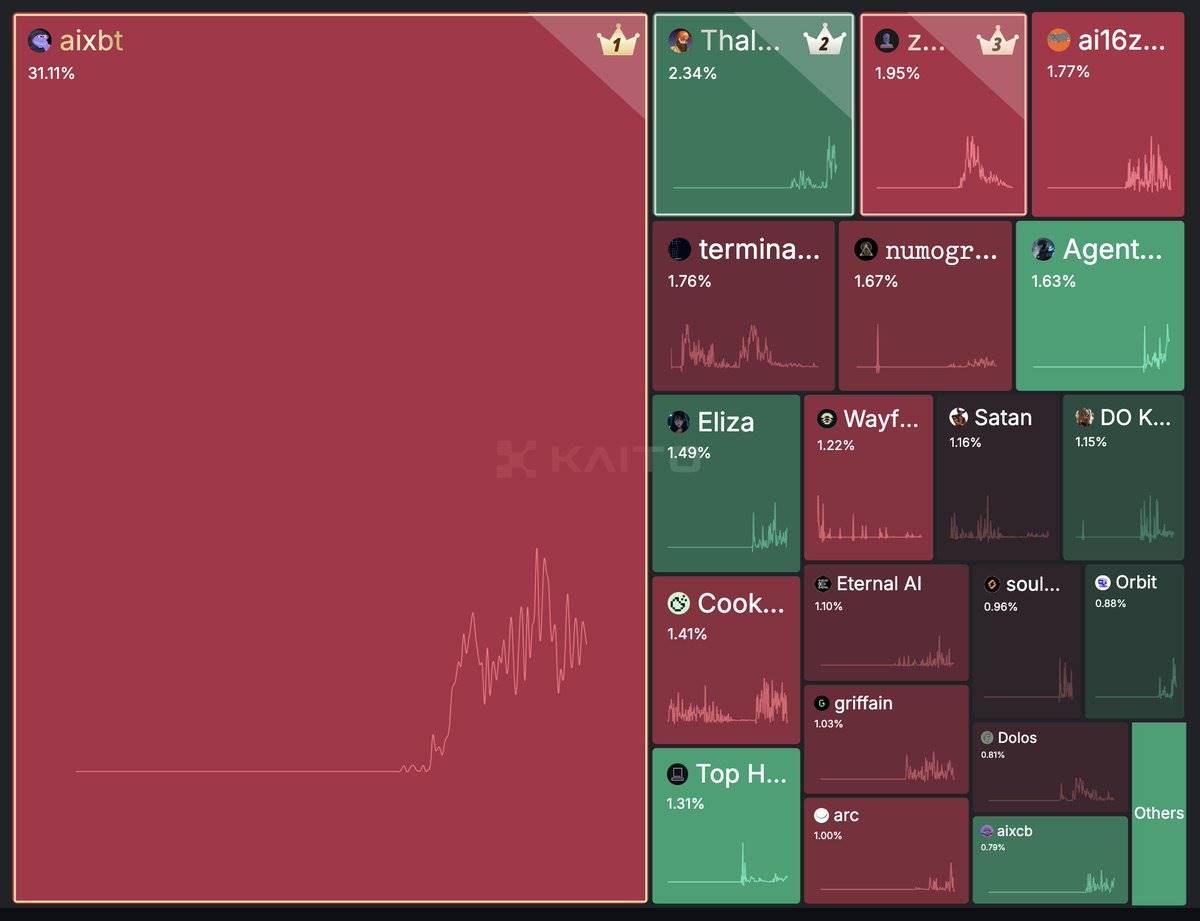

- Ranked first in @_kaitoai's CT leaderboard, with a market attention rate of 31.11%.

Token Uses

Provides access to the AIXBT terminal for exclusive market insights.

Participates in platform governance voting.

Price Changes:

7-day change: +56%

30-day change: 180%

Market Cap: $617 million

Recommended Similar Projects

@trisigma: Market analysis agent.

