Nearly ten thousand participants flocked to the Hong Kong Convention and Exhibition Centre, marking the grand occasion brought by the global Web3 industry's top summit, Consensus, making its debut in Asia. The choice of Hong Kong is not only because it is a testing ground for financial innovation but also a hub for the flow of values between the East and the West. From "tokenized green bonds" to "Hong Kong dollar stablecoin regulatory sandbox," from "RWA ecosystem" to "decentralized AI," Hong Kong is using policy innovation as an engine to push the narrative of Web3 from technical experimentation to deep integration with the real world.

OKG Research has been continuously tracking the development of Web3 in Hong Kong since 2022, focusing on ecological and technological innovation practices. It has produced over 30 in-depth articles on hot topics such as VASP, stablecoins, and RWA tokenization, and has established column collaborations with mainstream media in Hong Kong, such as Sing Tao Group and Ta Kung Pao, to continuously provide industry insights. Taking the Consensus conference as an opportunity, we once again focus on the core topics of Hong Kong Web3 and launch the "HK Web3 Frontline" special feature to analyze the past, present, and future of Hong Kong Web3 from a differentiated perspective.

1. Regulatory Leadership: An Ordered Exploration of Web3 Compliance Boundaries

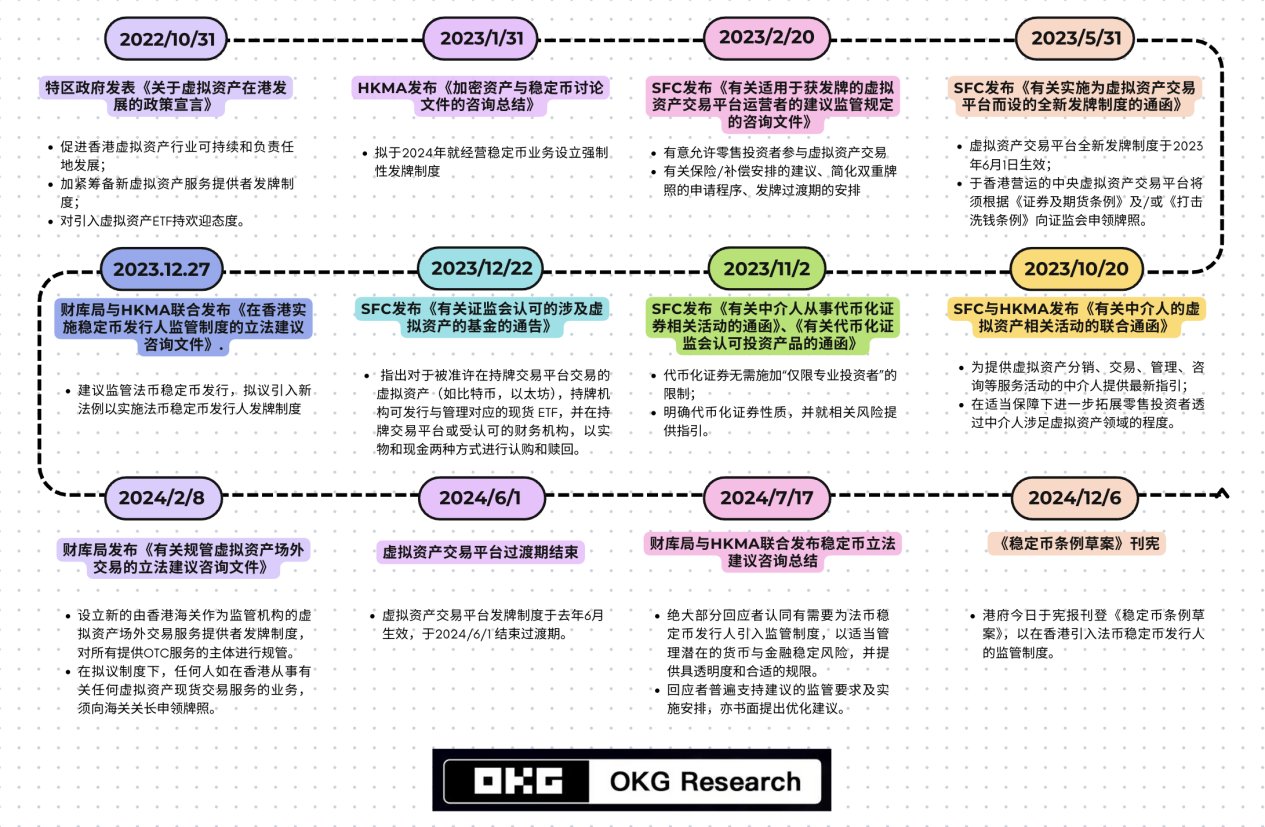

If we compare the Hong Kong Web3 ecosystem to a building, a reliable and applicable regulatory framework is its foundation. Since the policy declaration was released at the end of 2022, Hong Kong has been continuously reviewing and improving its regulatory system to promote the autonomous evolution of the virtual asset ecosystem within safe and compliant boundaries. By establishing a comprehensive regulatory framework covering virtual asset exchanges, stablecoin issuers, custodial service providers, and over-the-counter trading activities, Hong Kong has paved the way for value interconnectivity and long-term innovation in the financial market.

These measures have not only enhanced the credibility of Hong Kong's virtual asset market but have also continuously attracted capital and enterprises. By the end of 2024, nearly 300 Web3 companies had gathered in Hong Kong's Cyberport, accumulating a financing scale of over 400 million Hong Kong dollars.

