Market Overview

Overall Market Situation

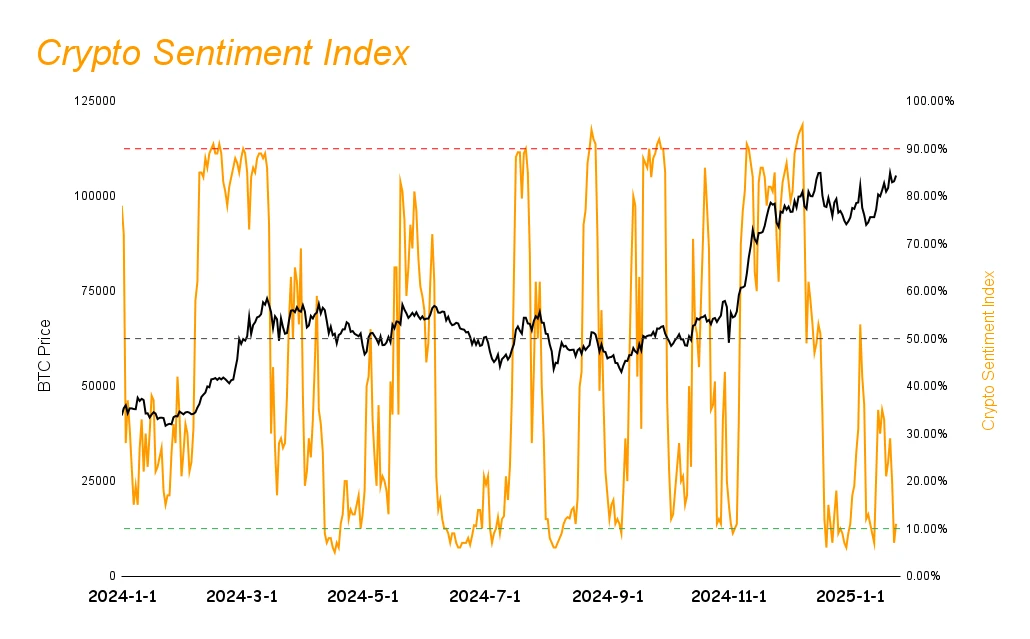

This week, the cryptocurrency market exhibited wide fluctuations, with the market sentiment index dropping from 35% last week to 10%, entering the extreme fear zone. The market capitalization of stablecoins continues to grow (USDT reached 138.9 billion, USDC reached 51.9 billion), indicating that institutional funds are still entering the market; the poor market sentiment is mainly influenced by Trump's failure to promptly introduce cryptocurrency-related policies after taking office. Although Trump issued a bill regarding cryptocurrencies and the SEC repealed SAB-121 on Thursday, it did not significantly boost market sentiment, leading to most tokens experiencing declines greater than the overall market, with Altcoins performing weaker than the benchmark index.

