1. TMTG Enters Cryptocurrency: The Beginning of a New Financial Era

Trump Media & Technology Group (TMTG) subsidiary Truth.Fi has recently garnered significant attention in the cryptocurrency space, planning to launch a Bitcoin exchange-traded fund (ETF) named Truth.Fi Bitcoin Plus ETF. This not only marks TMTG's official entry into the Bitcoin ETF market but also signals its expansion in the fintech services sector. Through a partnership with financial giant Charles Schwab, this initiative aims to provide investors with a more convenient avenue for Bitcoin investment, thereby expanding its financial business landscape.

Trump's Financial Revolution: The Strategy Behind Truth.Fi Bitcoin Plus ETF

The Truth.Fi Bitcoin Plus ETF will track Bitcoin prices and plans to offer investors a more diversified range of Bitcoin investment strategies. While the specific meaning of the "Plus" component is not yet fully defined, TMTG has indicated that it will explore various investment methods related to Bitcoin. TMTG's collaboration with Yorkville Advisors in New Jersey will ensure its professionalism in investment advisory services. Charles Schwab will act as the custodian for the fund, further enhancing its credibility in the industry.

Regulatory Challenges: Awaiting SEC Approval

Currently, TMTG has applied for trademark registration for this ETF but still needs to submit a formal application to the U.S. Securities and Exchange Commission (SEC). The launch of the ETF must undergo a rigorous regulatory approval process, leading to market anticipation and uncertainty regarding its successful rollout.

2. Market Impact of Bitcoin ETFs: The "Accelerator" of Capital Flow

Surge in Market Confidence: A Key Step for Cryptocurrency to Go Mainstream

Since the introduction of Bitcoin ETFs in 2024, capital inflow and market confidence have significantly increased. The launch of Truth.Fi Bitcoin Plus ETF by TMTG undoubtedly injects new confidence into the cryptocurrency market. Against the backdrop of the Trump administration's supportive stance on cryptocurrencies, investor confidence in this emerging market is growing. With more traditional investors joining, Bitcoin is gradually moving towards mainstream acceptance as a recognized asset class.

Stabilizer of Market Sentiment: A Safe Haven for Investors

Despite the high volatility in the cryptocurrency market, the introduction of Truth.Fi Bitcoin Plus ETF provides investors with a relatively stable investment option. Even though the policy environment under the Trump administration may bring uncertainty, investors are still willing to allocate funds into Bitcoin ETFs as a means of hedging risks. This trend was particularly evident in the first week of February 2025, when the fund attracted a significant influx of capital, further enhancing market stability.

3. Capital Flow: A "Two-Way Shuttle" Between Traditional Markets and Cryptocurrency

Capital Inflow: The "Capital Magnet" of Bitcoin ETFs

The launch of Truth.Fi Bitcoin Plus ETF is undoubtedly a capital attractor. In the first week of February 2025, the ETF attracted up to $1.1 billion in capital inflow, a significant increase from the previous week's $515.9 million. Meanwhile, the iShares Bitcoin Trust Fund (IBIT) also attracted substantial funds, reaching $905.9 million. The speed and scale of this capital inflow indicate that Bitcoin ETFs have become an undeniable force in the capital markets.

New Driving Force of Capital Flow

Bitcoin ETFs not only attract funds from traditional financial markets but also drive capital towards the cryptocurrency market. This shift in capital flow is not only a sign of market mainstreaming but also an indication that cryptocurrency products are increasingly favored by institutional investors. As more financial institutions enter the cryptocurrency investment space, products like Bitcoin ETFs are expected to spark greater interest among investors, further enhancing market depth.

4. Changes in Market Structure: Rapid Transformation from Niche to Mainstream

Deepening Market Depth: A "New Face" of Bitcoin Trading

The introduction of Bitcoin ETFs has driven an increase in market depth and trading volume for Bitcoin. This change has led to improved market efficiency, with trading activities becoming more frequent and active. Bitcoin ETFs provide investors with a more liquid investment platform, making the market more transparent and efficient, allowing investors to execute trades more quickly.

