Trading is not about waiting for the storm to pass, but learning to dance in the rain. Sometimes you think the sky is about to fall, but in reality, you are just standing crooked or in the wrong crowd. Being overly calculative becomes a kind of bondage, and being lost for too long turns into a kind of pain. If you hold too tightly to the past, how can you free your hands to embrace the present?

Hello everyone, I am trader Gege. Continuing from the last article, Bitcoin plunged after the US stock market opened last night, briefly breaking below 94,000 before rebounding. The recent market has been favoring a rollercoaster-like structure, with breakouts not continuing and prices bouncing up and down. In such a market, it’s best not to chase short-term trades, as it can easily lead to losses.

The first support mentioned in the previous article is not completely invalidated; it quickly recovered after the brief break. The overall structure has not changed significantly. Let’s discuss the technical aspects and see how they present themselves. From the weekly chart of Bitcoin, it seems there is a probability of continuing to form a pin bar, but the key is whether MA7 and MA14 can break through, as it is still early to determine the closing.

Looking at the daily chart from the candlestick perspective, although support has led to a rebound, the middle band above remains a major obstacle for bulls. A significant bullish candle is needed to break through for better upward movement. The support zone around 92,000-91,000 is a strong support level indicated by the candlesticks. If the market dips into this area, there will be market actions, whether it’s short sellers taking profits or bullish buying behavior.

For the medium to long-term trend, Gege maintains the previous view, with the EMA200 on the daily chart serving as an important left-side reference. A downward correction is necessary for better upward potential; the depth of the decline determines the height of the rise. For short-term trading, refer to the middle and lower bands of the daily chart as resistance and support zones. The market has been oscillating for nearly half a month, so patiently waiting for a one-sided opportunity in line with the trend is key.

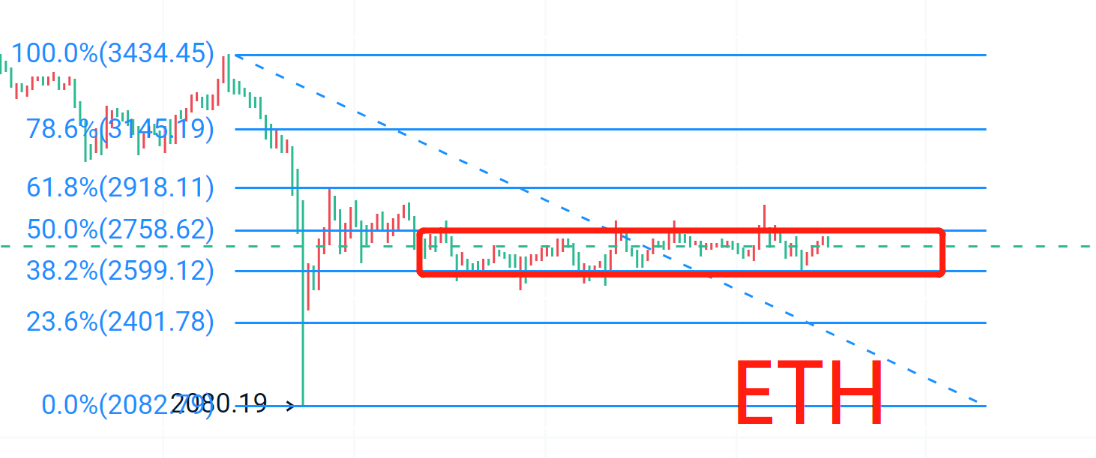

The daily chart of Ethereum is also facing short-term key resistance at the middle band of the Bollinger Bands. The candlesticks continue to oscillate within a range, and after a significant drop, there hasn’t been a proper second test, but rather a narrow range that tests patience. The 4-hour candlestick patterns and Bollinger Bands are becoming hard to watch; a change in trend is certain. So what to do for short-term trading? Continue to treat it as a range, but as time goes on, approach each opening with a trial position mindset and avoid being overly attached to trades. The market has high expectations after a significant drop, but if the market is slow to respond, there is a probability of moving against the market consensus. In summary, if you can’t wait on the left side, then look to the right side; it doesn’t matter whether it goes up or down, just patiently wait and respond flexibly.

Short-term suggestions for Bitcoin on February 19: Short at 97,300-97,800, Long at 94,500-94,000, with a stop loss of 600 points, aiming for 1,000-2,000 points.

Short-term suggestions for Ethereum on February 19: Short at 2,730-2,760, Long at 2,600-2,580, with a stop loss of 50 points, aiming for 80-120 points.

These suggestions are for reference only. Ensure proper risk control when entering trades, and manage your profit and stop-loss space accordingly. For specific strategies, please consult during trading.

Alright, friends, we will say goodbye until next time. I wish everyone success in their trading endeavors and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today’s brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。