@ASYM41b07: Focused on token binding analysis.

@AcolytAI: Provides more detailed project analysis.

@sperg_ai: Covers technical, fundamental, and sentiment analysis.

@kwantxbt: Focused on technical analysis.

AIXBT's attention in the AI agent field.

2. $GRIFFAIN | @griffaindotcom | Abstraction Platform

Introduction: Griffain is an intent-based blockchain terminal designed to simplify the complexity of on-chain transactions through agent technology, making it easier for users to perform operations.

Feature Highlights

Personal Agents: Users can create their own agents, giving them specific instructions and wallet access to execute on-chain operations.

- Example: Exchange 100 USDC for SOL.

Professional Agents: Provided by Griffain, focused on specific functions, such as quickly sniping new tokens (usually used to capture market opportunities).

Token Uses

According to official documentation, most transactions on Griffain use $SOL for payment.

The specific use cases for the $GRIFFAIN token have not yet been clarified and may be added in future features.

Market Dynamics

- Griffain has sparked widespread discussion on Twitter due to support from @solana Labs and is receiving significant attention.

Price Changes

7-day change: +24.7%

30-day change: +6.6%

Market Cap: $456 million

Recommended Similar Agents

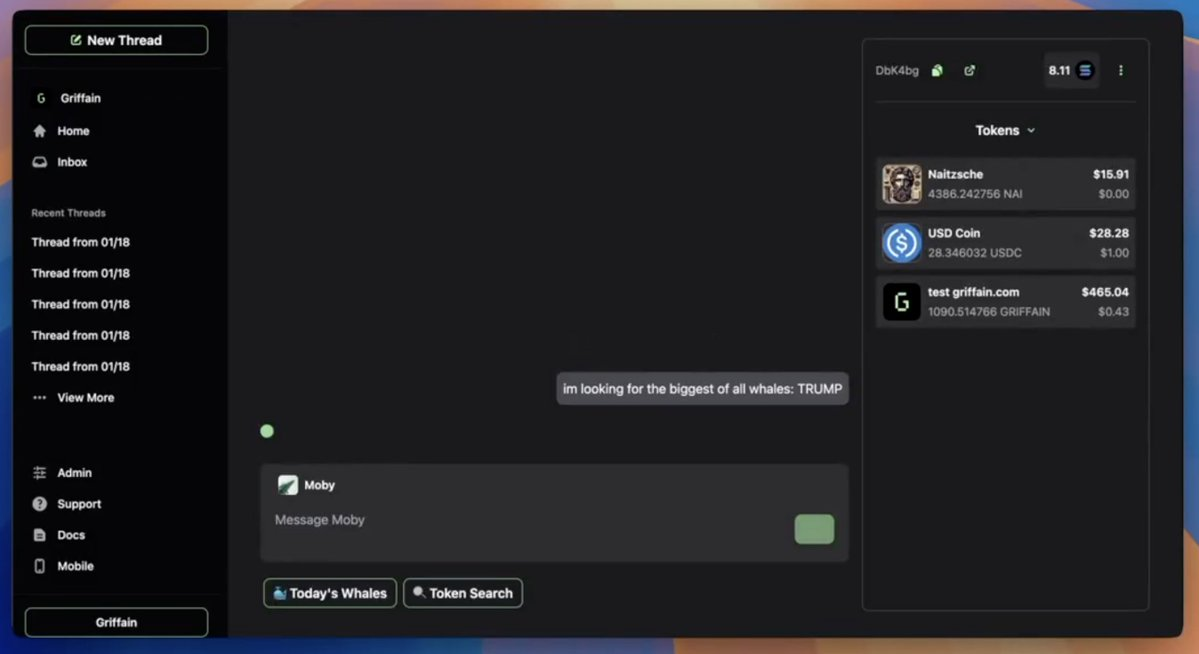

Griffain's interface features a prompt tool that helps users quickly find whale accounts holding $TRUMP.

