I. Introduction

Donald Trump, in the 2024 U.S. presidential campaign, has adopted the slogan of "the president who supports innovation and Bitcoin," proposing a series of disruptive cryptocurrency policy commitments that completely reverse his anti-crypto stance from his first term. He has repeatedly emphasized the goal of making the U.S. the "global cryptocurrency capital" and has put forward multiple policy proposals to support the development of cryptocurrencies.

This shift is not only a political strategy to win the votes of the crypto industry but also reflects the U.S. strategic consideration regarding the global status of the dollar—strengthening dollar hegemony through cryptocurrencies. This article systematically reviews Trump's cryptocurrency policy commitments, analyzes the progress and resistance in their implementation, and looks ahead to the impact of his domestic and foreign policies on the crypto market.

II. Overview of Trump's Cryptocurrency Policy Commitments

1. Top Ten Cryptocurrency Policy Commitments by Trump

During the 2024 campaign, Trump proposed a series of policy commitments aimed at supporting and promoting cryptocurrencies, focusing on the following ten core areas:

1) Establishing a National Strategic Bitcoin Reserve: Trump proposed incorporating Bitcoin into the U.S. sovereign reserve assets, using Bitcoin seized by the federal government through law enforcement actions as an initial reserve, and legislating annual procurement targets. He believes that by establishing a Bitcoin reserve, the U.S. can dominate the global digital economy while providing new avenues for national wealth appreciation.

2) Firing SEC Chairman Gary Gensler: Trump criticized the current SEC Chairman Gary Gensler's "enforcement-style regulation" as stifling innovation and promised to dismiss him on his first day in office. He advocates appointing regulators who are friendly to cryptocurrencies to promote industry development.

3) Stopping the Development of Central Bank Digital Currencies (CBDCs): Trump believes that CBDCs could threaten personal freedom and has committed to permanently banning the Federal Reserve from issuing a digital dollar, arguing that privately issued cryptocurrencies should play a larger role in the financial system rather than government-led digital currencies.

4) Supporting the Development of Stablecoins: Trump plans to create a loose regulatory framework that allows stablecoins to access the Federal Reserve's payment system, promoting their use as international trade settlement tools. He believes that stablecoins can improve the efficiency of payment systems and reduce cross-border transaction costs.

5) Building a Bitcoin Mining Powerhouse: Through tax incentives, energy subsidies, and support for technological research and development, Trump hopes to attract global mining companies to the U.S., enhancing America's competitiveness in the Bitcoin mining sector. This would not only help create jobs but also elevate the U.S. position in the global cryptocurrency ecosystem.

6) Defending Self-Custody Rights: Trump advocates for legislation that guarantees users the right to control their private keys, opposing restrictions on transactions from self-custody wallets, asserting that individuals should have the right to manage their digital assets without government or institutional interference.

7) Repealing SAB 121 Accounting Rules: Trump believes that current accounting rules are unfair to crypto companies and limit their development, planning to alleviate the burden on crypto companies' balance sheets to enhance industry competitiveness.

8) Ending "Operation Choke Point 2.0": Trump has committed to halting regulatory restrictions on banking services for crypto companies, ensuring that these companies can access financial services fairly.

9) Pardon Silk Road Founder Ross Ulbricht: Trump stated that he would consider pardoning Silk Road founder Ross Ulbricht as a symbolic gesture to support the libertarian values of the crypto community.

10) Establishing a Cryptocurrency Presidential Advisory Council: Trump plans to create a dedicated advisory council to develop a transparent regulatory framework that promotes the integration of the crypto industry with traditional finance. He believes that the government should collaborate with industry experts to formulate policies that benefit innovation and protect investors.

2. Reasons for Trump's Shift in Position

Trump's attitude towards cryptocurrency has undergone a significant transformation from "high-profile skepticism" to "active embrace," driven by several underlying factors:

1) Economic Strategic Considerations: Consolidating Dollar Dominance

The U.S. has enjoyed the benefits of the dollar as the world's primary reserve and settlement currency for many years, but globally, the trend of de-dollarization and diversification of settlement is accelerating. The stablecoins introduced by the crypto industry (most of which are pegged to the dollar) provide a new pathway for the dollar to maintain its status as the "global currency." The binding of stablecoins to U.S. Treasury bonds and dollar reserves can continue and amplify dollar hegemony in international financial markets.

