In the winter of Wall Street, fine snow drifts down, and the glass curtain wall of the Nasdaq building reflects the eerie green light of cryptocurrency market screens.

Just last night, $8.4 billion worth of Bitcoin options were settled at the $98,000 mark, laying an astonishing foundation for the 2025 cryptocurrency market in this silent capital war—perhaps the most unique "iceberg collision" moment in human financial history.

1. Under Currents of Capital Channels

Beneath the warm current of net inflows into spot ETFs for three consecutive days, the persistent negative premium on Coinbase exchange over the past three months has revealed dangerous signals.

It's like the convergence of the Atlantic warm current and the Arctic cold current; beneath the seemingly calm surface, the struggle between institutional capital and retail funds is reshaping the market ecology.

The "financial humpback whale" of American capital is voraciously consuming Bitcoin liquidity. Monitoring data from Croquant shows that the current institutional holding ratio has surpassed 63%, a figure that was only 38% at the peak of the 2021 bull market. Even more intriguing is that the slope of BlackRock's ETF holding curve astonishingly aligns with the capital curve at the time of the Chicago Mercantile Exchange's Bitcoin futures launch in 2017.

2. Sovereign Fund's Crypto Assault

When the Czech central bank governor signed a Bitcoin reserve agreement at Prague Castle, a crystal cup on his desk suddenly trembled slightly—this was not an earthquake, but an on-chain fluctuation triggered by a $7.3 billion capital influx into the crypto market. The central bank leader gently caressed the Bohemian crystal cup and stated in front of the Financial Times camera, "Compared to gold, Bitcoin is more like Noah's Ark of the 21st century."

Turning our gaze eastward, an interesting detail is hidden in the $745 million financing plan of Japan's MetaPlanet: the company cafeteria has begun accepting Bitcoin for lunch payments, the president's office is adorned with an abstract painting of Satoshi Nakamoto, and even more exaggerated, their shareholders' meeting was held in a Decentraland virtual venue.

3. Financial Changes Under Regulatory Easing

A storm of regulatory change is brewing in Washington. Documents on the desk of the new SEC chairman indicate that lawsuits against crypto companies like Ripple may see a dramatic reversal.

More noteworthy is that after the repeal of the SAB121 guidelines, JPMorgan's crypto custody scale surged by 470% in just three months—this traditional financial giant is rapidly evolving in the blockchain jungle.

If there’s anyone on Wall Street who is particularly happy lately, it’s Elon Musk. Tesla's financial report shows that its Bitcoin holdings have surpassed the $1 billion mark, with the CFO jokingly calling it "the easiest way to generate revenue in history." The new accounting standards are quite magical: when the price rises, it’s "value re-evaluation," but when it falls, it’s "strategic reserve." This clever financial magic leaves traditional gold investors dumbfounded.

4. Quantum Entanglement of Cycles

Hogan's theory of "four-year cycle quantum states" is overturning conventional understanding. This "Schrödinger" of the crypto world points out that when the three major variables of ETF fund flows, corporate balance sheets, and government policies overlap, Bitcoin may simultaneously exist in a state of "bull market continuation" and "cycle termination." His mathematical model suggests that $200,000 could be the "quantum tunneling point" of this market cycle.