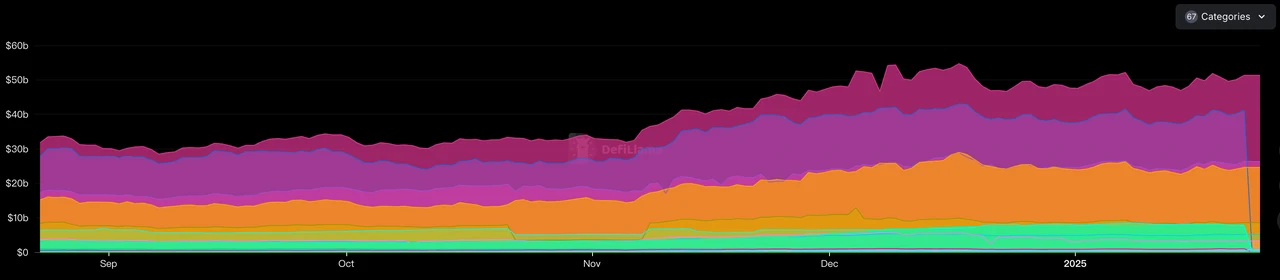

DeFi Ecosystem Development

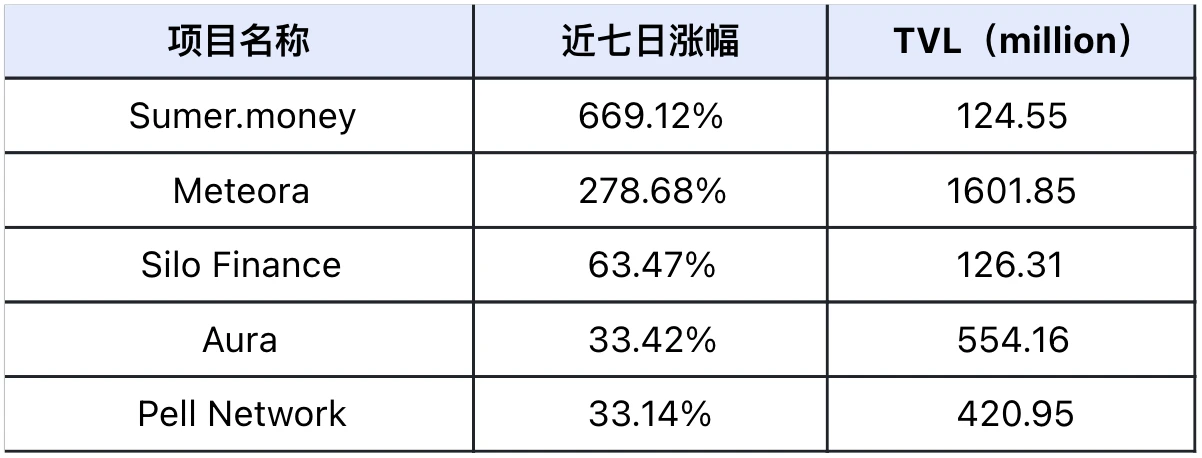

The DeFi sector performed outstandingly, with TVL increasing from 53.5 billion to 53.8 billion, a growth of 0.56%, marking two consecutive weeks of positive growth. This is mainly attributed to the rise in the prices of underlying assets and project incentive measures, with on-chain APY generally increasing. Projects like Sumer.money and Meteora performed well in terms of TVL, indicating that investors are beginning to refocus on the fundamental returns in the DeFi space.

AI Sector Development

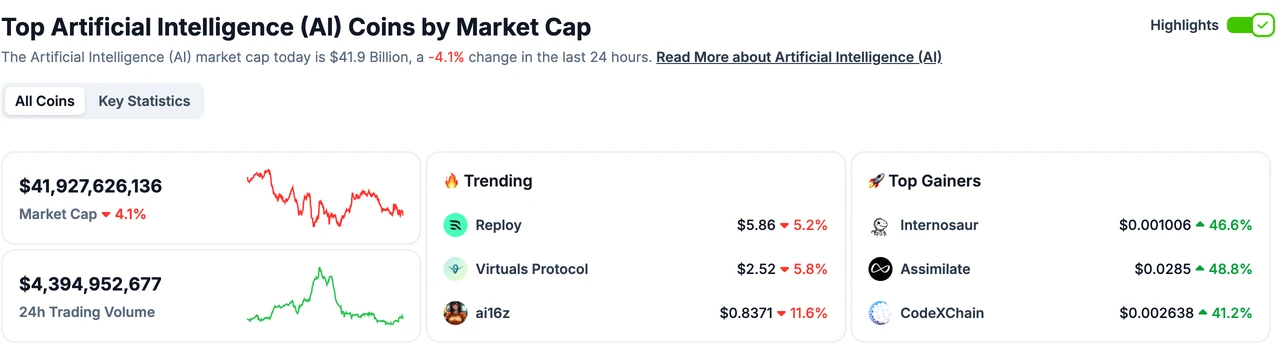

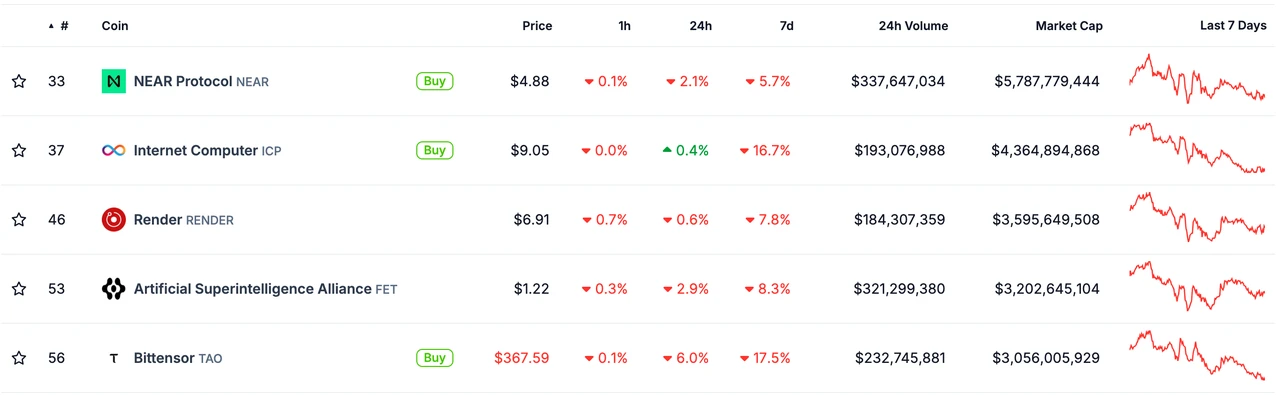

Influenced by Trump's announcement of a $500 billion AI infrastructure plan, the total market capitalization of the AI sector reached $41.9 billion, but subsequently experienced a pullback due to low market sentiment. In terms of projects, Virtuals Protocol and Swarms continue to push for technological innovation, focusing on autonomous trading agents, multi-agent collaboration frameworks, and infrastructure development, while emerging narratives such as TEE technology applications and agent economic systems are gradually gaining attention.

Meme Coin Trends

This week, the focus of the Meme coin market was on the official tokens TRUMP and MELANIA issued by Trump and Melania on Solana, which led to a significant concentration of funds and attention on these two tokens, causing other Meme coins to experience substantial declines, highlighting the highly speculative and trend-following nature of the Meme coin market.