2) Political Maneuvering: Gaining Voter and Capital Support

With the explosive growth of the crypto industry in recent years, the number and scale of individuals holding digital assets have significantly increased, especially among young voters and tech professionals, where crypto thinking has gradually become a "new trend." During the 2024 election cycle, political donations to candidates from both parties have exceeded $200 million. Trump has keenly recognized the importance of this emerging force. Additionally, the funding and technological capabilities of these crypto companies can provide a greater resource backing for Trump's campaign.

3) Personal and Business Interests: Promoting Trump Family Interests

Beyond the political and national strategic factors, the Trump family also has potential interests in the crypto world. The Trump family-supported project WLFI has begun buying and holding Bitcoin and other digital assets such as ETH, WBTC, ONDO, TRX, LINK, AAVE, and ENA. They have also launched a token related to their image or brand, "Trump Coin" ($TRUMP), which briefly surpassed a market value of $15 billion.

Regardless, if Trump pushes for loose crypto policies during the campaign, it will undoubtedly indirectly enhance the value of his family's assets and create a broader stage for future business endeavors.

III. Analysis of Progress and Resistance in Trump's Cryptocurrency Policy Commitments

1. Implemented Measures

1) Changes in Regulatory Leadership: SEC Chairman Gary Gensler voluntarily resigned on January 20, 2025, and Trump appointed pro-crypto figure Paul Atkins to succeed him, shifting the SEC towards "guidance-based regulation." Additionally, Trump plans to nominate Brian Quintenz, the policy director at a16z and former CFTC commissioner, to serve as CFTC chairman.

2) Signing of Cryptocurrency Executive Order: On January 24, 2025, Trump signed an executive order establishing a cross-departmental working group to coordinate the development of a federal regulatory framework and prohibit CBDC development.

3) Repeal of SAB 121: The SEC rescinded this accounting rule in January 2025, alleviating financial pressure on crypto custody platforms.

