Let’s confront the unvarnished truth: financial markets currently resemble a cacophony of dissonance, plumbing depths unseen since the prelude to the 2024 election cycle. In the intervening period, President Trump has unfurled an expansive tariff regime targeting imports from Canada, Mexico, and China—a maneuver intensifying geopolitical economic friction. These policies, comprising 25% levies on most Canadian and Mexican goods and 10% on Chinese imports, are scheduled for implementation Tuesday, casting a pall over international commerce.

Investor sentiment has soured conspicuously in response, with worldwide equity indices retreating as anxieties over protracted trade hostilities crystallize. Asian bourses bore immediate brunt Monday: Japan’s Nikkei 225 contracted 2.4%, South Korea’s Kospi hemorrhaged 2.9%, and Hong Kong’s Hang Seng dipped 1%. European exchanges mirrored the gloom, the Euro Stoxx 50 enduring a pronounced contraction at opening bell.

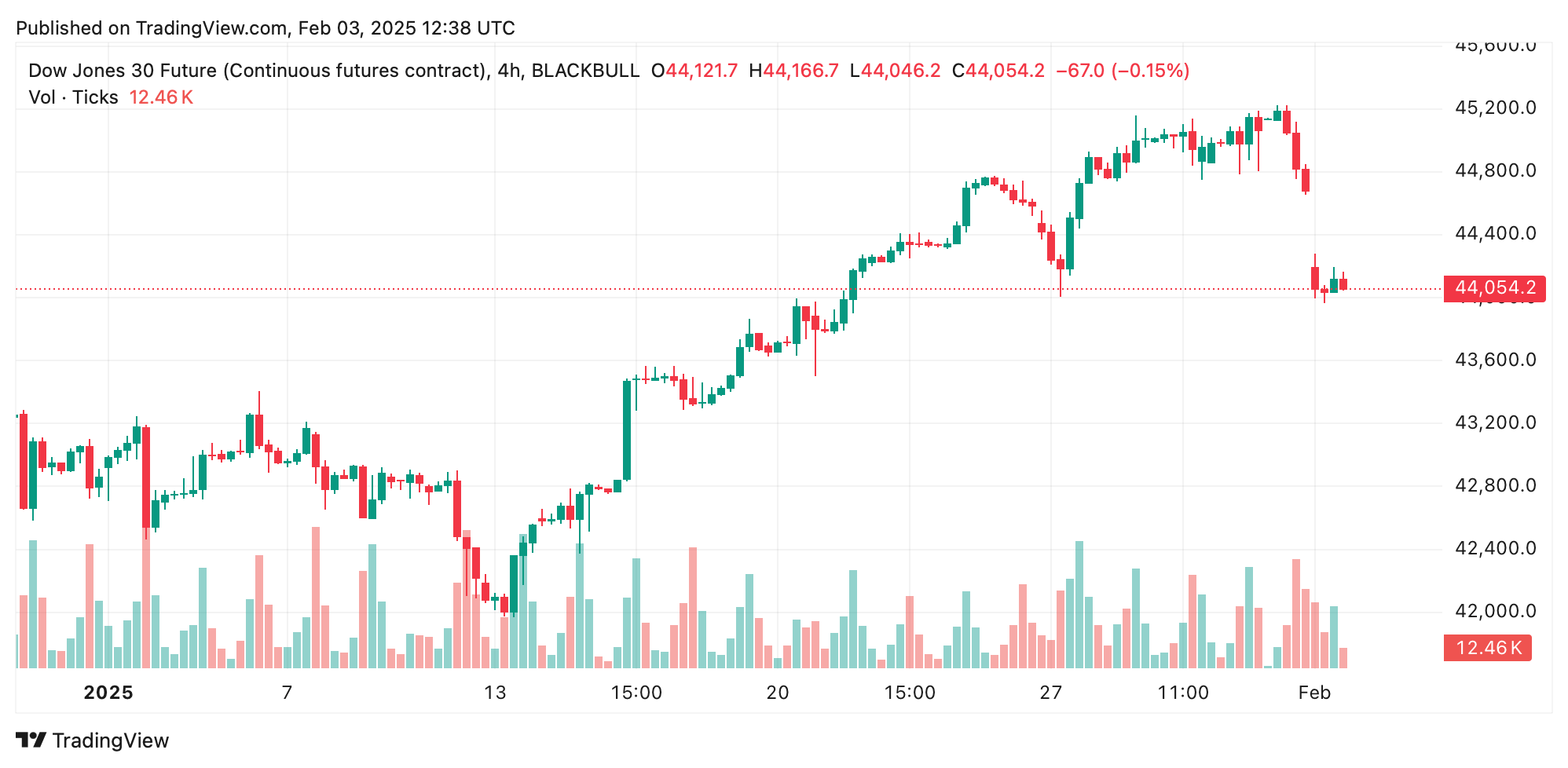

Dow Jones Futures alongside all of the benchmark U.S. indices have seen a considerable market rout before Wall Street’s opening bell on Feb. 3, 2025.

