Step-by-step analysis of how to efficiently obtain and analyze Solana blockchain data.

Author: Jack Stewart

Compiled by: Deep Tide TechFlow

Introduction

Solana has become one of the most talked-about blockchain ecosystems due to its high speed and low-cost architecture. However, this speed comes with complexity—users new to Solana data may feel lost. Compared to traditional blockchains, Solana's parallel processing mechanism and account-based model present unique challenges in data querying, indexing, and analysis.

Whether you are a developer building applications, an analyst researching trends, or an enthusiast wanting to understand transaction flows, choosing the right tools is key.

This guide will help you gain a comprehensive understanding of how to use Solana data. We will cover best practices from accessing raw RPC endpoints to utilizing powerful indexing services, and step-by-step analysis of how to efficiently obtain and analyze Solana blockchain data.

After reading this article, you will clearly understand how to find the data you need, how to process it efficiently, and which tools are best suited for each scenario.

Let’s start exploring!

Solana's RPC Services

Remote Procedure Call (RPC) services are the bridge for developers and applications to interact with Solana. They provide access to blockchain state, submission of transactions, and retrieval of historical data.

Core Use Cases

Common scenarios for obtaining data through RPC providers include:

DeFi Applications – Querying token holders, obtaining account balances, etc.

NFT Applications – Tracking minting records, querying metadata, and ownership changes.

Data Applications – Aggregating data to generate application metrics and dashboards.

RPC Providers

There are many different RPC providers available in the market today. While their core functionalities are similar, several key factors should be considered when choosing: response latency, operational stability, data accuracy, request rate limits, service costs, native support experience for Solana, and technical support capabilities.

Here are some common providers:

Helius

Triton

QuickNode

Alchemy

Ankr

ChainStack

For scenarios requiring real-time responses (such as real-time account or program monitoring), consider using tools like Webhooks, WebSockets, or gRPC. These tools are better suited for handling latency-sensitive tasks.

Real-time Data Stream Tools

In scenarios where real-time data access is needed, Geyser streams and webhook-based services can continuously push updates on Solana blockchain activity without relying on traditional pull-based RPC polling. These solutions are particularly important for trading bots, data analysis platforms, and real-time monitoring applications, as these scenarios have a high demand for low-latency data.

Geyser streams allow external services to receive real-time updates on transactions, account changes, and program interactions by directly subscribing to Solana validators. This method is more efficient than frequently querying RPC, as it reduces redundant requests and captures new on-chain events instantly.

Geyser Streams

The Geyser plugin provided by Solana allows validators to stream real-time data directly to external services. This makes it a powerful tool for indexing on-chain data, custom data aggregation, and on-chain analysis. However, using Geyser's gRPC stream feature requires you to run your own validator node or rely on dedicated node services.

Webhooks, WebSocket, and Real-time APIs

Webhooks provide an alternative that does not rely on RPC or gRPC nodes, allowing developers to track specific blockchain activities through event notifications.

Developers can subscribe to specific events (such as wallet transactions, token transfers, or on-chain program interactions) and receive updates in real-time without frequently polling RPC. This approach not only reduces infrastructure overhead but also significantly improves efficiency.

Similarly, WebSocket connections support real-time streaming of blockchain data, enabling applications to stay synchronized with the latest on-chain data without repeatedly sending requests.

For applications requiring real-time data, Geyser, WebSocket, and Webhooks provide the lowest latency data access methods, effectively reducing infrastructure costs and improving response times.

However, it is important to note that real-time data stream tools and RPC nodes are not suitable for large-scale historical data analysis. For processing historical data, SQL-based solutions like Flipside and Dune are more efficient and convenient.

Solana Historical Data Tools

Flipside and Dune are two SQL-based on-chain data analysis tools that help users query and analyze Solana's historical blockchain activity without directly handling complex RPC calls.

These two platforms index and structure Solana data, making it more suitable for data analysis scenarios. However, due to some delay in their data updates, they are better suited for historical data analysis rather than real-time data retrieval.

