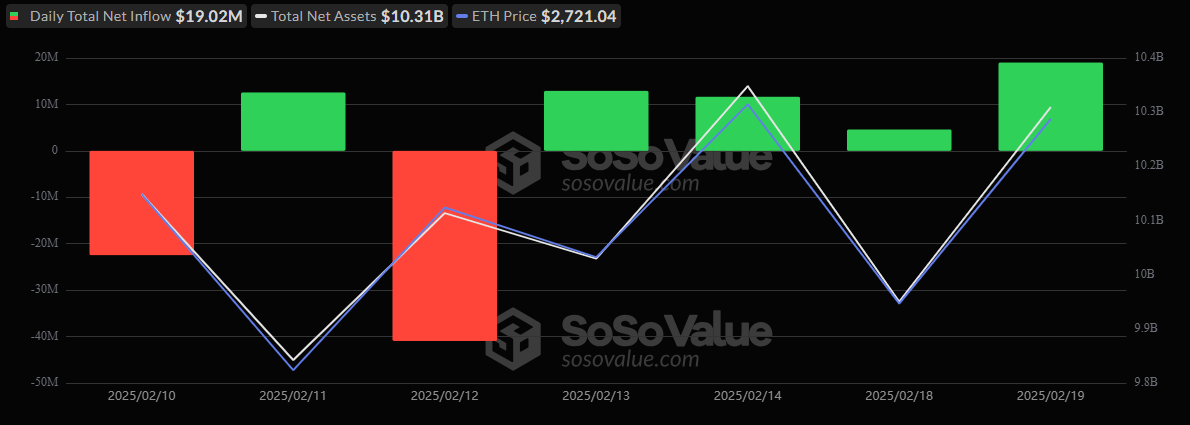

Ether ETFs Secured $19.02 Million Inflows While Bitcoin ETFs Saw $71.07 Million Exit

The contrasting fortunes for crypto exchange-traded funds (ETFs) extended into Wednesday, Feb. 19’s trading session. Ether ETFs attracted net inflows totaling $19.02 million with Fidelity’s FETH leading the positive trend.

The fund attracted $24.47 million in new investments and despite, Grayscale’s ETHE experiencing an outflow of $5.45 million, ether ETFs closed the day in the green.

This extended the inflow streak for ether ETFs to the 4th day with investors continuing to favor ether ETFs over bitcoin ETFs in the current market conditions.

On the other hand, bitcoin ETFs faced a challenging day, recording a net outflow of $71.07 million. Fidelity’s FBTC bore the brunt with a substantial withdrawal of $48.39 million. Other notable outflows included Valkyrie’s BRRR at $9.27 million, Ark and 21Shares’ ARKB with $8.65 million, and Vaneck’s HODL seeing a $4.77 million exit.

Notably, no bitcoin ETFs reported inflows during this period, reflecting a cautious sentiment among bitcoin investors.

This contrasting movement between ether and bitcoin ETFs highlights the evolving trading patterns of crypto investors. Since February, ether ETFs have seen 9 days of inflow as against just 2 days of outflows.

Currently, net inflows for ether ETFs in February stand at $480.84 million while net outflows for the same period stand at just $63.41 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。