Public Chain Performance Analysis

In the public chain ecosystem, Solana and Tron stood out, particularly Solana, which benefited from the issuance of the TRUMP token, with the on-chain stablecoin supply reaching a historic high of $10.138 billion. Meanwhile, emerging public chains like Sonic, Core, and BSquared continue to innovate in the DeFi and AI sectors, demonstrating good potential for ecological development.

Future Market Outlook

Looking ahead to next week, the market will focus on important events such as the Federal Reserve FOMC meeting, PCE price index, and tech stock earnings reports. The market is expected to maintain a fluctuating trend, but investors are generally optimistic about the opportunities that may arise as cryptocurrency policies gradually clarify after February. The DeFi and AI sectors are likely to continue benefiting from improvements in fundamentals and policy support, while competition in the public chain ecosystem will intensify.

Market Sentiment Index Analysis

The market sentiment index dropped from 35% last week to 10%, entering the extreme fear zone.

Altcoins performed overall weaker than the benchmark index this week, with most tokens experiencing declines greater than the overall market. This is mainly because market investors are generally waiting for the introduction of cryptocurrency-related bills and policies in Trump's new administration. Although Trump issued a bill regarding cryptocurrencies and the SEC repealed SAB-121 on Thursday, it did not significantly boost market sentiment, leading investors to be cautious in their current market investments, resulting in poor overall market sentiment. Given the current market structure, it is expected that Altcoins will remain in sync with the benchmark index in the short term.

Overall Market Trend Overview

The cryptocurrency market was in a fluctuating trend this week, with the sentiment index entering the extreme fear zone.

DeFi-related cryptocurrency projects performed better than those in other sectors, indicating ongoing market attention to improving fundamental returns.

AI-related projects garnered high public attention this week, showing that investors are actively seeking the next market breakout point.

Hot Sectors

AI Rise: From Trump's $500 billion infrastructure to 90% on-chain transaction intelligence, Web3 is ushering in the AI revolution year

This week, with Trump announcing a $500 billion AI infrastructure plan for the next four years, the overall AI sector experienced a rebound. However, it subsequently fell back due to the overall low market sentiment.

In the past week, various projects did not halt their innovation despite the significant market fluctuations. Virtuals Protocol updated its value accumulation mechanism, Swarms established a $10 million token ecological fund and plans to launch new features, AI16Z expanded into the Near and Avalanche ecosystems, and Holoworld launched its Launchpool. Meanwhile, AIXBT continued to dominate the Kaito attention leaderboard, indicating that various project teams are still steadily advancing their development. Currently, the market is mainly focused on autonomous trading agents (such as Cod3x, Almanak), multi-agent collaboration frameworks (Spectral Lux), and infrastructure development (Virtuals SDK), while emerging narratives such as TEE technology application validation, the formation of agent economic systems, and cross-chain agent ecosystem integration are gradually gaining market attention.

According to Messari's predictions, by the end of 2025, it is expected that 90% of on-chain transactions will no longer be manually operated by humans but will be completed by a group of AI agents. These intelligent agents can not only perform micro-payments based on real-time data but also continuously optimize liquidity pools and allocate rewards reasonably, achieving more efficient and intelligent operations. It is foreseeable that the Crypto market is about to enter the AI era.

DeFi Sector TVL Growth Ranking

The top 5 projects with the highest TVL growth in the past week (excluding projects with low TVL, standard set at over $30 million), data source: Defilama

Sumer.money (not yet issued): (Recommended Index: ⭐️⭐️⭐️)

Launched NFT minting activities in collaboration with numerous projects.

Project Introduction: Sumer.money is a cross-chain synthetic asset protocol with a lending market, deployed on supported chain networks. Sumer.money supports the creation of SuTokens (synthetic assets of USD, ETH, and BTC), providing users with a credit card-like experience.

Latest Developments: Sumer Money successfully surpassed the $100M TVL milestone this week. Additionally, Sumer Money has partnered with BeraSkool, Bera Horses, and Kingdomly to launch NFT minting activities and strategically joined the Core DAO's Core Ignition program. The team revealed optimization strategies for Sumer Money Multipliers (suBTC) through AMA and is actively preparing new liquidity pool design plans; Sumer.money maintains community engagement through Twitter interaction contests.

Meteora (not yet issued): (Recommended Index: ⭐️⭐️⭐️)

Launched the "Liquidity Ratio Slider" feature to enhance user experience.

Project Introduction: Meteora is a DeFi project based on the Solana blockchain, aimed at improving capital efficiency and trading experience through optimized liquidity. It provides decentralized liquidity management tools, including automated trading, fee analysis, and anti-sniping bot protection for token issuance.

Latest Developments: Meteora launched the innovative "Liquidity Ratio Slider" feature this week, simplifying the process for users to adjust asset liquidity allocation. In terms of ecological development, the LP Army is showing a diversified development trend, attracting users from different languages and regions to participate in liquidity provision and collaborating with the Starseed team. In community operations, activities such as LP Army community conference calls and Office Hours continue to strengthen interaction and communication with users, showcasing the project's ongoing innovation capabilities and global development strategy in the DeFi field.

