# A New Choice for Red Packet Investment: In-Depth Interpretation of DeFi Lending

When receiving red packets and year-end bonuses during the New Year, besides buying new clothes and enjoying delicious food, have you ever thought about making them "work" during the Spring Festival? DeFi lending, a concept that sounds a bit sophisticated, is actually a decentralized financial service based on blockchain technology. It allows users to lend or borrow digital assets, thereby earning interest income or using leverage for investment.

Compared to traditional centralized finance, Web3's DeFi lending has the following advantages:

Decentralization: No single point of control, making it more secure and reliable.

High Transparency: All transaction records are recorded on the blockchain, open and transparent.

High Efficiency: Automated processes lead to faster transaction speeds.

Globalization: No geographical restrictions, allowing global users to participate.

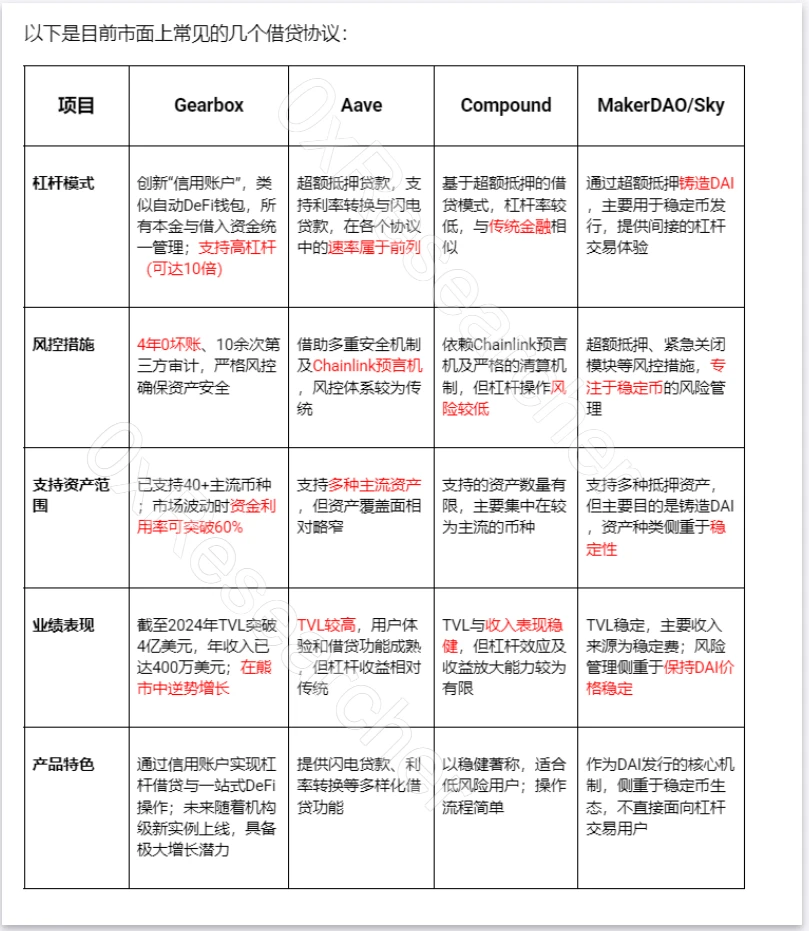

However, high returns often come with high risks. The DeFi lending market is highly volatile, and vulnerabilities in smart contracts, hacker attacks, and market risks can lead to financial losses. Therefore, choosing the right platform and strategy is crucial. Currently, some DeFi platforms have proven that safety and high returns can coexist. For example, the general leverage lending protocol Gearbox Protocol on Ethereum is set to launch two institutional-level instances soon, even amidst recent market volatility, further promoting the scaling of funds. Through its innovative design, it integrates functions such as deposits, borrowing, leveraged trading, and yield farming into one account, and the continuous influx of institutional funds validates the reliability of its risk control model, allowing users to participate in high-yield, low-risk lending strategies with one click.

# How to Choose a Reliable DeFi Lending Platform? — Safety First

In the DeFi world, choosing a safe and reliable platform is the crucial first step. How can you determine if a platform is safe and reliable? You can check the following key features:

Historical Risk Control Record: Prioritize protocols with a long operating history, zero bad debt records, and continuous institutional funding.

Capital Utilization Rate: A high capital utilization rate usually indicates higher capital efficiency of the protocol, leading to more stable returns. However, an excessively high capital utilization rate may also imply higher risks, requiring careful assessment.

User Experience: A good platform should provide a user-friendly interface and simple operation processes, lowering the learning threshold for novice users. Supporting multi-chain operations, providing multi-language support, and having comprehensive help documentation are all important components of user experience.

Risk Control Mechanism: A strong risk control mechanism is an important means to ensure the safety of user funds. This includes but is not limited to: AI risk control assistants, liquidation protection funds, insurance mechanisms, collateral rate management, etc. A well-established risk control system can effectively reduce risks and safeguard user assets.

Transparency and Audits: Choose platforms that conduct regular security audits and publicly disclose audit results. A transparent operating model can enhance user trust.

# Choose Suitable Investment Strategies Based on Risk Preference — Act Within Your Means

The flexibility of DeFi lending allows you to choose different investment strategies based on your risk tolerance:

Conservative: Suitable for risk-averse investors, you can choose stablecoin deposits to earn stable returns. Stablecoins are cryptocurrencies pegged to fiat currencies, with relatively stable prices and lower risks.

Balanced: Allocate part of your funds to stablecoin deposits and part to low-risk lending or yield farming, seeking a balance between returns and risks. This requires you to have a certain understanding of the market and be able to adjust your investment strategy based on market conditions.

Aggressive: Suitable for investors with high risk tolerance, you can try leveraged trading to pursue higher returns. However, leveraged trading also comes with higher risks, requiring you to have rich investment experience and risk management skills. Remember, high returns often come with high risks!

Regardless of the strategy chosen, it is essential to conduct thorough risk assessments and set stop-loss points to control potential losses.

# Spring Festival Investment Tips: Steady Appreciation, Preventing Risks

Diversify Investments: Do not put all your eggs in one basket; diversifying investments can effectively reduce risks.

Set Stop-Loss Points: In case of market fluctuations, timely stop-loss to avoid greater losses.

Pay Attention to Gas Fees: When performing cross-chain operations, be mindful of gas fees and choose the appropriate network to lower transaction costs.

Invest Rationally: Do not be blinded by high returns; analyze risks and returns rationally and formulate a reasonable investment plan.

Continuous Learning: The DeFi field is developing rapidly; continuous learning of the latest knowledge and technologies is essential to better cope with market changes.

This guide aims to help Web3 newcomers understand the basic principles of DeFi lending and risk management methods. Before engaging in DeFi investment, be sure to conduct thorough research and risk assessments. DYOR, invest cautiously, and make rational decisions to navigate the world of DeFi with ease! Wishing you a Happy New Year and abundant wealth!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。