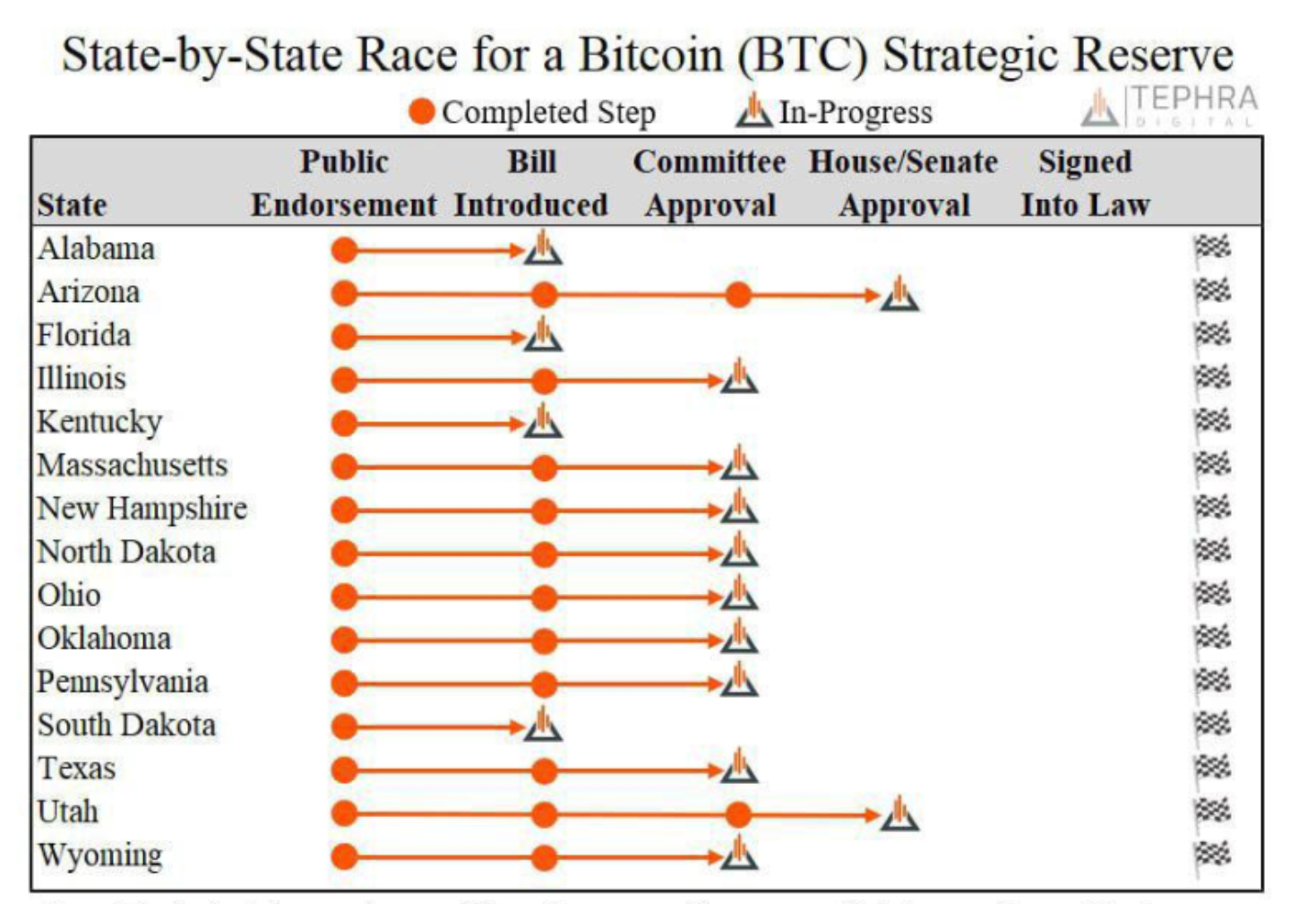

4) State-Level Bitcoin Reserve Pilot Programs: Several states in the U.S. have proposed or passed bills to establish strategic Bitcoin reserves, allowing state treasuries to allocate part of their budgets to Bitcoin.

2. Policies in Progress

1) National Bitcoin Reserve Bill: Senator Cynthia Lummis submitted the "Bitcoin Strategic Reserve Act," proposing to purchase 1 million Bitcoins within five years, but it requires congressional budget approval and faces bipartisan skepticism regarding volatility risks.

2) Stablecoin Regulatory Framework: The Treasury Department, in collaboration with issuers, has launched a "Payment Stablecoin Regulatory Standards Initiative," aiming to establish an international payment framework within five years, but traditional banks are likely to oppose the impact of stablecoins on existing payment networks.

3) Mining Support Policies: The "Bitcoin Energy and Technology Innovation Act" has entered the legislative process, proposing tax breaks for green mining, but there are still disputes over grid capacity and sources of subsidy funding.

3. Major Resistance and Uncertainties

1) Legislative Delays: Federal-level policies regarding Bitcoin reserves and mining subsidies require congressional approval, with the Republican Party holding only a slim majority in the Senate, and Democratic lawmakers criticizing them as "fiscal recklessness."

2) Judicial Challenges: Pardoning Ulbricht may provoke public backlash (he was sentenced to life imprisonment for drug trafficking and money laundering), and the legal process is complex.

3) Market Volatility Risks: If the national Bitcoin reserve plan is implemented on a large scale, it could exacerbate fiscal deficits due to BTC price fluctuations. The U.S. federal budget deficit for fiscal year 2024 is projected to reach $1.8 trillion, an increase of $139 billion from the previous fiscal year.

4) International Coordination Challenges: The opposition to CBDCs conflicts with the EU's MiCA regulations and China's promotion of the digital yuan, which may lead to fragmentation in the cross-border payment system.