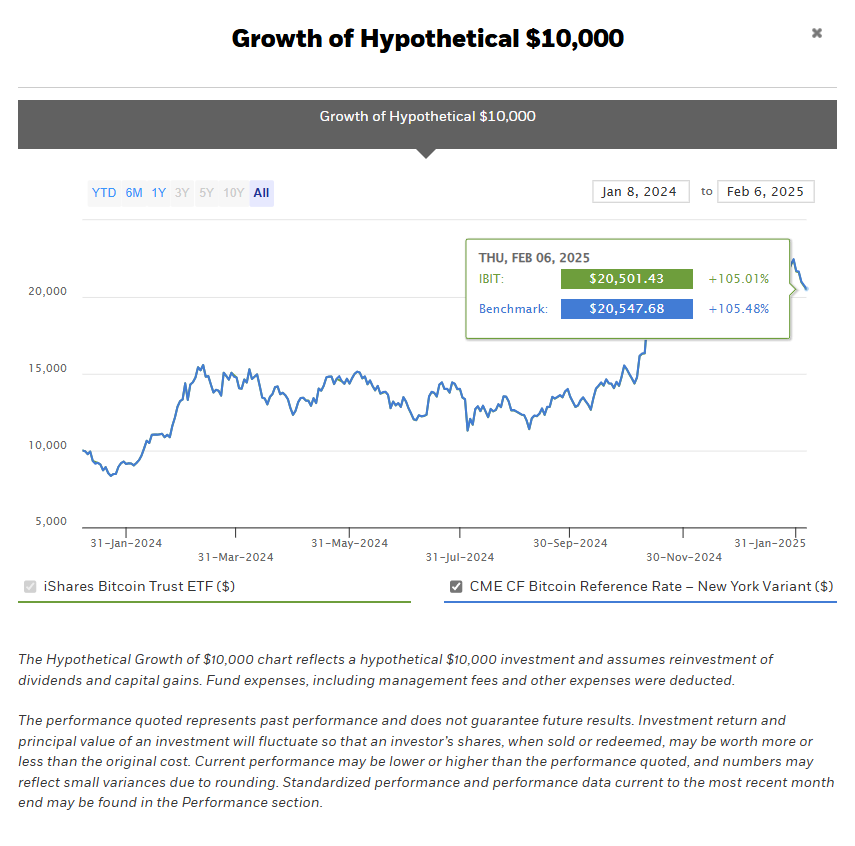

The following illustrates a hypothetical investment growth scenario, focusing on the growth of a $10,000 investment from January 8, 2024, to February 6, 2025. The chart primarily compares the performance of two investment tools:

iShares Bitcoin Trust ETF (IBIT) - Represented by the green line, its growth rate from early January 2024 to early February 2025 is +105.01%, meaning a $10,000 investment grew to $20,501.43 during this period.

CME CF Bitcoin Reference Rate – New York Variant (Benchmark) - Represented by the blue line, its growth rate is +105.48%, meaning a $10,000 investment grew to $20,547.68.

From the chart, it can be seen that during the period from May 2024 to July 2024, the growth gap between IBIT and the benchmark was small, but after August 2024, IBIT's growth performance showed significant fluctuations, slightly declining overall in the later period, while the benchmark's growth remained relatively stable.

New Participants: Traditional Investors Testing the Waters in Cryptocurrency

Bitcoin ETFs not only attract individual investors but, more importantly, they draw in a large number of traditional institutional investors. These new market participants are changing the structure of the cryptocurrency market, allowing Bitcoin to gradually shed its label of being "limited to early adopters" and become a truly mainstream investment tool. The entry of institutional investors brings more capital and professional management to the Bitcoin market, also pushing the market towards greater maturity.

5. Future Outlook: TMTG's Blueprint for a Financial Empire

TMTG plans to launch multiple ETFs and customized investment accounts to further expand its influence in the fintech sector. The Truth.Fi Bitcoin Plus ETF is just one part of its plans, but it is undoubtedly a key step in opening up the cryptocurrency market. As Trump Media Group gradually steps into the financial services sector, its partnerships with financial giants will become an important support for its future success. The launch of Bitcoin ETFs not only brings capital and confidence to the cryptocurrency market but also provides investors with a relatively stable investment tool.

In the future, the integration of cryptocurrency and traditional financial markets will become increasingly close, and how TMTG establishes itself in this blue ocean remains a question worth watching.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。