5. Future Navigation Guide

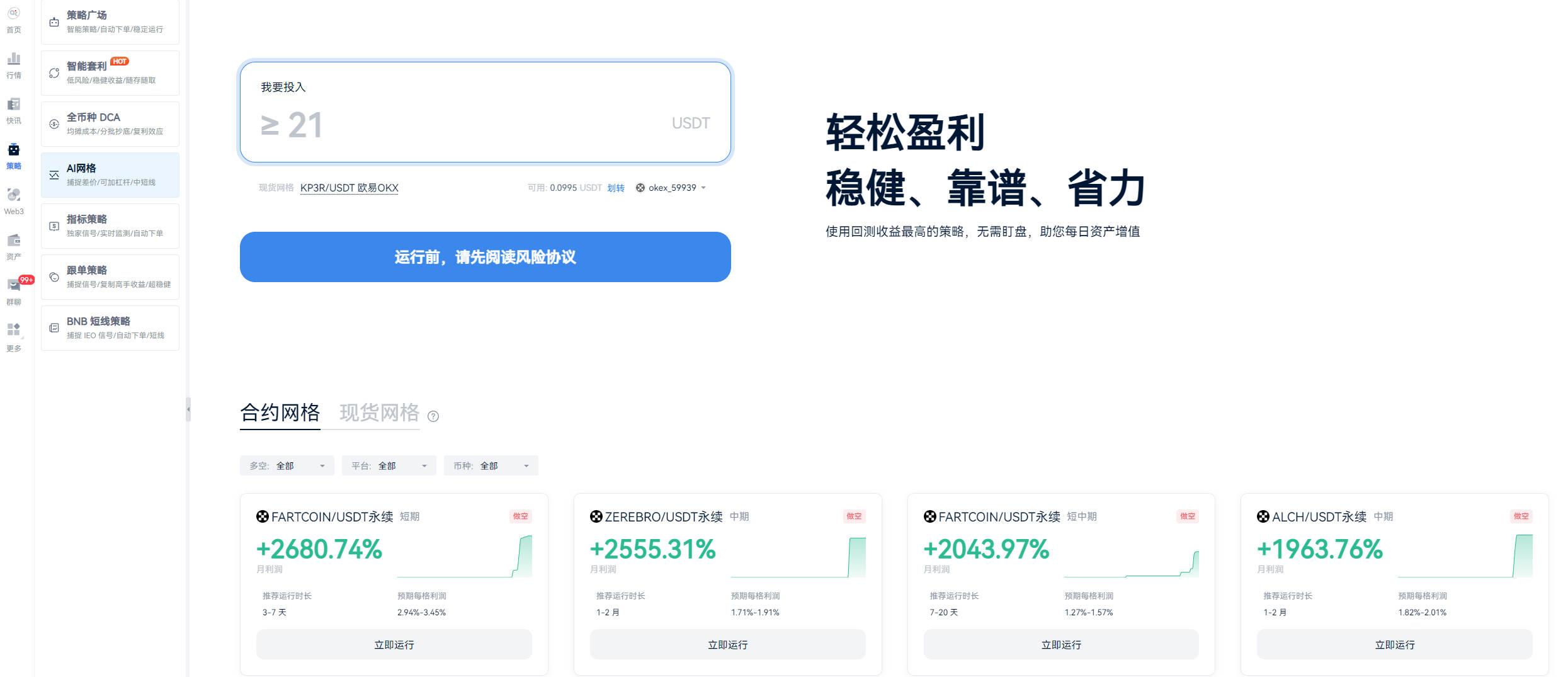

Want to navigate this unknown sea safely? AiCoin's grid trading robot is like a "crypto radar." Its unique volatility capture algorithm can automatically build a safety net during market turbulence—don’t worry, this isn’t a sales pitch, but a step-by-step guide on how to elegantly take advantage of market opportunities. Such good fortune is much easier to find than the heart of the ocean from the Titanic.

As we indulge in the champagne party of institutional capital, BlackRock analysts remind us: the current MVRV ratio is nearing a dangerous threshold. It’s like the pressure gauge on a ship; every tick of the needle is worth being cautious. Remember, even the sturdiest giant ship fears icebergs, and even the craziest bull market needs lifeboats.

Looking back from the temporal coordinates of January 2025, we may be witnessing a "great bifurcation moment" in financial history. When sovereign funds, tech giants, and traditional banks meet on the consensus continent of Bitcoin, this smoke-free capital war will ultimately reshape humanity's understanding of wealth. The only certainty is that in this silent revolution, you and I are both witnesses to history—or perhaps, become history itself.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。