"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past seven days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

The First Crypto President: An Overview of Trump's Crypto Landscape

Uncovering the New Leadership Team of U.S. Crypto Regulation: How Long Until Implementation?

The article introduces two newly appointed U.S. crypto regulators: SEC Acting Chair Mark Uyeda and CFTC Acting Chief of Staff Harry Jung.

Also recommended: 《In Conversation with Mr. Mai: A Hardcore Meme Mining Class - Practical Tips for Degen Players | Friends of OKX Episode 6》.

Airdrop Opportunities and Interaction Guides

Jupiter's Surprise Airdrop: What Does It Teach Us About Maintaining Quality Accounts?

How to efficiently and cost-effectively maintain a batch of quality accounts? First, when participating in popular on-chain projects, it is recommended to conduct transactions across multiple wallets. Secondly, increasing the trading volume of wash trading wallets and forming popular project LPs is a strategy. Finally, while the strategy seems simple, sticking to the plan to maintain "quality small accounts" is not an easy task.

Additionally, in the first quarter of this year, top-tier projects are clustering around TGE, and while maintaining a batch of quality accounts, it is still necessary to regularly participate in these high-funding, high-heat, unlaunched projects. The focus should be on quality rather than quantity. Notable unlaunched projects worth participating in include Story, Berachain, Nillion, Initia, pump.fun, and OpenSea.

Meme

Reviewing the Top 10 Profitable Addresses: How to Capture Early Buying Signals for TRUMP?

An introduction to on-chain monitoring ideas and tools.

ZachXBT and the $3.9 Million Meme Coin: Has the Slayer Become the Dragon?

ZachXBT was "issued" and airdropped a Meme coin, followed by a series of operations. In summary:

He did not stop the project but increased liquidity, allowing others to trade;

10% of withdrawals helped him gain economic benefits, but many believe this is what he deserves;

The re-increase in liquidity showed no signs of struggle.

