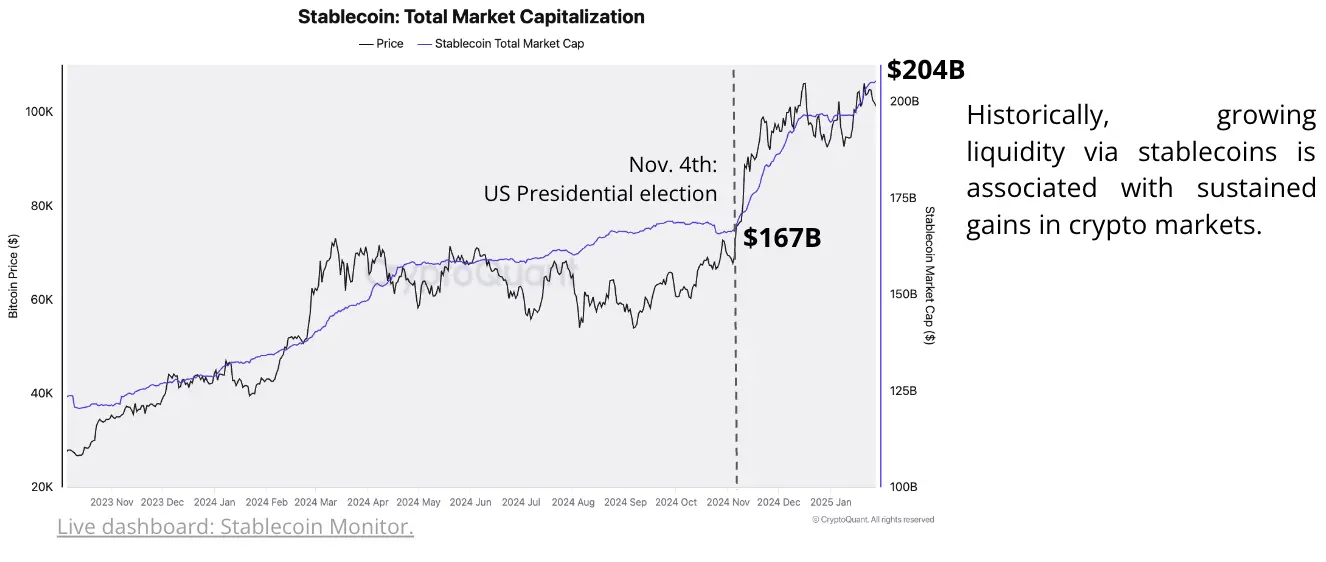

Cryptoquant analysts disclosed that the total market capitalization of USD-pegged stablecoins exceeded $200 billion for the first time last week, climbing to $204 billion—an increase of $37 billion since Nov. 4, 2024, following the U.S. presidential election. This surge in liquidity reflects a broader capital influx into digital assets, a phenomenon historically linked to upward price movements.

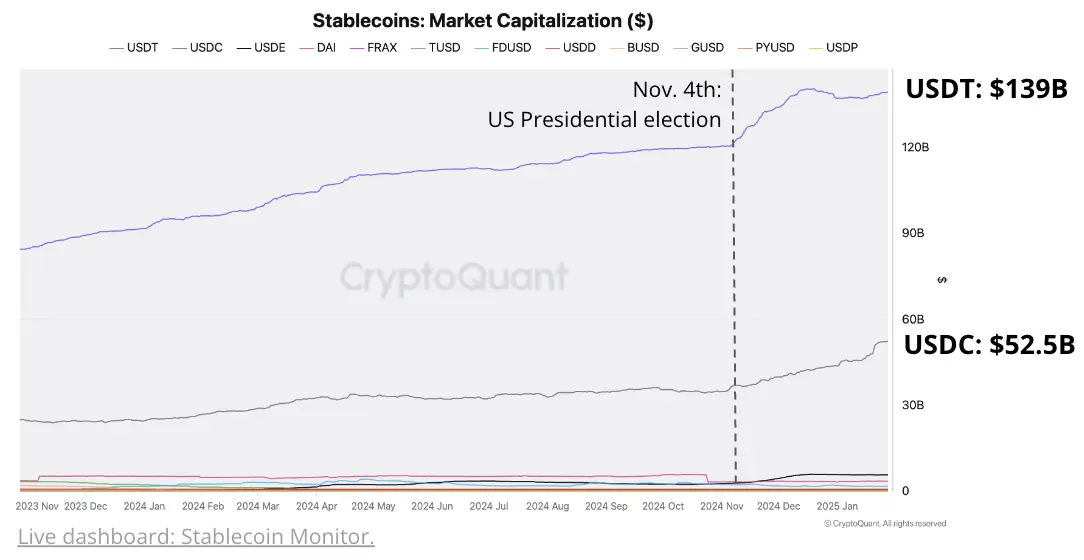

USDT continues to dominate the stablecoin sector, with its market cap expanding 15% ($19 billion) to reach $139 billion since early November. Meanwhile, Circle’s USDC has staged an impressive rebound, soaring 48% ($17 billion) to $52.5 billion over the same period—its fastest growth rate in at least a year, according to Cryptoquant’s stablecoin data.

A substantial portion of this liquidity has flowed into centralized exchange platforms. The study highlights that USDT deposits on these platforms have climbed 41%, rising from $30.5 billion to $43 billion since Nov. 4, setting a new all-time high. Cryptoquant further emphasized that stablecoin reserves on exchanges serve as a key measure of trading liquidity, often preceding upward price momentum in assets like bitcoin (BTC).

The liquidity impulse—a metric tracking the 30-day percentage change in stablecoin market capitalization—has turned positive for USDT after contracting by 2% in early 2025. Meanwhile, USDC’s liquidity impulse has surged to 20%, its highest level in more than a year. Historically, such accelerations have preceded significant rallies in crypto valuations, according to Cryptoquant’s analysis.

Bitcoin’s price trajectory appears closely aligned with these trends. The firm’s “Stablecoin Monitor” dashboard points to a well-documented correlation between increasing stablecoin liquidity and bitcoin’s historical price peaks, suggesting that current conditions may foreshadow a continued bullish cycle.

Cryptoquant researchers concluded that the market’s next upward movement may depend on sustained stablecoin expansion, particularly if inflows of USDT and USDC continue to outpace redemptions. With exchange reserves at record highs, trading activity is poised to intensify—potentially setting the stage for price breakouts in the months ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。