However, the global Web3 landscape has undergone significant changes in the past two years. With Trump returning to the White House, the regulatory environment for cryptocurrencies in the U.S. has clearly improved, as the long-standing high-pressure punitive regulatory model is fading. Regions like Singapore and Dubai are also continuously releasing crypto-friendly signals. As "the East rises and the West declines" is no longer mentioned, and as global Web3 competition intensifies, how should Hong Kong seize this wave of innovation? OKG Research has previously suggested that Hong Kong's development of Web3 and virtual assets should not only be theoretical but also pragmatic: the Hong Kong government is focused on technological and application innovations that can have a substantial impact on the economy and society. The CEO of the Hong Kong Securities and Futures Commission, Ashley Alder, also expressed a similar view at the Consensus conference, stating, "The second trend shaping the future financial landscape is integrating Web3 innovation into the real economy."

At the same time, although the market share of crypto assets in the global financial system is less than 1%, their rapid expansion and increasing correlation with mainstream financial assets have made their risks impossible to ignore. In the past, Hong Kong and the U.S. seemed to be on different paths at many points in time, but in reality, they share the same goal: to maintain innovative activities while preventing the potential financial risks posed by this new category of assets.

2. Hong Kong Dollar Stablecoin: Hong Kong's "Financial" Ambition

Stablecoins are a hot topic at this Consensus conference and have been a key area of focus and investment for Hong Kong over the past two years. Standard Chartered Hong Kong, ANX Group, and Hong Kong Telecom have recently been reported to establish a joint venture, hoping to apply for a license from the Hong Kong Monetary Authority under the new regulatory framework to issue a stablecoin pegged to the Hong Kong dollar. Circle, the issuer of USDC, has also announced a partnership with Hong Kong's three major note-issuing banks to launch HKDCoin, pegged 1:1 to the Hong Kong dollar.

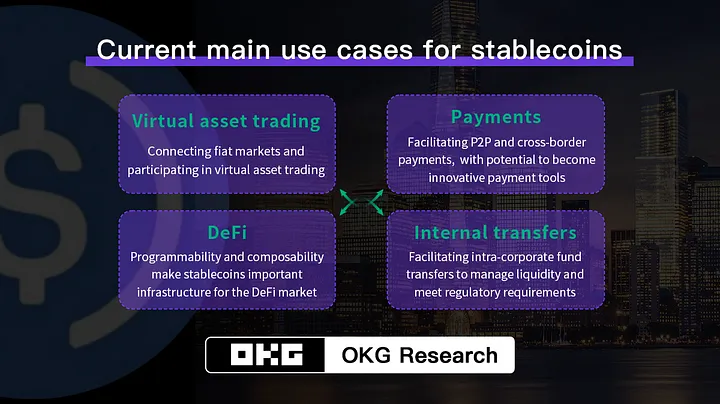

While it is uncertain how much market share the Hong Kong dollar stablecoin can capture in an environment dominated by U.S. dollar stablecoins, for Hong Kong, developing a Hong Kong dollar stablecoin is an inevitable choice to seize the initiative in Web3 development and gain a competitive edge in future finance. The connection channel with fiat currency is currently the most valuable and easily realizable scenario in the crypto ecosystem, and stablecoins are essential infrastructure for building that channel. Meanwhile, the next phase of Hong Kong Web3's development focuses on breaking the barriers between the virtual and real worlds, and stablecoins serve as the core link connecting traditional finance and the crypto world, potentially becoming widely accepted payment tools.

