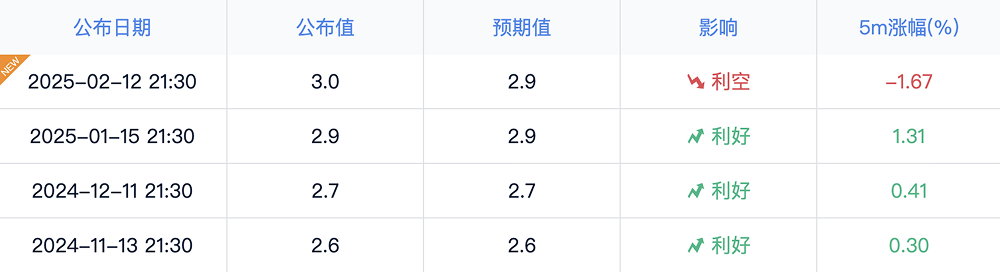

On February 12, 2025, the U.S. Department of Labor released the Consumer Price Index (CPI) report for January, which unexpectedly recorded an unadjusted annual CPI rate of 3.0%. This not only exceeded the market's general expectation of 2.9% but also surpassed the previous value of 2.9%. This data immediately sparked widespread attention in the market regarding the direction of the Federal Reserve's monetary policy, particularly constituting a significant revision to the previously prevalent expectations of interest rate cuts.

Inflation Alarm Rings Again: CPI Data Exceeds Expectations

Data released by the U.S. Bureau of Labor Statistics showed that the CPI increased by 0.5% month-on-month in January, marking the largest single-month increase since August 2023. Excluding the more volatile food and energy prices, the core CPI also rose by 0.4% month-on-month, again exceeding market expectations. Analysts pointed out that this data clearly indicates that inflationary pressures in the U.S. remain significant, and their persistence may exceed previous market predictions.

Immediate Effects of Data Release: Bitcoin Price Plummets

Following the release of the CPI data, market risk aversion quickly intensified, with risk assets being the first to bear the brunt. Bitcoin's price fell sharply after the data was published, briefly touching the critical support level of $94,000. Although the price rebounded afterward, the market's sensitivity to changes in macroeconomic policy was fully evident. Particularly in the context of uncertainty regarding interest rate trends, the short-term volatility of risk assets significantly increased.

Significant Cooling of Rate Cut Expectations: Fed Policy May Remain Hawkish

After the release of the January CPI data, market expectations for the Federal Reserve to cut interest rates within the year underwent a significant adjustment. Interest rate swap contracts indicate that traders currently expect only one 25 basis point rate cut this year, in stark contrast to previous expectations of at least two cuts. The timing of any rate cut has also been pushed back to December, whereas the market previously widely anticipated September.

Market analysis suggests that this adjustment in expectations reflects the market's judgment that the Federal Reserve may cautiously maintain its current monetary policy tightening until it confirms that inflationary pressures are effectively contained. Federal Reserve Chairman Jerome Powell's public statements following the data release also corroborated this market interpretation. Powell noted that the January CPI data reminds the market that while progress has been made on inflation, it has not yet fully reached policy goals, thus the Fed is inclined to maintain a restrictive policy for the foreseeable future. This statement further solidified market expectations for the Fed to maintain current interest rates in the short term.

Rebalancing Risk Appetite: Can the Crypto Market Shift from "Speculation" to "Safe Haven"?

The CPI data exceeding expectations directly points to the possibility that the Federal Reserve may slow down its rate-cutting pace, and even reconsider the possibility of raising rates. Market liquidity expectations are tightening, and high-risk assets such as tech stocks and cryptocurrencies will be the first to feel the pressure. However, this does not mean that the outlook for crypto assets is bleak.

Long-term observations suggest that Bitcoin is gradually shedding its label as a "highly speculative asset" and evolving into an alternative asset with "digital gold" properties. If inflation remains high in the future and the Fed's policy response lags, it may trigger a flow of funds out of traditional markets in search of alternative safe-haven assets with anti-inflation characteristics. In this macroeconomic context, Bitcoin's appeal may actually be strengthened, provided it can effectively withstand short-term liquidity shocks.

- Short-term perspective: Under expectations of tightening market liquidity, cryptocurrencies like Bitcoin may face downward pressure.

- Long-term outlook: If the market reassesses Bitcoin's anti-inflation properties, it may become a new option for safe-haven asset allocation.