For example, Flipside's data updates typically have a 15-minute delay, while Dune's data delay can range from 1 minute to 60 minutes depending on the specific dataset.

Dune

Dune is a platform that allows users to analyze Solana data through SQL queries, offering highly flexible data modeling capabilities. Users can create custom tables and dashboards to track blockchain activity and key metrics.

The platform operates on a pay-per-use model, with query costs increasing as usage rises.

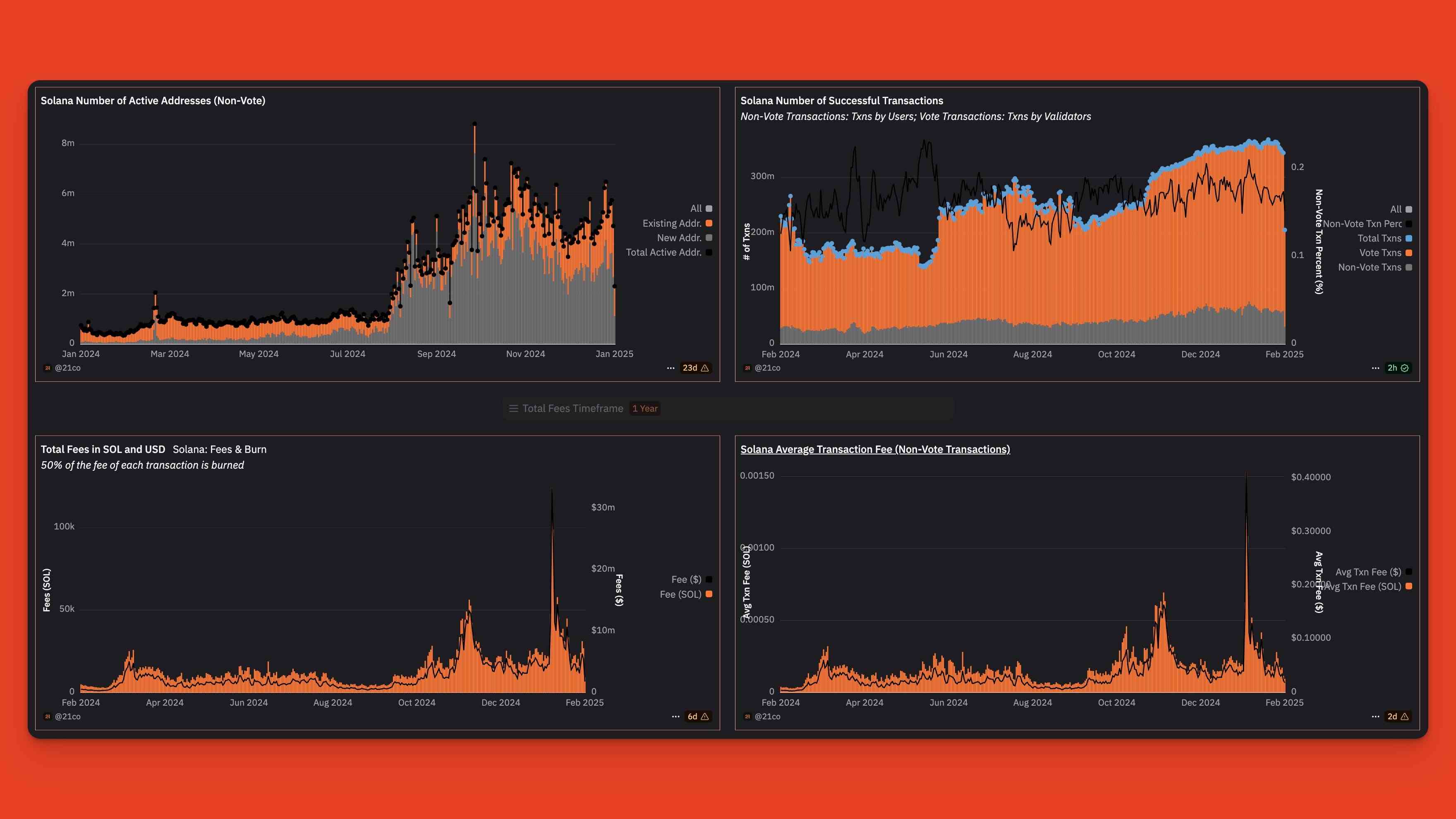

The Solana Key Metrics Dashboard displayed on Dune, provided by 21co.