IV. Progress of Bitcoin Reserve Legislation in U.S. States

Source: [https://legiscan.com/

As of February 11, public information indicates that at least 27 states in the U.S. are participating in the Bitcoin reserve legislative race, aiming to diversify investments to combat inflation and enhance fiscal resilience.

](https://legiscan.com/As of February 11, public information indicates that at least 27 states in the U.S. are participating in the Bitcoin reserve legislative race, aiming to diversify investments to combat inflation and enhance fiscal resilience.)

1. States That Have Passed or Are Close to Approval

1) Utah: The Utah House of Representatives passed HB230 on January 28, 2025, allowing 5% of public funds to be invested in Bitcoin, high-market-cap cryptocurrencies, and stablecoins. The bill is currently under review by the Senate, and if passed, Utah will become the first state in the U.S. to officially establish a Bitcoin reserve.

2) Arizona: Senate Bill SB1025 has passed the Senate Finance Committee and is awaiting a vote in the House. If approved, Arizona may follow Utah in establishing a reserve.

3) Pennsylvania: In November 2024, it was one of the first states to propose a bill allowing the state treasury to use 10% (approximately $1 billion) of its general fund to purchase Bitcoin, becoming an early advocate for this legislation.

2. States with Bills Under Review

1) Texas: A bill proposed in December 2024 allows residents to donate to a state Bitcoin fund, requiring Bitcoin to be cold-stored for at least five years and prohibiting out-of-state transactions. The bill has not yet entered the final voting stage.

2) Ohio: Two bills (including Bill 57) have been proposed, requiring the establishment of a Bitcoin reserve fund and authorizing the treasurer to purchase Bitcoin, currently in the legislative framework discussion stage.

3) Maryland: House Bill 1389 plans to use seized gambling illegal funds to purchase Bitcoin, expected to take effect in October 2025.

4) Kentucky: House Bill 376 allows state funds to invest in digital assets with a market value exceeding $750 billion (currently only Bitcoin qualifies), with an investment cap of 10%.

5) Other States: Similar bills have been proposed in 15 other states, including Florida, Alabama, New Hampshire, and South Dakota, but most are still in the early legislative stages.

3. States That Have Failed or Encountered Obstacles

1) North Dakota: House Bill 1184 was rejected due to a high number of opposing votes (32 in favor, 57 against).

2) Wyoming: The bill did not pass the legislative process, with specific reasons not disclosed.

4. Federal-Level Developments

Senator Cynthia Lummis has promoted the "U.S. Bitcoin Strategic Reserve Act," proposing to purchase 1 million Bitcoins (5% of the total supply) within five years and suggesting the use of gold reserves or asset seizure funds to support the plan. Although the Federal Reserve maintains a conservative stance, the crypto-friendly policies of the Trump administration may accelerate the federal legislative process.