Silo Finance (SILO): (Recommended Index: ⭐️⭐️)

Launched S-ETH and S-USDC to increase user yields.

Project Introduction: Silo Finance is a decentralized, permissionless lending protocol that provides secure and efficient money markets by utilizing isolated elements. Silo's design aims to address the main pain points of existing lending protocols, solving the security flaws of shared pools by isolating each lending pool.

Latest Developments: Silo Finance launched two important markets, S-ETH and S-USDC, this week, providing users with a rich array of trading options. The S-USDC market offers an annualized yield of up to 5,425%, while stS/S silo provides a stable yield of 7.9%. Additionally, Silo Finance has established a strategic partnership with Solv Protocol and successfully ranked as the second-largest protocol in Sonic Labs, controlling 20% of the Sonic USDC supply and 10% of the stS supply. This week, Silo Finance attracted user participation through its innovative Sonic points mechanism and diversified yield strategies.

Aura (AURA): (Recommended Index: ⭐️⭐️)

Launched StableSurge, innovative anti-peg mechanism shows effectiveness, capital efficiency skyrockets to 1:1.58

Project Introduction: Aura Network is an NFT-centric public chain project aimed at accelerating the adoption of blockchain internet for global NFTs. Aura Network provides an open system that maximizes interoperability and integrates NFTs into the infrastructure layer of the metaverse.

Latest Developments: This week, Aura launched the StableSurge Hook technology in collaboration with Balancer. This innovative mechanism effectively mitigates de-pegging risks through a price tax mechanism while enhancing LP holders' returns during market fluctuations. Additionally, it will soon launch Balancer v3 Boosted Pools on the platform, providing users with diversified sources of income, including rewards from trading, lending, T-Bills, and more. Aura has also partnered with GnosisChain to offer up to 5% GNO cashback incentives. In terms of governance, Aura demonstrates significant capital efficiency, indicating that every $1 invested in incentives can yield $1.58 in output. Recently, it distributed over $300,000 in incentives to vlAURA voters during the recent dual cycle, showcasing the project's ongoing innovation capabilities and operational efficiency in the DeFi space.

Pell Network (PELL): (Recommended Index: ⭐️⭐️⭐️)

Pell Network lays out full-chain BTC re-staking

Project Introduction: Pell Network aims to create a decentralized token economy security leasing platform for the Bitcoin ecosystem. By building an aggregation of native BTC Stake and LSD re-staking services, it allows stakeholders to choose verification based on new software modules built within the Pell Network ecosystem.

Latest Developments: This week, Pell Network focused on enhancing the functionality of the PELL token and integrating the EGLD re-staking protocol. It launched an innovative Omnichain Bitcoin re-staking network in collaboration with SovereignChains and established an exclusive partnership with Hatom Protocol to provide algorithmic lending solutions for the MultiversX ecosystem. Additionally, it formed strategic partnerships with Atlas_Nodes and P2Pvalidator to jointly promote the development of Bitcoin re-staking, while Pell Network is actively preparing for its IDO issuance on xLaunchpad.

In summary, we can see that the projects with rapid TVL growth this week are mainly concentrated in the machine gun pool projects.

Overall Sector Performance

- Liquidity gradually increases: The APY of on-chain DeFi projects has seen a significant increase due to the rise in the prices of underlying assets and various DeFi projects issuing points as incentives. Therefore, for investors who are optimistic about the long-term prospects of the Crypto market, returning to DeFi will be a very good choice.

- Capital Situation: The TVL of DeFi projects rose from $53.5 billion last week to $53.8 billion now, an increase of 0.56%. This marks two consecutive weeks of positive growth in the TVL of various DeFi sectors. This is mainly due to the market's optimistic outlook following Trump's inauguration as President of the United States in the first quarter, leading to a flow of funds into the DeFi industry. Additionally, the APY of various DeFi projects has increased, attracting on-chain capital participation and driving the rise in DeFi market TVL.

