Author: Balaji (Angel Investor, Former Coinbase CTO)

Compiled and Organized by: BitpushNews

The era of tech mergers and acquisitions may be coming to an end, but the era of cryptocurrency may just be beginning.

The comprehensive effects of new policies have made it more difficult for startups to exit through IPOs or mergers and acquisitions, but issuing equity-backed security tokens (STOs) on the internet has become easier. Why? This article will explain one by one:

1) IPOs Have Become Difficult

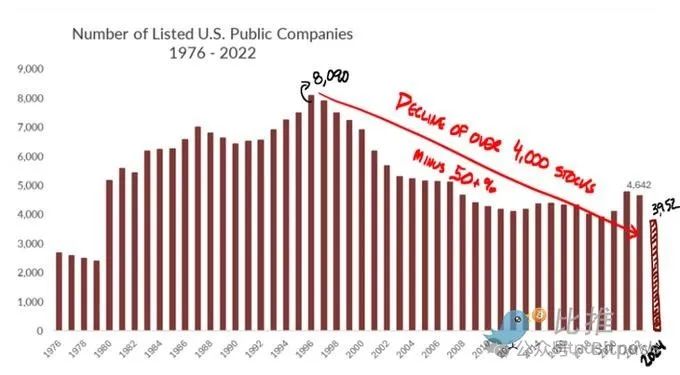

For decades, the Sarbanes-Oxley Act (Sarbox) rules from the U.S. Securities and Exchange Commission (SEC) have made it exceptionally cumbersome for small companies to go public. These rules were intended to prevent the next Enron incident, but they have not worked (nor have they prevented financial crises). However, they have halved the number of publicly listed companies in the U.S. since the peak in 1999:

2) Mergers and Acquisitions Have Also Become Difficult

As a result, since the mid-2000s, the conventional view has been that tech companies should remain private for longer. Due to the difficulties of IPOs, mergers and acquisitions have become the primary exit route for venture capital-backed tech startups. Over the past 20 years, there have been massive exit cases, including Instagram ($1 billion), Oculus ($2 billion), and WhatsApp ($19 billion).

However, since Lina Khan took the helm of the Federal Trade Commission (FTC), large mergers have been blocked under the pretext of "increasing competition," arguing against big fish eating small fish. This is the (superficial) rationale behind the joint regulatory agencies of the EU, U.S., and U.K. blocking Adobe's acquisition of Figma, which was supposed to be a massive exit that would fund more startups:

Khan's logic is fundamentally flawed because when large companies acquire small competitors at high prices, it is actually a form of surrender—and a significant capital injection into the venture capital ecosystem to create more such competitors. If such exits (whether IPOs or mergers) decrease, tech startups will struggle to obtain capital, leading to a lack of competition.

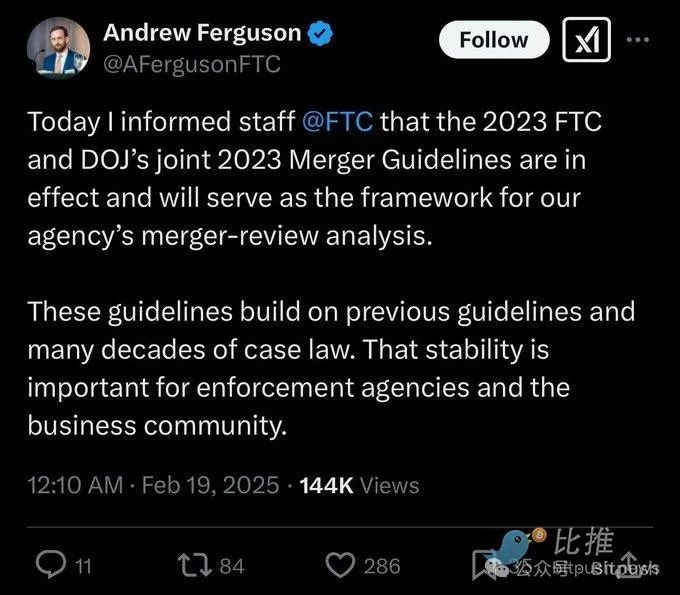

3) The New Trump Administration Still Opposes Mergers!

People in the tech industry once thought the new administration would be more friendly to mergers. Surprisingly, the new administration has adopted Lina Khan's logic—and is clearly continuing her policies:

I believe this is partly due to their understandable tribal hostility towards large tech companies stemming from the media-driven scrutiny during the 2020 election. But unless circumstances change, this means that tech mergers will not return.

Additionally, the new administration has continued Biden's anti-merger policies in another aspect. Japan's Nippon Steel was blocked by Biden from acquiring U.S. Steel, and the new administration has maintained this block. However, they seem to offer a different path, allowing Nippon Steel to invest in U.S. companies without owning them.

In any case: it is not easy for either large companies or foreign companies to acquire U.S. companies. And mergers themselves have already become quite difficult. It's like getting married now; it's a big undertaking. If you layer unpredictable government risks on top of an already challenging deal, many mergers won't even be considered.

4) But the Crypto Window Has Opened

However, when the government closes one door, it sometimes opens a window. Although IPOs remain expensive and mergers have become more difficult… the new administration has effectively relaxed regulations on cryptocurrencies by launching presidential Meme coins and pro-crypto executive orders.

While no one knows what the new rules are yet, if you can issue unsupported Meme coins, then you can almost certainly issue equity-backed ICOs, also known as security token offerings (STOs):

In fact, STOs align with the government's vision that "the world should invest in tokens created in the U.S." and that "small entities should be able to remain independent for longer."

Remember their idea that Nippon Steel can invest in U.S. Steel but cannot own it? This could be a way to solve the problem. If you do not allow large tech companies to acquire small tech companies, you need to allow the latter to raise funds in some way to compete with large tech companies.

Thus, let the world invest in them on-chain without owning them, just like Nippon Steel invests in U.S. Steel. Just like Masa and Saudi Arabia are investing hundreds of billions of dollars in U.S. companies without fully owning them.

This is a financial win-win while retaining sovereignty.

Moreover, theoretically, small businesses (like restaurants) could also conduct STOs. In theory, STOs could reduce the cost of public capital from millions to zero. But you need to layer new decentralized regulatory mechanisms on such a market, similar to the star ratings and bans on bad actors seen in Uber/Airbnb/Amazon.

5) From Blue States to Blockchain

In any case: there are countless details to resolve regarding putting equity on-chain and conducting high-trust public offerings (with lock-up periods, etc.).

But this is ultimately where we want to go. California is no longer the only place to operate, Delaware is no longer the best place to register, and New York is no longer a trustworthy place for the rule of law.

The era of blue states is over, but blockchain is on the rise.

Because it is clear that internet companies should exist on-chain in an internet-native form and be able to access capital markets at internet scale through cryptocurrency. In fact, while the number of stocks listed in New York has been declining, the number of digital assets listed on the internet has been rising.

So, I want to say to my tech friends: yes, the window for tech IPOs and mergers may have closed, but the window for tech STOs may be wide open.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。