Macroeconomic Interpretation: The US CPI data released last night can be described as a "fireworks show" in the financial market. The core CPI rose by 0.446% month-on-month, far exceeding the expected 0.3%, shattering the market's fantasies about a rate cut by the Federal Reserve in March. This wave of data not only sent the dollar index soaring to a high of 108, but also caused US Treasury yields to jump 10 basis points, vividly illustrating the narrative of "as long as inflation persists, the bulls will not perish." Interestingly, the market behaved like a fickle weather vane—US stock futures and gold initially plummeted, only to stage a dramatic rebound, while BTC experienced a rollercoaster ride, perfectly capturing the inner turmoil of market participants.

Looking closely at the data details, the California wildfires not only turned the sky red but also ignited car insurance prices, with auto insurance soaring 1.99% month-on-month; even more bizarrely, obscure items like hospital fees, parking fees, and club membership fees collectively "went wild," leading analysts to jokingly refer to it as the work of the "January merchants' retaliatory price increase alliance." However, the Federal Reserve is not to be underestimated; it quietly adjusted the CPI seasonal adjustment factor, the "beautifying filter," making the inflation data from the past three months appear smoother, which in turn raised the baseline for this period's data—this operation can be seen as a classic example of "data wizardry."

In terms of market reaction, the expectations for rate cuts were directly knocked down— the first rate cut was pushed from July to September, and the total number of rate cuts for the year shrank to a meager 1.06 times. But don’t rush to sing the blues; the base effect from February to April and the "double sword" of housing inflation may still deliver a surprise "flash of light" for the bulls. However, by the second half of the year, as Trump's tax cuts, tariffs, and immigration policies begin to take effect, the Federal Reserve may find it hard to even locate the microphone for rate cuts.

Shifting focus to tonight's PPI data, the market seems to be in a "dead pig is not afraid of boiling water" stance. Despite warnings from analysts about potential "January effects" and tariff disturbances, the market appears more entranced by the "Trump-Putin friendly phone call" illusion. Current expectations are for a PPI month-on-month rate of 0.3% and a core year-on-year rate of 3.3%. If these figures exceed expectations, traders may have no choice but to employ the "selective blindness" tactic. After all, Powell just performed a set of "Tai Chi" in Congress, acknowledging that inflation is close to the target while emphasizing that there is no rush to cut rates; this "Schrödinger's dovish" attitude leaves the market with interpretative space larger than a black hole.

Interestingly, despite the macroeconomic clouds looming, the crypto market seems to be like a spinach-fueled Popeye. Pantera partners stated that "2025 will be a favorable year for crypto," while ARK's "stock goddess" Cathie Wood boldly claimed "aiming for $300,000," and Base's founder was busy debunking rumors of ETH sell-offs, resembling a protective mother hen. These positive signals act like a bulletproof vest for Bitcoin, allowing it to bounce joyfully amidst the Federal Reserve's rate hike barrage.

When the macro storm meets the crypto carnival: BTC's magical realism script. Bitcoin currently stands at a crossroads, with one side facing liquidity anxiety from the Federal Reserve's delayed rate cuts, and the other side receiving continuous blood transfusions from crypto-native positives. In the short term, a strong dollar and high interest rate environment may cause BTC to stumble like a drunken man, but let’s not forget its built-in "anti-inflation" persona—when traditional assets are ravaged by inflation, the story of digital gold becomes even more enticing.

More subtly, the art of market expectation management is at play. Although the January CPI knocked down rate cut expectations, the futures market stubbornly assigns a 12.9% probability for a rate cut in May; this delicate psychological game resembles guessing high or low in a casino—knowing the odds are not high, yet still hoping for a miracle.

If tonight's PPI data unexpectedly comes in mild, combined with Powell's vague remarks about the "difficult-to-measure impact of trillion-dollar spending cuts," it could lead to another round of back-and-forth between bulls and bears. In the long run, the crypto market is also undergoing changes. Institutions are transitioning from "sneaky" to "grandiose" purchases of BTC, and the ambition of stablecoins is marching towards a scale of $1.4 trillion; these endogenous forces are building a moat. Even if the Federal Reserve transforms into a "rate hike maniac," the wealth creation effect in the crypto world may still attract hot money through the back door. After all, while traditional financial markets play the "inflation whack-a-mole" game, Bitcoin has already equipped itself with a rocket booster.

This collision of macro policies and the crypto revolution may ultimately evolve into an absurd drama of "you fight your fight, I rise my rise." After all, in the crypto world, faith can sometimes be more lethal than the Federal Reserve's balance sheet.

Data Analysis:

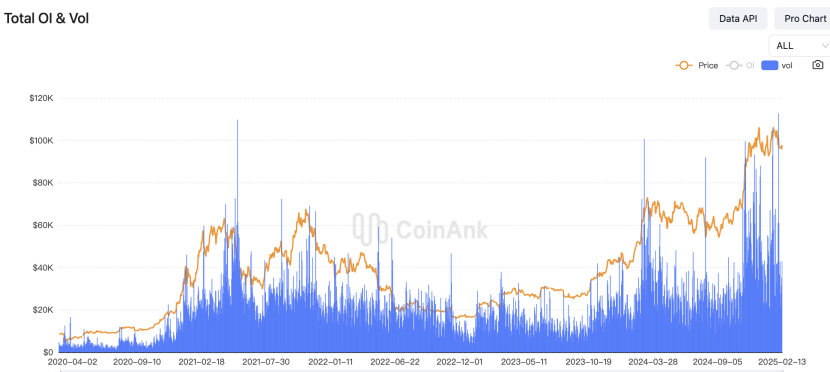

According to Coinank data, the total trading volume of CEX in 2024 is projected to reach $18.83 trillion, a 134% increase from $8.05 trillion in 2023, but still below the historical high of $25.21 trillion in 2021. Although the trading volume in 2024 shows a significant rebound, it has not yet returned to the peak levels of the 2021 bull market. The competitive landscape of the crypto trading market is evolving, with emerging exchanges rapidly rising and traditional exchanges losing market share.

From the perspective of market evolution, we believe that while the trading volume of centralized exchanges in 2024 is expected to double year-on-year to around $18.8 trillion, there remains a 23% gap compared to the historical peak in 2021, reflecting the structural differentiation characteristics of the crypto market's recovery. Data indicates that institutional capital entry (such as the approval of spot ETFs) and innovations in derivative tools are driving liquidity recovery, but retail leverage demand has not yet been fully activated, resulting in overall activity being weaker than in the previous bull market.

The changes in the competitive landscape are even more noteworthy, as emerging exchanges are capturing market share through regional licensing, zero-fee strategies, and on-chain asset integration, while traditional platforms are constrained by rising regulatory compliance costs and user migration pressures. This dynamic balance reflects the trend of the crypto market transitioning from rough expansion to refined operations, with liquidity evolving from monopolistic dominance to a more diversified distribution.

It is worth noting that the growth gap between trading volume and market capitalization suggests an increase in market maturity—investors are holding positions for longer periods, and short-term speculative behavior is decreasing. However, caution is warranted regarding the potentially systemic risks posed by the high proportion of derivatives (currently over 70%). In the future, CEXs need to explore new growth points such as asset issuance and yield tools within a compliance framework to break through the current trading volume ceiling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。