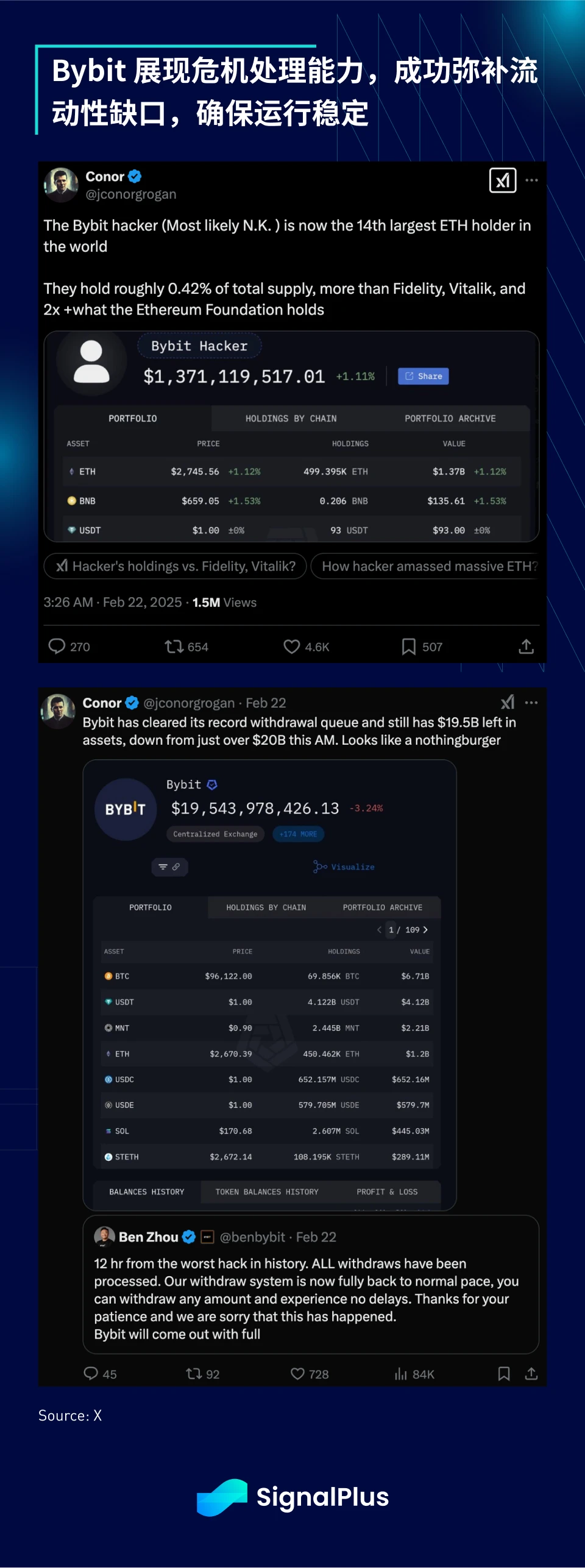

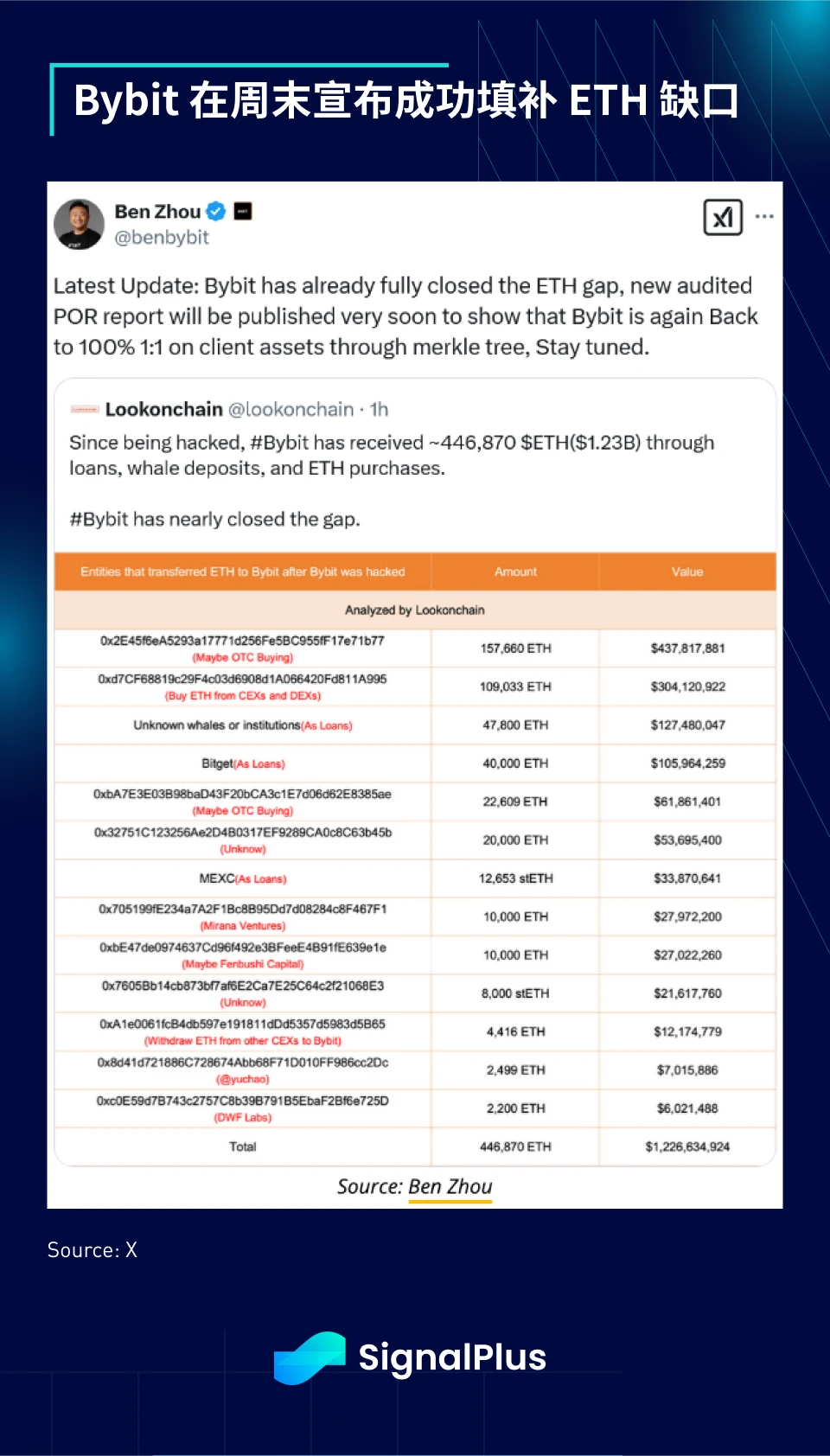

Just as the victims of FTX were finally receiving repayments, the cryptocurrency market faced another heavy blow. Bybit announced it had been hacked, with a cold wallet stolen containing approximately $1.5 billion worth of ETH, believed to be the work of North Korea's Lazarus Group.

Over 400,000 ETH were stolen, making it the largest cryptocurrency heist in history. The hacker has thus become one of the largest holders of ETH globally, surpassing even Vitalik, Fidelity, and the Ethereum Foundation.

If this incident had occurred a few years ago, it would likely have triggered widespread panic and a chain reaction in the market. However, this time the situation was handled properly within 24 hours, including a timely and clear public statement from Bybit's management to alleviate public concerns, while ensuring that around $5.5 billion in withdrawal requests proceeded smoothly. Additionally, the entire cryptocurrency community quickly united to support Bybit through short-term lending to bridge the funding gap, ultimately stabilizing the situation and market prices, with minimal impact (at least for now).