Other Sector Performance

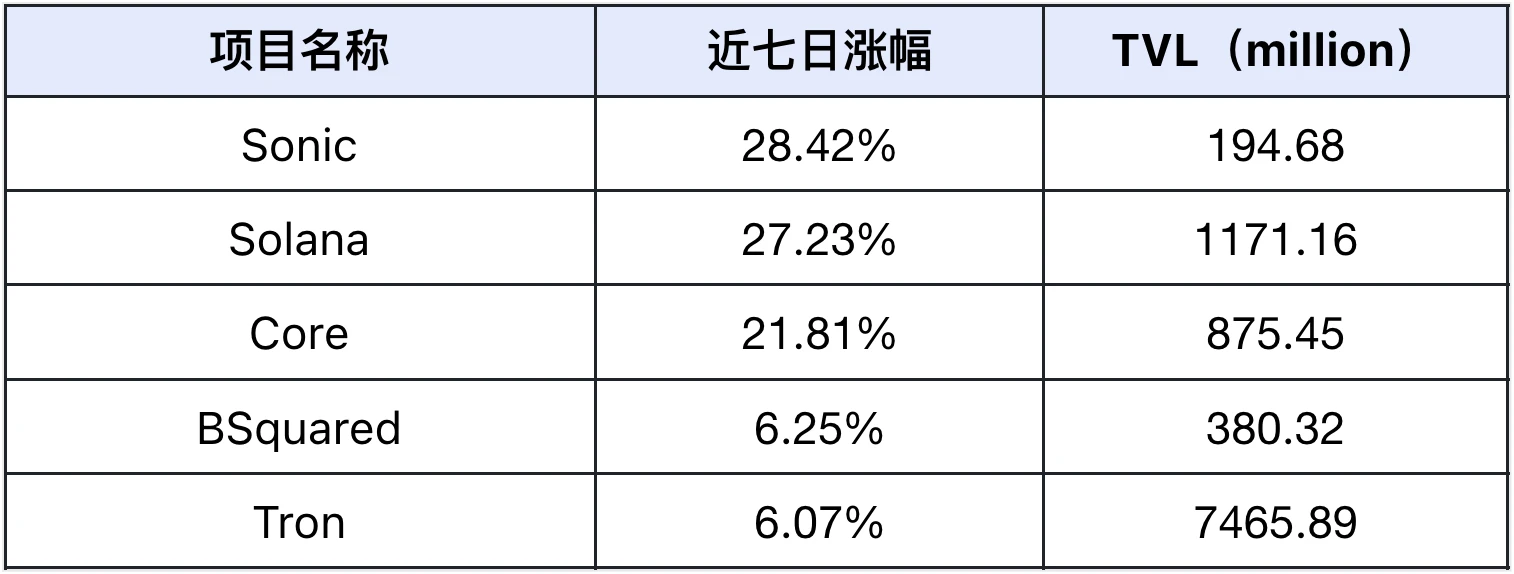

Public Chains

The top 5 public chains with the highest TVL growth in the past week (excluding public chains with low TVL), data source: Defilama

Sonic: Sonic dual exchange launch ignites ecological enthusiasm: Integrates Chainlink cross-chain functionality, $250,000 DeFAI hackathon boosts AI Agent development

This week, Sonic successfully integrated Chainlink's cross-chain and data feed functionalities and collaborated with OrderlyNetwork to provide stronger cross-chain liquidity support. Additionally, Sonic's token $S successfully launched trading on two major exchanges, OKX and Binance, bringing significant traffic to Sonic. Furthermore, Sonic initiated a $250,000 prize pool for the DeFAI hackathon, encouraging developers to build AI agent applications. Sonic has also established partnerships with multiple platforms, including KuCoin, OKX, and TrustWallet, to support token migration and continuously strengthen community interaction through events like AMAs.

Solana: Trump and Melania's arrival on Solana sparks Meme craze, on-chain stablecoin supply breaks $10 billion record

This week, Solana's core work focused on expanding its stablecoin ecosystem, with the on-chain stablecoin supply reaching $10.138 billion, setting a new historical high. Solana also partnered with E Money Network to enable the use of Solana stablecoins for payments and rewards at over 150 global merchants. Additionally, Multicoin Capital released a research report highlighting Solana's advantages in capital markets, emphasizing its low latency and tight spreads. In terms of ecological development, Solana added Indie.fun as a dedicated community fundraising platform for Solana games. Most notably, this week, Trump and Melania issued their official Meme coins TRUMP and MELANIA on Solana, bringing significant traffic and capital influx to the platform.

Core: Core focuses on BTC consumer chain with a three-pronged approach: Collaborates with SumerMoney to enhance lending, Coretoshi NFT innovation incentives

This week, Core's work revolved around three directions: First, in ecological development, it established a deep partnership with SumerMoney to enhance the platform's lending capabilities. Second, in product innovation, it optimized the Sparks reward mechanism through Coretoshi NFTs while continuously attracting Bitcoin inflows to solidify its position as a Bitcoin consumer chain. Lastly, in market promotion, it plans to host a DAO gallery event in Tokyo and launch the Core Ignition initiative to enhance user engagement and platform activity.

BSquared: B² Network partners with 0G_labs to create a decentralized AI operating system, laying out the BTC native AI Agent ecosystem

This week, B² Network focused on AI sector layout: First, it reached a strategic partnership with 0Glabs and GaianetAI to jointly develop a decentralized AI operating system. Second, through collaborations with projects like ElizaOS_ai and ai16zdao, it deepened the technical integration of Bitcoin and AI Agents. Additionally, it partnered with utxostack to launch the Lightning Genesis airdrop event, showcasing the project's development dynamics across multiple dimensions, including AI infrastructure, application ecology, and community building.

Tron: Following Sun Yuchen's appointment as Trump's family crypto advisor, Tron makes a high-profile appearance at three major events in Washington

After Tron founder Sun Yuchen was appointed as an advisor for Trump's family cryptocurrency project World Liberty Financial, with Trump's inauguration as President of the United States this week, Tron focused on participating in a series of high-profile events in Washington, D.C., including the Crypto Ball, President’s Reception, and Candlelight Dinner. Through in-depth dialogues with policymakers and industry leaders, Tron aims to promote the compliant development of cryptocurrencies and the widespread adoption of blockchain technology.