U.S. stock futures nosedived pre-dawn Monday, foreshadowing turbulence at Wall Street’s opening—a precursor mirrored by cryptocurrency markets, which began relinquishing value over the weekend as a bellwether for traditional finance’s trajectory. In correspondence to Bitcoin.com News, Etoro analyst Simon Peters posited that Trump’s tariff gambit fuels the selloff, suggesting savvy traders might view this as a strategic acquire-at-discount moment.

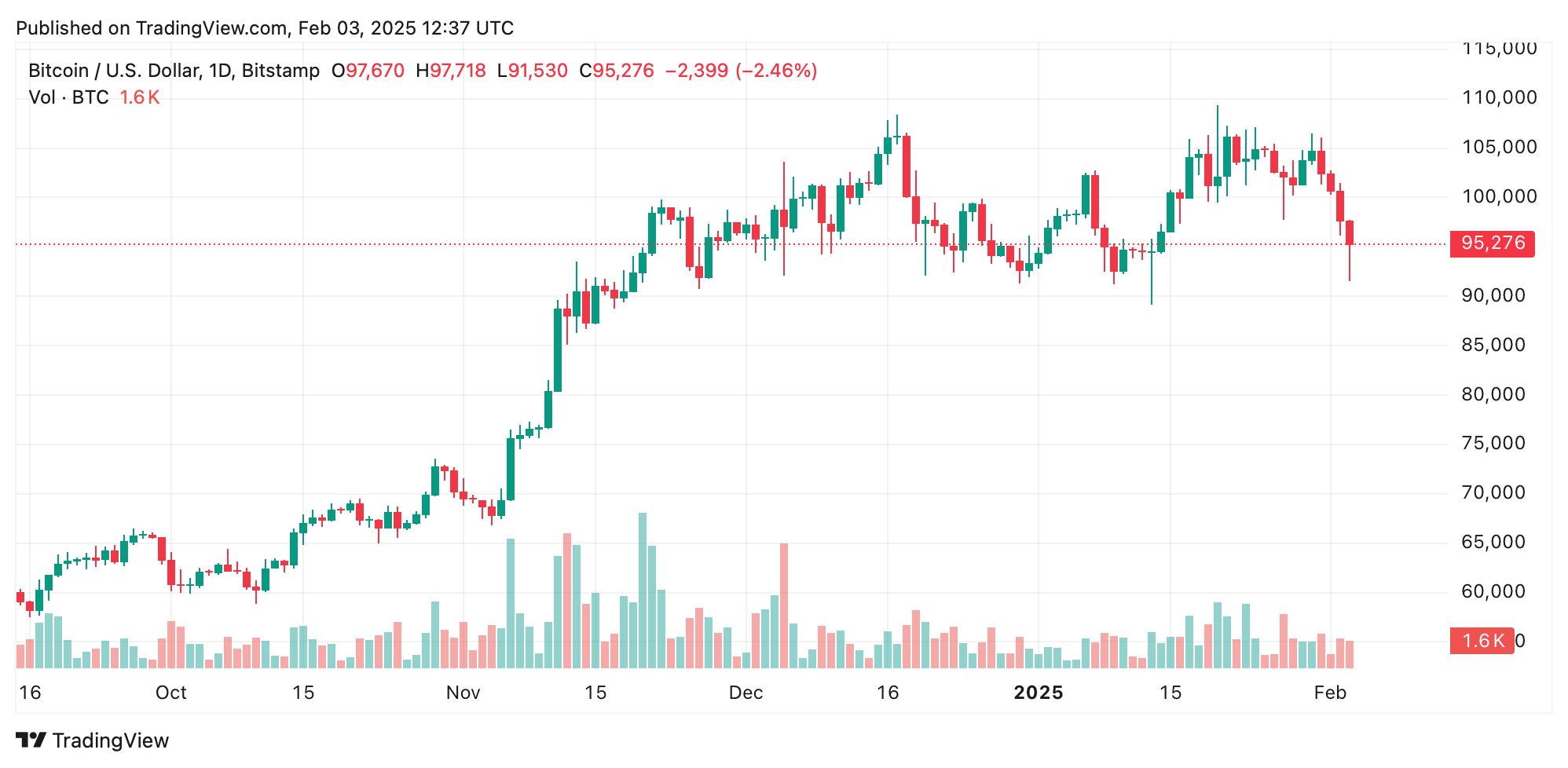

Bitcoin has been hit hard this past weekend leading up to the chaos that is seemingly about to ensue on Wall Street.

“Risk-off sentiment continues to have a hold over crypto, as markets react negatively to President Trump’s decision at the weekend to slap 25% tariffs on imports from Mexico and Canada and a 10% levy on goods from China,” Peters told our newsdesk. “At the time of writing, bitcoin is standing relatively firm, down 7%, and currently trading at $95,300 after testing a level of support at $92,000.”

The Etoro analyst added:

Altcoins have been hit harder. Ethereum down 35%, solana 25%, XRP at its lowest was down 40% since Saturday. With that being said, investors with a long-term view on crypto markets may see this as an opportune time to buy-the-dip.

