The weekend's homework was much better than I imagined yesterday. Investor sentiment did not continue to collapse with the decline of the U.S. stock market; instead, it eased during the weekend when liquidity was lower. This also represents the intentions of real investors, indicating that there is not much interest in buying and selling right now, especially in selling. The recent decline in turnover rate over the past 24 hours is the best proof of this.

The consensus conference in Hong Kong has also come to a close. I won't write a small essay this time, as there was no significant participation. The purpose of attending this time was to chat with some friends about the progress of #BTCFi and to meet some new and old friends. However, it was quite evident that most investors are confused about the future market, especially many project teams are caught in a dilemma. The market is not good, and the cost of counter-trend rallies is too high, and no one believes that they are still building.

Project teams that have not yet issued tokens are even more anxious. They fear that if they issue now, the data will look too bad, and they are also worried that there won't be users to buy in. If they don't issue, they are concerned about having to wait another two or four years, which would be hard to endure. The most difficult situation should be for investors in the primary market; those once highly sought-after friends are now almost only participating in small gatherings secretly.

The entire market is filled with the voices of Meme and P. Interestingly, there were very few people discussing Bitcoin at offline events, while many were talking about #ETH, indicating that many people likely have a significant amount of ETH piled up.

Looking back at the #BTC data, there is nothing new in the garbage time of garbage time. Although sentiment was poor on Friday, it remained quite stable on Saturday without external interference. The key focus will still be on the attitude of American investors after the U.S. stock market opens on Monday.

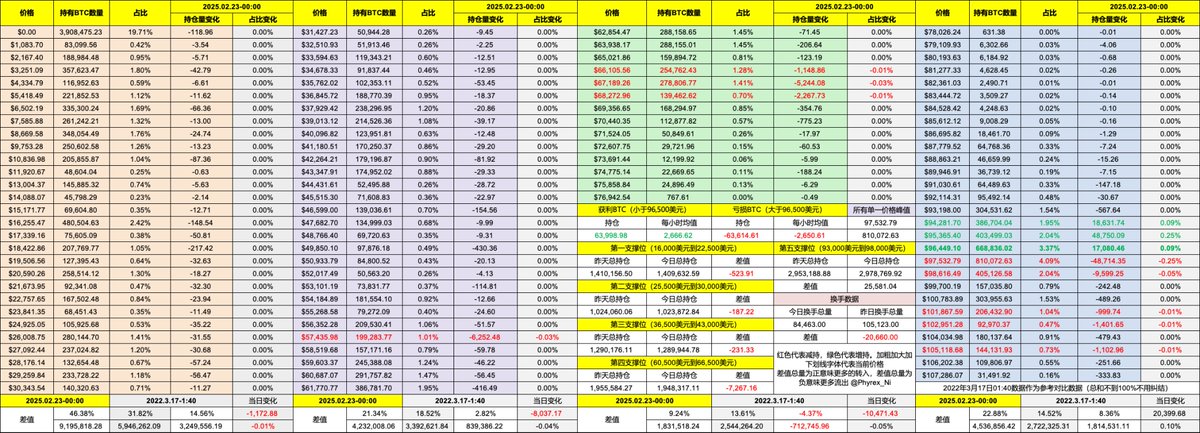

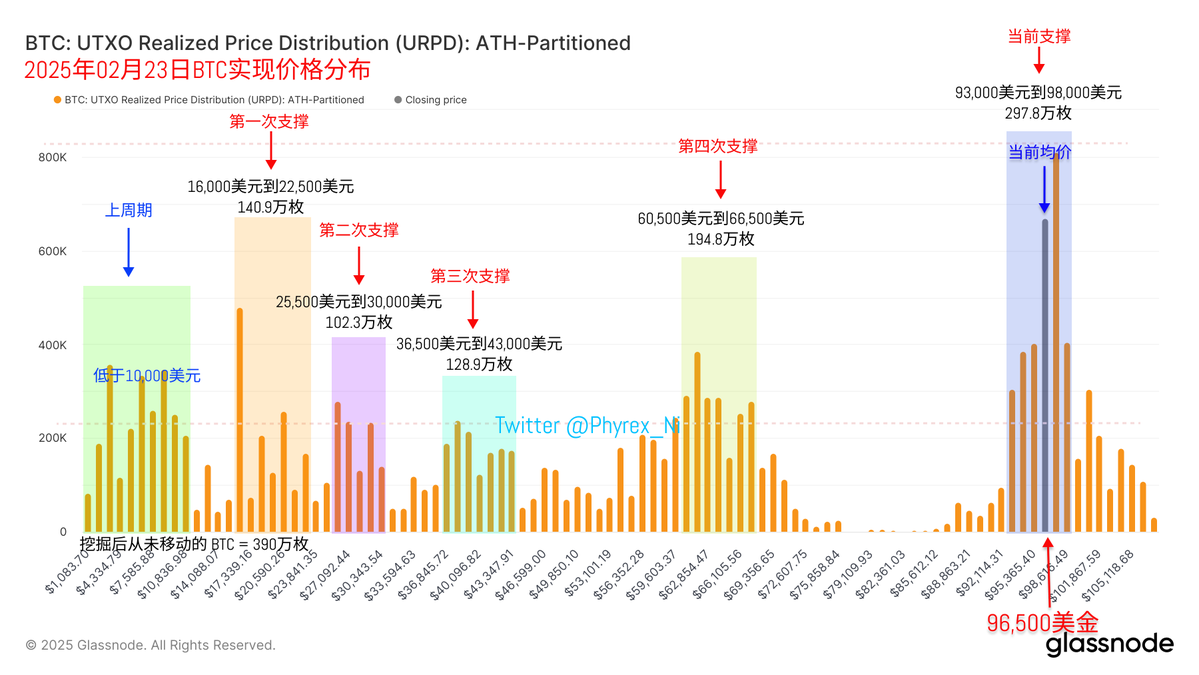

Currently, the support between $93,000 and $98,000 is still very solid. There are no signs of breaking below this level; instead, more chips are being gathered every day. As long as this group of investors does not exhibit collective panic selling, the price stability remains quite good.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。