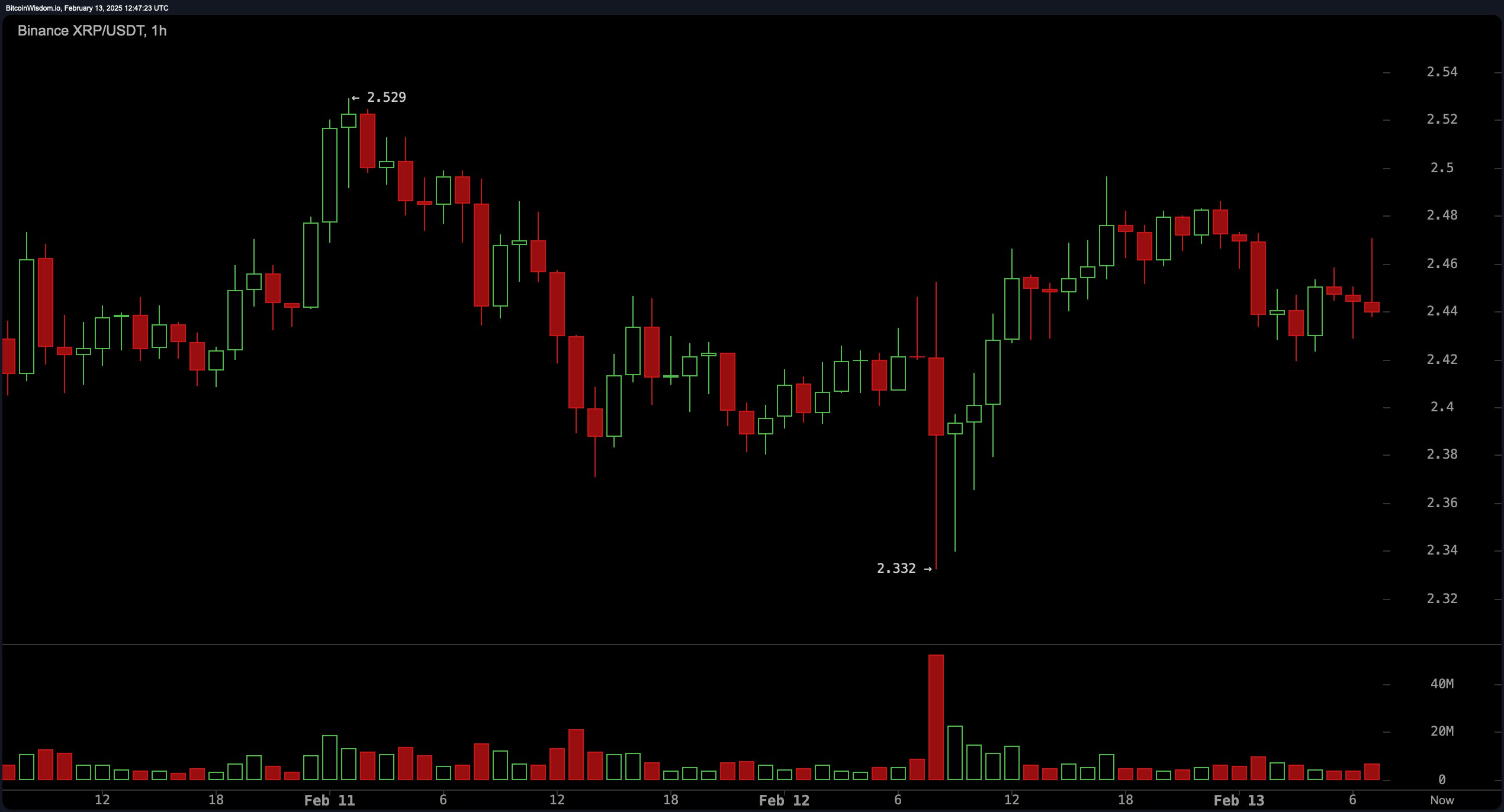

The one-hour XRP chart unveils a transient equilibrium phase, with the crypto asset grappling against a $2.52 ceiling while finding solace in the $2.33-$2.35 corridor. A modest retreat materialized after testing upper bounds, yet the emergence of a higher trough hints at latent upward ambition. Sustaining above $2.35 could propel a charge toward $2.50-$2.52; conversely, slipping below $2.33 might invite a descent toward $2.30 or beneath. Trading activity holds firm, mirroring a collective pause as participants await directional conviction.

Binance XRP/USDT on Feb. 13, 2025, 1 hour chart.

Zooming out, the four-hour chart paints a grander equilibrium dance between $2.40 and $2.50, a sequel to recent depreciation. Foundational support coalesces at $2.30-$2.40, while overhead barriers loom at $2.60 and $2.70. Piercing $2.50 could ignite bullish fervor targeting loftier thresholds, whereas breaching $2.30 may unravel gains toward $2.10. The market lingers in anticipatory stasis, observers debating whether stability will endure or a fresh trajectory will crystallize.

Binance XRP/USDT on Feb. 13, 2025, 4 hour chart.

