On the last day of January, just as I was preparing to do my homework, there was a sudden drop in both the US stock market and BTC, while the US dollar index was rising. It seems that the news about the new tariffs officially starting on February 1st caused panic in the market. After all, in Powell's speech the day before, he also mentioned the issue of tariffs. The market is worried that raising tariffs will make it difficult to control inflation, and an increase in inflation means that the Federal Reserve must continue to maintain monetary tightening, which implies sticking to the original interest rate cut path, or even lower.

Of course, I cannot say that the market's concerns are unfounded, as imported goods do indeed relate to the lives of the American people. Trump will impose a 25% tariff on Mexico and Canada, and a 10% tariff on China. It is worth noting that about 15% of the food supply in the US relies on imports, mainly from Mexico and Canada. Tariffs could cause food prices to rise by about 3%.

Moreover, Mexico and Canada are highly dependent on the US market. Tariffs could lead to a decrease in exports from these two countries to the US, especially in key industries such as automotive and agriculture. As for the tariff issue with China, I won't go into detail, as Powell has already acknowledged that the current inflation is not related to China (one must understand the meaning of this statement).

The price increases caused by tariffs could exacerbate inflation in the US, forcing the Federal Reserve to adopt stricter monetary policies, thereby increasing borrowing costs for businesses. This could be the reason for the decline in risk markets, but I don't think it is that terrifying. It is possible that the market is overreacting, as inflation is indeed decreasing, and food itself is not part of the core inflation data, nor is it a primary concern for the Federal Reserve.

PS: The core inflation (core PCE) that the Federal Reserve focuses on does not include food and energy data.

Therefore, I believe the market is overreacting, and for #BTC, it is currently more dependent on policy, or to put it bluntly, on Trump, rather than on inflation. Furthermore, for the Federal Reserve, considering another interest rate cut will definitely be a matter for June or later.

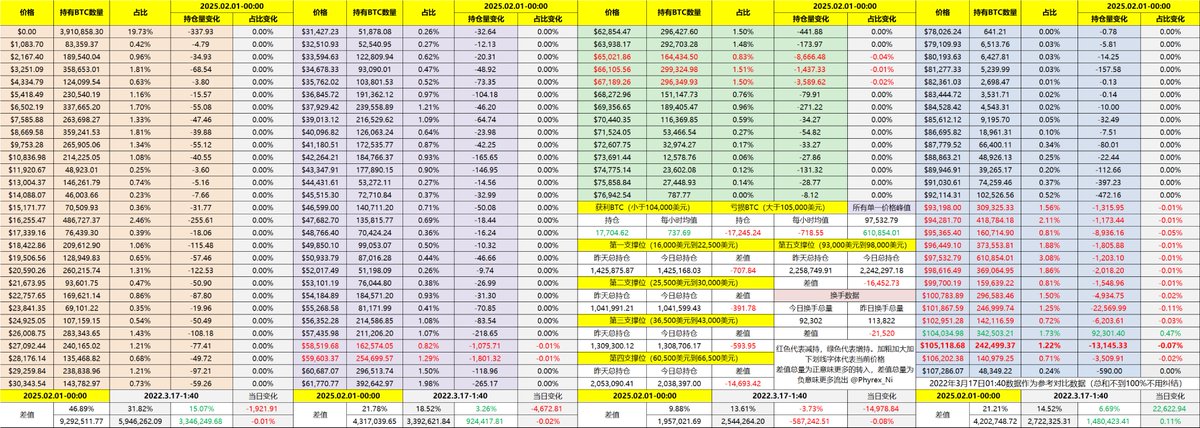

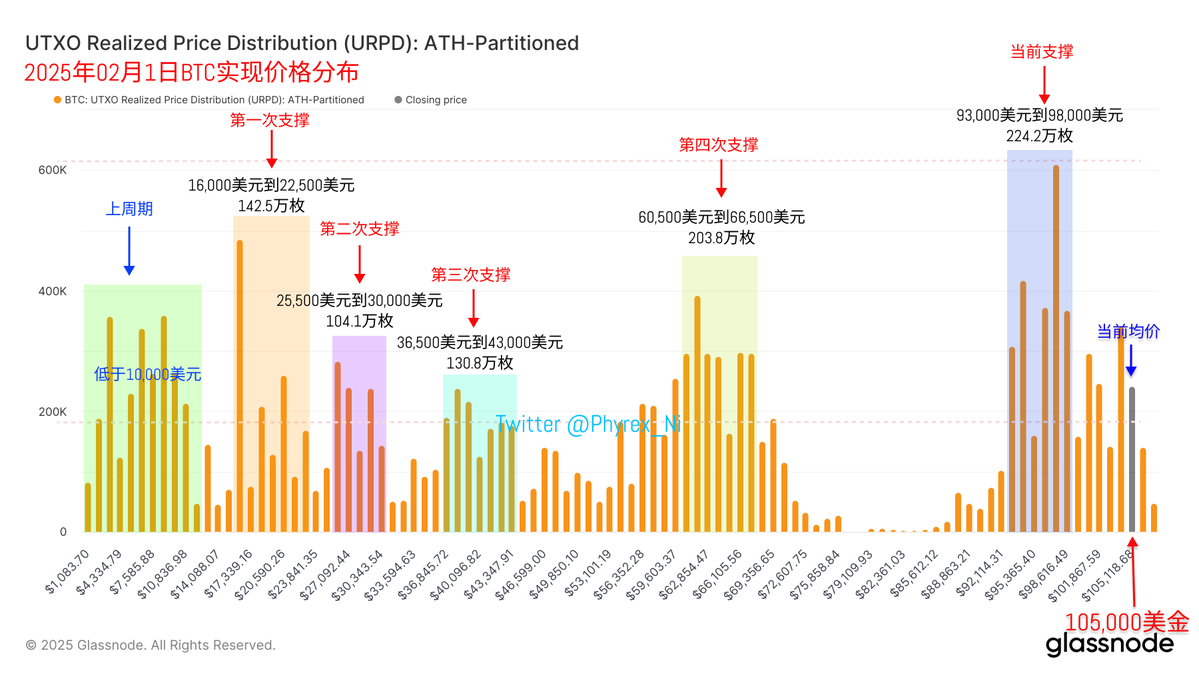

Looking at the data for #Bitcoin itself, short-term holders are still the main players, especially with many short-term profit investors exiting. This has already become a norm, as I mentioned earlier, the current key narrative is Trump. As long as Trump and the US government continue to release positive news, this matter is not significant for cryptocurrencies.

Although there is a lot of turnover, it has no impact on the current support, but the aggressiveness is still lacking, which is what we have always referred to as being just a breath away. It is likely that we will have to see what information is released next.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。