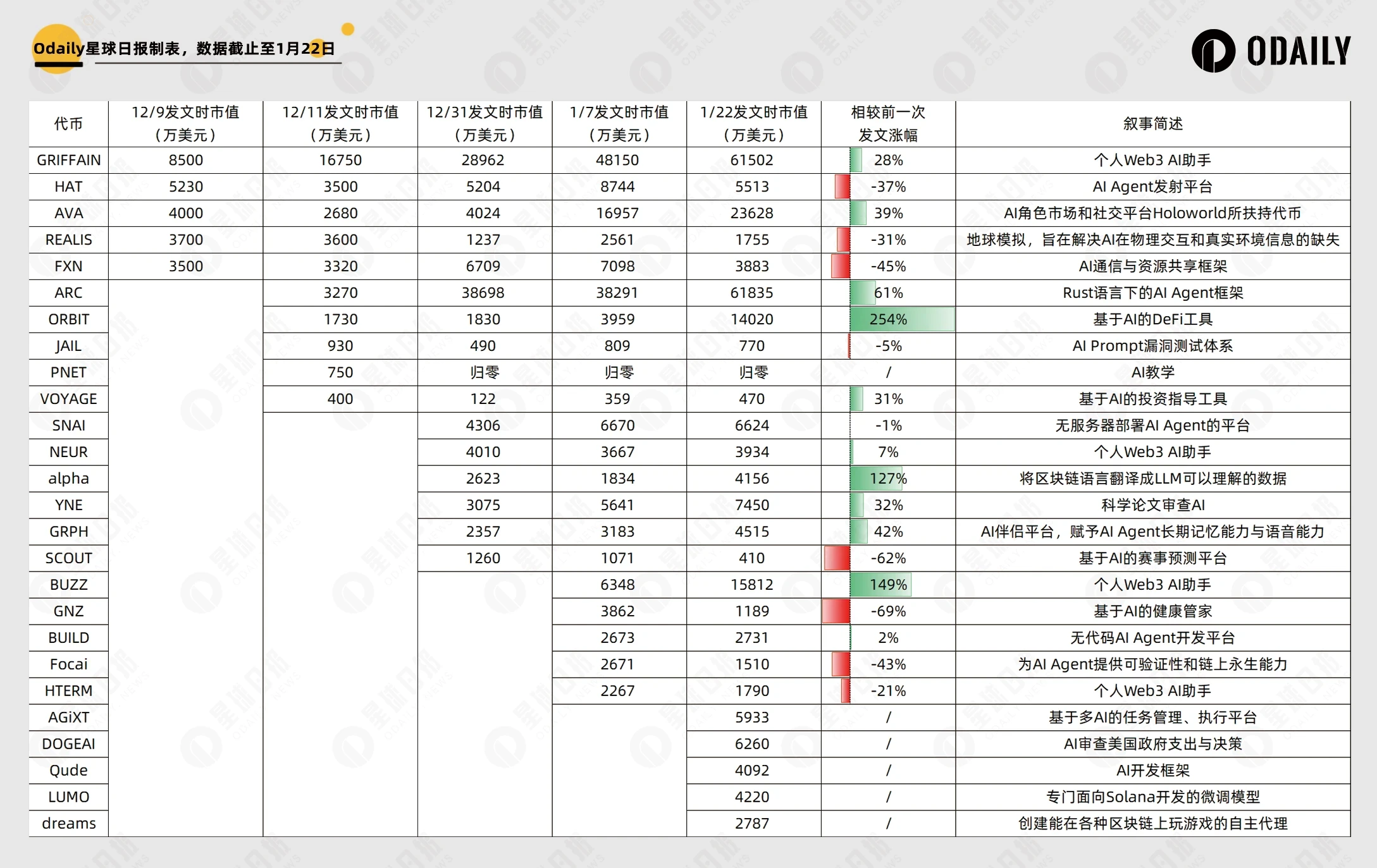

AI + Government Efficiency Departments? What Story is the New Batch of Meme Speedruns Telling?

AI applications have long underperformed, with DeFAI still being the main line.

Also recommended: 《Beginner's Guide: A Step-by-Step Guide to On-Chain Meme Trading》《Hot Money Floods In, Liquidity Soars: A Detailed Explanation of How GMGN Can Help You Earn Millions in Explosive Markets》《Trump's Coin Launch Earns Billions for Chinese Investors, Leading to a Split in the U.S. Crypto Faction》.

Ethereum and Scalability

Leading Projects Pressure Ethereum Foundation, But EF Remains Unmoved

Synthetix and Infinex founders: EF should require L2 to use revenue to buy back ETH.

Curve founder: EF should immediately abandon the L2 strategy.

Aave founder proposed 12 measures to save EF.

Former growth lead of Ethena: EF should focus on DeFi.

Wintermute founder analyzes the potential death spiral of Ethereum.

Insufficient Blob Space: Is Ethereum L2 on the Brink of Collapse?

This article discusses the issue of insufficient Blob space facing Ethereum L2. As L2 chains grow, multiple L2s compete for limited Blob storage, leading to skyrocketing fees and increased user costs. Even with the Pectra upgrade increasing the number of Blobs to 6, the problem can only be temporarily alleviated, not fundamentally resolved. Solutions include short-term Pectra upgrades, mid-term PeerDAS implementation, and long-term DA expansion, but whether these solutions can be timely implemented remains uncertain.

Wealth Effect Severely Diminished: Can Ethereum Survive Its "Midlife Crisis"?

Old and new money no longer favors Ethereum; L2s are splitting liquidity, and doubts are rising; DeFi and NFT dual turbo power are waning; Ethereum's wealth effect is fading, with Solana taking over; Ethereum Foundation selling coins and a bloated team.

Injecting 50,000 ETH: Ethereum Foundation's First Substantial Participation in DeFi

The Ethereum Foundation and Vitalik Buterin recently announced two major decisions: one is to allocate 50,000 ETH (approximately $150 million) to participate in the Ethereum DeFi ecosystem, and the other is a significant restructuring of the leadership structure that has been in the works for nearly a year.

