On the one-hour timeframe, XRP inches upward from recent troughs, its gradual incline confined by a slender corridor. The $2.50 ceiling has stifled progress, while the $2.35 floor persists as a bulwark against deeper retreats. Trading patterns reveal an appetite for accumulation near lower bounds, though lethargic momentum mutes volatility. A decisive breach of $2.50 may catalyze a challenge at $2.60; conversely, slipping below $2.35 risks revisiting $2.30.

Binance XRP/USDC 1H chart on Feb. 7, 2025.

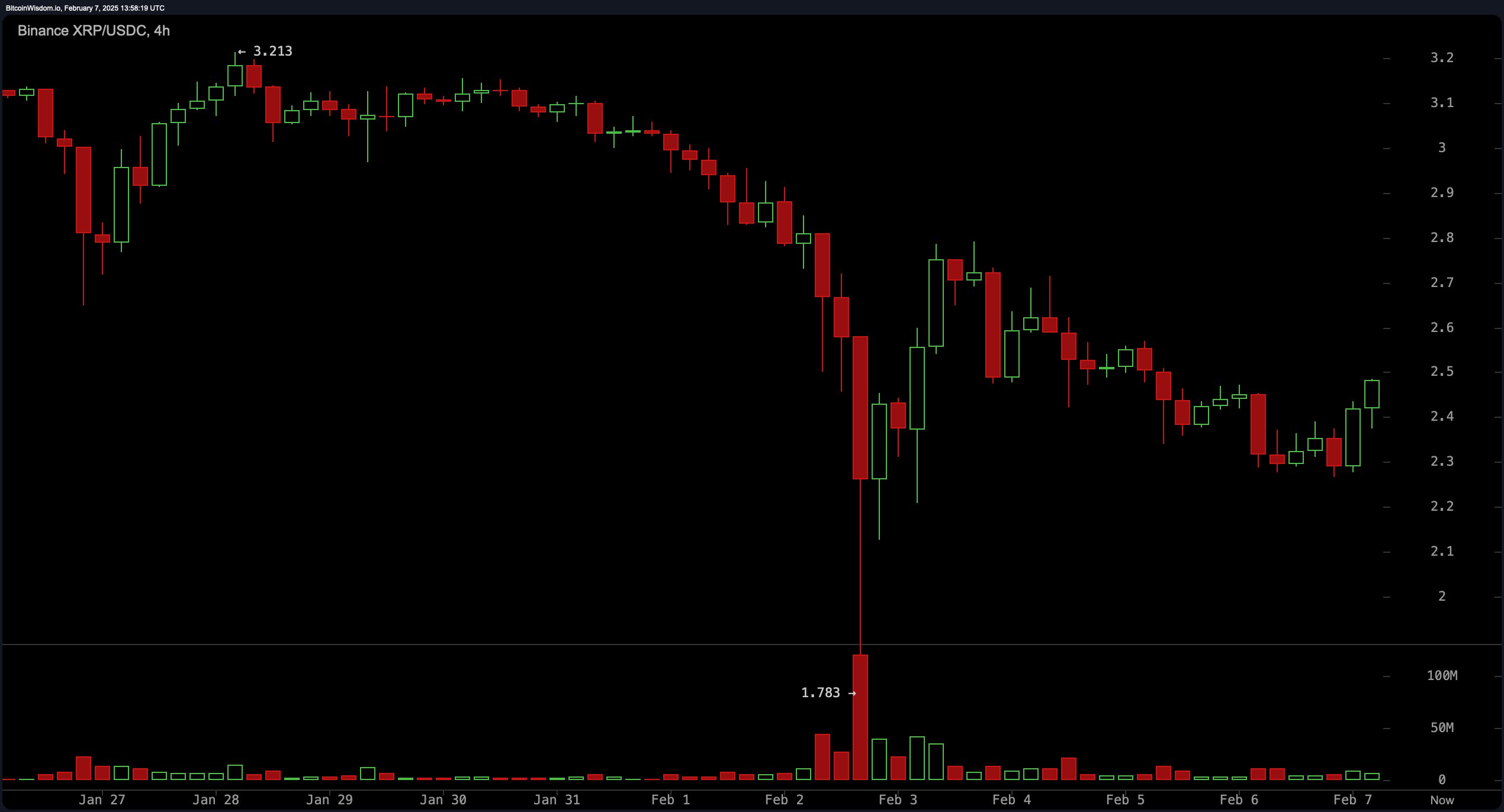

The four-hour perspective unveils an extended equilibrium, with prices swaying between pivotal thresholds. After plummeting from prior peaks near $3.40, stability has emerged between $2.30 and $2.50, punctuated by sporadic bursts of demand. Piercing $2.60 could propel XRP toward $2.80, while crumbling below $2.30 might hasten a descent to $2.20. Neither bulls nor bears dominate this stalemate.

Binance XRP/USDC 4H chart on Feb. 7, 2025.