Flipside Crypto

Flipside is another on-chain data analysis platform that supports SQL queries, providing pre-indexed Solana datasets. These datasets cover transaction records, token transfers, DeFi protocols, and NFT activities, structuring this data to simplify user queries.

Flipside offers a free basic version that allows users to use it for free within high query limits, making it suitable for various analysis needs.

SQL-based historical data analysis tools are particularly suitable for intermediate to advanced data analysts, especially when dealing with large datasets, as these tools can significantly simplify the querying process for complex data. However, if access to archived data or custom datasets is needed, tools like Google BigTable and custom indexers may be more appropriate.

Archived Data and Custom Indexing Tools

When conducting in-depth blockchain analysis, custom indexing solutions are a more efficient choice than directly calling RPC nodes.

Due to the vast amount of historical transaction data on Solana, extracting historical data directly from RPC nodes often faces issues of slow speed, high costs, and inefficiency.

Indexing solutions store and structure blockchain data, allowing users to query more quickly and flexibly. For example, when developers need to analyze a large volume of transaction data over a period, these tools can significantly enhance query efficiency and reduce infrastructure overhead.

Custom Indexers

Custom indexers are tools that allow developers to define their own data indexing logic based on specific needs. This approach helps users analyze long-term trends, DeFi activities, and token flows more efficiently without frequently extracting raw log data from the blockchain.

Unlike pre-built analytical tools like Flipside and Dune, custom indexers provide developers with complete control over data storage and access methods, allowing them to flexibly adjust data structures and query logic according to specific needs.

Google BigQuery

Google BigQuery is a cloud platform that supports SQL queries, allowing users to access Solana's blockchain historical data. This platform enables large-scale data analysis without requiring users to run their own indexers.

Unlike the pre-structured datasets provided by Flipside and Dune, BigQuery allows users to freely define their own data models. This flexibility makes it particularly suitable for scenarios that require custom analysis and business intelligence, such as enterprise-level data analysis or complex on-chain activity research.

Decentralized Data Storage

For scenarios that require long-term storage of blockchain data, decentralized storage tools provide reliable archiving solutions. For example, Filecoin's Old Faithful project, Arweave, and Shadow Drive can permanently store raw blockchain data without relying on traditional centralized databases.

These tools are suitable for developers, research institutions, or data analysts who need to preserve on-chain data for the long term. For ordinary users who do not require archived data or large-scale historical datasets, block explorers offer a simpler and more intuitive way to understand on-chain activities.

Block Explorers

Block explorers are tools used to view, analyze, and verify on-chain data. They present information such as transaction records, account balances, token flows, and on-chain program interactions in a structured format, making them essential tools for traders, developers, and analysts to track blockchain activities.

Users can search by transaction ID, wallet address, token, or contract and view related details such as the execution path of transactions, fees, and changes in accounts.

While the core functionalities of all block explorers are similar, they differ in data presentation, feature richness, and user experience. For example, Solscan is one of the commonly used block explorers in the Solana community, known for its clear interface and detailed data presentation.

Common Block Explorers

Here are some of the currently most popular Solana block explorers:

Solana Data Dashboards

In the Solana ecosystem, there are many public dashboards available to track high-level data, such as network revenue, validator performance, token activity, and MEV (Maximum Extractable Value). MEV refers to the additional profits obtained by optimizing block ordering, which is significant for studying on-chain value distribution.