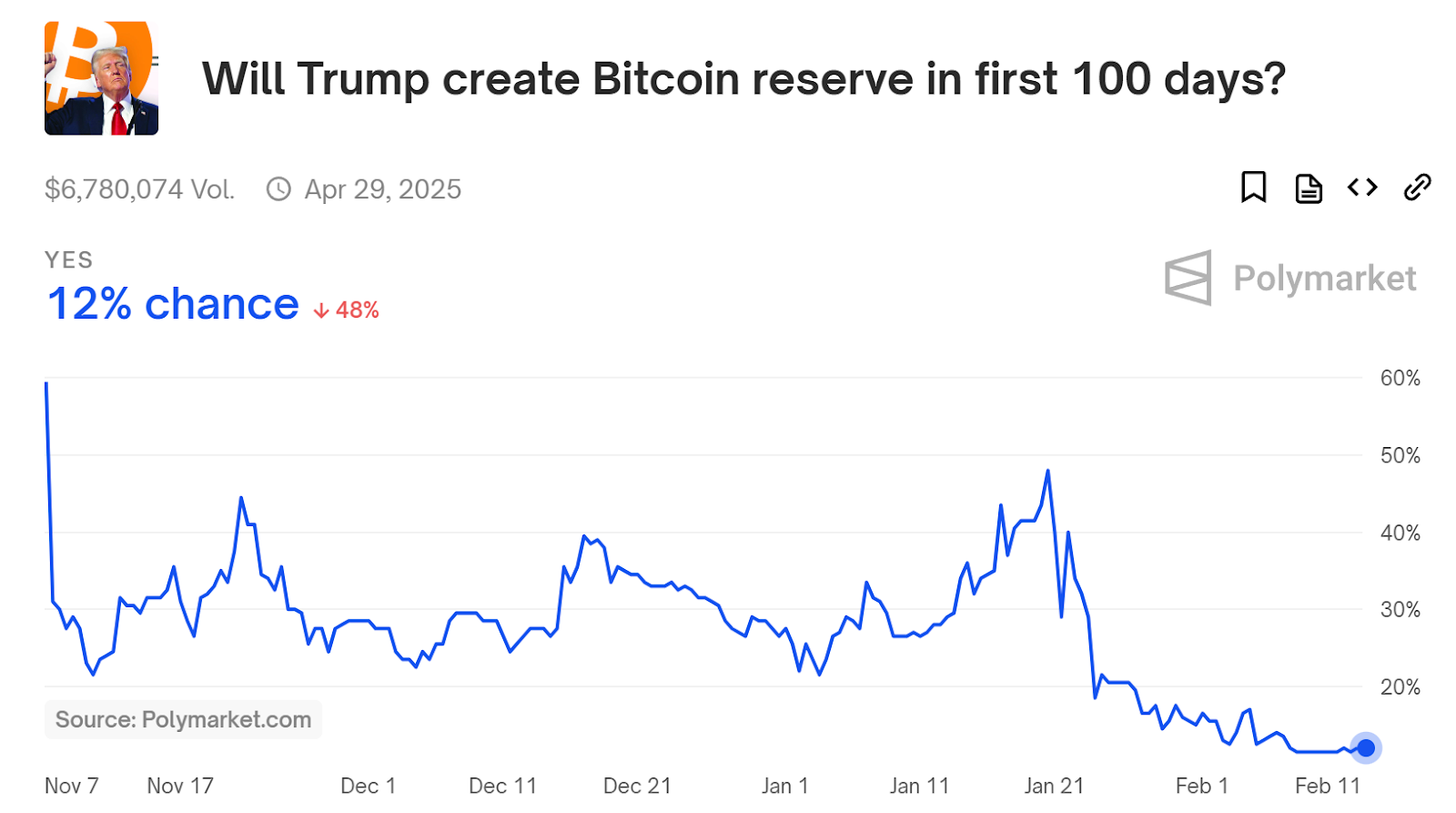

Source: https://polymarket.com/

V. Impact of Trump's Domestic and Foreign Policies on the Crypto Market

1. Tariff Policies and Trade War Risks

On February 1, Trump signed an executive order announcing a 10% tariff on goods imported from China and a 25% tariff on goods from Canada and Mexico (with a 10% tariff on Canadian energy products). This policy is seen as a continuation of Trump's "protectionist" trade policies aimed at protecting domestic industries and increasing fiscal revenue.

1) Short-term Market Volatility: Following the announcement of Trump's tariff policy, there was a strong risk-averse sentiment in the market, and the cryptocurrency market reacted quickly, with Bitcoin's price dropping over 6% within 24 hours, briefly falling below $94,000; Ethereum experienced an even larger decline of 27%, with prices dropping to around $2,100. The market saw liquidations exceeding $2 billion.

2) Long-term Dollar Liquidity Contraction: If a trade war escalates and leads to a sell-off of U.S. Treasury bonds (currently at $36 trillion), the crypto market may face pressure alongside risk assets.