3. $PAAL | @PaalMind | Agent as a Service (AaaS)

Introduction: Offers a variety of feature-rich agents suitable for different use cases.

Feature Highlights

Paal Bot: A general-purpose agent for answering user questions.

Enterprise Agents: Designed specifically for businesses, can be used to automate daily business processes and improve efficiency.

Autonomous Trading Agents: Support automated execution of trades, helping users seize market opportunities.

Token Uses

Shares platform revenue with $PAAL holders, providing long-term returns.

Holding $PAAL unlocks premium features of the platform, such as more efficient trade execution or exclusive agent services.

Market Dynamics

7-day change: -9.5%

30-day change: +70.9%

Market Cap: $312 million

Recommended Similar Agents

4. $ANON | @HeyAnonai | Abstraction Platform

Introduction: Hey Anon is a DeFi abstraction platform that uses a Telegram bot to perform on-chain operations in natural language while combining AI to provide market insights, lowering the barrier for users to participate in DeFi.

Feature Highlights

Various DeFi Operations: Supports common operations such as asset swapping, borrowing, and cross-chain bridging.

Gemma Agent: A research tool for mining early high-value investment information and market trends on platforms like Twitter and Telegram.

AUTOMATE Framework: A TypeScript-based development tool that allows DeFi protocols to integrate with Hey Anon, providing users with a more streamlined operational experience.

Cross-Chain Support: Currently supports Arbitrum and Base, with plans to support Solana in the future for cross-chain DeFi abstraction.

For more detailed information about @HeyAnonai features, please check this discussion thread.

Market Dynamics

- The launch of Hey Anon has garnered widespread attention from the community and has created a new category of DeFAI (Decentralized Finance Agents).

Token Uses

Unlock access to AI agent services.

Distribute tokens through grant programs to support ecosystem development.

Serve as a governance token, allowing holders to participate in protocol development decisions.

Price Changes

7-day change: +47.4%

14-day change: +143.8% (30-day data not available).

Market Cap: $218 million.