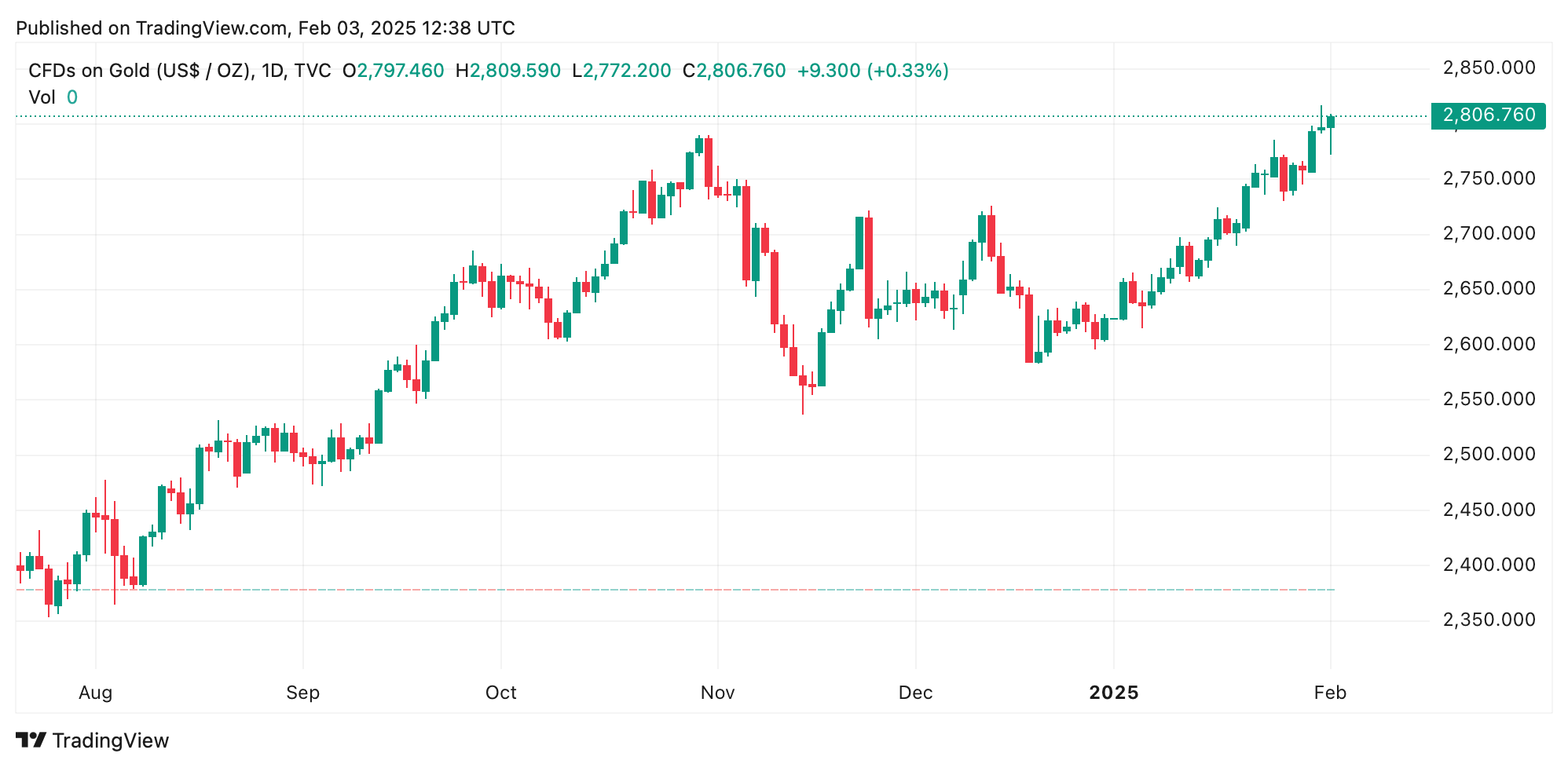

Simultaneously, gold has achieved an unprecedented peak, breaching the stratospheric $2,800-per-ounce threshold—yet another historic apogee cementing its status as the financial phoenix of this era. Analysts posit that the precious metal could emerge as the principal refuge from the tempest of market instability ignited by Trump’s protectionist maneuvers.

Bloomberg’s commodities savant Mike McGlone posits that gold’s current hegemony is so pronounced it risks eclipsing both American equities and bitcoin in comparative luminosity. In a social media dissection, McGlone observed that gold’s parallel ascent during bitcoin’s fleeting flirtation with $100,000 potentially fortified that psychological barrier, insinuating speculative froth in risk-sensitive assets like cryptocurrencies.

Meanwhile, the price of gold continues to carve new all-time highs on Feb. 3, 2025.

“[With] over 10 million cryptocurrencies now listed on Coinmarketcap may suggest price-appreciation limits of highly speculative, volatile cryptos facing unchecked supply and competition,” McGlone concluded.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。