Key Points

● The total market capitalization of cryptocurrencies is $3.32 trillion, down from $3.33 trillion last week, representing a decrease of 0.3% this week. As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $39.56 billion, with a net outflow of $559 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $3.15 billion, with a net inflow of $1.61 million this week.

● The total market capitalization of stablecoins is $234 billion, with USDT's market cap at $142.5 billion, accounting for 60.9% of the total stablecoin market cap; USDC's market cap is $57.1 billion, accounting for 24.4%; and DAI's market cap is $5.36 billion, accounting for 2.3%.

● According to DeFiLlama, the total TVL of DeFi this week is $111.2 billion, an increase of 1.9% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 53.81%; Solana with a share of 7.42%; and Bitcoin with a share of 5.89%.

● On-chain data shows that ETH saw a significant increase in trading volume this Sunday, with an increase of 89.6% compared to last week, while SOL saw a decrease of 42.2% compared to last week; in terms of trading fees this week, SUI saw a significant increase of 71%. The total TVL of Ethereum Layer 2 is $37.6 billion, with an overall increase of 4.2% from last week.

● Innovative projects to watch: STEAMM: STEAMM is based on Sui and is a capital-efficient AMM that allows users to lend idle assets for additional returns, currently in beta; Kiyotaka: Kiyotaka is a crypto market intelligence platform currently in testing, receiving attention from the co-founder of @Delphi_Labs; Altius: Altius is a future-oriented blockchain infrastructure designed to optimize blockchain performance through a VM-agnostic execution framework, enhancing scalability, efficiency, and cross-chain interoperability.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Share 2

3. ETF Inflow and Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Rates 5

5. Decentralized Finance (DeFi) 6

7. Stablecoin Market Cap and Issuance 11

II. Hot Money Trends This Week 13

1. Top Five VC Coins and Meme Coins This Week 13

1. Major Industry Events This Week 15

2. Major Upcoming Events Next Week 16

3. Important Investments and Financing from Last Week 16

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Share

The total market capitalization of cryptocurrencies is $3.32 trillion, down from $3.33 trillion last week, representing a decrease of 0.3% this week.

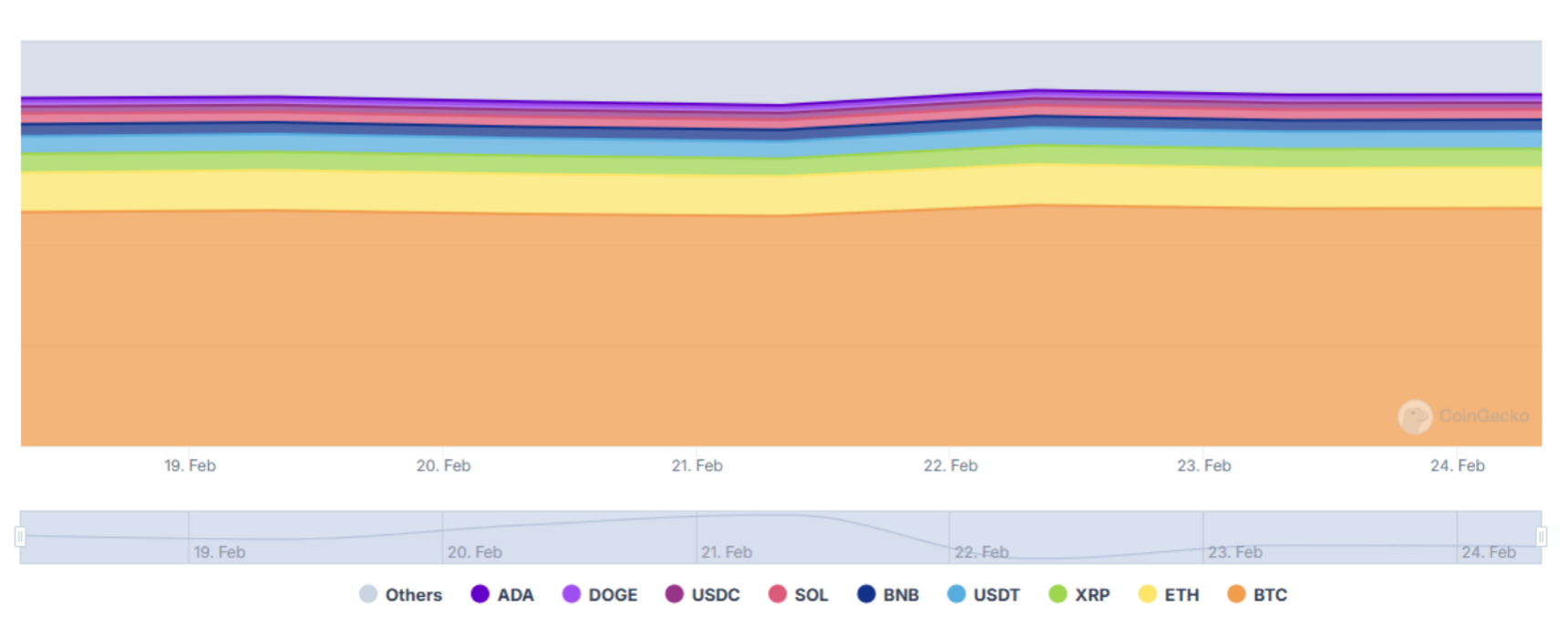

Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $1.91 trillion, accounting for 57.49% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $234 billion, accounting for 7.05% of the total cryptocurrency market cap.

