This Monday coincided with Presidents' Day, and the U.S. stock market was closed. After the market opened on Tuesday, overall market sentiment was optimistic, with the S&P 500 index rising 0.24%, setting a new historical high, and the Nasdaq Composite also slightly increasing by 0.07%.

In contrast to the strong performance of U.S. stocks, the cryptocurrency market faced downward pressure and corrections.

Recently, the entire cryptocurrency market has been experiencing a downward trend, with overall market sentiment appearing gloomy, and both trading volume and investor confidence have been impacted to some extent. Meanwhile, the meme coin market has been like a roller coaster, with prices fluctuating wildly, leaving many investors feeling lost amid such uncertainty. However, in this weak and unpredictable market environment, the token S has emerged as a standout, showing remarkable growth momentum. Not only has it steadily increased in price, but the activity and support from its community have also added significant highlights to this token. Compared to the erratic performance of other tokens, S's outstanding performance undoubtedly injects a bit of vitality into the currently sluggish crypto market, making it one of the focal points for investors.

1. $S Price Set to Rise, Potential Expected

Sonic is an EVM Layer 1 blockchain platform evolved from Fantom, focusing on providing high performance and scalability for decentralized applications. The platform supports the native token $S, which is used for transaction fees, staking, governance, and running validators. After the new network launches, users holding the old FTM token will be able to convert it to $S at a 1:1 ratio.

Key Features:

High Performance: Sonic has the capability to process over 10,000 transactions per second, with completion times in the sub-second range, making it suitable for high-demand applications in various fields such as gaming and finance.

Interoperability: The platform emphasizes seamless interaction between different blockchains.

Developer Incentives: Sonic Labs plans to implement various incentive programs to attract developers and promote innovation within its ecosystem.

2. Fantom Upgrades to Sonic, Comprehensive Optimization of Fundamentals

Three Aspects of Upgrade

Fantom Virtual Machine (FVM)

Storage System (DataBase)

Bridge (Sonic Gateway)

1) On-chain Internal Optimization:

Blockchain Scalability Challenge: Existing blockchains face trade-offs between decentralization, security, and scalability; Fantom plans to achieve a balance among the three.

