It's too difficult. I have to submit my assignment at five in the morning, and three hours later I will head to the airport, take a five-hour flight, and then in less than 20 hours, I will take another five-hour flight. After that, I will have to take a four-hour flight, and only after sending the chipmunk off at the airport can I go home. After getting home and taking a nap, I will have to go to the airport again to consider it finished. Within 48 hours, I will cross four countries (cities) just to do an interview. To be honest, I am quite dedicated, especially since it is purely a voluntary visit because I think it is a very interesting thing.

Of course, many friends are asking me about the reasons for the decline in the US stock market. It can't possibly be caused by cryptocurrencies. Unfortunately, after checking information for several hours, I couldn't find a 100% matching reason, but I did find the timing. Although the US stock market started to decline after opening, it can actually be seen from the S&P futures that it began to drop at 10:20 PM Beijing time.

This means that the decline started just 10 minutes before the US stock market opened, and prior to that, there was actually a slight upward trend. So there are basically two possibilities: the first and simplest is that a large number of investors or institutions are preparing to sell off just before the opening. In this case, it is very difficult to determine the real reason, as many things happen throughout the day. The second possibility is that news around 10:20 PM caused panic selling among investors.

So I looked at what happened during this time. From the publicly disclosed events, there are two key points. One key point is that Russia conditionally agreed to allow the US to use frozen Russian funds to rebuild Ukraine, but the reconstruction must be in the areas of Ukraine currently controlled by Russia. The second point is that Trump wants to escalate the tariff war, and the latter seems to be more likely.

But regardless of the reason, cryptocurrencies have indeed suffered as well. In fact, the sentiment today is still quite good, especially since the SEC is preparing to drop the lawsuit against Coinbase, which not only caused $Coin to rise but also gave $SOL and $ADA a chance to escape the SEC's prosecution, and better face the spot ETF applications. Especially after the news broke, it was announced that Franklin Templeton also submitted a spot ETF application for SOL.

But everyone knows what happened next. The decline in the US stock market itself made investors' sentiment not very optimistic, and then the withdrawal wave triggered by the theft at Bybit further undermined investors' confidence. Until the US stock market closed, investors' sentiment did not recover. Originally, I thought that after dinner, even though I was physically tired, I could relax mentally over the weekend. As a result, both my body and mind remained highly tense, fearing that something unexpected would happen over the weekend, and most of my time would be spent on the plane, unable to do anything.

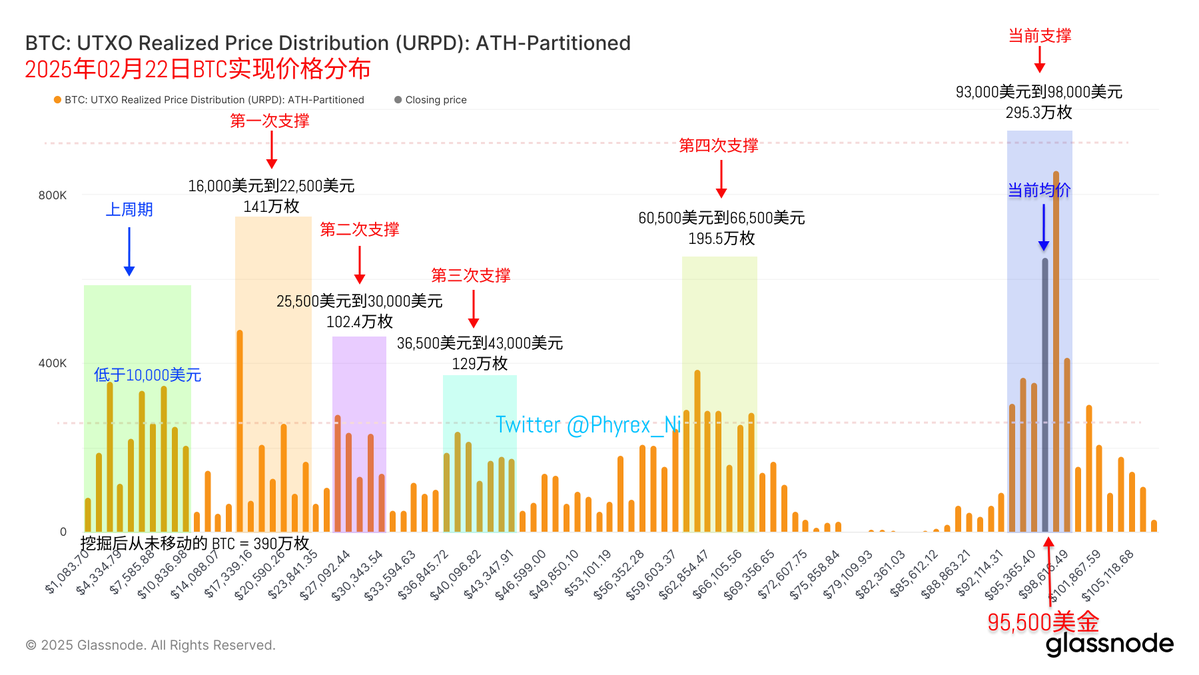

Looking back at the data of #Bitcoin itself, it is much better than many friends imagine. There hasn't been a widespread panic, and the turnover rate has actually decreased, which confirms what we said before: it is becoming increasingly difficult for investors to give up their holdings at low prices. I have been saying this since $60,000, and it still holds true.

The investors with higher turnover are still those who are short-term bottom-fishing, especially during the decline, a large number of new bottom-fishing investors are quickly selling their holdings, while earlier investors are still holding back and observing.

The support level is still quite good, with support between $93,000 and $98,000 remaining very solid. For now, there is no sign of large-scale risk, but tomorrow is the weekend, and liquidity will be very low over the weekend. If sentiment is poor, it is very likely that a small amount of chips could create a big pit. I hope that won't happen.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。