But how should the Hong Kong dollar stablecoin be issued? How should Hong Kong regulate it? Which institutions will be the first to "take the plunge"? The article "Seven Questions About the Hong Kong Dollar Stablecoin: Issuance Logic, Regulatory Rules, and Potential Impact" provides answers and suggests that stablecoins not backed by U.S. dollar assets cannot compete with U.S. dollar stablecoins in the short term. However, through mechanism innovation (such as interest-bearing stablecoins) and application innovation (such as RWA), the Hong Kong dollar stablecoin is expected to avoid direct competition with U.S. dollar stablecoins, thereby attracting a more diverse range of institutions and users to participate.

Of course, we must also distinguish between the Hong Kong dollar stablecoin and the digital Hong Kong dollar. Although there may be potential competition between the digital Hong Kong dollar and the Hong Kong dollar stablecoin in the short term, they are expected to achieve resource sharing and complementary advantages in the future: the utilization rate, expansiveness, and friendliness of the Hong Kong dollar stablecoin in the virtual asset market will far exceed that of the digital Hong Kong dollar, while the digital Hong Kong dollar will lead in value support and reliability.

3. RWA Tokenization: From Concept to a Trillion Market Evolution

RWA is undoubtedly the hottest concept at this Consensus. "RWA tokenization is not a trend, but an inevitability." John Cahill, head of digital assets at Morgan Stanley, asserted at the "Institutional Investment Summit," revealing the general strategic shift of traditional financial giants today.