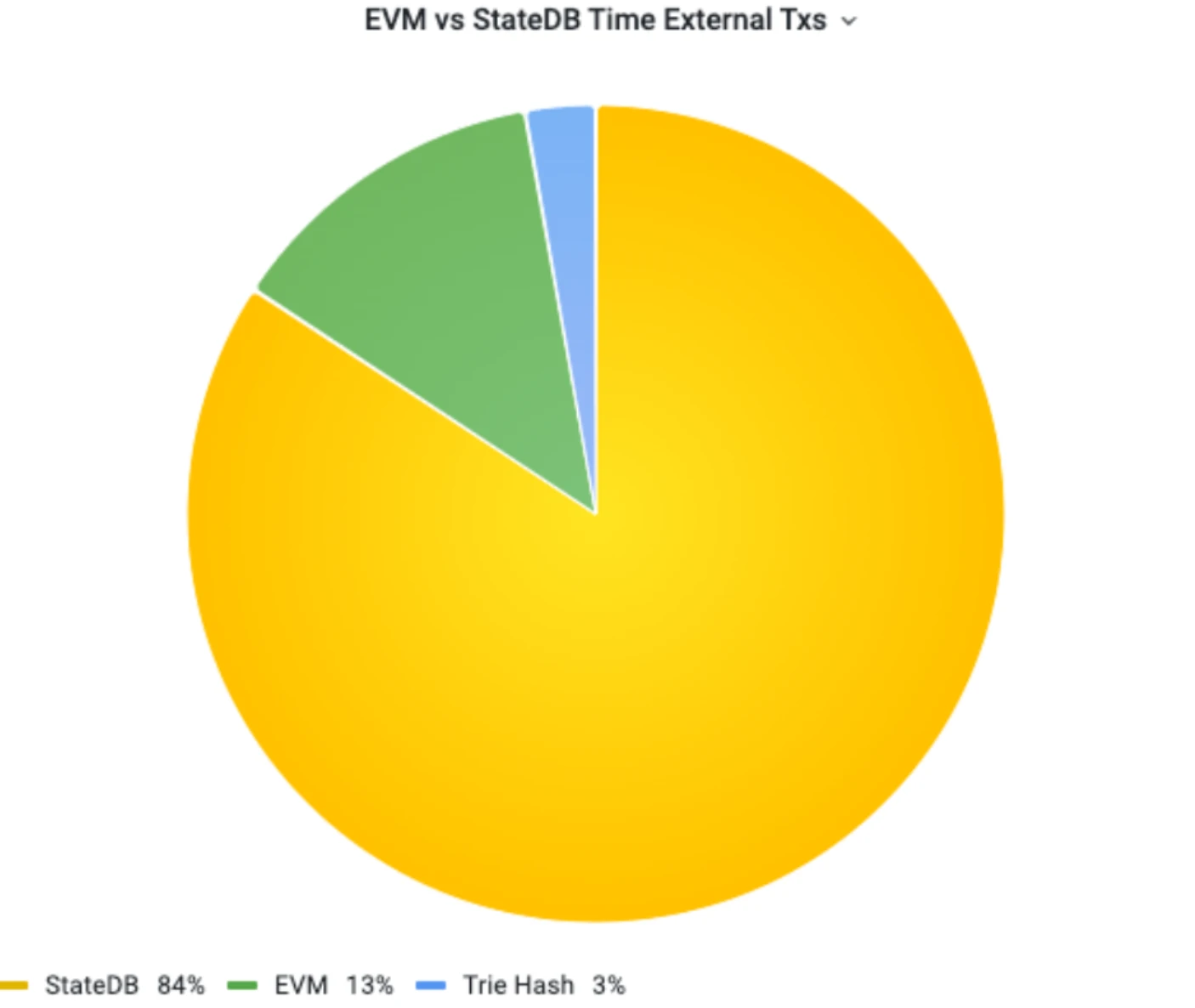

Bottleneck Analysis (Aida Project): Testing 40 million blocks revealed that EVM only accounted for 13% of processing time, while StateDB accounted for 84%, indicating that the storage system is the main bottleneck.

Storage Upgrade (Carmen Project): The existing Merkle Patricia Trie (MPT) solution has performance bottlenecks; Fantom adopts a new file-based StateDB to optimize storage efficiency.

Fantom Virtual Machine Upgrade (Tosca Project): FVM replaces EVM, supporting Solidity and Vyper compatibility, and uses "super instructions" to improve execution efficiency.

Testing Results:

The FVM solution increases transaction speed by 8.1 times and reduces storage usage by 98%, significantly optimizing network performance.

By upgrading the storage and virtual machine systems, Fantom enhances transaction processing capacity and reduces node operating costs, further improving on-chain scalability.

2) Off-chain Optimization:

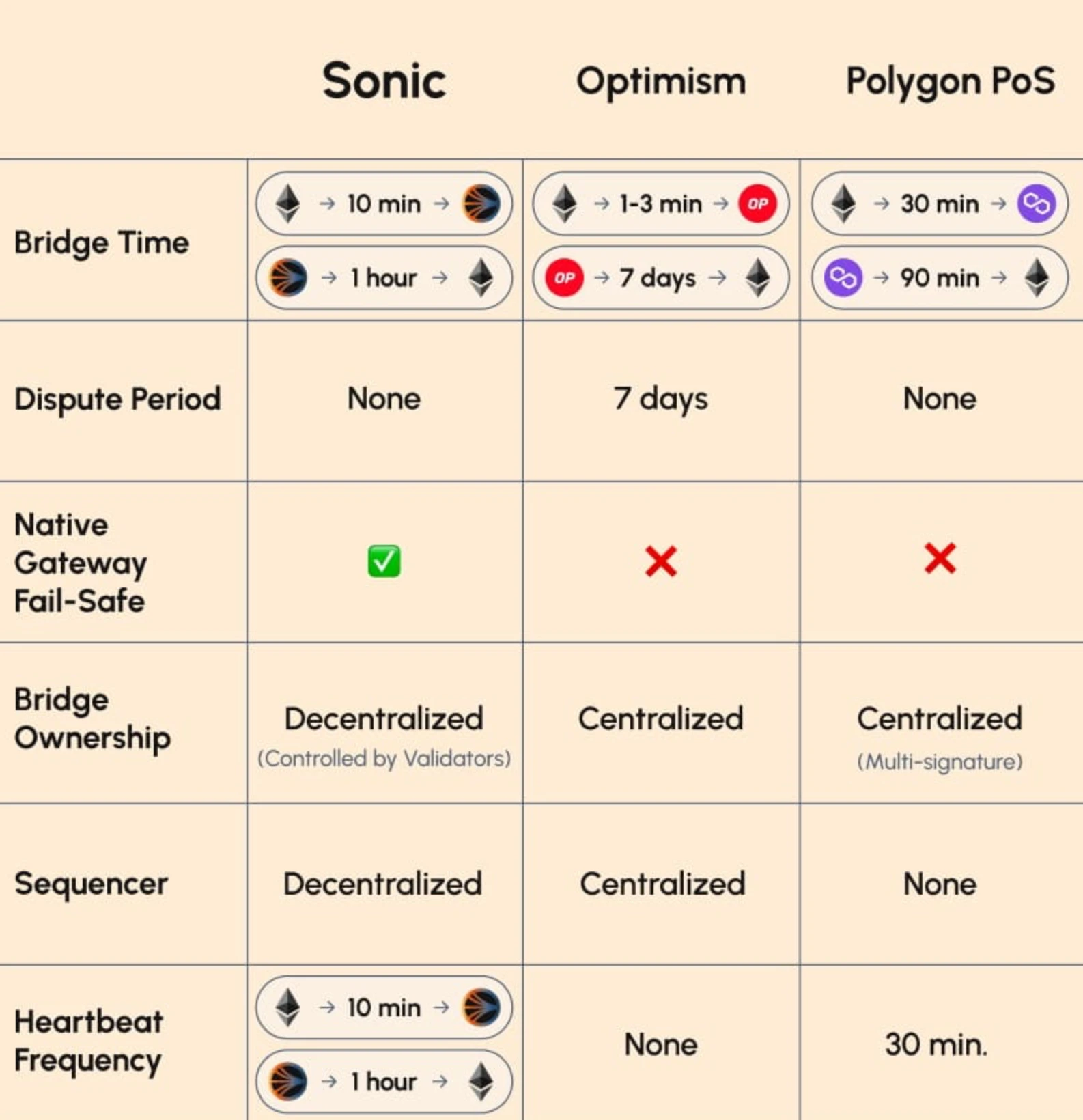

Sonic Gateway is a decentralized cross-chain bridge designed to connect Ethereum and the Sonic network, aiming to enhance interoperability while eliminating users' custodial risks.

Core Features of Sonic Gateway:

Allows secure transfer of ERC-20 assets between Ethereum and Sonic.

Transfers from Ethereum to Sonic take about 10 minutes, while transfers back to Ethereum take about 1 hour.

Security Mechanisms:

Built-in fail-safe mechanism: If the gateway is unavailable for 14 consecutive days, users can retrieve their assets on Ethereum.

Monitors the gateway status through inter-chain "heartbeat" signals to ensure the safety of user funds.

Comparison with Layer-2 Solutions:

- Sonic offers a faster transfer experience without a challenge period and provides instant finality, superior to the typical 7-day challenge period of Optimistic Rollup solutions.

User Benefits:

- Allows users to access native assets (such as BTC, ETH, SOL) on Sonic without relying on wrapped assets.

Different from Layer-2 Operation Models:

- Sonic operates as Layer-1, not as an extension layer of Ethereum, using Merkle proofs to verify asset states rather than relying on Ethereum's consensus mechanism.

Efficient Data Storage:

- Only stores Merkle root hashes and block heights, significantly reducing Ethereum's data storage burden and improving on-chain efficiency.

