Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.13 trillion, with BTC accounting for 60.9825%, amounting to $1.91 trillion. The market cap of stablecoins is $223.9 billion, with a 7-day increase of 3.08%, of which USDT accounts for 63.46%.

This week, BTC's price has shown range fluctuations, with the current price at $96,628; ETH has also shown range fluctuations, with the current price at $2,645.

Among the top 200 projects on CoinMarketCap, a small number have risen while most have fallen, including: OM with a 7-day increase of 12.92%, VIRTUAL with a 7-day decrease of 41.22%, FARTCOIN with a 7-day decrease of 51.85%, and SPX with a 7-day decrease of 48.72%. AI agent projects have seen significant declines, returning to where the dream began.

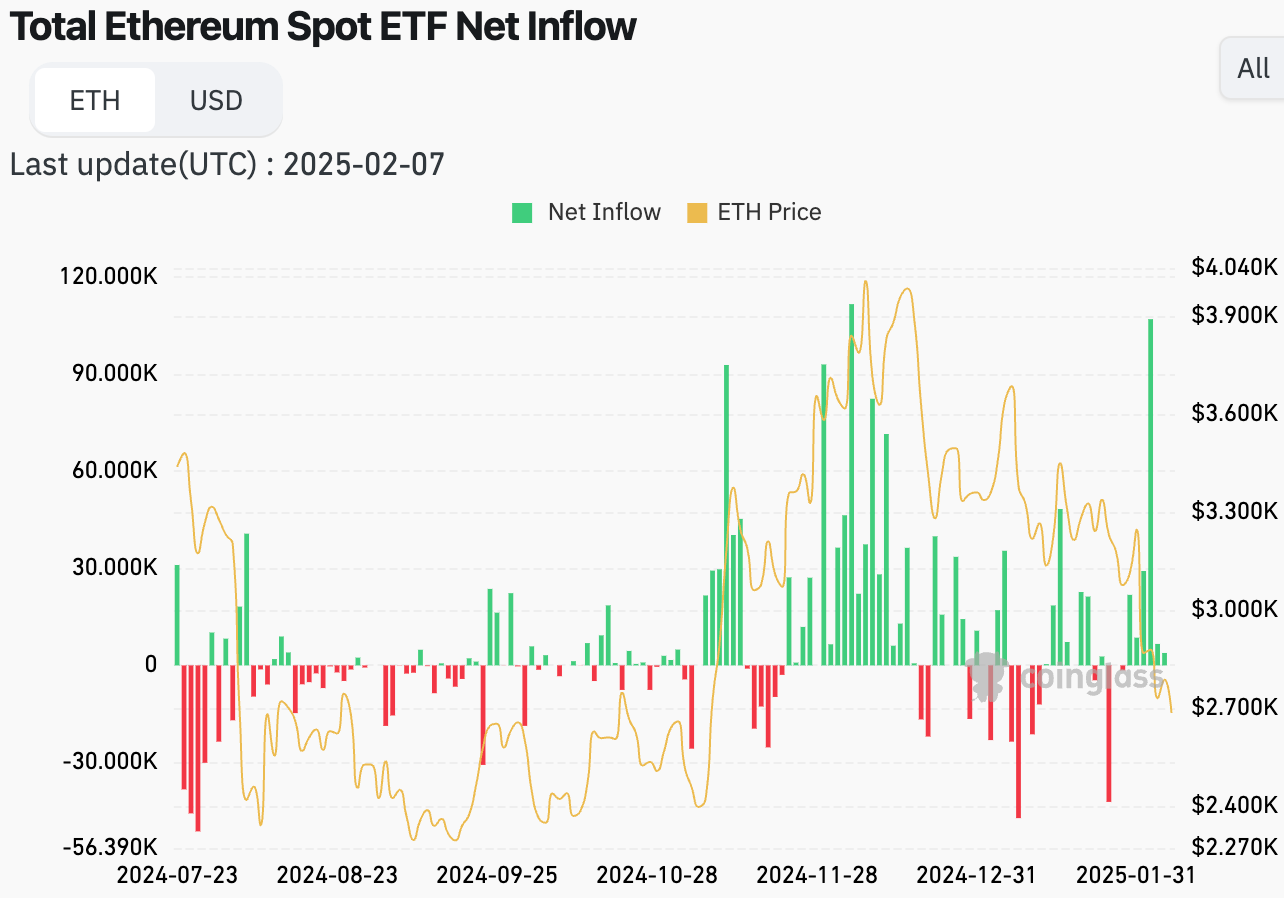

This week, the net inflow for the U.S. Bitcoin spot ETF was $182.4 million; the net inflow for the U.S. Ethereum spot ETF was $420.4 million.

The "Fear & Greed Index" on February 8 was 44 (lower than last week), with this week's sentiment: 6 days neutral, 1 day greedy.

Market Prediction: This week, due to the U.S. government's executive order imposing tariffs on Canada, Mexico, and China, panic sentiment emerged in the crypto market, with a single-day drop of over 20% last weekend. However, stablecoins continue to increase, and the growth rate has risen. Both U.S. BTC and ETH spot ETFs have seen net inflows. On-chain observations indicate that short-term funds that entered the market in the past six months are beginning to exit, while whales have started to increase their holdings. This significant drop should be seen as a phase of chip turnover, and this period should be cherished. The trading activity on DEX has also seen a certain decline. During this phase, it is recommended to hold mainstream coins and adopt a cautious wait-and-see attitude towards potential sectors.