2. Bitcoin Reserve Collateralization and High Volatility Risks

The Trump administration proposed incorporating Bitcoin into the U.S. strategic reserve assets (SBR), planning to purchase Bitcoin through the Treasury's Exchange Stabilization Fund (ESF) to enhance economic resilience. The current U.S. government holds 207,000 Bitcoins (valued at approximately $10.4 billion). If the policy is implemented, Bitcoin's "digital gold" attributes may be reinforced, driving up its valuation. However, the feasibility of this path is questionable. If Bitcoin is used as collateral for U.S. Treasury bonds, international creditors must recognize its value stability, but Bitcoin's high volatility may undermine its credibility as collateral.

3. Stablecoin Circulation Mechanism Concept and Compliance Risks

The Trump team hinted at strengthening dollar inflow through a "dollar-stablecoin-Treasury bond" closed loop. Currently, 95% of stablecoins are pegged to the dollar, with 80% of reserve assets invested in Treasury bonds, forming a cycle of "stablecoins purchasing Treasury bonds—Treasury bonds supporting dollar credit—dollars flowing back to the U.S." If this mechanism is scaled, it could deeply bind the crypto market to the dollar system while alleviating debt pressure. However, this mechanism relies on the regulatory compliance of stablecoins. If the "21st Century Financial Innovation and Technology Act" promoted by Trump's new policies is passed, it may clarify the classification and regulatory framework for stablecoins, providing a policy foundation for this closed loop.

4. Payment System Fragmentation Under U.S.-China Tech Competition

China is accelerating the promotion of the digital yuan (DCEP), expanding its influence in cross-border payments through digital yuan pilot programs, while the Trump administration firmly opposes central bank digital currencies (CBDCs) and instead supports private stablecoins to maintain the dollar's dominance in payments. This "CBDC vs. Stablecoin" systemic confrontation may reshape the global financial landscape.

VI. Outlook and Conclusion: Opportunities and Risks Coexist

Trump's new crypto policies undoubtedly bring significant changes to the U.S. crypto industry, emphasizing a "strategic embrace" of the crypto market and somewhat shifting the U.S. government's regulatory attitude towards crypto assets. However, the actual effects of the policies and future developments still face numerous challenges.

Historical data shows that Trump's commitment fulfillment rate is only 31%. This low fulfillment rate necessitates caution from the crypto industry when facing Trump's new policies, particularly regarding his policy commitments. The success of Trump's crypto policies still depends on resolving three core contradictions.

1) Balancing Innovation and Risk: Trump's new policies emphasize loose regulatory measures, attempting to provide space for innovation in crypto technology through deregulation. However, excessive looseness may lead to the risk of a similar collapse re-emerging, necessitating the establishment of a more dynamic regulatory mechanism to find a balance between innovation and risk, avoiding excessive regulation that stifles technological development while ensuring market stability.

2) Conflict Between Political Commitments and Legislative Realities: The grand vision of the Trump administration, such as the Bitcoin reserve, requires overcoming bipartisan political differences and fiscal constraints. In the U.S. political environment, the divergence of opinions between the two parties may significantly impact the advancement of crypto policies. The implementation of policies will face more political maneuvering, which also means that the crypto market will encounter greater policy uncertainty.

3) The Game Between Dollar Hegemony and Decentralization Ideals: While private stablecoins can consolidate the dollar's position, this approach conflicts with the decentralization ideals of the crypto industry. Decentralization has always been a core value in the crypto industry; however, Trump's policies may further integrate the dollar into the crypto market, and this contradiction may challenge the crypto industry's "anti-censorship" spirit.

Overall, Trump's crypto policies present unprecedented opportunities for the U.S. and global crypto industries, but the implementation of these policies and market reactions remain fraught with uncertainty. For investors, it is crucial to be wary of policy reversals and the risks of market bubbles. The future of the crypto market relies on solidifying the technological foundation, such as Layer 2 scaling technologies, ZK proofs, and a more robust compliance framework. These technologies and compliance measures will help the market navigate cyclical volatility and embrace a true "crypto civilization" era.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play and Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed analyses of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto field for the first time or a seasoned investor seeking deeper insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

X: x.com/Hotcoin_Academy

Mail: labs@hotcoin.com

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。