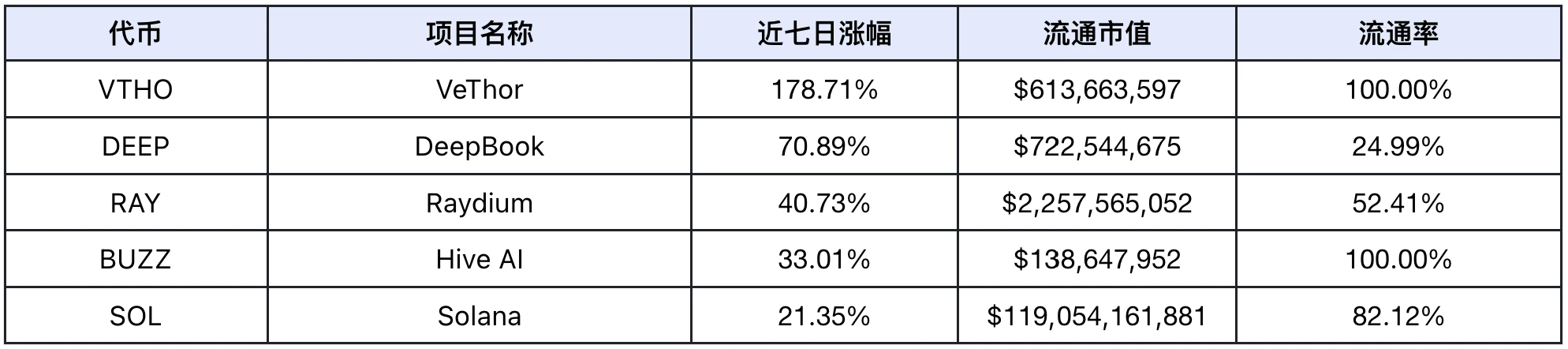

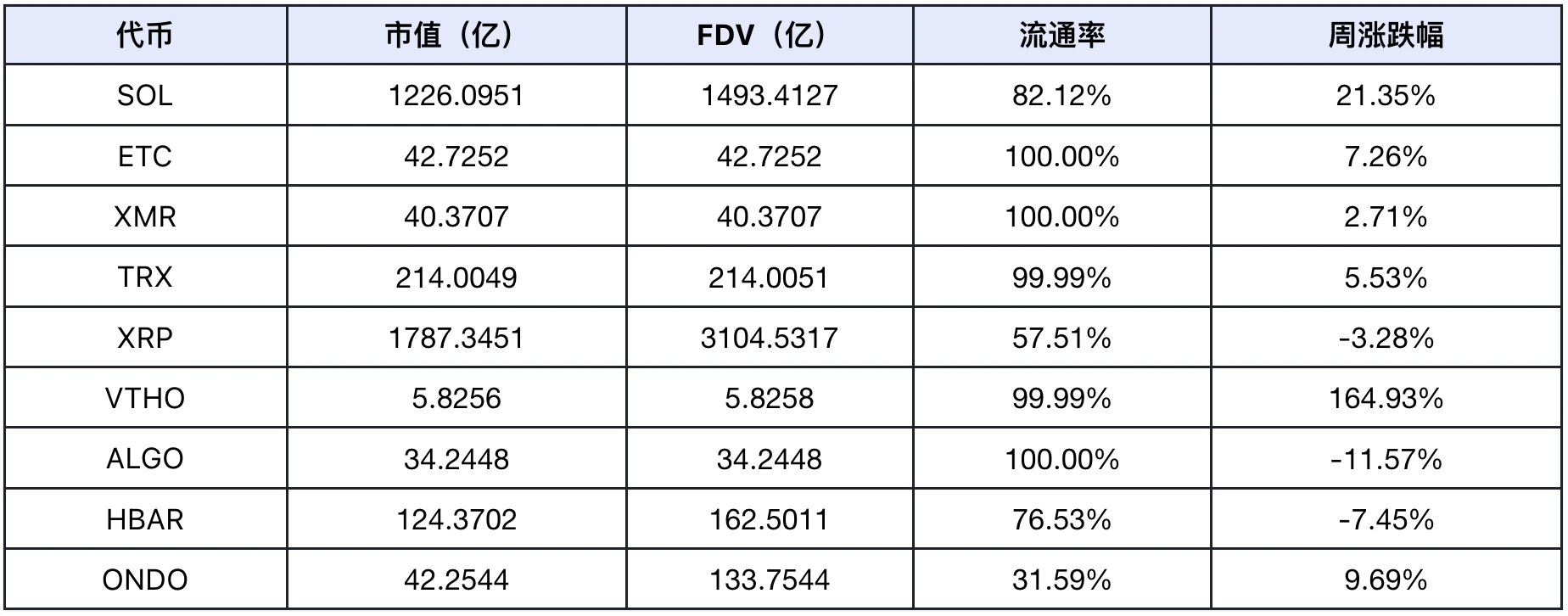

Growth Ranking Overview

The top 5 tokens with the highest growth in the past week (excluding tokens with low trading volume and meme coins), data source: Coinmarketcap

VTHO: VeThor launches B3TR protocol upgrade to enhance security, UFC collaboration continues to strengthen NFT ecological layout

This week, VeThor advanced key protocol upgrades on a technical level and launched the B3TR feature to enhance platform security and daily application scenarios. In terms of ecological development, it showcased vitality through ongoing collaboration with UFC and support for NFT innovation projects while optimizing staking and reward distribution mechanisms to improve user experience and actual yield. Additionally, VeThor deepened its layout in the sustainable development field through collaboration with Mugshot, reflecting its balanced development strategy between technological innovation and practical application.

