Original Authors: Jay Jo, Yoon Lee, Tiger Research

Original Translation: Luffy, Foresight News

Key Points

South Korea's cryptocurrency trading volume remains high, attracting global attention, but unclear regulations and lack of guidelines hinder industry development.

The government prohibits companies from opening real-name cryptocurrency trading accounts. This restriction, combined with a vague regulatory framework, has led to the outflow of talent, capital, and businesses, weakening the competitiveness of the Web3 ecosystem.

As the global Web3 industry is expected to develop rapidly under the Trump administration, South Korea must reform its regulatory policies to ensure the long-term sustainability of the industry.

1. Introduction

The inauguration of "cryptocurrency-friendly president" Trump and the establishment of the U.S. Securities and Exchange Commission (SEC) Crypto Special Task Force (Crypto 2.0 TF) will accelerate structural changes in the global Web3 market. This is a critical turning point. Talent, capital, and businesses may migrate to countries with sound regulatory frameworks, while outflows from countries with regulatory uncertainty will intensify.

2024 Inflow/Outflow of Funds by Country, Data Source: Henry & Partners

South Korea is also part of this trend. The "2024 Private Wealth Migration Report" by Henry & Partners shows that South Korea ranks first in Asia for high-net-worth individuals migrating. Economic, social, and cultural factors are driving this wave of migration. Although not directly related to the Web3 industry, these groups often serve as canaries in the coal mine, indicating changes in a country's business environment.

In this context, it is crucial to reassess South Korea's Web3 industry. This report explores the flow of capital, businesses, and talent in the South Korean Web3 market, as well as the key challenges the industry must address.

2. Capital Outflow: Offshore Exchanges and Accelerated On-Chain Transfers

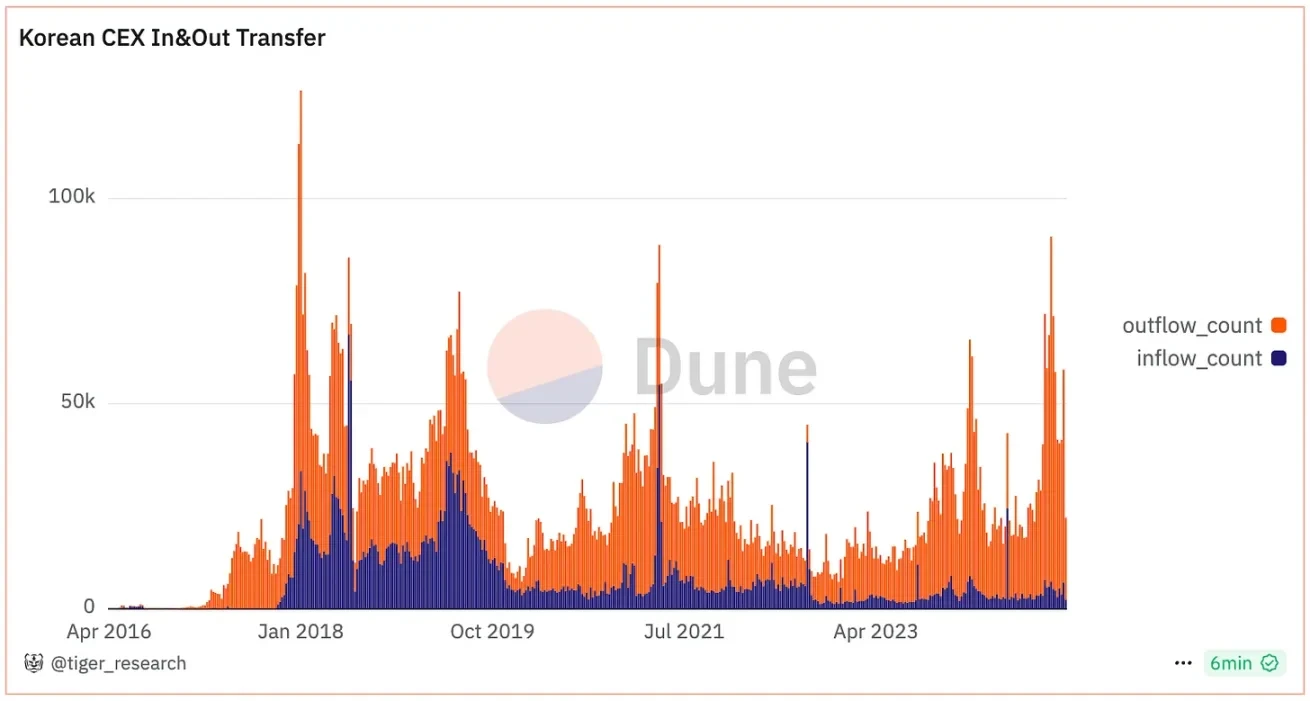

South Korea's cryptocurrency market has developed rapidly. There are 15.6 million cryptocurrency investors holding assets worth $73 billion. The daily trading volume of cryptocurrency exchanges is now comparable to the combined trading volume of the Korea Composite Stock Price Index (KOSPI) and the Korea Securities Dealers Automated Quotations (KOSDAQ). This reflects South Korean investors' enthusiasm for crypto assets, driven by low stock market returns and politically unstable conditions related to martial law.

