Macroeconomic Interpretation: The U.S. Bureau of Labor Statistics will press the inflation data launch button at 21:30 tonight, specifically the CPI data, which has not only the crypto market but also global investors eagerly awaiting. This annual spectacle, humorously dubbed the "Federal Reserve Spring Festival," coincides with Trump waving the tariff stick and Powell's hawkish remarks echoing, even Bitcoin is showing relative anxiety today, waiting for the data release.

This CPI data can be considered a "mixed breed"—it carries the genes of the traditional inflation trifecta (energy, food, housing) while also infused with the wild bloodline of Trump's tariff policies. The market generally bets on an overall CPI month-on-month increase of 0.3% and a core CPI year-on-year of 3.1%, which seems lukewarm, but Goldman Sachs has quietly raised its forecast to a 0.34% core month-on-month increase, resembling a top student secretly reviewing before an exam. Even more stimulating, the statistical department has subtly updated seasonal factors and consumption weights, effectively putting a "beauty filter" on the data.

Looking closely at the "criminal gang" of inflation: used car prices, this old actor, are expected to rise by 1.5% month-on-month; auto insurance has transformed into a dark horse, with the increase possibly jumping from 0.4% to 0.75%; even the usually laid-back communication services are starting to act up, expected to reverse the deflation trend with a 0.5% increase. This scene is comparable to market vendors banding together to raise prices, making Powell grind his teeth in frustration.

As for the most attention-grabbing supporting role, it has to be Trump's tariff policy. This former president dropped a 25% steel and aluminum tariff "bomb" on the inflation battlefield, turning the 2025 inflation forecast into a guessing game. Current Treasury Secretary Yellen is likely biting her handkerchief in the office: the script for interest rate cuts has been abruptly changed to a suspense thriller.

The market has long been poised for volatility—the S&P 500 options market anticipates a ±1.3% fluctuation, creating the largest "electrocardiogram" since the 2023 banking crisis. The bond market is staging a "bull-bear melee": the 10-year U.S. Treasury yield is sharpening its knives around 4.55%, and the swap market has slashed interest rate cut expectations to less than two. Even consumers from the University of Michigan are joining the fray, raising their inflation expectations for the next year from 3.3% to 4.3%, resembling a collective consumption of inflation stimulants.

As for Bitcoin, the "rebellious youth" of the digital age, it has recently shown signs of fatigue. While traditional assets are dancing with joy, BTC's price movement resembles a video with poor internet speed—buffering to the point of anxiety. QCP Capital's analysis hits the nail on the head: although the dollar bulls seem like paper tigers, the liquidity in the crypto market has been sucked dry by the listing of various new coins, more thoroughly than a black hole. Last week's liquidation disaster further taught traders that playing leverage in the crypto space is even more thrilling than walking a tightrope.

However, undercurrents are always surging. If tonight's CPI data gives the dollar bulls a "knee-jerk reaction," Bitcoin may be able to stage a comeback. After all, this market, known for its penchant for "slapping faces," loves the drama of turning the tide against the wind. Those smart money investors who have preemptively positioned themselves with put options are now holding their breath like large felines waiting for prey.

Uncle Powell's hawkish stick may be waving vigorously, but the market seems to sense the aura of a paper tiger—the dollar index is struggling to breach the 105 high ground, as if under a freezing spell. Behind this delicate balance is institutional capital's "secret maneuvering" in the crypto market: while complaining about BTC's poor performance, they are secretly increasing their positions in spot ETFs. This kind of "mouth complaining but body acting right" operation resembles the daily life of a star-chasing girl.

As the clock strikes midnight, regardless of whether the CPI data brings surprise or shock, Bitcoin faces a critical choice: to continue being the tail of the traditional market or to replay the independent trend of 2020? The only certainty is that on this fantastical night where inflation and policy dance together, and traditional and crypto markets clash, every digit after the decimal point could explode into brilliant fireworks on the candlestick chart. Meanwhile, savvy investors have already prepared their popcorn, ready to enjoy this cross-border spectacle between Wall Street and the crypto market.

