Written by: Peter, Foresight News

In the cryptocurrency field, Binance is an unavoidable name for every practitioner, and Binance Labs, as a leader in primary investment, has an undeniable impact on the crypto space. In the months following Zhao Changpeng's release from Long Beach, the fervent rise of cryptocurrencies has elevated his net worth to $70 billion.

In this context, Binance Labs officially announced its rebranding to YZi Labs on January 23, completing its transformation from a cryptocurrency venture capital firm to Zhao Changpeng's private family office. As the on-chain market flourishes, what impact will the Binance lineage and the new investment strategy shift and expansion carried by YZi Labs have on the entire ecosystem?

Investment Expansion

Although CZ has stepped down from Binance, he will continue to play a significant role in YZi Labs, providing one-on-one guidance and strategic advice directly to entrepreneurs to help them optimize their business models and investment strategies.

CZ emphasized that his investment philosophy focuses more on social impact rather than short-term returns. The return of Ella Zhang also supports this belief. Ella, who previously served as the first head of Binance Labs, will lead the strategic development of YZi Labs. She has successfully incubated over 40 projects, including Polygon, Injective Protocol, and CertiK, and her experience will bring more innovative momentum to YZi Labs.

Since his release from prison, Zhao Changpeng has repeatedly stated that he will pay more attention to applications related to "human welfare," and he has previously delved into the education sector to some extent (through Giggle Academy for K12 education). In the disclosed investment context, YZi Labs' investment areas cover Web3 infrastructure, DeFi, etc. In the future, it will expand from its original focus on cryptocurrencies and blockchain to include Web3, artificial intelligence (AI), and biotechnology (biotech).

- Web3: YZi Labs will continue to support blockchain and decentralized technology projects, including its previously incubated BNB Chain "Most Valuable Builder (MVB) Program." As one of its core investment areas, Web3 will continue to drive the development of dApps and blockchain infrastructure, with investments in this area primarily empowering the Binance ecosystem.

- AI: AI is seen as a crucial driving force for future technology, and YZi Labs plans to invest in startups in the AI field and explore its integration with blockchain technology. For example, it has invested in AI infrastructure projects like Sahara AI and MyShell, which aim to achieve decentralization of AI through blockchain technology. However, for users, the perception may be more concentrated in the Agent field, so there may be a focus in subsequent investments.

- Biotechnology (biotech): Investments in the biotech field will focus on projects with transformative potential, especially innovative applications that intersect with AI and Web3 technologies. Previously, Zhao Changpeng attended the DeSci conference in Bangkok and engaged in related discussions, and this preference is also reflected in subsequent investments. For instance, in previous investments, BIO Protocol provided a financing paradigm for decentralized science, and the expansion in this area reflects YZi Labs' attention to interdisciplinary technology integration.

After transforming into a family office, YZi Labs will manage the wealth of Zhao Changpeng and his family members, including the assets of Binance co-founder He Yi. This transformation allows for a more flexible investment strategy while maintaining a focus on high-potential projects. YZi Labs currently manages approximately $10 billion in cryptocurrency-related assets and plans to further expand its investment portfolio.

YZi Labs also plans to expand its team from the current 9 members to 20 and recruit experts in AI and biotechnology to enhance its investment capabilities in emerging fields. After distancing itself from the Binance name, we can anticipate that YZi Labs will have greater freedom and breadth in decision-making. At the same time, the fully spun-off VC department will be more influenced by Zhao Changpeng's personal preferences.

Complementary

YZi Labs plans to optimize its incubation program by launching a 12-week offline Bootcamp program to create an immersive collaborative environment for entrepreneurs. This initiative not only strengthens face-to-face communication among entrepreneurs but also accelerates the growth and innovation of startups through direct mentorship, aiming to help entrepreneurs bridge the gap from concept to market while exploring the innovative possibilities brought by the integration of these fields.

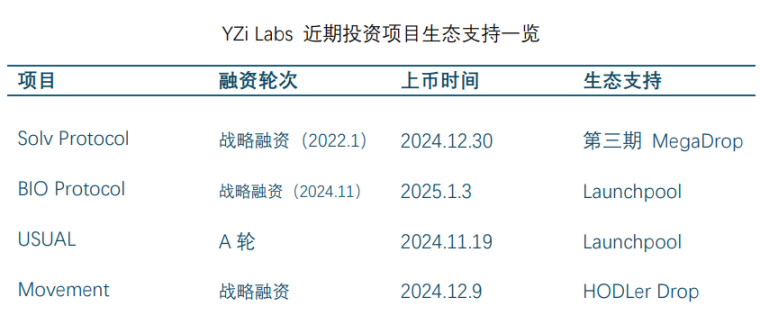

From Binance's previous ecosystem perspective, it needs to empower its public chain BNB CHAIN and related applications. In the on-chain ecosystem, existing pure on-chain liquidity is concentrated in the Solana and Base ecosystems, and for the BNB ecosystem, a certain post-investment driving effect is needed for support. As an industry-leading exchange, the resources Binance can provide are unmatched by others. The various products launched in recent years (such as Binance Alpha, HODLER Drop, etc.) demonstrate that Binance is advancing user engagement for many projects, including those invested in by YZi Labs (such as Solv Protocol and BIO Protocol).

The rebranding and transformation of YZi Labs is not only a brand upgrade but also a comprehensive expansion of its investment strategy. By focusing on Web3, AI, and biotechnology, and relying on the leadership of CZ and Ella Zhang, YZi Labs is expected to become an important driver of cross-domain innovation in the coming years. Its positioning as a family office also provides it with greater flexibility and a long-term investment perspective.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。