These dashboards are widely used in the work of Solana research firms (such as Pine Analytics), developers, analysts, and investors, helping them understand the economic health, macro trends, and on-chain dynamics of Solana. Additionally, various platforms focus on hosting and displaying this data, enabling users to quickly access the information they need based on specific requirements.

Revenue and Network Metrics

Solana's revenue sources mainly include transaction fees, staking rewards, and protocol-generated income. Understanding these revenue sources is crucial for assessing the sustainability and future growth of the Solana network. Here are some commonly used dashboards:

Blockworks – Provides research and financial reports on the Solana ecosystem.

Artemis – Covers data on protocol revenue, fees, stablecoin inflows/outflows, etc.

DeFiLlama – Provides data on fees, revenue, Total Value Locked (TVL), and yield.

Nansen – Offers institutional-level on-chain activity analysis.

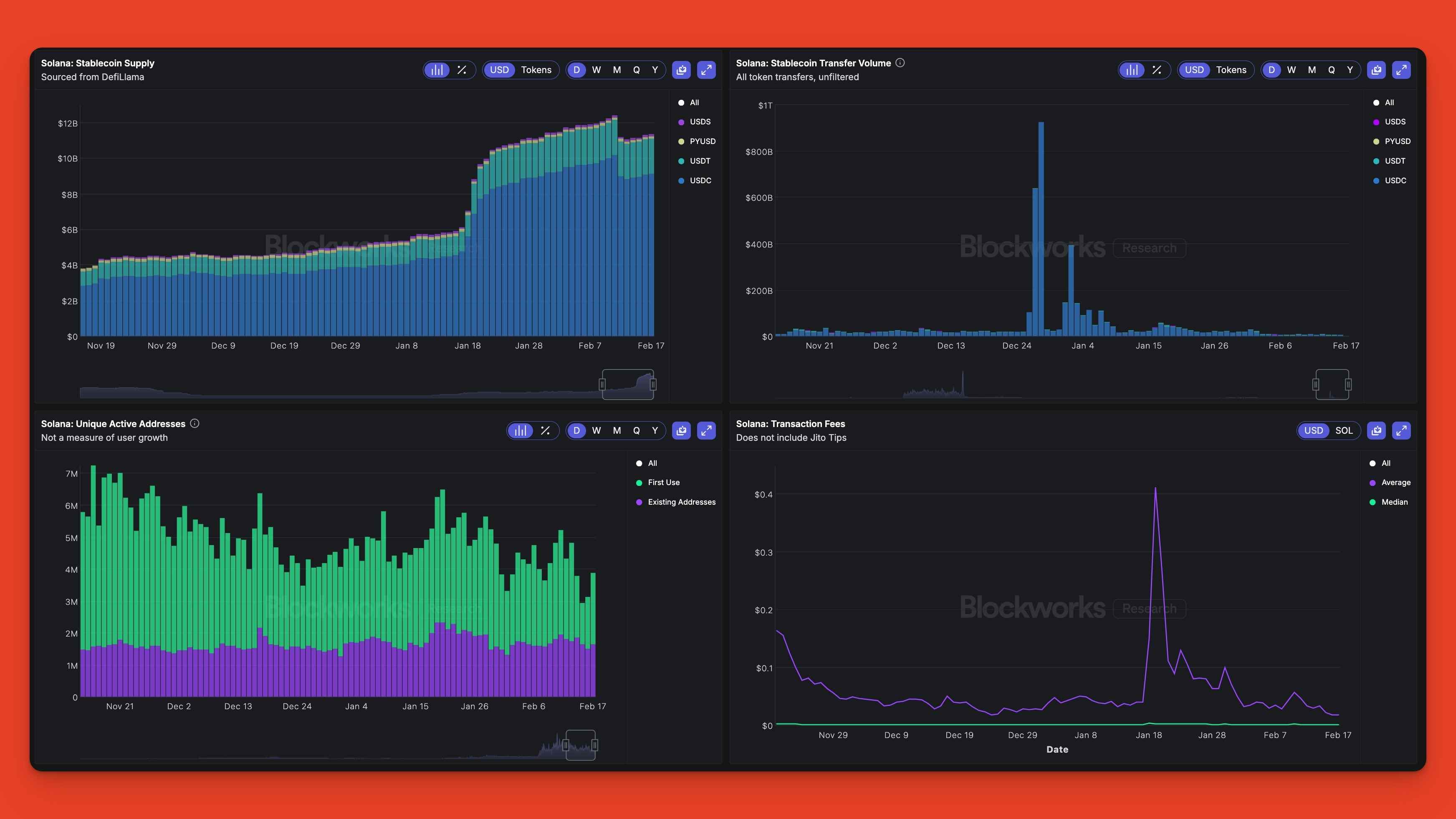

The Solana On-chain Metrics Dashboard provided by Blockworks Research helps users intuitively understand key data about the network.

Validator and Staking Dashboards

Validator data is crucial for analyzing Solana's decentralization, staking distribution, and network health. These dashboards can help users track staking annual percentage yield (APY), validator uptime, and other key metrics:

Stakewiz – Provides validator analysis, staking data, and APY information.

Solana Beach – Focuses on validator performance, distribution, and governance-related data.

Validators.app – Offers detailed metrics for validators, including software versions and latency tests.

VX Tools – Provides cluster voting statistics, total block counts, and block reward data.

Blockchain Forensics Tools

Blockchain forensics tools are specialized tools used to monitor wallet activities, identify suspicious behavior, and assess risks. These tools are typically used by enterprises and teams that require high compliance, such as financial institutions or law enforcement agencies.

Here are two commonly used Solana forensics tools:

Chainalysis – Provides real-time monitoring, risk assessment, and blockchain forensics services suitable for financial compliance scenarios.

Arkham Intelligence – Offers wallet identity tracking, fund flow analysis, and other features to help users identify the flow of on-chain assets.