According to Coinank news, 32 institutions predict the U.S. January seasonally adjusted core CPI month-on-month rate to be released at 21:30 tonight, as follows:

- ANZ: +0.2%; Capital Economics: +0.2%; Danske Bank: +0.2%; Deutsche Bank: +0.2%;

- JPMorgan: +0.2%; Jefferies: +0.2%; Royal Bank of Canada: +0.2%; Sumitomo Mitsui: +0.2%;

- Bank of Montreal: +0.3%; Rabobank: +0.3%; Barclays: +0.3%; Bank of America Merrill Lynch: +0.3%;

- DBS Bank: +0.3%; Citigroup: +0.3%; Commerzbank: +0.3%; Goldman Sachs: +0.3%;

- HSBC: +0.3%; ING: +0.3%; Mizuho: +0.3%; MONEX Group: +0.3%;

- Moody's Analytics: +0.3%; Nomura: +0.3%; Pantheon Macroeconomics: +0.3%; Scotiabank: +0.3%;

- Societe Generale: +0.3%; Standard Chartered: +0.3%; TD Securities: +0.3%; UBS: +0.3%;

- UOB: +0.3%; Wells Fargo: +0.3%; Morgan Stanley: +0.4%; Reuters survey: +0.3%.

Data Analysis:

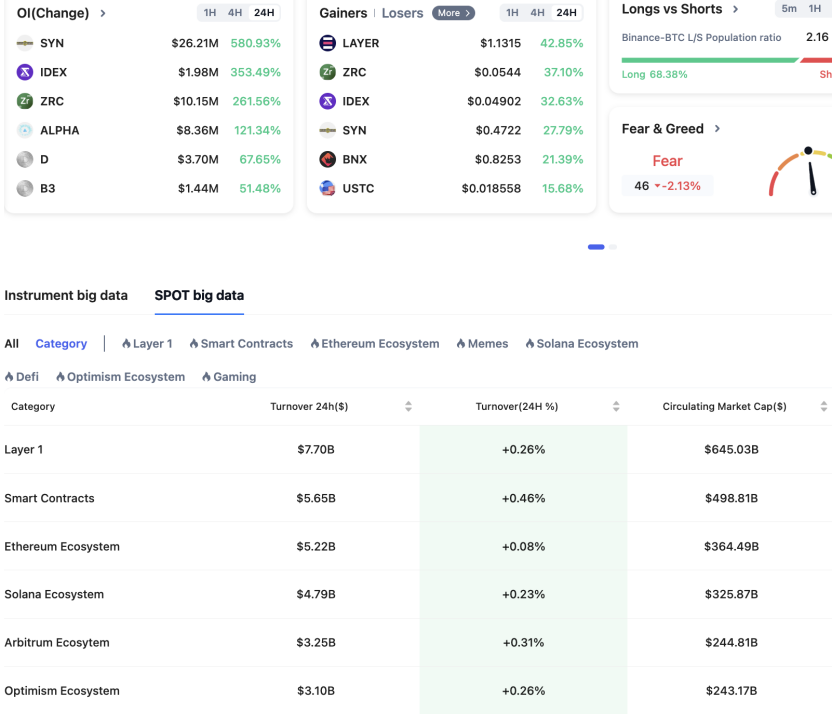

Coinank data shows that the Meme and AI token sectors have suffered the most severe declines during the recent market adjustment, with MEME and AI sectors down 60% and 56% respectively from their December 2024 highs. Additionally, several sectors such as L2, DEPIN, and SOLMEME have returned to levels seen before the U.S. elections.

In contrast, mainstream coins and the DeFi sector have shown relatively stable performance. The mainstream coin sector has only retraced 29% from its January 2025 peak, covering projects like SOL, XRP, DOGE, ADA, LINK, LTC, and XLM. DeFi has dropped 38% from its December peak but still outperforms the Meme and AI tokens. DeFi components include LINK, OM, UNI, ONDO, AAVE, and MKR.

Overall, the top 30 crypto assets have seen a 24% decline since December, primarily supported by the relative stability of BTC, XRP, and BNB, while other altcoins have generally weakened. BTC's dominance has increased by 13%, indicating that funds are concentrating towards Bitcoin, reflecting a massive sell-off in the altcoin market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。