Multi-Ecosystem

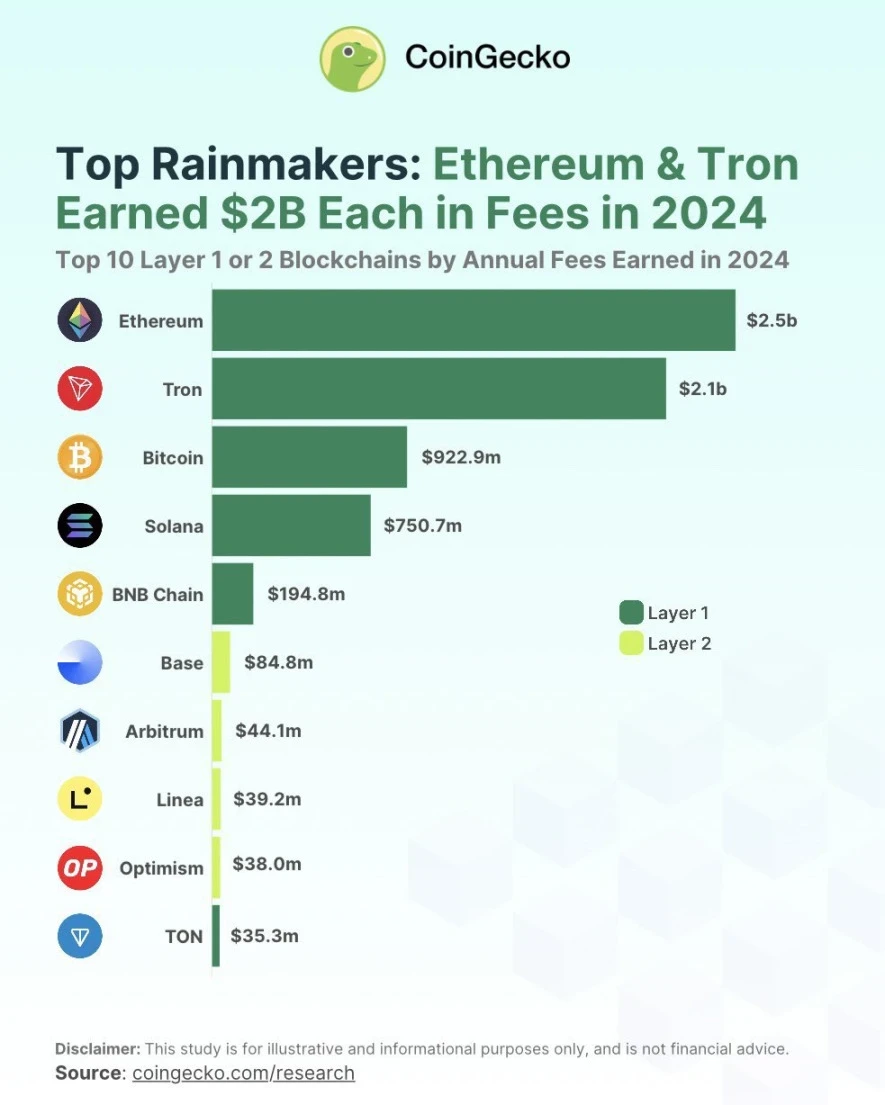

Public Chain Fee Wars: Will Solana Achieve Nearly 30x Growth in 2024?

Crazy Weekend: 10 Charts Analyzing the Solana Moment in the Crypto Market

Solana network DEX trading volume surged from an average of about $5 billion to $27 billion, a 5.4-fold increase. TRUMP, MELANIA, and SOL dominate the market. Meanwhile, market sentiment towards ETH has turned negative again.

Money-Making Guide: Which Protocols on Solana Are Worth Storing PVP Earnings?

The article introduces a batch of unlaunched or potentially airdropped projects: RateX, Fragmetric, Lulo, Meteora, marginfi, Kamino & The Vault.

With Nearly $200 Million in Debt, Will THORChain Collapse?

Thorchain faces serious debt issues, but despite the risks, the protocol still has significant business potential, generating over $30 million in fees annually. By freezing lending and depositor positions, deleveraging, and tokenizing debts, the protocol can be saved while maintaining its core liquidity. Additionally, establishing an economic design committee will ensure the protocol returns to basic principles, improves capital efficiency, and prevents falling back into debt.

NFT, GameFi, SocialFi

In Conversation with Azuki Founder Zagabond: The Crypto Journey and Dreams of the ANIME Universe

The strategy supporting Anime 2.0 involves "full-stack anime": this strategy aims to create a flywheel effect, where each component drives the growth of others. By seamlessly integrating blockchain infrastructure, consumer platforms, and IP, full-stack anime ensures that as more users and developers join, the network becomes increasingly valuable and self-sustaining.

It consists of three parts: blockchain infrastructure, Anime.com, content, and IP.