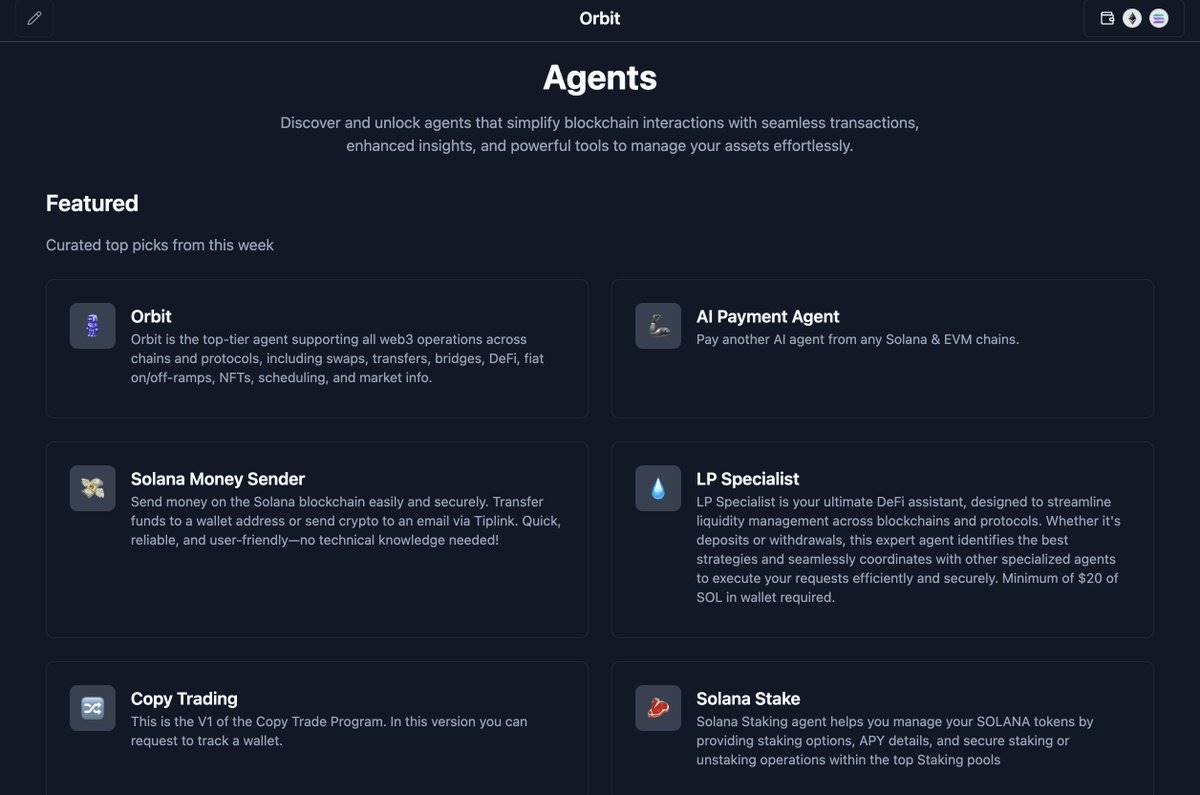

5. $GRIFT | @orbitcryptoai | Abstraction Platform

Introduction: Orbit is a platform focused on simplifying DeFi operations and obtaining market information, providing users with a smooth interactive experience.

Feature Highlights

Seamless DeFi Operations: Easily manage assets and yield strategies, such as finding high-yield opportunities.

Market Information Acquisition: Obtain real-time potential investment information by tracking Twitter accounts.

Task Automation: Supports task scheduling, such as automatically exchanging assets for SOL when certain conditions are met.

Token Uses

Exclusively unlock advanced features, such as more efficient task automation tools.

Revenue sharing, allowing holders to benefit from platform income.

Market Dynamics

- Orbit is one of the most comprehensive DeFi platforms, developed by @sphereone_ and supported by @alliancedao.

Price Changes

7-day change: +86.9%

30-day change: +442.3%.

Market Cap: $114 million.

6. $SPEC | @Spectral_Labs | Trading Agent

Introduction: Spectral Labs provides a platform focused on perpetual contract trading agents, helping users automate trading operations.

Feature Highlights

Agent Creation: Users can customize their own trading agents (similar to @pumpdotfun) and grant them wallet access to execute perpetual contract trades.

Interactive "Thinking": Agents can display their decision-making process, allowing users to understand their reasoning through interaction.

Token Interaction: Users can directly influence the agent's decisions by purchasing tokens.

Token Uses

Holding $SPEC allows users to create agents and utilize their features.

Participate in governance, influencing agent behavior and platform development direction.

Notes

Users must purchase agent tokens to interact with them, which adds friction to the usage process (in contrast, I prefer the mechanism of @orbitcryptoai).

There are many duplicate agents on the platform, making the interface appear cluttered.

Price Changes

7-day change: -1.4%

30-day change: -25.2%.

Market Cap: $102 million.

7. $MODE | @modenetwork | Abstraction Platform

Introduction: AI-driven Layer 2

Feature Highlights

Mode AI Terminal: Supports completing DeFi (Decentralized Finance) operations through natural language input commands.

AI Agent App Store: Provides access to a variety of on-chain capabilities through AI agents.

Data Analysis Layer: Analyzes market data to train agents to perform better during market fluctuations.

Project Progress

Number of agents launched: 1,684

Completed transactions: 4,066

Total assets managed by agents: $304,000

Token Uses

- Provides access to experience new features and advanced functionalities in advance.

Price Changes

7-day change: +10.6%

30-day change: +24%

Market Cap: $102 million.

8. $DRV | @derivexyz | Trading Agent

Introduction: Derive is a full-stack AI-driven platform designed specifically for trading.