DEEP: DeepBook V3 daily trading volume breaks $52.6 million record, low fee advantage solidifies Sui DeFi infrastructure position

This week, DeepBook achieved a significant milestone with a 24-hour trading volume of $52.6 million after the V3 version launch. This achievement not only confirms the maturity of its technical architecture but also reflects the platform's important position in the DeFi space. By continuously emphasizing its low fee advantage and branding itself as "I am the pulse of DeFi," DeepBook further solidified its status as a core DeFi infrastructure within the Sui ecosystem. DeepBook is making substantial progress in the decentralized trading field through an optimized user experience and stable technical support.

RAY: Raydium seizes the Trump concept coin opportunity to push 10x leverage contracts, distributing $200,000 USDS to incentivize liquidity

With the explosive popularity of the Solana ecosystem this week, Raydium, as a well-known DEX on the Solana chain, also received a significant boost. This week, Raydium launched perpetual contracts for $MELANIA and $TRUMP with 10x leverage, expanding its Perps trading product line. It also renewed the USDS reward program, offering weekly rewards of 50,000 USDS + 750 RAY in the SOL-USDS Vault, 100 RAY in the SOL-USDS 0.03% pool, and 150,000 USDS in the USDS-USDC Vault. These measures continuously attract user participation and enhance platform liquidity.

BUZZ: Hive AI upgrades Swarm distributed architecture to achieve multi-agent collaboration, Market Agent intelligently tracks top traders' strategies

This week, Hive AI implemented a multi-agent collaborative working mechanism through its innovative Swarm distributed architecture, significantly enhancing the overall system efficiency. The Token Analysis Agent updated its charting tools and token data UI while launching an experimental portfolio page, enhancing support for liquidity management of the Raydium protocol. By continuously integrating more protocol data, Hive AI provides users with more comprehensive portfolio analysis and yield discovery capabilities. Notably, Hive AI's Market Agent enables intelligent analysis of the trading behaviors of top traders, showcasing its unique advantages in cryptocurrency data processing and intelligent analysis.

SOL: Trump and Melania's arrival on Solana sparks Meme craze, on-chain stablecoin supply breaks $10 billion record

This week, Solana received a massive boost from the issuance of official Meme coins TRUMP and MELANIA by Trump and Melania, bringing significant traffic and capital influx to Solana. The on-chain stablecoin supply on Solana reached $10.138 billion, setting a new historical high. Solana also partnered with E Money Network to enable the use of Solana stablecoins for payments and rewards at over 150 global merchants. Additionally, Multicoin Capital released a research report highlighting Solana's advantages in capital markets, emphasizing its low latency and tight spreads. In terms of ecological development, Solana added Indie.fun as a dedicated community fundraising platform for Solana games.

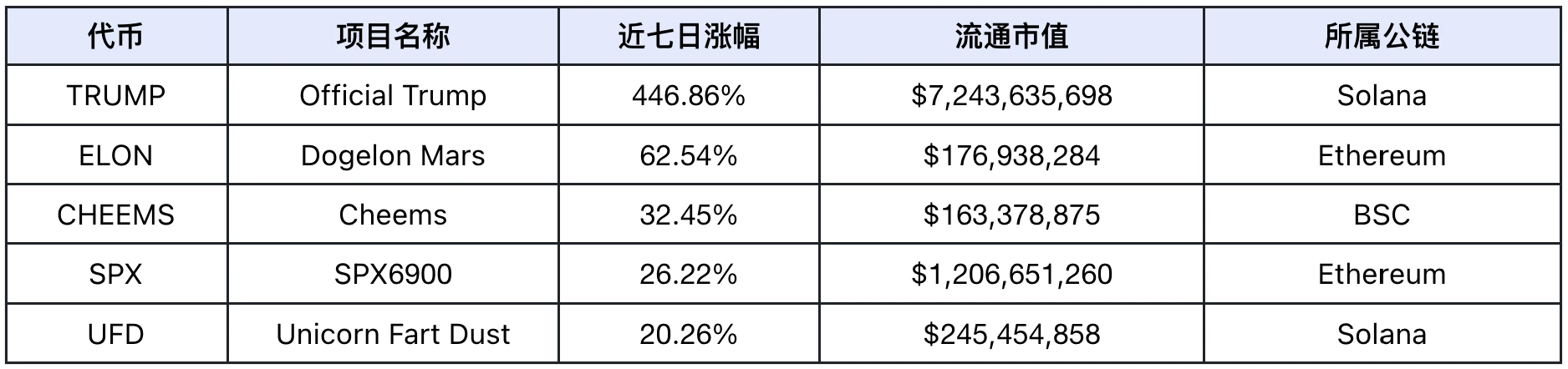

Meme Token Growth Ranking

Data Source: coinmarketcap.com

This week, the market experienced wide fluctuations. After Trump and Melania issued their official Meme coins TRUMP and MELANIA on Solana, most of the market's funds and attention were drawn to them, causing a significant decline in most other tokens, especially other Meme coins, in a short period.

