Author: Nancy, PANews

As a representative project of cross-chain stars in the last bull market, THORChain is now facing a severe survival crisis, with nearly $200 million in high debt raising concerns within the community. In response, THORChain plans to implement a restructuring plan to address the debt crisis.

Facing Insolvency Crisis, Protocol Hides Multiple Issues

On January 24, a core member of THORChain, TCB, revealed that THORChain is facing serious insolvency, pointing out that the protocol has high leverage risks, excessive liquidity incentives, and excessive complexity.

“If a large-scale debt redemption occurs or depositors and synthetic assets de-leverage, THORChain will be unable to fulfill its debts denominated in Bitcoin and Ethereum,” TCB noted. Currently, THORChain's total debt includes approximately $97 million in borrowing liabilities (denominated in BTC and ETH) and about $102 million in liabilities to depositors and synthetic assets. However, THORChain's assets only include $107 million in external liquidity injected into liquidity pools.

“THORChain's borrowing obligations are met by minting RUNE and selling it into liquidity pools, which creates a design that has a high reflexivity risk, and the situation is worse than it appears,” TCB further disclosed. If any large debt redemptions and/or de-leveraging of depositors and synthetics occur, THORChain will be unable to fulfill its obligations denominated in BTC and ETH.

TCB revealed that since joining the community, he has been warning about the hidden dangers of leverage. Since the launch of Impermanent Loss Protection (ILP), he has advocated for de-leveraging, stating that the protocol only needs less capital to fill in because the currently active liquidity can participate in filling them. He believes that THORChain is too complex and must return to basic principles to grow. Until then, no smart capital will be able to buy RUNE or LP due to the high risks. In many past DeFi cases, a publicly known massive debt can become a lure for liquidation. If no action is taken and all redemptions occur chaotically, it could trigger a "death spiral." This would lead to a mad dash to escape, and the entire value of the THORChain protocol would vanish.

In fact, not long ago, THORChain also stated in its latest roadmap that it will focus on the THORChain App Layer in the first quarter of this year to eliminate risks at the underlying protocol layer. Specific goals include: integration with Base and Solana networks; reducing THORFi—lowering risks at the base layer and shifting focus to the application layer; adding a CosmWasm execution environment called App Layer; bringing more assets into the application layer using IBC; launching proactive yield activities to improve liquidity supply experience; upgrading the Ethereum router's transferOutAndCall.

As a result, THORChain's token RUNE and TVL have both seen varying degrees of decline. Data from CoinGecko and DeFiLlama show that in the past 24 hours, THORChain's token RUNE has dropped by 33.3%, and TVL has decreased by over 8.9% to $250 million.

Protocol Captures Over $30 Million in Revenue, Initiates 90-Day Restructuring Plan

“THORChain has gone bankrupt and suspended on-chain operations, similar to a bankruptcy freeze, to avoid capital outflows. Is this the first on-chain restructuring?” said Haseeb Qureshi, managing partner at Dragonfly.

Despite the risk of a blow-up, TCB believes the protocol is valuable. THORChain generates about $200,000 in revenue daily, with an annual trading volume exceeding $50 billion and over $30 million in revenue, boasting a solid business model that only needs to eliminate toxic debt from its balance sheet.