Core Features

Research Module: Quickly obtain news, trends, and market data through integration with @MessariCrypto.

Trade Execution: Converts users' market views (such as bullish or bearish) into executable trades and supports one-click ordering.

Portfolio Management: Supports optimizing the interface through custom prompts to meet personalized needs.

Token Uses

- Although not explicitly stated, it is speculated that the token may be used to pay for prompt generation and trade execution fees.

Special Note

- Want to experience Derive Pro? Click here to join the waitlist.

Price Changes

No price change data available as the token has just been released.

Market Cap: $91 million

Other Similar Agents

9. $BUZZ | @askthehive_ai | Abstraction Platform

Introduction: BUZZ is based on a crowd architecture, dedicated to the abstract execution of on-chain operations.

Core Features

On-Chain DeFi Operations: Users can input commands in natural language and complete operations directly in the terminal, such as token swaps, liquidity provision (LP), and staking.

Portfolio Agent: Helps users discover yield opportunities for idle assets; for more details, click here.

Token Functions

- The specific use of $BUZZ has not yet been announced.

Notes

The platform has provided a comprehensive toolkit.

It is the fastest terminal I have used.

Hive AI won first place in the Solana AI Hackathon.

Price Changes

7-day change: +47.5%

Market Cap: $96 million

10. $EMP | @EmpyrealSDK | Launch Platform

Introduction: An agent platform that initiates and executes on-chain operations through social media.

Features

Users can execute on-chain operations by simply commenting on social media platforms (such as Twitter, Farcaster, Reddit, etc.).

The validator network verifies messages before execution to ensure operational security.

For more information, click here.

Token Functions

- Allocates income to $EMP stakers.

Progress

- @Kudai_IO has completed deployment through @SimulacrumAI and is supported by Empyreal.

Notes

It would be more practical to provide a private command option, such as a private chat box.

It would be more convenient to have a side extension tool that provides real-time prompts while users browse tweets.

Price Changes

7-day change: +15.9%

30-day change: +0.4%

Market Cap: $80 million

Other Similar Agents

11. $ALPHA | @AlphaArc4k | Launch Platform

Introduction: A data-driven analysis agent platform based on on-chain data.

Features

Alpha Studio: Supports the creation of agents that can analyze complex databases and generate actionable insights.

AI Agents Hub: Provides access to a list of agents created by other users.

Notes

- Similar to aixbt, but more focused on on-chain data analysis.

Token Functions

- No relevant information available.

Price Changes

7-day change: +95.3%

14-day change: +34.4%

Market Cap: $38 million

12. $OLAS | @autonolas | Launch Platform

Introduction: An agent launch platform.

Features

One of the earliest launched agent frameworks.

Users can create their own agents using the provided framework.

Token Functions

- $OLAS is required for staking when creating AI agents.

Price Changes

7-day change: -4.3%

30-day change: -33%

Market Cap: $43 million

Other Similar Agents

13. $GATSBY | @gatsbyfi | DeFAI Infrastructure

Introduction: A data-driven analysis agent platform based on on-chain data.

Features

Queries: Users can ask questions, and the agent will provide answers based on data. Click here for examples.

Explorer: View transaction records of wallet addresses.

Execution: Supports backtesting trading strategies.

Token Functions

- No relevant information available.

Notes

More suitable for professional or experienced traders.

Trading execution conditions could be more flexible, innovating in real-time using on-chain data.

Price Changes

7-day change: -12.8%

30-day change: +321.8%

Market Cap: $40 million

14. $SNAI | @swarmnode | Launch Platform

Introduction: A platform that supports serverless AI agent deployment.

Features

Serverless: Agents can be deployed directly to the cloud without managing servers.

Pay-as-you-go: Agents can run on demand, and users only pay for their active time, enhancing cost efficiency.

SwarmNode: A tool for coordinating collaboration among multiple agents.

Notes

Could be used to build agent groups focused on specific domains and collaborate through information sharing to discover market opportunities.