Social Media Hotspots

Based on the top five daily growth topics from LunarCrush and the top five AI scores from Scopechat, the statistics for this week (1.18–1.24) are as follows:

The most frequently mentioned topic was L1s, with the following tokens listed (excluding tokens with low trading volume and meme coins):

Data Source: Lunarcrush and Scopechat

The TRUMP coin caused market turbulence and fund diversion, with Layer 1 projects stabilizing and rebounding first due to high DeFi yields.

According to data analysis, the most discussed projects on social media this week were Layer 1 projects. The overall market experienced wide fluctuations. After Trump issued his official Meme coin TRUMP on Solana last weekend, liquidity was quickly drawn away by TRUMP, and active funds on-chain surged into the Solana chain, leading to declines across various sectors. On Monday, during Trump's inauguration, the oath ceremony and the first two days of signed bills did not mention Crypto. Although on Thursday, Trump signed a bill regarding cryptocurrencies and the SEC's repeal of SAB-121, it did not significantly boost market sentiment. As a result, various projects experienced varying degrees of decline. However, after a brief drop, Layer 1 projects rebounded due to market optimism about future trends, and the APY of various on-chain DeFi projects increased, attracting more on-chain users to participate. Most DeFi projects use tokens from various Layer 1 projects, causing the market to shift attention and funds back to public chain projects.

Market Topic Overview

Data Source: SoSoValue

According to weekly return rate statistics, the DeFi sector performed the best, while the GameFi sector performed the worst.

DeFi Sector: There are many projects in the DeFi sector. In SoSoValue's sampling, LINK, UNI, and AAVE accounted for the largest shares at 43.36%, 18.11%, and 13.07%, respectively, totaling 74.54%. This week, LINK, UNI, and AAVE rose by 11.42%, 2.13%, and 7.86%, respectively, leading to the largest increase in the entire DeFi sector. Additionally, the significant price volatility this week created many arbitrage opportunities, resulting in the best performance of DeFi sector projects.

GameFi Sector: The GameFi sector has not received market attention during this cycle, resulting in a lack of funds and traffic, which has diminished its previous wealth creation effect and led to decreasing interest. The sector's top tokens, IMX, BEAM, GALA, SAND, and AXS, accounted for a total of 71.99%, and all of these tokens experienced significant declines this week, resulting in the worst performance for the GameFi sector.

Next Week's Major Crypto Events

Thursday (January 30): The Federal Reserve FOMC announces interest rate decisions; U.S. initial jobless claims for the week ending January 25; U.S. Federal Reserve interest rate decision (upper limit) for January 29; Plan B Forum El Salvador 2025; Ethereum Zurich 2025; Tesla releases Q4 and full-year financial reports for 2024.

Friday (January 31): U.S. December core PCE price index year-on-year; OneKey Card announces it will gradually cease services.

Next Week's Outlook

- Macroeconomic Factors Analysis

Next week will see several financial events, including the Federal Reserve's interest rate meeting, the U.S. December core PCE price index year-on-year, and the start of earnings season for U.S. listed companies. The market has largely priced in that the Federal Reserve will maintain interest rates in January. The upcoming U.S. December core PCE price index is one of the indices the Federal Reserve is particularly concerned about, which may influence the next interest rate meeting to some extent. Additionally, as U.S. listed companies enter earnings season, especially the performance reports of the seven major tech giants, the results will cause short-term market fluctuations. Therefore, it is expected that the market will continue to maintain a volatile trend next week.

- Sector Rotation Trends

Although the DeFi sector currently faces poor sentiment after several weeks of repeated fluctuations, investors generally expect that after February, as policies related to Crypto are gradually announced, the market will experience a broad rally. Therefore, most investors are still unwilling to sell their tokens. Meanwhile, to increase holding yields, they are participating in machine gun pool projects to enhance returns.

The AI sector, particularly the AI Agent segment, has not received sustained market attention, and the market capitalization has begun to decline for the first time, currently at $15 billion, down nearly 5.66% from last week. This week, due to Trump's announcement of a $500 billion investment in AI infrastructure over the next four years, the AI sector experienced an overall rebound. However, this rebound trend did not persist, indicating that current market sentiment is poor, and investors are generally waiting for the introduction of Crypto-related bills and policies in Trump's new administration. As a result, current investments in the market are relatively cautious. However, as an industry supported by the U.S. government over the next four years, the AI sector still has significant development potential. According to market research reports, by the end of 2025, it is expected that 90% of on-chain transactions will no longer be manually operated by humans but will be completed by a group of AI agents. It is foreseeable that the Crypto market is about to enter the AI era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。