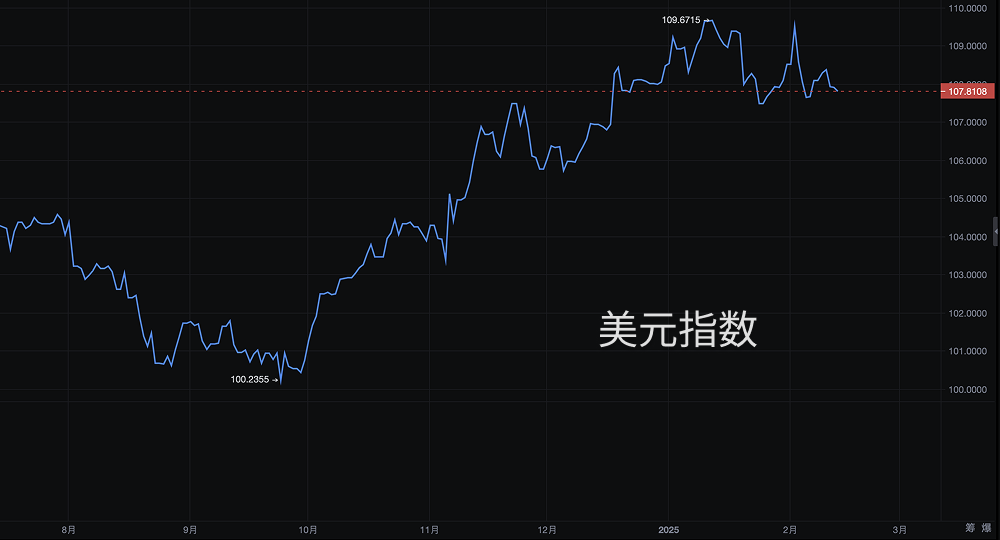

Strong Dollar and Crypto Market Dynamics: A Delicate Balance

The U.S. Dollar Index (DXY) strengthened significantly after the CPI data was released. If the Federal Reserve insists on maintaining high interest rates, dollar-denominated assets, such as U.S. Treasury bonds and dollar deposits, will become more attractive to global capital, potentially leading to a repatriation of international capital to the U.S. and reducing allocations to high-risk assets, including cryptocurrencies.

Strong dollar → Capital flows back to the U.S. → Crypto market faces short-term pressure

However, there is also a potential balance point in the market. If a high-interest-rate environment exacerbates concerns about an economic recession, risk aversion may rise again, at which point Bitcoin's appeal as an "alternative safe-haven asset" may become more pronounced. During the banking crisis of 2023, Bitcoin's price rise against the trend partially validated this logic.

Institutional Investor Strategy Adjustments: Evolution of Crypto Market Funding Structure

Institutional funds have deeply entered the cryptocurrency market, particularly with the launch of Bitcoin spot exchange-traded funds (ETFs), which have opened the door for traditional funds to enter on a large scale. Compared to retail investors, institutional investors are more sensitive to changes in the macroeconomic environment, and their investment strategy adjustments are also quicker.

In the context of CPI data exceeding expectations, institutional investors may adopt the following strategies:

- Reduce allocations to highly leveraged speculative assets: In the short term, liquidity-driven cryptocurrencies, such as meme coins and altcoins, may face greater selling pressure.

- Increase allocation to low-correlation assets: If the market forms long-term high inflation expectations, the long-term allocation value of Bitcoin may increase.

- Use derivatives to hedge risks: Changes in open interest in the Chicago Mercantile Exchange (CME) Bitcoin futures market are worth close attention, as institutional investors may use the futures market to hedge risks and strategize in advance.

Challenges for DeFi and Altcoin Ecosystems: Survival Test in a High-Interest Rate Environment

Compared to mainstream cryptocurrencies like Bitcoin and Ethereum, decentralized finance (DeFi), non-fungible tokens (NFTs), and the broader altcoin ecosystem may face more severe challenges. The reasons are as follows:

- Rising funding costs and shrinking speculative demand: Many protocols in the DeFi space rely on liquidity mining mechanisms, and rising funding costs may lead to accelerated market liquidity loss.

- Lower risk appetite, preference for blue-chip assets: When market risk aversion rises, investors may prefer to allocate to more liquid and consensus-driven blue-chip crypto assets like Bitcoin and Ethereum, rather than smaller tokens.

- Declining liquidity in the NFT market: A high-interest-rate environment is generally unfavorable for highly speculative assets, and trading activity in the NFT market may further decrease.

For DeFi and altcoin investors, the key to future development lies in enhancing the project's "self-sustainability," that is, the ability to maintain sustainable growth in a low liquidity environment, rather than overly relying on market speculation.

Uncertainty in Fed Policy Direction: Market Pricing Faces Challenges

The current market faces "dual uncertainties":

- Inflation and policy: CPI data exceeding expectations has delayed rate cut expectations and even triggered a reassessment of the possibility of future rate hikes.

- Potential impacts of fiscal policy: Considering potential future changes in fiscal policy (which may refer to the fiscal policies of the Trump administration, as originally stated), this may further exacerbate inflationary pressures.

If CPI data continues to exceed expectations in the coming months, the Federal Reserve may be forced to adopt more aggressive tightening policies, which would pose significant challenges to risk assets, including the cryptocurrency market. However, if the market ultimately determines that the Fed cannot effectively control inflation, and currency depreciation becomes a long-term trend, Bitcoin's long-term value as an anti-inflation asset may be further reinforced.

In other words, the cryptocurrency market may experience severe volatility in the short term, but the long-term development direction will still depend on the ultimate trajectory of the macroeconomy.

Participants in the cryptocurrency market should maintain a rational investment attitude, prudently control leverage risks, and closely monitor the Federal Reserve's monetary policy trends, dollar exchange rate movements, and institutional fund flows to better respond to future market fluctuations.

Disclaimer: The above content does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。