Solana Token and Market Data

Token analysis platforms provide users with deep insights into token supply, liquidity, and market performance:

Birdeye – Offers token analysis and real-time price tracking for Solana assets, suitable for ordinary users to quickly understand token dynamics.

Token Terminal – Provides key metrics for tokens, including price-to-earnings (P/E) ratios, user growth, etc., suitable for in-depth financial and market analysis.

Messari Token Portal – Provides token reports and basic analysis to help users understand the potential value of tokens from a macro perspective.

MEV (Maximum Extractable Value) Dashboards

MEV data platforms focus on analyzing behaviors such as front-running trades, sandwich attacks, and priority gas auctions within the Solana ecosystem:

Jito Explorer – Provides auction data, MEV alerts, and detailed transaction information to help users understand the dynamics of on-chain auctions.

Sandwiched.me – Offers real-time sandwich attack and transaction data, suitable for studying on-chain trading behavior and potential risks.

These platforms help developers, analysts, and investors conduct in-depth analyses of Solana's performance, security, and economic activities by providing structured data. Whether tracking network revenue, validator metrics, or analyzing trading behavior, these tools provide important decision support for users.

Conclusion

Solana's data ecosystem includes a variety of tools optimized for different needs. Whether you need real-time data streams, historical data analysis, structured indexing, or simple on-chain transaction queries, you can find suitable tools to support you.

If you need low-latency data access and fine-grained control, you can choose RPC, WebSockets, Geyser (gRPC), or Webhooks. For scenarios that require querying historical states or analyzing organized datasets, Dune, Flipside, and Google BigQuery are ideal choices. For single transaction analysis or trend observation, block explorers and pre-built dashboards provided by Solana analytics firms can meet the vast majority of needs.

If you have more questions about the Solana data ecosystem, you can contact @jackthepine on X (Twitter) or join the Helius community on Discord and Telegram for discussions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。