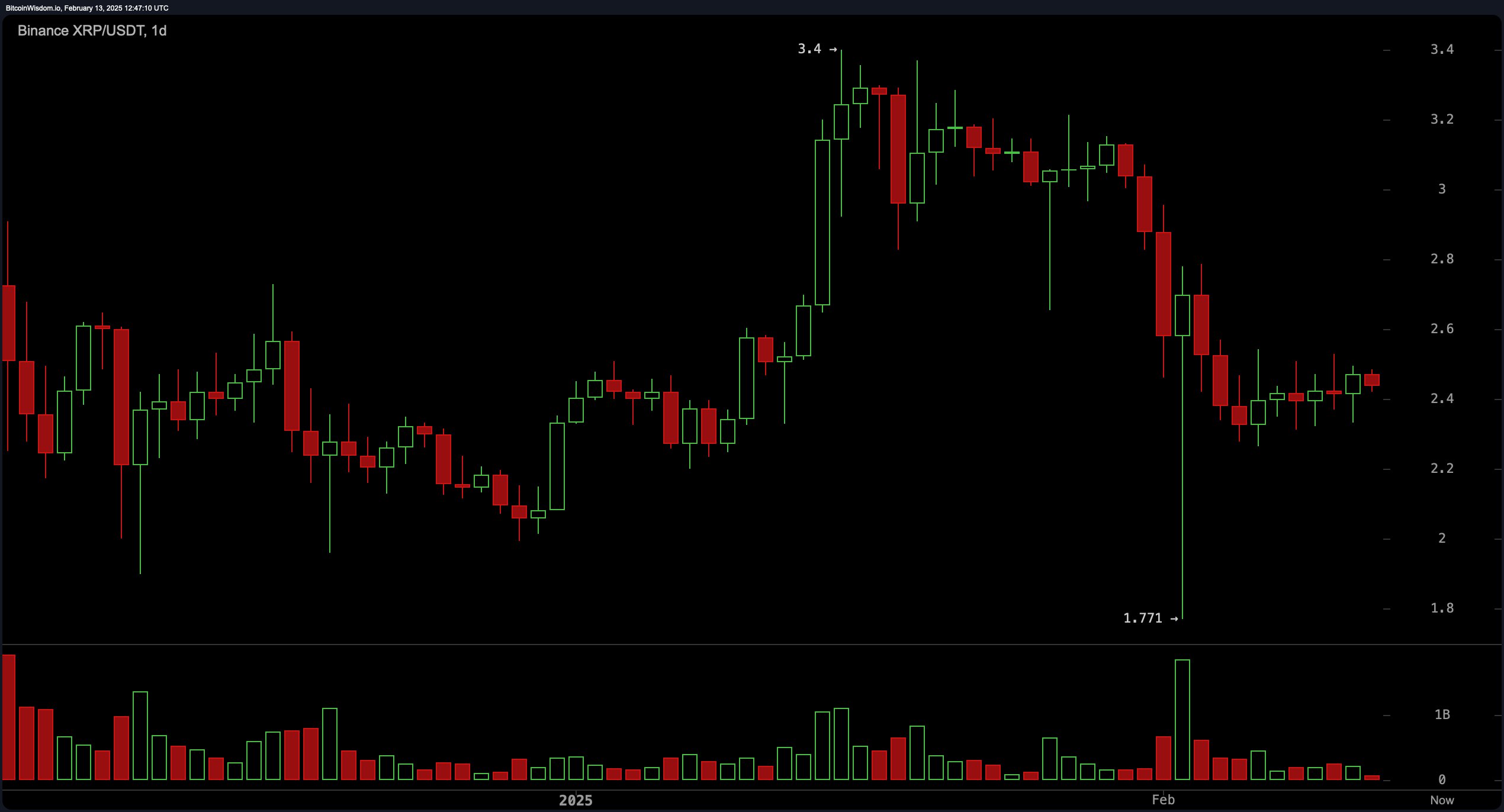

The daily lens reveals XRP in a corrective interlude, retreating from a Feb. 2025 zenith of $3.40 to a $1.77 trough before rebounding into the $2.40-$2.50 theater. The $1.77 floor persists as a linchpin, while the $3.40 pinnacle beckons as a distant aspiration for bulls. Holding above $2.40 might nurture consolidation ahead of renewed ambition, though faltering here risks a slide toward $2.20 or $2.00.

Binance XRP/USDT on Feb. 13, 2025, daily chart.

Oscillators whisper of cautious equipoise: the relative strength index (RSI) at 41.03, Stochastic at 49.09, commodity channel index (CCI) at -55.26, average directional index (ADX) at 36.69, and awesome oscillator at -0.36. Momentum metrics tilt bearish (-0.25), with the moving average convergence divergence (MACD) echoing skepticism at -0.10. Collectively, they signal neither exuberance nor despair, merely a paucity of bullish verve to catalyze swift gains.

Moving averages weave a schizophrenic narrative: Exponential averages (10, 20, 30, 50-period) flash caution, while the 10-period simple average advocates optimism. Longer-term metrics (100 and 200-period EMAs/SMAs) lean bullish, implying latent strength beneath short-term lethargy. Reclaiming pivotal average thresholds could reignite upward fervor; stagnation, however, may prolong indecision or invite retreat.

Bull Verdict:

Despite short-term consolidation, XRP’s ability to hold above $2.40 suggests accumulation before another breakout attempt. If the price pushes past $2.52 and gains momentum above key moving averages, XRP could target $2.60 and beyond, with long-term prospects remaining bullish as support levels hold strong.

Bear Verdict:

Weak short-term momentum and multiple sell signals from moving averages indicate that XRP could struggle to maintain its current range. If the price falls below $2.33 and breaks support at $2.30, bearish pressure may push XRP toward $2.20 or even $2.00 before finding a new support base.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。