Macroeconomic Interpretation: When Tesla casually mentioned in its latest financial report that it had "increased profits by $600 million due to the adoption of new accounting standards," the capital market seemed to be under a spell. Behind this seemingly mundane financial adjustment lies a "Cinderella transformation" in the world of Bitcoin—cryptocurrency assets, once suppressed by accounting standards, are now magically turning into "cash cows" in corporate financial reports through the wand of the new FASB regulations. This financial revolution not only caused Tesla's Bitcoin holdings to soar in value from $184 million to $1.08 billion but also unveiled the covert competition among publicly traded companies to position themselves in the crypto asset space.

To understand the secret of this magic, we must start with the groundbreaking new regulations from the Financial Accounting Standards Board (FASB) last year. Previously, holding Bitcoin was like being forced to participate in a "misery competition," as companies had to account for it at the lowest value during the holding period, even if the price skyrocketed, they could only weep silently. Now, the new regulations allow for quarterly revaluation at market price, effectively equipping Bitcoin assets with a value spring—Tesla leveraged this "market value accounting method" to suddenly add $600 million in net profit to its books, easily achieving a magical increase in earnings per share to 68 cents. The financial gains from this accounting magic are akin to finding gold bars hidden in the cushions of the balance sheet.

In this digital asset frenzy, Tesla is by no means an outlier. MicroStrategy, the "Bitcoin hoarding fanatic," holds $23.9 billion in crypto assets, and its CEO, Michael Saylor, can be considered a "human Bitcoin ETF." Even the video platform Rumble has begun converting 90% of its cash reserves into Bitcoin, and the social media site Reddit has openly acknowledged holding Bitcoin and Ethereum in its IPO documents. This corporate-level trend of holding cryptocurrencies is more ferocious than the retail army of crypto exchanges. These tech newcomers seem to have reached a consensus: in an era of central bank monetary expansion, Bitcoin is the ultimate bulletproof vest against inflation.

Interestingly, this corporate holding movement coincides with subtle changes in the U.S. political landscape. When Musk's old partner, David Sacks, was appointed by Trump as the White House cryptocurrency czar, and when the price of Bitcoin formed a mysterious resonance curve with Trump's approval ratings, astute observers could sense a shift in policy direction. The timing of Tesla's massive increase in holdings in Q4 perfectly aligns with market expectations for "Trump 2.0 era" crypto-friendly policies. This interplay between politics and business has allowed Bitcoin to leap from a fringe asset to a mainstream financial tool.

However, this feast is not without risks. When corporate profits can dance to the tune of cryptocurrency price fluctuations, financial stability becomes deeply intertwined with the volatility of the crypto market. Tesla currently holds 11,509 Bitcoins, which could either be a future growth engine or a ticking time bomb. However, savvy publicly traded companies have clearly found a balancing act—by pledging Bitcoin for liquidity, they maintain exposure to rising prices without affecting daily operations. This "having your cake and eating it too" operation is a pinnacle of contemporary corporate financial engineering.

From a broader perspective, this accounting revolution is reshaping the structural logic of corporate balance sheets. When Bitcoin can openly enter financial statements, and when digital assets are on par with traditional assets, the valuation system in capital markets is undergoing a silent yet profound transformation. Those companies that have positioned themselves early have already seized strategic high ground in the price discovery mechanism of crypto assets. As demonstrated by MicroStrategy's aggressive strategy of hoarding Bitcoin through debt financing, this corporate-level "digital gold rush" is rewriting the rules of the capital game.

As Tesla's Bitcoin holdings realized a $347 million actual increase in value in Q4, and as crypto-native companies like Coinbase and Block continue to expand their holdings, a clear signal is emerging: under the dual variations of the digital economy and geopolitical dynamics, Bitcoin is transforming from a speculative target into a standard component of corporate financial strategy. This butterfly effect triggered by changes in accounting rules may very well be the key turning point for the mainstreaming of crypto assets. After all, things that can bring Wall Street accountants and Silicon Valley geeks to a consensus are indeed rare in this era.

Data Analysis:

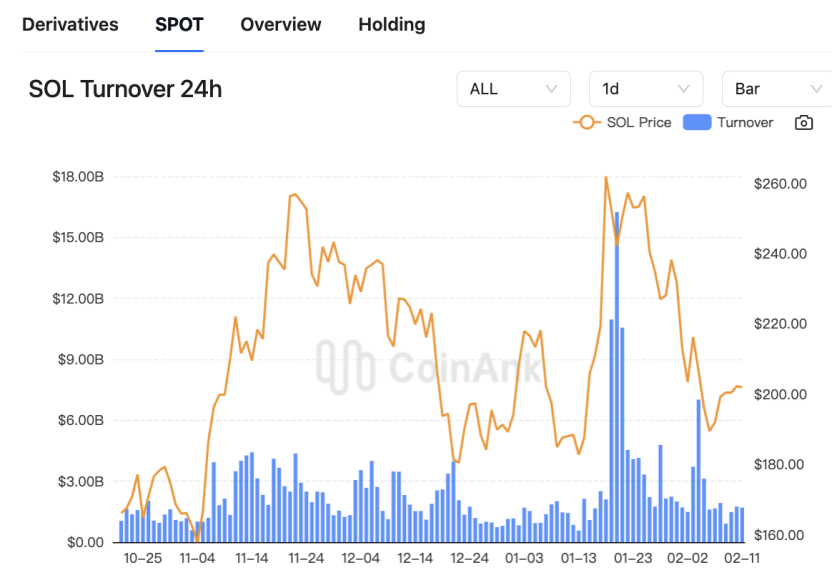

According to Coinank data, the Solana ecosystem's DEX daily trading volume reached $60 million, surpassing Ethereum's DEX trading volume for the fourth consecutive month. The data shows that the main DEX platforms in the Solana ecosystem, including Jupiter, Raydium, and Orca, significantly contribute to the overall trading volume.

We believe that Solana's DEX trading volume surpassing Ethereum for four consecutive months reflects a dual drive of its technical advantages and market dynamics. First, technical performance is the core support: Solana's "proof of history" protocol enables it to achieve a processing capacity of up to 65,000 TPS, with extremely low transaction costs (about $0.00001 per transaction), significantly optimizing user experience. This high efficiency attracts high-frequency trading demand, especially during speculative hotspots like Meme coins (such as the launch of the official Trump Meme coin), making Solana the preferred choice for capital inflow.

Secondly, ecosystem expansion accelerates the positive cycle: cross-chain bridging solutions (such as BRC20 asset migration) and the growth of native projects enhance asset diversity, while leading DEX platforms like Raydium and Jupiter contribute over 50% of the ecosystem's trading volume through aggregated trading and liquidity incentives. Additionally, the continuous rise in market share is strategically significant: by Q4 2024, Solana's share of spot DEX trading volume is expected to exceed 30%, and weekly trading volume in January 2025 surged by 323% year-on-year, indicating a shift from short-term hotspots to long-term ecological competitiveness. However, potential risks must also be noted: despite the growth in trading volume, network activity and developer engagement showed a decline in the second half of 2024, which may impact future innovation momentum. Overall, Solana is temporarily leading due to performance dividends and ecosystem expansion, but maintaining its advantage will require balancing the dynamic relationship between technological iteration, developer ecology, and market speculation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。