Understanding Now

Review of Major Events of the Week

On February 3, Trump signed an order imposing a 25% tariff on imports from Mexico and Canada, and a 10% tariff on China, which will take effect on Tuesday. The cryptocurrency market showed a risk-averse trend, dropping significantly, with BTC recently down 8% to $92,798.34. Jeff Park, head of alpha strategies at Bitwise, stated that the ongoing tariff war will be "amazing" for Bitcoin in the long run, as the dollar and U.S. interest rates will eventually weaken;

On February 5, The New York Times reported that the U.S. Securities and Exchange Commission (SEC) is cutting back a special division that previously consisted of over 50 lawyers and staff dedicated to handling enforcement actions related to cryptocurrencies. Insiders indicated that this is one of the first concrete actions taken by President Trump and his administration regarding the regulation of cryptocurrencies and other digital assets. One of Trump's initial executive orders aims to promote the growth of cryptocurrencies and "eliminate excessive regulation of digital assets";

On February 5, Cointelegraph reported that Republican leaders of the U.S. House and Senate committees announced the formation of a task force focused on developing a legislative framework for digital assets and stablecoins;

On February 5, Litecoin's official Twitter account announced that the NYSE has submitted a 19b-4 filing to the SEC for Grayscale's Litecoin ETF, seeking to convert its Litecoin (LTC) trust into a spot ETF;

On February 6, Barron's reported that with the support of the Trump administration, the U.S. banking industry is expected to expand its cooperation with cryptocurrencies, potentially no longer restricting banks from entering the field as during the Biden administration. The Federal Deposit Insurance Corporation (FDIC) plans to modify banking guidelines to allow banks to conduct certain crypto businesses without prior regulatory approval;

On February 6, Arthur Hayes published a blog post stating that the Bitcoin strategic reserve policy is terrible, "the fundamental problem with the government hoarding any asset is that they buy and sell assets primarily for political gain, not financial gain." This policy may change with shifts in the political landscape, altering Bitcoin's original trajectory. Therefore, Arthur Hayes still believes that Bitcoin will retest the $70,000 to $75,000 range. Only if the Federal Reserve, U.S. Treasury, Japan, and others print money in some form or enact specific legislation allowing unlicensed cryptocurrency innovation can the current market conditions improve;

On February 7, The New York Post reported that potential candidates for Trump's cryptocurrency advisory committee have been revealed, including former Kraken General Counsel Marco Santori, Ripple co-founder Brad Garlinghouse, podcast host Frank Chaparro, Circle CEO Jeremy Allaire, Coinbase CEO Brian Armstrong, and Crypto.com CEO Kris Marszalek;

On February 8, Reuters reported that President Trump informed Republican lawmakers of plans to announce a reciprocal tariff policy as early as Friday.

Macroeconomics

On January 29, the first interest rate decision of 2025 saw the Bank of Canada cut rates by 25 basis points to 3.00%, in line with market expectations, marking the sixth consecutive meeting of rate cuts, following two previous meetings that each cut rates by 50 basis points;

On January 30, the European Central Bank's first meeting of the new year saw the deposit facility rate cut by 25 basis points to 2.75%, in line with market expectations, marking the fourth consecutive meeting of a 25 basis point cut. The main refinancing rate and marginal lending rate were reduced from 3.15% and 3.40% to 2.90% and 3.15%, respectively;

On February 3, CoinDesk reported that Coinbase has officially obtained cryptocurrency registration approval from the UK's Financial Conduct Authority (FCA), becoming the largest licensed cryptocurrency trading platform in the UK;

On February 6, the Bank of England cut rates by 25 basis points, lowering the benchmark rate from 4.75% to 4.5%, in line with market expectations, marking the third rate cut in this cycle;

On February 7, according to CME's "FedWatch" data, after the release of U.S. non-farm payroll data tonight, the probability of a 25 basis point rate cut by the Federal Reserve in March dropped from 14.5% to 8.5%, while the probability of maintaining rates rose from 85.5% to 91.5%;

On February 8, the Federal Reserve's monetary policy report stated: plans to stop balance sheet reduction at an appropriate time.

ETF

According to statistics, from February 3 to February 7, the net inflow for the U.S. Bitcoin spot ETF was $182.4 million; as of February 7, GBTC (Grayscale) had a total outflow of $21.86 billion, currently holding $19.231 billion, while IBIT (BlackRock) currently holds $56.122 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $115.248 billion.

The net inflow for the U.S. Ethereum spot ETF was $420.4 million.

Envisioning the Future

Event Preview

CoinDesk will hold Consensus Hong Kong from February 18 to 20, 2025, in Hong Kong;

ETHDenver 2025 will be held from February 23 to March 2, 2025, in Denver, USA.

Project Progress

The AI data platform Pundi AI announced that its token FX will upgrade to PUNDIAI on February 10, 2025, with the token supply reduced to 1/100;

The AI Agent tokenization cultivation and trading platform Mars Protocol will begin internal testing on February 14;

The open-source software platform Tea Protocol on the Base chain will launch its mainnet on February 14, 2025.

Important Events

- The UAE SCA released a draft regulation on the tokenization of securities and commodities, with public feedback accepted until February 14;

Token Unlocking

Cheelee (CHEEL) will unlock 11.85 million tokens on February 10, valued at approximately $93.27 million, accounting for 1.18% of the circulating supply;

The Sandbox (SAND) will unlock 187 million tokens on February 14, valued at approximately $68.81 million, accounting for 6.24% of the circulating supply;

Sei (SEI) will unlock 224 million tokens on February 15, valued at approximately $48.34 million, accounting for 2.25% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play and Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed analysis of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/ X: x.com/Hotcoin_Academy Mail:labs@hotcoin.com Medium:medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。