However, the recent outflow of crypto assets has reached concerning levels. During martial law, service disruptions at local major exchanges weakened trust in the stability of these platforms. Meanwhile, the diverse investment opportunities offered by foreign exchanges and decentralized finance (DeFi) further propelled capital migration.

A survey by the South Korean Financial Services Commission in the first half of 2024 showed that funds transferred to foreign Virtual Asset Service Provider (VASP) wallets increased by 2.3 times year-on-year. On-chain data confirms this trend, indicating a continued increase in asset migration from local exchanges to foreign platforms.

In the long term, capital migration may harm South Korea's Web3 industry. Trading fees and service revenues are flowing abroad, weakening the competitiveness of the local ecosystem and reducing investor protection. This also raises concerns about declining demand for the Korean won and increased volatility in its value.

3. Migration Wave: Relocating Headquarters to Cryptocurrency-Friendly Countries

South Korean Web3 companies are accelerating their offshore migration. In 2024, Nexon's blockchain division Nexpace and the Kaia Foundation of Klaytn and Line Finschia relocated to Abu Dhabi. WeMade's Wemix moved to Dubai. The Web3 industry is rapidly shifting to countries with clearer and more favorable regulations.

South Korea faces numerous obstacles in promoting Web3-related businesses. Companies are unable to open corporate accounts for cryptocurrency trading, making it difficult to use crypto assets. This complicates the monetization of crypto assets and creates issues in accounting, taxation, and business operations. For example, in a cryptocurrency payment business, Company A may receive crypto assets from consumers and need to settle payments in Korean won with sellers. Without a corporate account, monetizing assets becomes nearly impossible.

Although South Korea has established a regulatory framework, the lack of specific guidelines for stablecoins, DeFi, and Web3 gaming limits industry growth. The country's proactive regulatory approach restricts businesses that are not explicitly permitted. In contrast, global markets benefit from regulatory sandboxes that support various pilot projects.

The Trump administration's stance on cryptocurrency may highlight this disparity, as favorable regulatory environments abroad accelerate the migration of Web3 companies from South Korea.

4. Talent Outflow: Weakening the Technical Competitiveness of the Web3 Industry

The relocation of South Korean Web3 companies abroad may negatively impact the domestic Web3 talent pool. As companies move to countries with clearer and more favorable regulations, domestic job opportunities may decrease, leading to talent outflow. This could hinder the development of the domestic Web3 ecosystem.

Talent migration is not just an issue for South Korea's Web3 industry. South Korea is one of the countries with the highest proportion of key talent migrating to the United States, especially those with master's and doctoral degrees. This trend is particularly evident in the technology-dependent Web3 industry and may undermine the industry's competitiveness.

In contrast, countries like the United States and the UAE promote the development of their Web3 industries through clear regulations and supportive policies. South Korea's unclear regulatory environment accelerates talent loss, posing a long-term threat to the country's technological competitiveness and industrial ecosystem.

5. Challenges and Opportunities for the South Korean Web3 Market in 2025: Regulatory Reform and Industry Growth

South Korea is gaining global attention due to its cryptocurrency trading volume. However, this trading volume has not facilitated industry development, making the country a liquidity channel for global traders. This structure is detrimental to sustainable growth. South Korea urgently needs to make progress in business and technology to strengthen its Web3 ecosystem.

Source: Arthur Hayes

Due to insufficient domestic innovation and regulatory uncertainty, South Korea is on the margins of global Web3 development. This over-reliance on trading volume rather than ecosystem building has led to a "Korean discount" in international markets.

In 2025, with a new government in place, significant changes are expected in the global industry. South Korea stands at a critical crossroads in these changes. Positive initiatives include allowing cryptocurrency operators to open corporate accounts, formulating regulations for stablecoins, and advancing cryptocurrency legislation. However, these efforts only scratch the surface.

To make progress, South Korea must address risks, analyze global policy shifts, and develop a regulatory framework suitable for domestic conditions. South Korea must shift its focus from merely trading volume to establishing a sustainable innovation center characterized by excellence in business and technological leadership.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。