A few days ago, CZ tweeted that BNBChina will undergo an upgrade. The price of BNB has risen from around $500 to about $716 in about ten days, an increase of over 40%. It currently ranks fifth in market capitalization, still some distance from its peak rank of third. Just last night, as the leading coin on the BSC chain during the last bull market and once Binance's "first son," CAKE saw an increase of over 40%, while the former "second son," BAKE, nearly doubled with an increase close to 100%. Many believe that these surging tokens may, like before, experience significant daily spikes to attract retail investors for harvesting.

Regarding the surge of these coins, the old dog maintains a neutral stance. After all, these surging tokens are quite different from the newly listed tokens on Binance. These tokens are products from the peak of the last bull market and are generally linked to the strength of BNB. Furthermore, these tokens differ from most newly listed tokens, as the majority of new tokens have low circulation rates and are likely to face significant selling pressure later on. However, the tokens from the last bull market generally have high circulation rates and have survived through long bull and bear market cycles. From a market capitalization perspective, these surging tokens have very low market caps, allowing large funds to easily control the market. Therefore, when considering buying, one must also consider the risks involved.

After the CPI data was released yesterday, Bitcoin instantly dropped by about 2.6%. The reason is simple: the U.S. CPI in January increased by 3% year-on-year, exceeding market expectations and the forecasts of over 95% of analysts. This also raised expectations that the Federal Reserve would not lower interest rates next month to over 95%. Hence, the short-term sell-off occurred. However, after a night of adjustment, Bitcoin's price quickly broke through the high point before yesterday's drop, indicating that large players in the market still have confidence in Bitcoin's future performance.

Currently, the Federal Reserve and Trump are exchanging blows, but under Trump's pressure, Fed Chair Powell has started to be more friendly towards the crypto market. Just early this morning, Powell stated that they do not want to hinder banks from providing services to legitimate clients using cryptocurrencies. When banks engage in cryptocurrency activities, it is appropriate to ensure that they understand the associated risks. Many cryptocurrency-related activities can be conducted through banks. This indicates that the Federal Reserve has implicitly accepted that cryptocurrencies can operate within the traditional financial sector in the U.S., and banks can serve as trading venues for the cryptocurrency market, allowing people to buy and sell. This also shakes up the flow of traditional funds, as people can trade cryptocurrencies at banks. In the future, Americans might see cryptocurrency market trends displayed on large screens in every bank. At that point, if a large player gives a bank some money to cooperate with a trader to pump a certain token, it would be much easier to harvest than the current situation where project teams tweet.

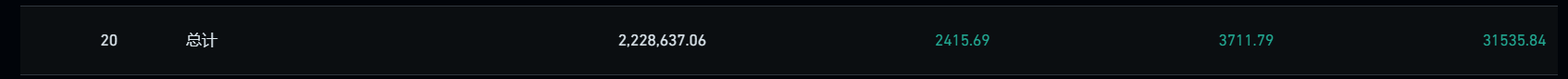

Now, let's take a look at the exchange data,

From the data of the last day and week, Bitcoin has been in an inflow state on exchanges recently, but the price has not seen a significant drop, remaining in the range of $94,000 to $102,500. The large inflow into the market without a sell-off suggests that large players and institutions may be transferring coins to exchanges to open long positions. Moreover, yesterday's daily closing was the first time since the drop on January 31 that it stood above the daily 5 and 10 MA averages. Therefore, once the price breaks through $102,500, it is highly likely to head towards new highs.

As for

Ethereum has seen significant outflows from exchanges in the last day and week, indicating that large players and institutions have been buying Ethereum during the downturn and consolidation period. In the latter half of the bull market, no mainstream coins want to fall behind, as the final performance during the peak bull market will determine the proportion of investor choices in the next bull market.

This round of the bull market is hard to predict, but one thing remains unchanged: Bitcoin's performance in this bull market has already surpassed over 90% of the coins on the market. This bull market has significantly dampened enthusiasm for buying altcoins, as many have been trapped in altcoins during this round. However, let's take it step by step; as long as the long cycle is not over, there are still opportunities. It all depends on whether Trump and Musk can give the crypto space another push.

That's all for today. Thank you all for your long-term support of the old dog.

If you have any questions, feel free to leave a comment!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。