3. Sonic On-chain TVL Soars, Ecosystem Growth Accelerates

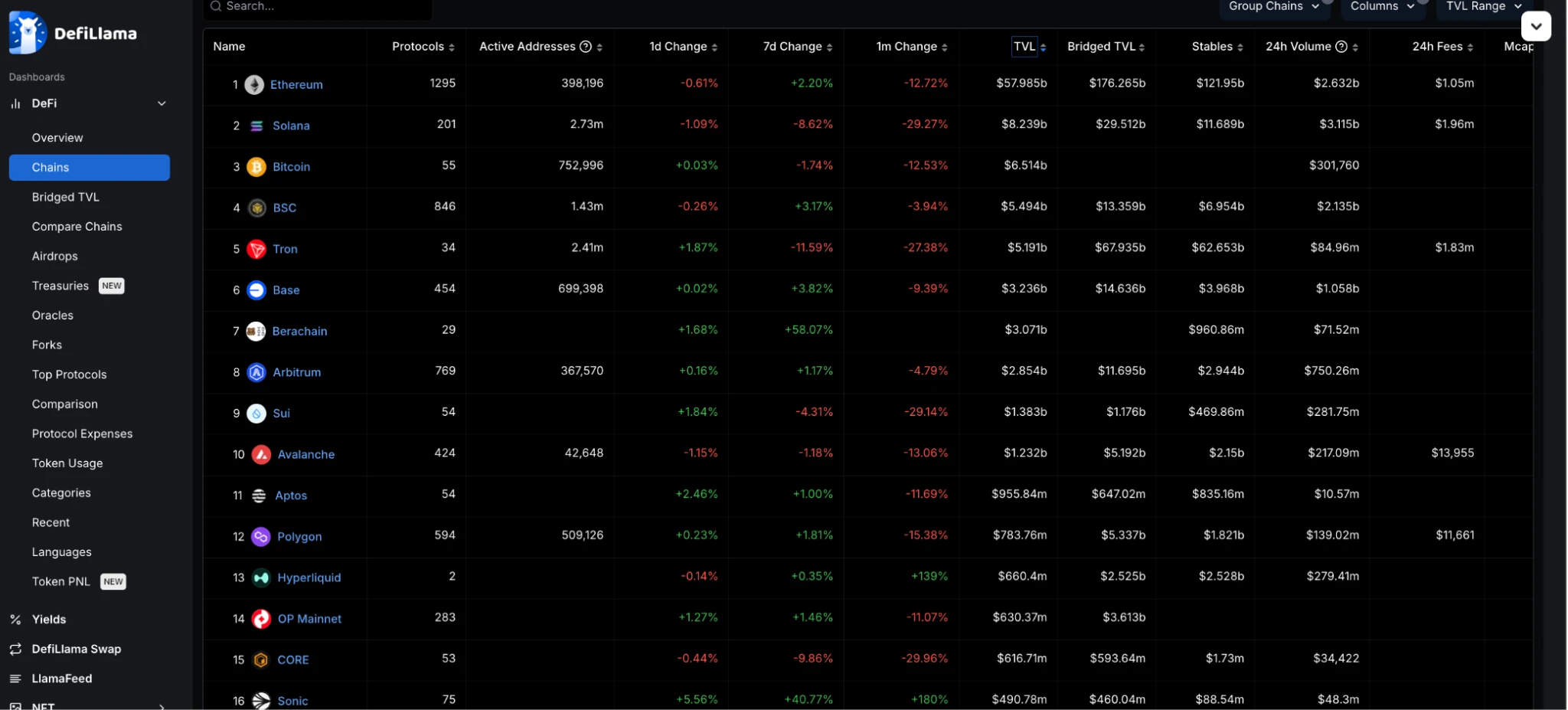

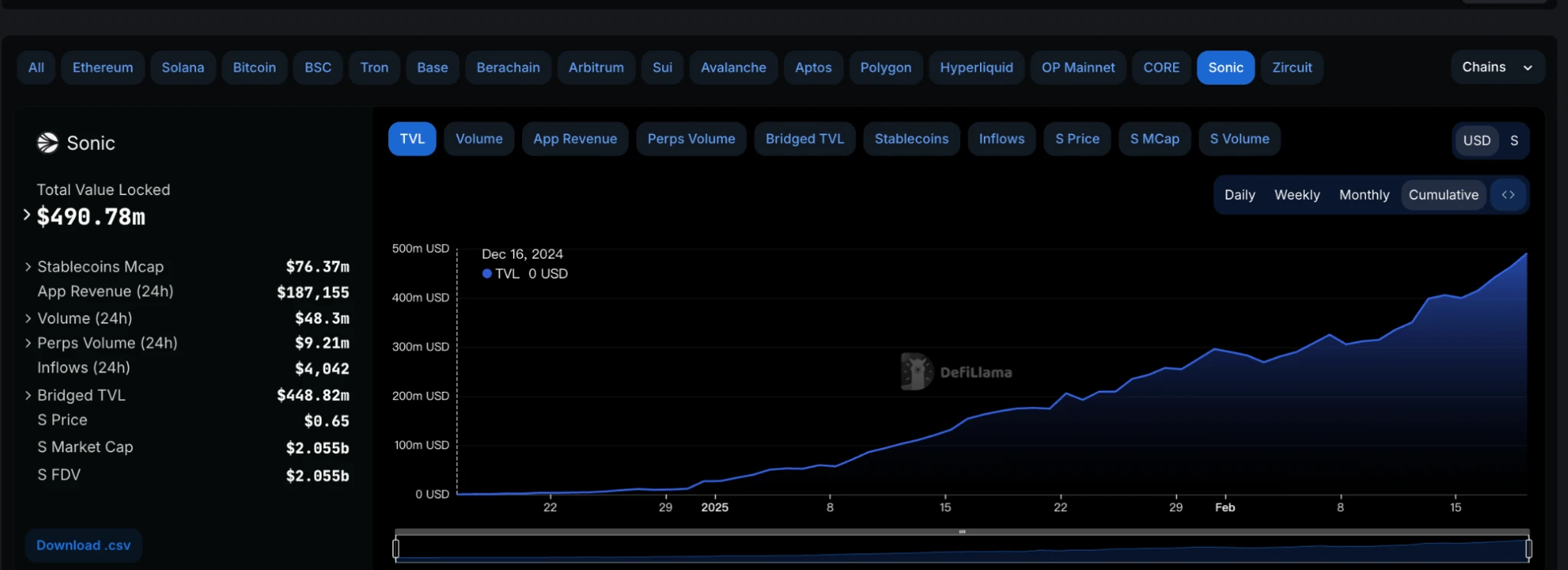

According to the latest data from the DefiLlama platform, Sonic currently ranks 16th in total value locked (TVL) across various blockchains, demonstrating its strong performance in the decentralized finance (DeFi) ecosystem. Notably, Sonic's TVL has increased by an astonishing 180% over the past month, indicating a significant boost in market confidence and capital inflow into the platform. Additionally, compared to the TVL levels of December last year, Sonic's total value locked has nearly tripled, highlighting its accelerated expansion in the DeFi space and investors' optimistic expectations for its future prospects. This growth not only reflects the platform's development momentum but also indicates the continuous inflow of market capital into the Sonic ecosystem, further solidifying its competitive position in the industry.

4. Sonic On-chain Data Active, Price Support Solid

According to trading volume data provided by SonicSca:

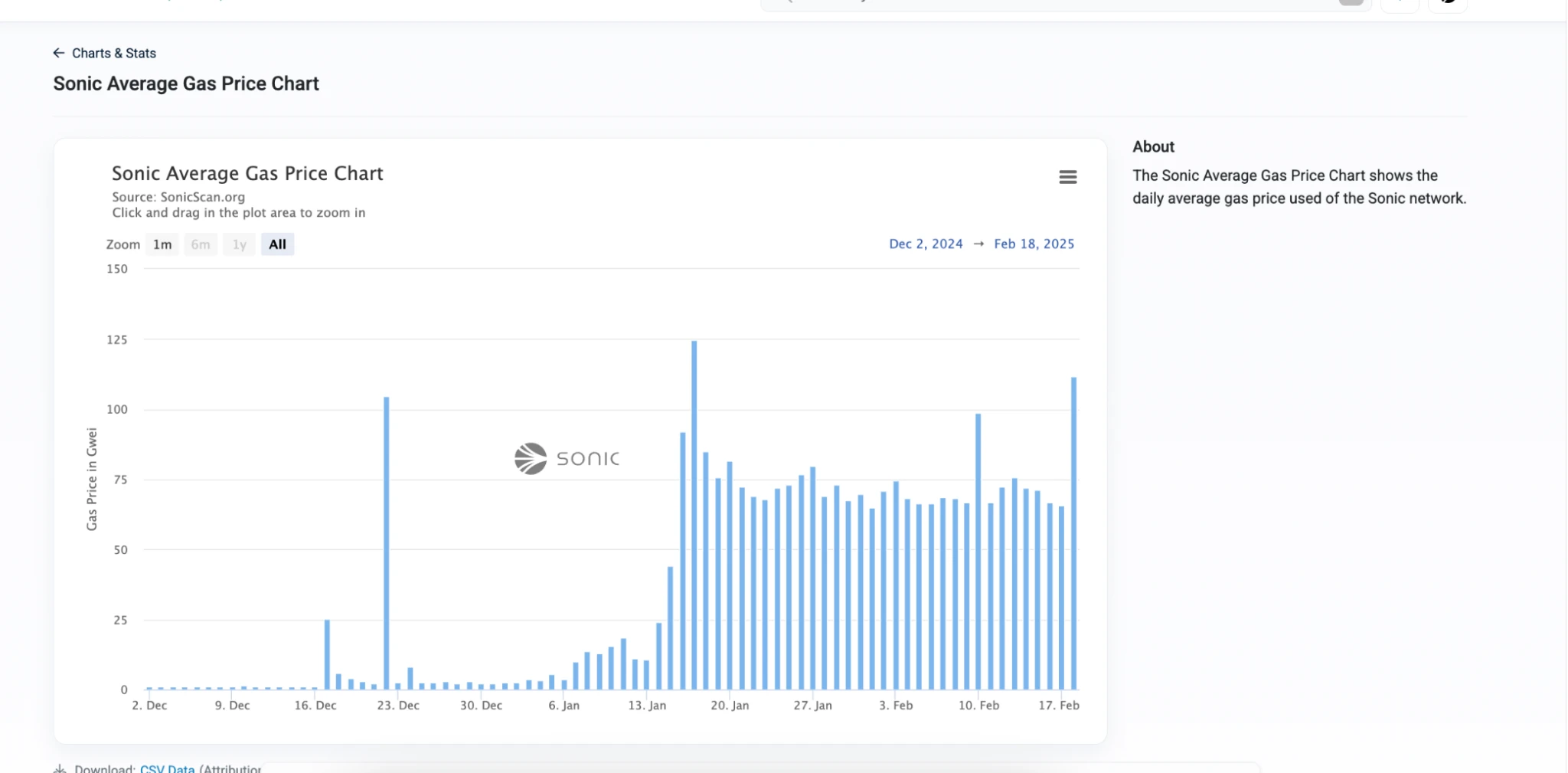

The highest trading volume on the Sonic chain occurred on January 13, 2025, reaching 975,252 transactions. Since December 16, trading volume has begun to increase significantly, followed by volatile growth; after peaking on January 13, trading volume declined somewhat but remained at a relatively high level; at the beginning of February, trading volume slightly rebounded, increasing market activity and returning to a growth trajectory, which is worth monitoring for future developments; similar conclusions can be drawn from the Gas usage charts, showing that the Sonic network experienced an active growth period from December to January, peaking in Gas usage in mid-January. Starting in February, although Gas usage has fluctuated, it remains at a relatively high level, indicating that the network is still active.

Despite the significant growth in TVL and robust on-chain data performance, the price of $S has been suppressed by moving averages since its launch at the beginning of the year, failing to fully reflect the impact of fundamental improvements. It wasn't until February 8 that the price ended its downward trend and began to recover. However, the current price is still far below historical highs. If $S can maintain above the support level of $0.57 and steadily rise along the moving averages, the subsequent trend is expected to strengthen further, targeting around $0.72.

In summary, since its rebranding from Fantom, Sonic has demonstrated strong development momentum. Its total locked value (TVL) has achieved significant growth in a short period, and on-chain data activity has increased, indicating rapid expansion of the ecosystem and heightened user participation. Nevertheless, the price of $S has yet to fully reflect these positive fundamental changes. As market attention on Sonic increases, along with its ongoing technical and ecosystem optimizations, the price of $S is expected to rise further in the future. Investors should closely monitor market dynamics and on-chain data to seize potential upward opportunities in this rapidly rotating market.

Reference Links:

FVM doc:

https://blog.fantom.foundation/fantom…

Bridge (Sonic Gateway) doc:

https://blog.soniclabs.com/sonic-gate…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。