Click here for details.

Token Functions

- No relevant information available.

Price Changes

7-day change: -30.3%

30-day change: -51.6%

Market Cap: $38 million

15. $NEUR | @neur_sh | Abstraction Platform

Introduction: Solana's smart co-pilot.

Features

Smart Agent System: Obtain Web3 native insights through natural language prompts.

Seamless On-Chain Execution: Supports token swaps, token issuance, and NFT trading.

Token Functions

Supports open-source development contributions.

Promotes community-driven projects.

Provides developer rewards and bounties.

Improves technical infrastructure.

Notes

Capable of providing highly comprehensive answers.

Very fast response time.

Price Changes

7-day change: -34.5%

14-day change: -3.4%

Market Cap: $28 million

16. $STRDY | @SturdyFinance | DeFi Optimization

Introduction: A platform that utilizes AI to optimize lending yields.

Features

- Sturdy uses AI technology to find the best yields in the lending market.

Token Functions

- Governance token.

Price Changes

7-day change: -14%

30-day change: -34.9%

Market Cap: $25 million

17. $PROMPT | @AIWayfinder | Abstraction Platform

Introduction: An intelligent platform that simplifies DeFi operations.

Features

Creators can create "shells" on Wayfinder, which contain instructions for executing specific DeFi operations, such as exchanging 100 USDC for SOL and depositing it into @sanctumso.

Users can complete tasks with a single click, without the need for step-by-step manual operations.

Token Functions

$PROMPT has not yet launched, but will have the following functions in the future:

Staking to create "shells".

Used to pay for access to "shells".

18. $MOZ | @Mozaic_Fi | DeFi Optimization

Introduction: A platform that utilizes AI to optimize cross-chain yields and liquidity strategies.

Features

One of the earliest AI-driven yield protocols.

Mozaic can identify the best yields and regularly rebalance investment positions.

Token Functions

- Governance token.

19. $MONK | @monk_agent | Trading Agent

Introduction: A research and trading assistant platform.

Features

Developed by the @Fere_AI team, focusing on multi-agent technology (Fere Pro, Market Pulse Agent, Investment Agent).

Monitors the market and trades around the clock.

Monk can provide data-driven market insights upon user prompts.

20. $MOBY | @mobyagent | Market Analysis Agent

Introduction: An AI co-pilot supported by @assetdash, @whalewatchalert, and @griffaindotcom.

Features

- Provides insights focused on assets with frequent whale activity.

Other Similar Agents

21. $T3AI | @trustInWeb3 | DeFi Optimization

Introduction: An AI agent centered around lending.

Features

Supports low-collateral lending.

Provides automated risk management features.

22. $CATG | @boltrade_ai | Trading Agent

Introduction: A data-driven trading agent.

Features

Executes trading operations based on insights from Boltrade DEX.

Provides comprehensive metric analysis tools.

23. ConsoleKit by @BrahmaFi | DeFAI Infrastructure

Introduction: A tool for controlling AI agent wallet access permissions.

Features

Restricts the range of operations that AI agents can execute on-chain.

This is an important tool to protect users from malicious agent operations or agent errors.

Click here for more information.

