Master Discusses Hot Topics:

First, let's talk about the recent rebound over the past couple of days. The Master is still following the old routine; seeing a volume decrease with an increase, he decided to short at highs. It was clearly stated in yesterday's article: as long as 98k cannot hold for 48 hours, we basically need to prepare for a drop.

As a result, in the latter half of the night, it directly plummeted to just before liberation, hitting a low around 94800. To be honest, this speed was unexpected for the Master; the operator's actions this time were truly ruthless!

Looking back now, the overall market situation is still the same. There hasn't been any significant institutional capital entering the market, and the trend won't easily reverse. If one is bullish, it's best to maintain a conservative attitude; in the short term, the only thing that can be done is to bet on an oversold rebound.

To judge the reversal criteria, several indicators need to be observed. First, the 4-hour K-line must stay above the zero axis for 48 consecutive hours, and the opening must be upward; secondly, the daily MACD must also climb above the zero axis, with an upward opening. In terms of levels, if Bitcoin can sustain a closing above 98k for 48 hours, it may give a reversal signal.

From an overall trend perspective, the Federal Reserve's interest rate cuts are a positive message for non-USD markets. It is almost a certainty that there will be no rate cuts in March and May.

This means that during the period from March to April, the market may maintain a range-bound movement. The real opportunity may have to wait until after the meeting on May 8, when expectations for rate cuts in June heat up, and the market may begin to build momentum for a rise.

Last night's decline in U.S. stocks has already impacted market sentiment, and investor confidence is continuously weakening. Coupled with the withdrawal wave triggered by the Bybit hacking incident, it has further exacerbated market unease, and investor sentiment remained cold until the U.S. stock market closed.

This chain reaction has really caught people off guard. Although, from a fundamental perspective, the benefits of rate cuts are expected to boost the market, the current market sentiment remains gloomy, which is why the Master has been saying recently that one should not be overly optimistic about short-term rebounds.

Overall, market sentiment and technical indicators are giving some warning signals; it is still best to remain cautious. Although the expectation of a bull market is still there, the risks of being bullish are still significant without clearer signals.

Master Looks at Trends:

Resistance Level Reference:

First Resistance Level: 97650

Second Resistance Level: 96800

Support Level Reference:

First Support Level: 95800

Second Support Level: 95200

Today's Suggestions:

At this stage, it can be preliminarily determined that we are in a rebound area. If the first resistance is broken, a bullish view can be maintained, and opportunities for ultra-short-term pullbacks can be sought. During the process of breaking the first resistance level, it is not recommended to chase long positions directly; instead, pay attention to whether the price will turn the first resistance into support after the breakout.

If an adjustment occurs, maintaining the first support level is key to sustaining the rebound view. If it briefly breaks below, but a lower shadow appears on the K-line, then opportunities can be sought when the next K-line forms.

The second support is a newly formed previous low. If the market breaks below it again accompanied by negative news, it may lead to further declines due to disappointment selling, at which point a change in perspective is needed.

Although the market fell due to last night's Bybit hacking incident, Bybit's reserves are still intact. The bad news has also been somewhat alleviated, so the view of a rebound can be maintained.

Due to low volatility and insufficient trading volume over the weekend, a significant breakthrough of resistance levels is unlikely. The Master suggests paying attention to whether Bitcoin can gradually raise its lows and maintain a gradual breakout.

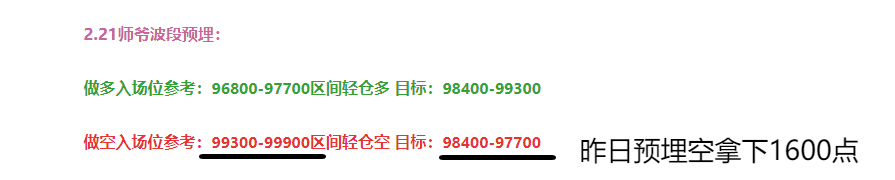

2.22 Master’s Wave Strategy:

Long Entry Reference: Not currently applicable

Short Entry Reference: Light short in the 97600-98600 range, Target: 96800-95800

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, liquidation, spot trading, short, medium, and long-term contract trading techniques, operational skills, and K-line knowledge, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Kind Reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。