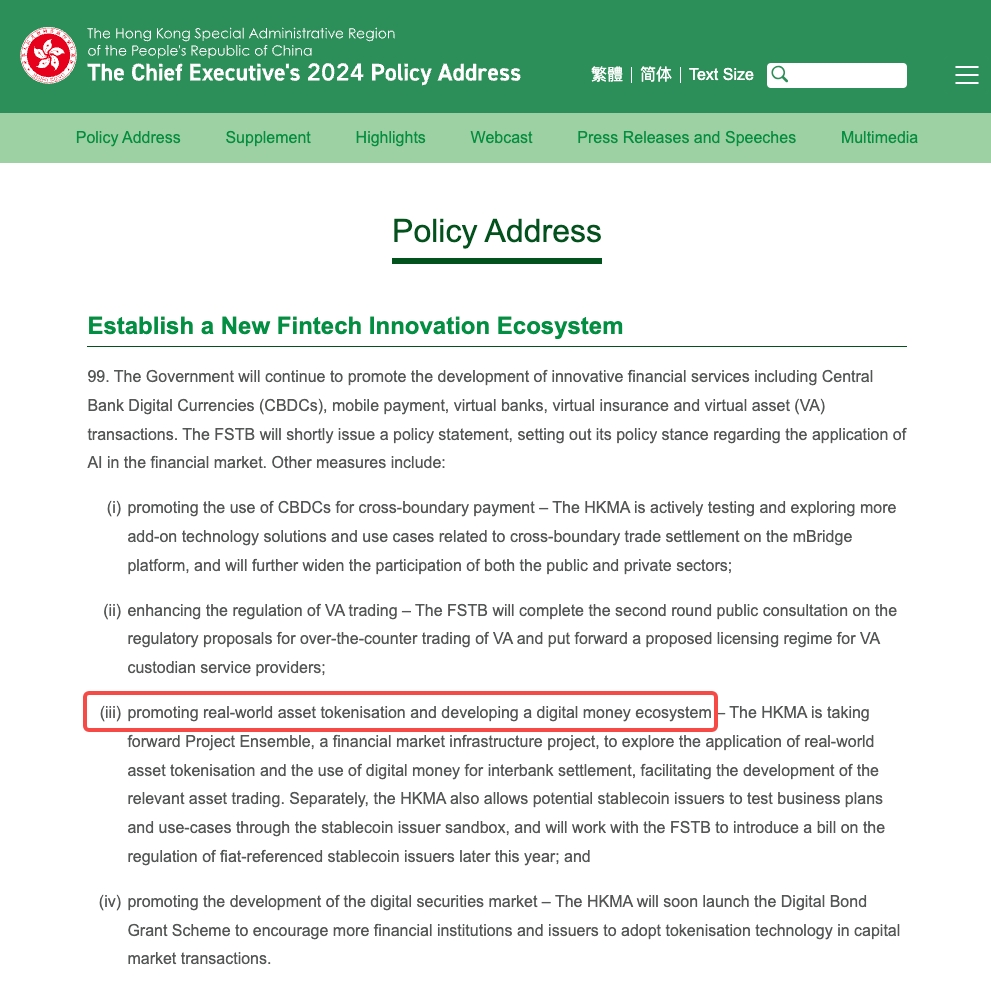

OKG Research suggested in 2023 that RWA is an important area for Hong Kong to focus on and invest in long-term, and how to tokenize the vast traditional assets is the biggest development opportunity for Hong Kong's virtual asset industry. Now, Hong Kong is actively embracing the wave of RWA tokenization. The 2024 policy address proposed promoting RWA tokenization and the digital currency ecosystem, while the Hong Kong Monetary Authority launched the "Digital Bond Financing Scheme" to encourage the capital market to adopt tokenization technology. The Secretary for Financial Services and the Treasury of the Hong Kong SAR Government, Christopher Hui, also stated at the Consensus conference that Hong Kong is considering promoting gold tokenization.

However, the current narrative of tokenization is not driven by Web3 but is more dependent on Web2 institutions, depending on whether they have enough motivation to change the status quo and put their assets on-chain and tokenize them. This is not easy for traditional institutions: any new technology attempting to migrate traditional assets/businesses to new fields often struggles to succeed quickly, as the incremental value it creates may not be significant enough, while the costs are often high. RWA is no exception. However, as Wall Street in the U.S. accelerates its layout in the tokenization market, Hong Kong urgently needs more resource-rich and asset-holding institutions to actively participate in tokenization innovation to gain more initiative in the transformation and avoid being quickly left behind in competition with the U.S. How to stimulate market vitality remains an important question.

Additionally, OKG Research suggested in "How Much Time Does Hong Kong Have Left for RWA Tokenization?" that Hong Kong should focus on the most suitable standardized financial assets for tokenization in the short term and fully leverage its geographical and institutional advantages as an international financial, trade, and shipping center, with a focus on tokenization applications in trade and cross-border scenarios to rapidly expand Hong Kong's RWA tokenization market size.

4. ETF and OTC: The "Light and Dark Clash" of Funding Channels

Another key initiative for the development of Web3 in Hong Kong in 2024 is the launch of virtual asset spot ETFs. From the end of 2023, when related applications were clearly accepted, to the formal listing of six virtual asset spot ETFs on the Hong Kong Stock Exchange approved by the Hong Kong Securities and Futures Commission by the end of April, it took just over a hundred days, reflecting the "speed" and "efficiency" of Hong Kong's regulatory authorities. The launch of virtual asset spot ETFs has opened another funding channel for investors to allocate crypto assets. By the end of 2024, the total asset management scale of Bitcoin spot ETFs in Hong Kong had exceeded 3 billion Hong Kong dollars, accounting for 0.66% of the total Hong Kong ETF market.

Compared to the United States, the main advantages of Hong Kong's virtual asset spot ETFs lie in supporting physical subscriptions and being the first to launch Ethereum spot ETFs. However, these have not led to sustained incremental growth. Although the share of physically subscribed ETF units exceeded 50% of the initial issuance scale, the Bitcoin holding community is reluctant to easily release their liquidity due to macro expectations, while the enthusiasm of investors in Ethereum spot ETFs is affected by the lack of staking support. Despite the current yield from Ethereum staking being only around 3%, the additional returns from staking are likely to be a significant factor in attracting investors, especially traditional financial investors, and are a key distinguishing feature between Bitcoin and Ethereum.

In addition to the ETF channel, Hong Kong has gradually formed a three-tier funding network of "licensed exchanges - compliant OTC - banks." OKG Research stated in "How Can Hong Kong's Crypto Market Improve Liquidity?" that the current focus of liquidity is in the over-the-counter (OTC) market. Although trading platforms remain the most important infrastructure in the crypto market, recent trends indicate that crypto liquidity is gradually converging towards the OTC market. Currently, the Hong Kong OTC market handles nearly $10 billion in transaction volume annually, and thanks to the regionally distinctive physical product of crypto exchange shops, it not only attracts young investors from around the world but also appeals to participants in the middle to older age groups. In recent years, the Hong Kong OTC market has also attracted attention from numerous users and institutions in international trade and cross-border payment sectors, becoming another important channel for Hong Kong to gather global funds.

The Hong Kong government is considering bringing OTC under regulatory oversight. Although this may impact trading activity in the short term, in the long run, it can help Hong Kong attract more compliant capital inflows and also provide another channel for the free flow of funds beyond licensed VATPs. Perhaps in the near future, a safe and compliant OTC market can not only help improve liquidity in the Hong Kong market but also become an important channel connecting the crypto market and Web3 ecosystem with the real liquidity market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。