Master's Discussion on Hot Topics:

It's Monday again, and although tomorrow is New Year's Eve, I still need to symbolically update the article. To be honest, last week was filled with positive news, but the price performance of Bitcoin really gives one the feeling of "the emperor is not anxious, but the eunuchs are."

It's not that the market is bad, but looking at the past few days, the price has been hovering at a high level without going down, and the turnover rate is so low that it reminds me of the long eight-month period of stagnation. Buyers think it's too expensive, sellers think they're losing, and the market sentiment is as stiff as frozen New Year's meat.

In fact, it's not just the crypto market; the US stock market is pretty much the same. High interest rates are pressing down, the dollar index is soaring, and the Federal Reserve is holding steady, causing investors' risk appetite to flatline. The root of all this is still the lack of liquidity.

Without these positive news supports, we might be heading back to the days when Bitcoin was at 90,000. Looking back at last year's interest rate cut phase, that was a real thrill, soaring past 110,000; now, we can only sigh: the wind rises at the edge of the green pond, but the market stops due to a lack of funds.

However, this week does have some highlights, especially with the Spring Festival and the Federal Reserve meeting on the horizon. First, regarding the Spring Festival, the A-shares will be closed on Tuesday, so it's normal for major funds to shift their focus overseas.

Then, at 3 AM on Thursday, the Federal Reserve will announce the interest rate results, with a 99% probability that the rate will remain unchanged. This result has already been cooked up since last December, and its announcement won't stir up much excitement. The key is whether Powell will give any hints to ignite expectations for a rate cut in March.

If Powell is a bit more optimistic, the market could see a short-term surge, and the Spring Festival market could really kick off. But don't be too optimistic; with events like the Federal Reserve meeting, it's customary for the market to experience volatility before and after the results, which can make your heart race.

Currently, the probability of a rate cut in March is only 27.1%, and any cuts this year may be delayed until after May. In other words, while we might enjoy a bit of a rally in February, by mid-March, we may have to be cautious and consider taking profits. As for what comes next, it will depend on the liquidity situation.

Master's Trend Analysis:

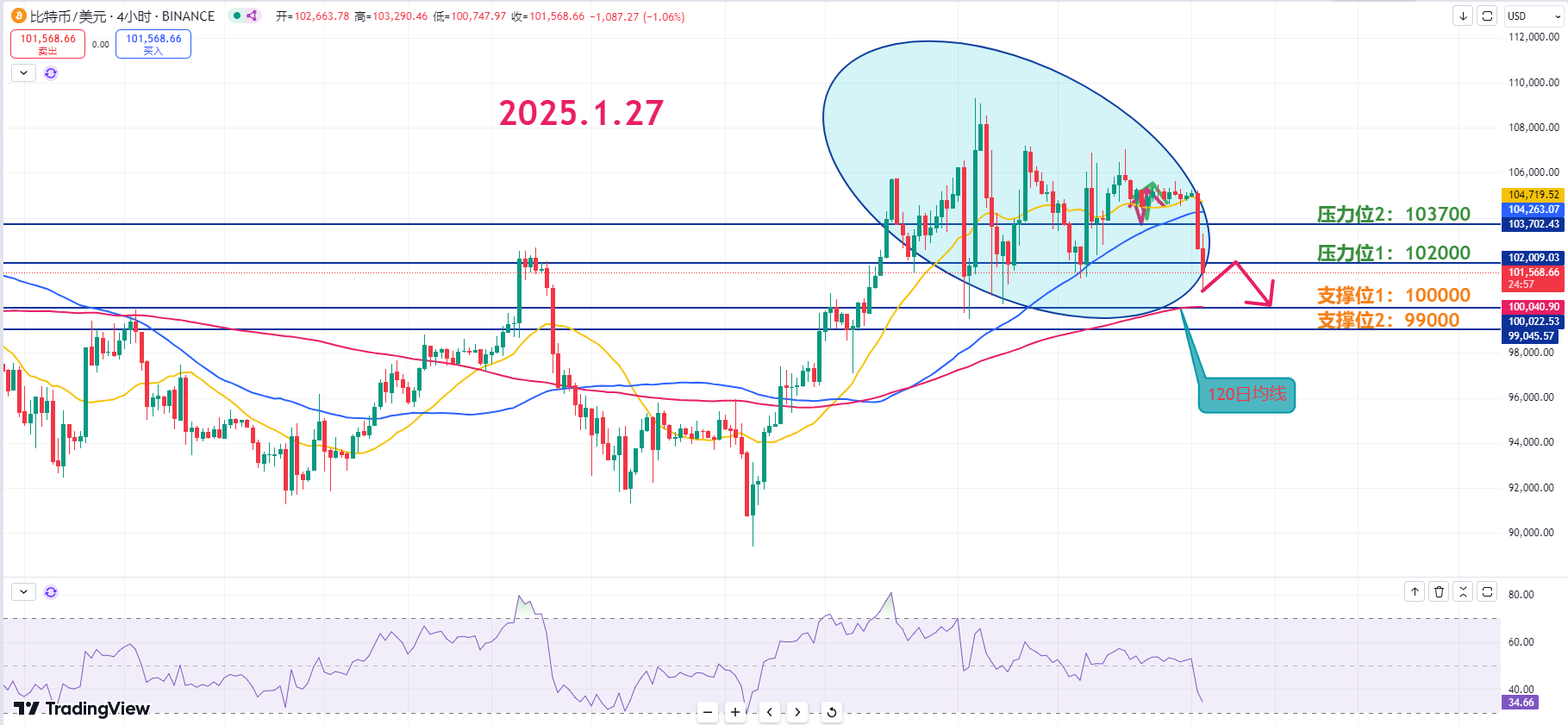

Resistance Levels:

First Resistance Level: 103700

Second Resistance Level: 102000

Support Levels:

First Support Level: 100000

Second Support Level: 99000

Today's Suggestions:

Bitcoin has formed a diamond pattern at a high level and is currently at a turning point in the trend. Currently, bearish sentiment is increasing, and the probability of falling below 100K again is quite high, with short-term expectations seeing a potential drop to 99K.

It is advisable to pay attention to the 20-day and 60-day moving averages on the daily chart to identify ultra-short-term entry opportunities. Given the weak rebound strength in the current downtrend, the bearish trend is expected to continue.

Within the technical rebound range, the first resistance level may be tested. However, be cautious of false rebounds in the downtrend. It is recommended to monitor the candlestick patterns and trading volume around 102K to strategically place ultra-short-term short positions.

Everyone knows that 100K is an important psychological support level, as many investors are concentrated at this position. Therefore, if it breaks below, it could trigger panic selling.

Currently, the expected lower space is set at 99K, and near 100K and the 120-day moving average on the 4-hour chart, one could attempt ultra-short-term rebound operations. Once the rebound reaches the expected position, switch to a short position strategy for trading.

1.27 Master's Wave Strategy:

Long Entry Reference: 100300 light long; if it retraces to the 98250-99250 range, go long directly; target: 1002000-1003700

Short Entry Reference: 103700-104600 range light short; target: 102000-100300

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans and community live broadcasts are now available!

Friendly Reminder: This article is only written by Master Chen on the official public account (as shown above). Any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。