Good evening, brothers!

Value investing ≠ never selling

In his 1983 letter to shareholders, Buffett wrote: "As long as we expect the good companies Berkshire holds to generate cash inflows and feel comfortable with the management and employees of the company, we will never sell them easily, regardless of the price." A considerable number of investors interpret one of Buffett's investment principles as long-term holding, never selling. So, is this understanding reasonable? Let's analyze it:

First, let's look at Buffett's investment classification. Buffett's investments can be roughly divided into companies and stocks. The former includes See's Candies, Buffalo News, Nebraska Furniture Mart, etc., while the latter includes General Foods, The Washington Post, Geico, etc. If we closely observe the companies and stocks held by Buffett, it is not difficult to find that his stock investment portfolio changes every year. Not easily selling companies refers more to Berkshire's wholly-owned subsidiaries.

Second, let's consider the scale of Buffett's investments. In 1983, Berkshire's pre-tax earnings were $137 million, and it had dozens of different types of companies covering various businesses such as insurance, textiles, retail, news, savings and loans, and consumer goods. If one or more equity assets are liquidated, it would require reconsidering where to place those funds. The U.S. has high capital gains taxes, and each sale and repurchase effectively interrupts the rhythm of compound interest accumulation.

For us ordinary investors, there are at least three differences between us and Buffett: First, we buy stocks, not entire companies; Second, given our investment size, the market is likely to support trading liquidity; Third, currently, there are no capital gains taxes in the A-shares and Hong Kong stock markets, so trading costs are relatively low. Therefore, when the stocks we hold are clearly overvalued and we have alternative investment options, I would choose to sell.

…

Musk is becoming an important driver in the digital asset industry.

According to Bloomberg, Musk has begun discussing the use of blockchain technology in the newly established Department of Government Efficiency (DOGE). He has explored ideas with close allies about using digital ledger technology to improve government efficiency and reduce costs.

Discussion topics include using blockchain to track federal spending, protect data, make payments, and even manage buildings.

The DOGE team has met with representatives from several public blockchain projects to assess their technical feasibility. A source said that Musk had recruited about 100 volunteers to write code for the project before Trump's inauguration.

BTC: On the 4-hour level, the price continues to oscillate near the middle band of the Bollinger Bands, with a general price trend.

On the daily level, the price continues to oscillate near the moving averages.

In summary, support level at 104500, resistance level at 105000.

ETH: On the 4-hour level, the price continues to oscillate near the middle band of the Bollinger Bands, with a support level at 3290 and a resistance level at 3330.

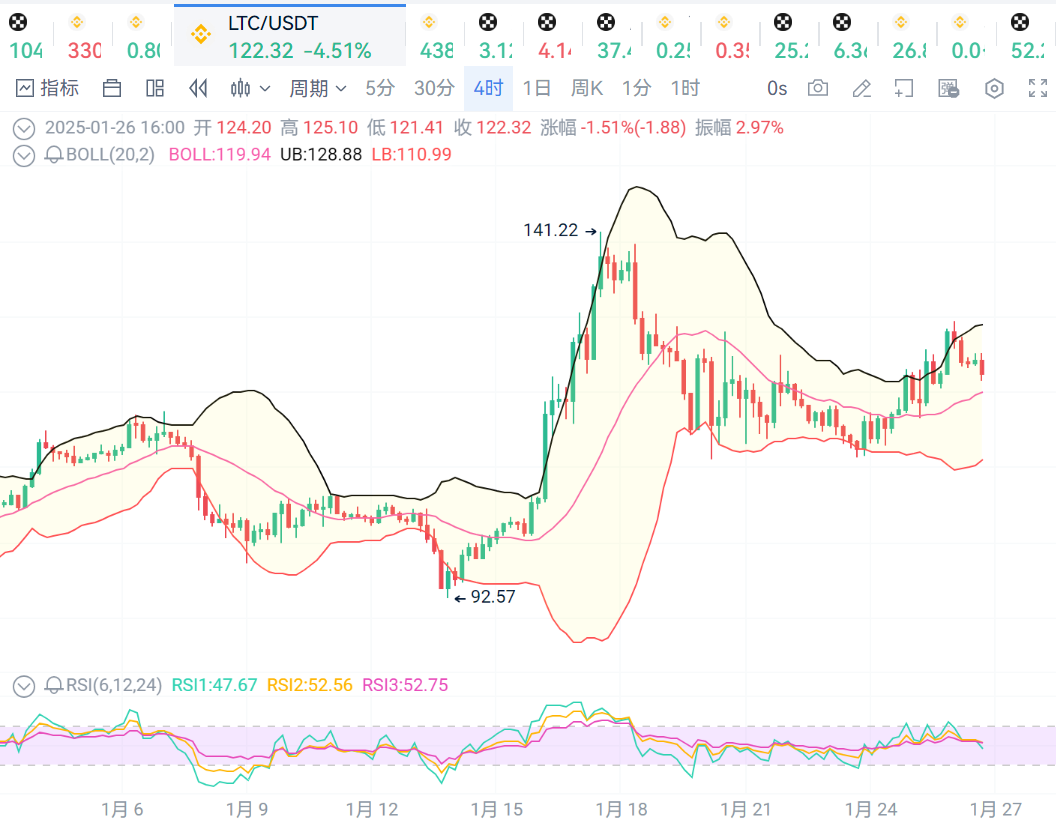

LTC: The price continues to stay above the middle band of the Bollinger Bands, with a healthy price trend, support level at 110, resistance level at 130.

BCH: The price continues to oscillate near the middle band of the Bollinger Bands, with a support level at 420 and a resistance level at 450.

That's all for now, good night!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。