Data Source: coingeck

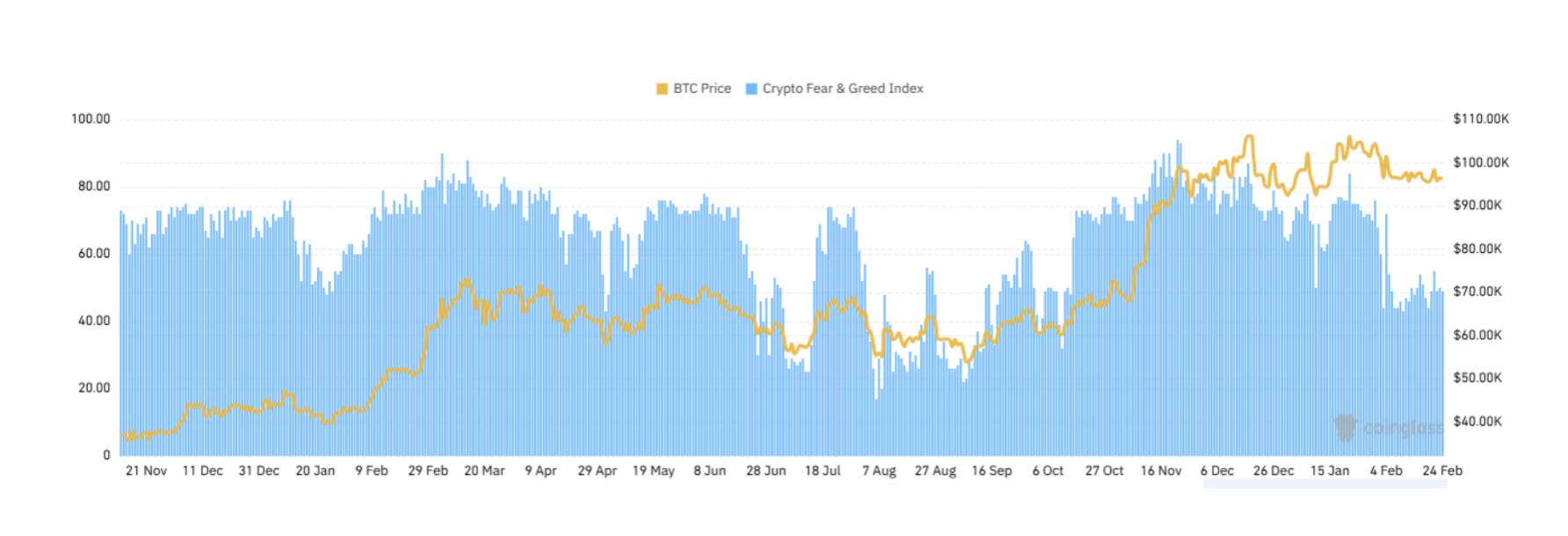

2. Fear Index

The cryptocurrency fear index is at 49, indicating a neutral sentiment.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $39.56 billion, with a net outflow of $559 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $3.15 billion, with a net inflow of $1.61 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $2,881, historical highest price $4,878, down approximately 42.61% from the highest price.

ETHBTC: Currently at 0.029093, historical highest at 0.1238.

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $111.2 billion, an increase of 1.9% from last week.

By public chain classification, the top three public chains by TVL are Ethereum with a share of 53.81%; Solana with a share of 7.42%; and Bitcoin with a share of 5.89%.

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current Layer 1 data related to ETH, SOL, BNB, TON, SUI, and APT from daily trading volume, daily active addresses, and transaction fees.

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, ETH saw a significant increase in daily trading volume, with an increase of 89.6% compared to last week. Additionally, SOL saw a decrease of 42.2% compared to last week; in terms of transaction fees this week, SUI saw a significant increase of 71%.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, BNB saw a significant decrease, down 22.5% compared to last week; in terms of TVL, overall changes are minimal.

Layer 2 Related Data

● According to L2Beat, the total TVL of Ethereum Layer 2 is $37.6 billion, with an overall increase of 4.2% from last week.

● Arbitrum and Base occupy the top positions with market shares of 31.21% and 30.15%, respectively, but both overall shares have decreased.

7. Stablecoin Market Cap and Issuance

According to Coinglass, the total market capitalization of stablecoins is $234 billion. Among them, USDT's market cap is $142.5 billion, accounting for 60.9% of the total stablecoin market cap; followed by USDC's market cap of $57.1 billion, accounting for 24.4%; and DAI's market cap of $5.36 billion, accounting for 2.3%.