Web3 & AI

DeFAI's Wild Growth: How to Identify "Pie-in-the-Sky Projects" and Find True Alpha?

The narrative of AI Agents originated from InvestmentDAO, and the ecosystem is just beginning but is growing:

Infrastructure is emerging: some platforms are launching AI trading agents that handle complex DeFi strategies.

Early experiments: individual agents are trading, but the verifiability of their performance remains a challenge. Few agents transparently share their results—BigTonyXBT is one of the rare exceptions.

Insufficient adoption of TEE: TEE remains computationally expensive and relatively immature (but efforts are still being made to demonstrate that agents are the ones steering, not humans).

Weekly Hot Topics Recap

In the past week, Trump issued the Meme coin TRUMP (list of major profit-makers); First Lady Melania Trump launched her personal Meme coin MELANIA; Trump was inaugurated as President of the United States; Trump: will revoke nearly 80 executive actions from the previous administration; Trump signed the first crypto executive order: banning CBDCs, requiring an assessment of strategic national digital asset reserves, and upholding dollar sovereignty; Trump: The U.S. will become the global capital of artificial intelligence and cryptocurrency; Trump signed an executive order to establish a government efficiency department; TikTok resumed services in the U.S.; Trump responded to the coin issuance: unsure if TRUMP coin is profitable, but heard it is very successful; Trump pardoned Silk Road founder Ross Ulbricht; Musk officially took office in the U.S. government efficiency department, with the Chief Diversity Officer Executive Committee becoming the first department to be cut;

In addition, regarding policies and the macro market, Trump will demand the Federal Reserve immediately cut interest rates; Mark Uyeda took over from Gary Gensler as SEC Acting Chair; Hester Peirce will lead the newly established cryptocurrency working group at the SEC; Massachusetts Senator proposed a bill to establish a Bitcoin strategic reserve in the state; sources: German politicians are preparing for the possibility of Trump announcing a strategic Bitcoin reserve;

In terms of opinions and voices, Bridgewater Capital founder: Trump's issuance of Meme coins is detrimental to the industry, stop deceiving yourself; Bitcoin Magazine criticized TRUMP: Trump likes cryptocurrency, as long as it can be used to make money; U.S. Congresswoman Maxine Waters: TRUMP represents "the worst side of Crypto", harming legitimate projects in the cryptocurrency industry; U.S. lawmakers: worried that foreign individuals and governments may use TRUMP or MELANIA to influence President Trump and his family; Arthur Hayes: Trump proves that Meme coins are the best fan interaction tool; CZ: FOMO has just begun; Vitalik: supports ETH engaging with funds, institutions, and countries, willing to discuss ETH from an asset perspective; Consensys founder: Ethereum will publicly disclose multiple high-value plans, which will leave you "dizzy"; Vitalik: The Ethereum Foundation team has decision-making power over personnel, please stop creating an environment harmful to talent; Vitalik's new article: should continue to adhere to the L2 scaling route, but L2 needs to fulfill commitments, such as contributing a certain income to support ETH; Multicoin co-founder: lost confidence in Ethereum since 2017, and the situation has hardly changed in seven years; Jupiter: ensured the smooth issuance of TRUMP by closely collaborating with the Meteora team during the process;

In terms of institutions, large companies, and leading projects, Solana faced a stress test; Solayer's pre-sale subscription phase ended, over-subscribed nearly five times; Jupiter: all systems are under extreme load, and the team is working hard to restore normal service as soon as possible; Tron DAO became the largest buyer of WLFI tokens for the Trump family project; Telegram reached a new cooperation with the TON Foundation, and Telegram will stop supporting blockchains and cryptocurrencies other than TON; Jupiter DAO launched Jupuary airdrop claims; Lido co-founder Konstantin Lomashuk created a "Second Foundation" for Ethereum; The Virtuals ecosystem buyback plan has been launched, with GAME, CONVO, and AIXBT currently ranking in the top three for buyback efforts; ANIME opened airdrop claims; Solana core developer Cantelopepeel resigned, stating he will establish "a new generation of L1 designed for performance"; the founder issued coins quickly, and Musk's short video platform Vine made a comeback;

In terms of data, Moonshot briefly became the most popular financial app in the U.S. Apple App Store and ranked in the top 5 free apps… well, it was another week of witnessing history.

Attached is the portal to the "Weekly Editor's Picks" series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。