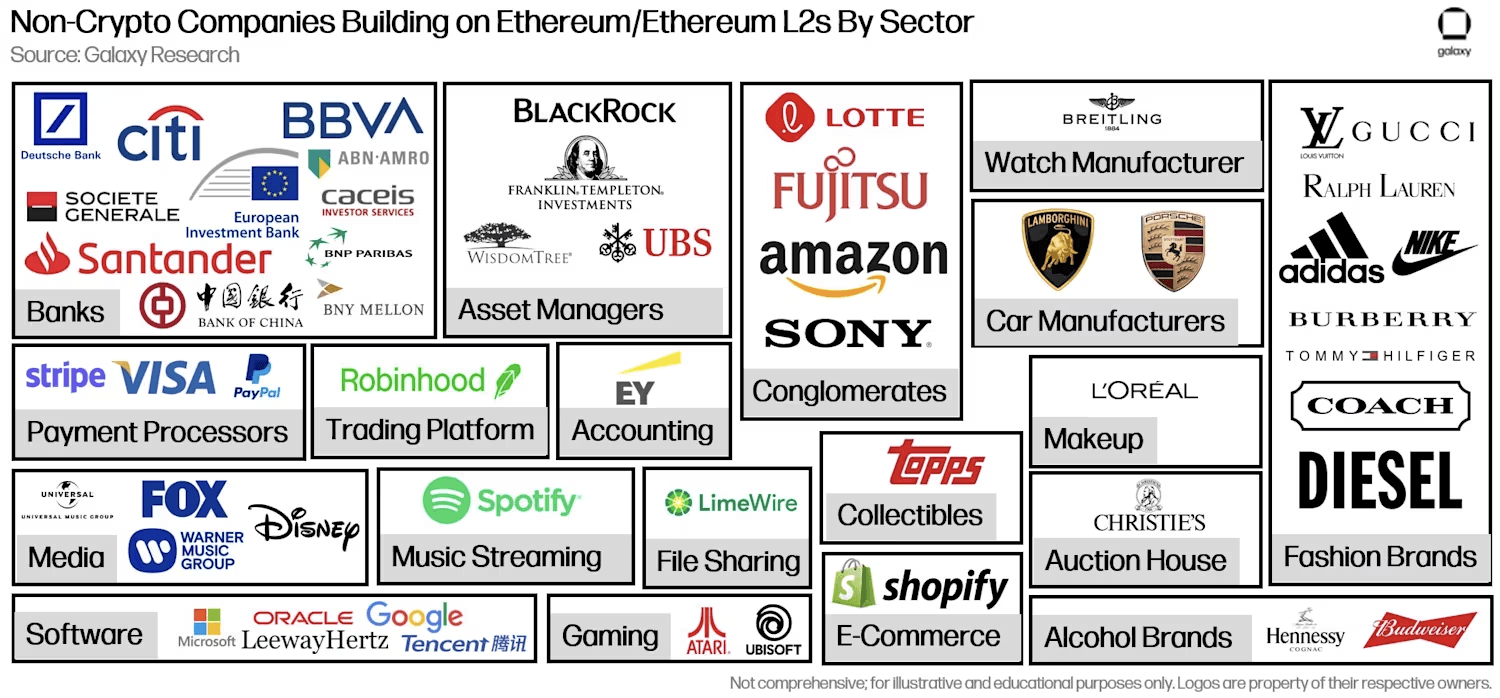

More than 50 traditional companies, including financial institutions like Deutsche Bank and Paypal and brands like Louis Vuitton and Adidas, are developing crypto-specific applications on Ethereum and its layer two (L2) networks, according to a report by Galaxy Digital Vice President of Research Christine Kim. These efforts focus on non-speculative use cases such as real-world asset (RWA) tokenization, NFTs, and Web3 gaming, bypassing general crypto infrastructure like exchanges.

Galaxy Digital’s research charts 55 traditional enterprises actively crafting blockchain-driven frameworks and decentralized tools on Ethereum and its L2 ecosystems, signaling a pivot toward Web3 integration beyond speculative trends.

Ethereum leads in RWA tokenization, hosting nearly 10 times the value of assets compared to rival blockchain Stellar, per Galaxy Research. Of 20 financial institutions building crypto infrastructure, 13 issue RWAs—including Blackrock’s Ethereum-based fund, BUIDL. Stablecoins also thrive on Ethereum, with Paypal’s PYUSD and Robinhood’s USDG driving a 70% supply surge in 2024. Ethereum commands over 50% of the $400 billion stablecoin market.

Scalable infrastructure investments underscore corporate adoption. Deutsche Bank is developing an Ethereum L2 with ZKSync for compliant finance solutions, while Sony’s Soneium rollup targets gaming and entertainment. These projects highlight Ethereum’s role as a foundation for customizable, enterprise-grade blockchains despite debates over centralized control, as seen in Sony’s oversight of Soneium activity.

Gaming drives NFT innovation, with firms like Atari and Lamborghini launching L2-based platforms. Atari deployed classic games on Coinbase’s Base network, offering NFT rewards, while Lamborghini’s Fastforworld enables cross-game digital car ownership. South Korea’s Lotte Group partners with Arbitrum for its “Caliverse” metaverse, citing the L2’s 250ms block speeds as critical for seamless gaming.

Ethereum’s L2-centric roadmap balances scalability and security, attracting institutions seeking efficient onchain solutions. Regulatory tailwinds, including SEC focus on tokenization, and partnerships like Stripe’s $1 billion acquisition of stablecoin platform Bridge, signal growing mainstream adoption.

Galaxy’s report concludes Ethereum remains the preferred chain for finance-focused crypto services, with RWAs and stablecoins poised for expansion in 2025. “As the general-purpose blockchain with the highest level of decentralization, the widest reach for crypto-native users, and the longest track record for network uptime, Ethereum is the gateway that many institutions are using to incubate and launch finance-focused crypto services and products,” Kim noted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。