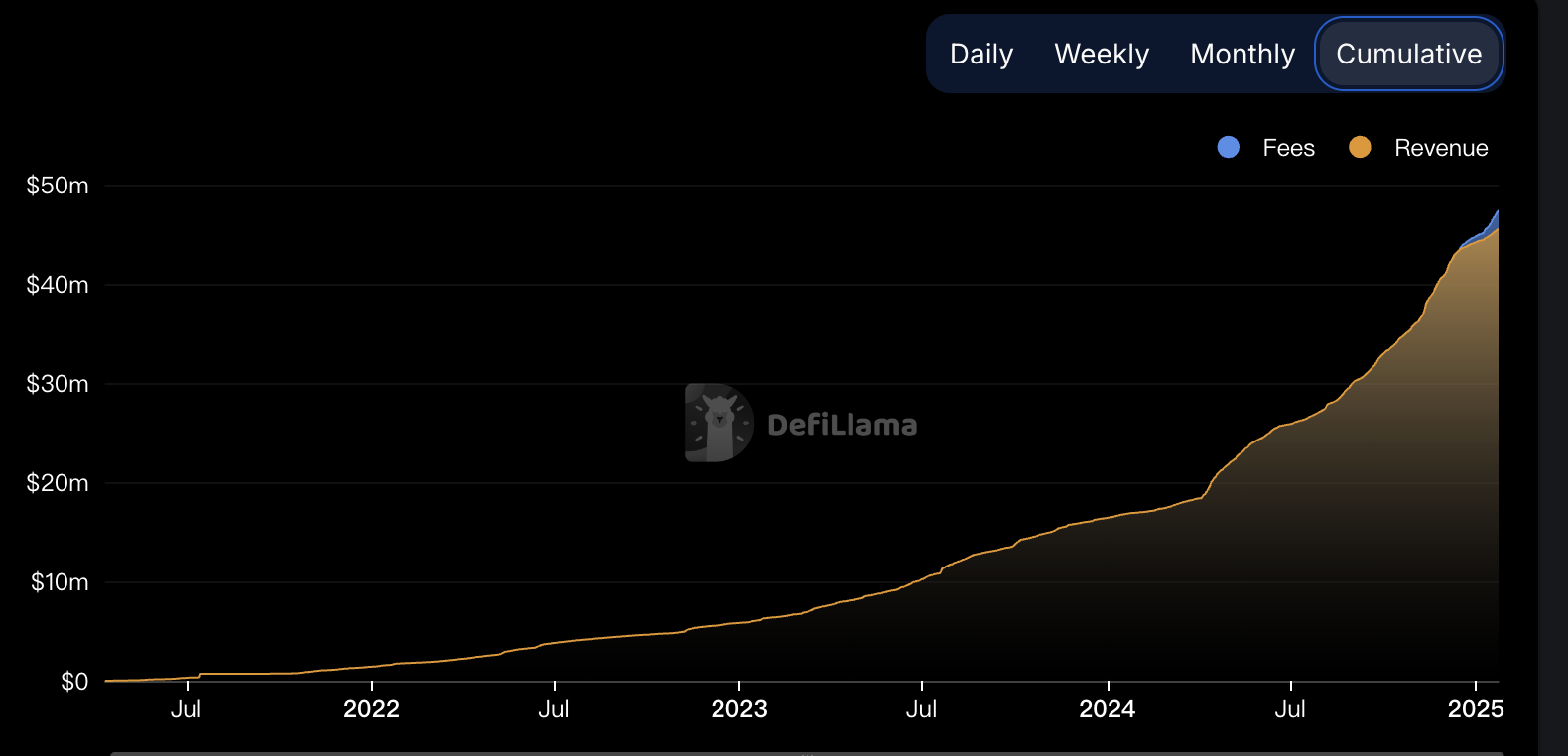

Data from DeFiLlama shows that as of January 23, THORChain's cumulative fees reached $47.45 million, with revenue at $45.54 million. In the past year alone, THORChain captured approximately $30.5 million in fees and $28.59 million in revenue.

TCB pointed out that the unliquidated lending of THORFi should be seen as a mistake; THORChain only needs to clear toxic debt from its balance sheet and return to its original spirit: back to basics. At the same time, TCB proposed two solutions: one is to let the situation develop, where about 5-7% of the value will be extracted first by a few, leading RUNE into a downward spiral and destroying THORChain; the other is debt default and bankruptcy, rescuing the valuable parts and developing them as much as possible to repay debts while not affecting the protocol's viability.

TCB suggested that for THORChain to survive the crisis, it could increase the chances of saving the protocol by permanently freezing all lending and depositor positions, tokenizing all lending and depositor claims, and de-leveraging. He also proposed establishing an economic design committee to help THORChain succeed, with specific methods including improving capital efficiency, never building leverage features within it again, and ensuring that Rujira does not jeopardize the L1 ecosystem.

Currently, THORChain has suspended THORFi lending operations as part of a 90-day restructuring plan aimed at reducing issues related to "savings and lending" projects and preventing large-scale withdrawals. Thorchain founder John-Paul Thorbjornsen stated, “The protocol itself is still operating well and has earned a lot of money. Once restructured, it can repay its debts.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。