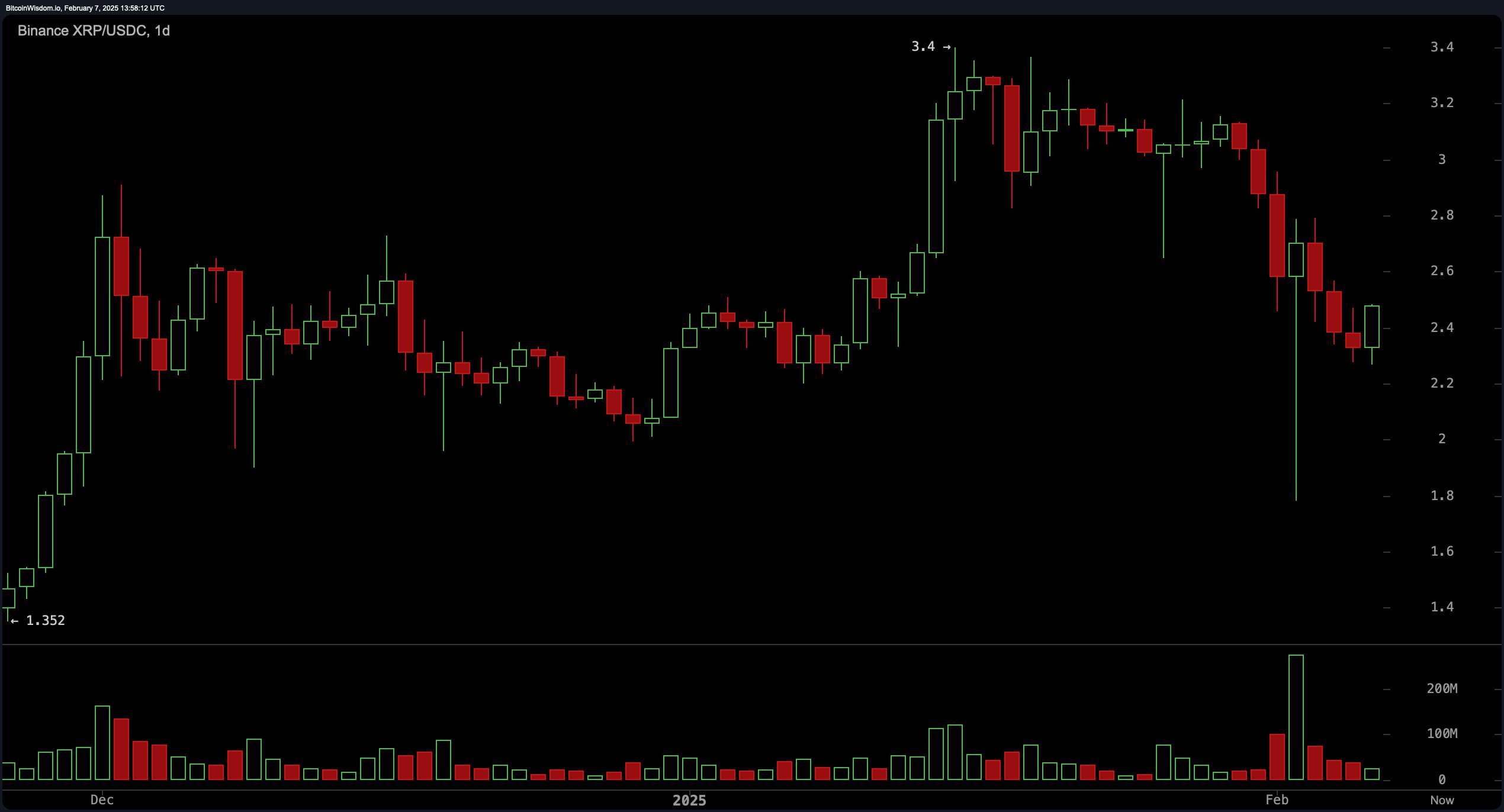

Zooming out, XRP’s daily trajectory reveals a tug-of-war near a pivotal foundation, seeking equilibrium after a spirited advance and subsequent retreat. Lingering beneath the $2.70 barrier, sustained elevation past this mark could herald a bullish pivot. Yet, the inability to stabilize above $2.50 risks inviting further slippage. Volatility looms, tethered to sentiment shifts and transactional vigor.

Binance XRP/USDC 1D chart on Feb. 7, 2025.

Oscillators paint a mosaic of ambiguity: the RSI at 40.05 hovers neutrally, while the Stochastic (43.04) mirrors this indecision. A CCI reading of -131.17 whispers of latent opportunity, but conflicting cues from the awesome oscillator (-0.36) and momentum (-0.59) muddy clarity. The MACD’s -0.07 tilt underscores caution, demanding corroboration before conviction.

Short-term moving averages skew negative, with the EMA 10 (2.64) and SMA 10 (2.71) flashing red, echoed by the EMA 20 (2.74) and SMA 20 (2.89). Longer horizons brighten: EMA 100 (2.18), SMA 100 (2.07), EMA 200 (1.64), and SMA 200 (1.32) all signal constructive horizons. Until XRP vaults above $2.60, however, the path remains mired in neutrality, awaiting a catalyst to tilt the scales.

Bull Verdict:

Despite short-term resistance, XRP is stabilizing after its recent decline, with longer-term moving averages signaling potential upside. If buyers manage to push the price above $2.60, a rally toward $2.80 or higher could unfold, supported by improving momentum and accumulation at lower levels. Holding key support at $2.30 strengthens the bullish case, suggesting a possible trend reversal if resistance levels are cleared.

Bear Verdict:

XRP remains under pressure, with short-term moving averages and the moving average convergence divergence (MACD) indicator flashing bearish signals. A failure to break above $2.50 could lead to further downside, with potential support retests at $2.30 and even $2.20 if selling pressure intensifies. Until momentum shifts decisively bullish, XRP risks continued consolidation or a move lower in the near term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。