According to Whale Alert, USDC Treasury issued a total of 1.32 billion USDC this week, representing an increase of 25.71% compared to the total issuance of stablecoins last week.

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins This Week

The top five VC coins with the highest increase over the past week

The top five Meme coins with the highest increase over the past week

2. New Project Insights

STEAMM: STEAMM is based on Sui and is a capital-efficient AMM that allows users to lend idle assets for additional returns. By lending idle capital, STEAMM creates new income sources for LPs, attracting deeper liquidity, and is currently in beta.

Kiyotaka: Kiyotaka is a crypto market intelligence platform currently in testing, receiving attention from the co-founder of @Delphi_Labs.

Altius: Altius is a future-oriented blockchain infrastructure designed to optimize blockchain performance through a VM-agnostic execution framework, enhancing scalability, efficiency, and cross-chain interoperability. By separating the execution layer from monolithic network design, the Altius Stack can seamlessly integrate with Layer 1, Layer 2, and application-specific chains without the need for specialized hardware, immediately improving performance.

III. New Industry Dynamics

1. Major Industry Events This Week

● Bybit has called on elites in the global cybersecurity and crypto analysis fields to jointly investigate the perpetrators of the largest theft in crypto history. Contributors who successfully recover funds will receive a 10% reward, with the total bounty based on the verifiable amount of stolen ETH worth over $1.4 billion at the time of the incident. If all funds are recovered, the total bounty could reach $140 million.

● The cloud network built on Arweave, ar.io, has launched its mainnet and token generation event. The total fixed supply of ARIO tokens is 1 billion tokens. The majority of the token distribution is as follows: 17.08% allocated to its core team and advisors, 20.29% for supporting early development and infrastructure, 17.5% specifically for early adopters, developers, and user communities contributing to network growth, and 28.63% for incentivizing partnerships and collaborations. In addition to securing the network, ARIO also enables users to purchase and manage ArNS smart domain names, providing permanent blockchain-native identities for applications, data, and digital ownership.

● The AI smart layer Rivalz Network has announced that its RIZ testnet airdrop query is now live. If users believe they are eligible but do not see rewards, they can submit a review request via a form before March 5. Users do not need to interact with the query tool, and RIZ tokens will be claimed through a separate website. All testnet users will receive participation rewards for Season One of Rome.

● Ondo Finance has announced that its tokenized U.S. Treasury fund, Ondo Short-Term U.S. Government Bonds (OUSG), is now launched on the blockchain securities market Assetera, which has received MiFID approval in Europe.

● Elon Musk stated that the AI chatbot Grok 3 will be made available for free to all users in a short time.

2. Major Upcoming Events Next Week

● The decentralized autonomous organization VitaDAO, which funds longevity research projects, has announced the launch of a new compound experimental token on the Pump Science platform on February 25.

● CoinList will open the token sale for Obol on February 25, offering a 30% discount compared to previous VC round investments. The token price is $0.25, with 33% unlocking after the TGE and the remaining unlocking linearly over the next 12 months.

● The liquid staking protocol MilkyWay from Celestia has announced that it will end its mPoints program on February 28, and all accumulated mPoints will be counted in the final snapshot.

● Turkey's new anti-money laundering regulations for cryptocurrencies will take effect on February 25, 2025. Under the new regulations, users with transaction amounts exceeding 15,000 Turkish Lira (approximately $425) must share identity information with the country's cryptocurrency service providers. The new regulations aim to prevent the laundering of illegal funds and the financing of terrorism through cryptocurrency transactions.

3. Important Investments and Financing from Last Week

● Mansa Finance, seed round, raised $10 million, with investment from Tether. Mansa Finance is a real-world asset (RWA) DeFi fixed income protocol that provides short-term liquidity to African venture-backed fintech companies through invoice discounting, asset leasing, inventory financing, and payroll. (February 20, 2025)

● Aria, public offering round, raised $20 million, with undisclosed investment institutions. Aria is a platform that combines RWA and IP, focusing on the compliant tokenization and segmentation of RWIP, releasing liquidity for RWIP through secondary trading and lending markets. Aria allows for distributed ownership and decision-making, remixing, and derivative works to increase revenue streams. (February 18, 2025)

● Cygnus, pre-seed round, raised $20 million, with investors including OKX Ventures, Mirana Ventures, Manifold Trading, UpHonest Capital, G-20 Group, and CL. Cygnus is a modular real yield layer that combines non-EVM systems like TON with the EVM ecosystem as the ultimate goal of real yield. Its liquidity verification system generates yield and serves any system that requires its own distributed verification semantics. Users can participate in ecological liquidity security while automatically enjoying staking rewards, LVS fees, and other system incentives. (February 18, 2025)

● Blockaid, Series B, raised $50 million, with investors including Ribbit Capital, Variant Fund, Google Ventures, and Cyberstarts. Blockaid is a Web3 security tool that can prevent malicious transactions before they occur, protecting Web3 users from scams, phishing, and hacking attacks. (February 18, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。