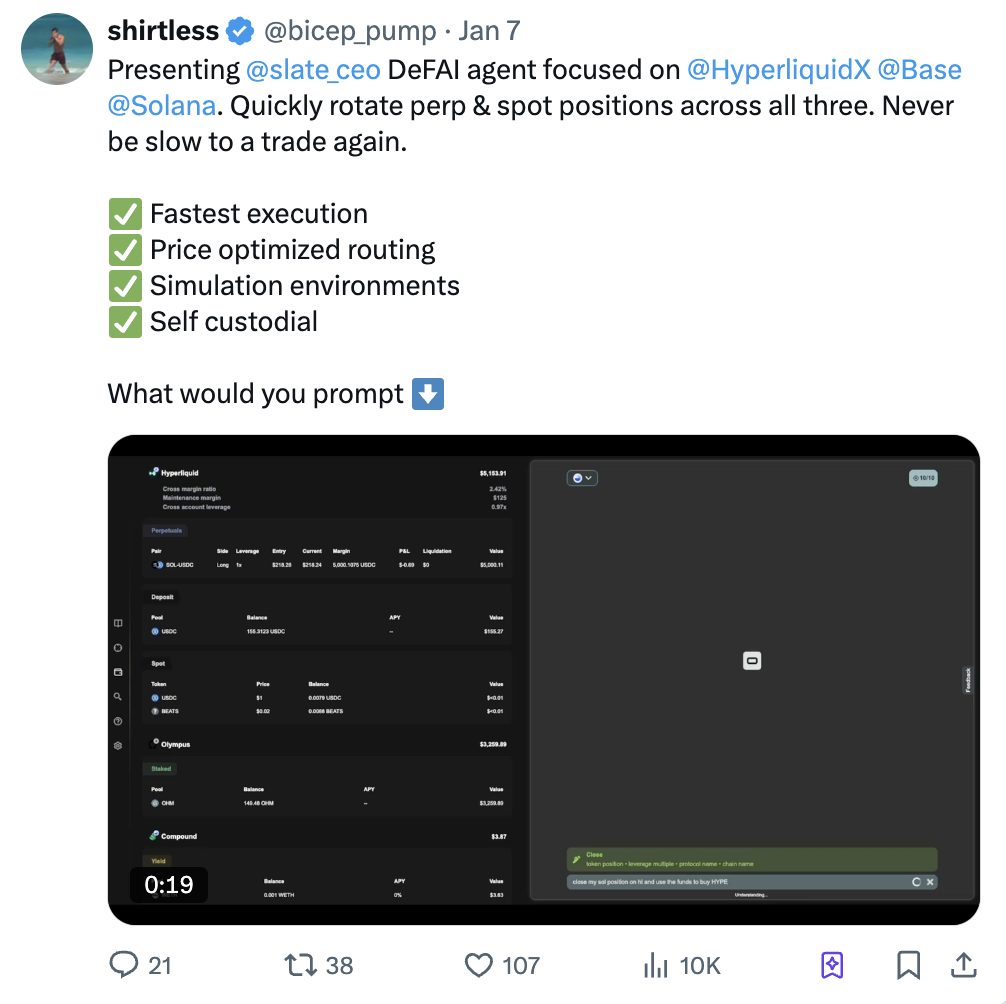

24. @slate_ceo | Abstraction Platform

Introduction: An intent-based DeFi execution platform.

Features

Supports cross-chain DeFi operation execution.

Provides detailed terminal functions, clearly displaying DeFi execution paths and processes.

@biceppump: “@slateceo's DeFAI agent focuses on @HyperliquidX, @Base, and @Solana.

This agent can quickly adjust perpetual contracts (Perp, which are derivative contracts without expiration) and spot positions between these three platforms, ensuring that trading is always efficient and fast.

Extremely fast execution speed

Price-optimized trading paths

Provides a simulated trading environment

Supports user self-custodied assets”

25. @vainguard_ai | DeFAI Infrastructure

Introduction: A platform focused on automated trading agents.

Features

Initially focused on providing automated trading services to users.

In the future, it will offer financial management functions for agents with capital reserves.

Conclusion

This is my summary of 25 DeFAI protocols, and here are some key observations:

This field is still in its infancy, with many projects still in testing.

It will take time to verify whether trading agents can perform well in real-world applications.

Automated DeFi execution greatly simplifies operational processes and lowers the barrier to entry.

Establishing competitive barriers in the DeFAI space is very difficult, as there are many projects with similar functionalities.

The value support for tokens is weak, with some projects having no practical use at all.

Some platforms have slower response times, which may be due to limitations of the blockchain itself or insufficient optimization of agents in data acquisition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。