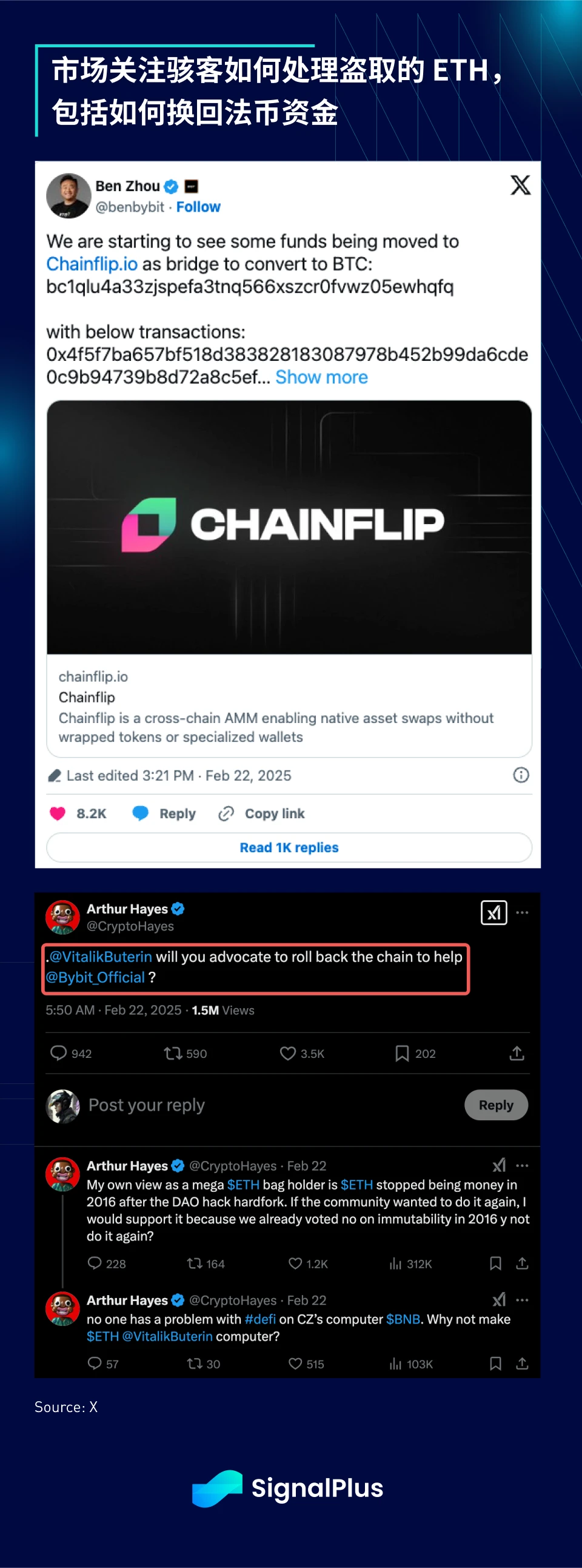

However, there remains a question in the market: what to do with the 400,000 ETH now stored in these contaminated wallets? The U.S. OFAC may soon take sanctions actions to prevent these funds from re-entering the system. However, the hacker has begun to launder the funds through cross-chain bridges and various AMM protocols, which could trigger broader regulatory measures and affect Ethereum's acceptance among compliance agencies.

Moreover, there have even been calls in the market for a "rollback" to reverse the transactions stolen by the hacker. However, this raises controversies regarding centralization issues and feasibility, making it difficult to reach a consensus in the short term.

There are many speculations in the market about how to make up for this ETH shortfall, but Bybit announced over the weekend that it had resolved the funding gap through various measures, temporarily calming market concerns.

Just hours before Bybit was hacked, Coinbase announced that the SEC had withdrawn its lawsuit against it, marking the end of a long legal dispute. Additionally, the regulatory agency recently approved the first stablecoin security issuance (YLD), which will offer a floating interest rate of SOFR - 50bps.

As cryptocurrency payments and transfer services become more mainstream, the market expects to see more such stablecoin products launched as savings alternatives.

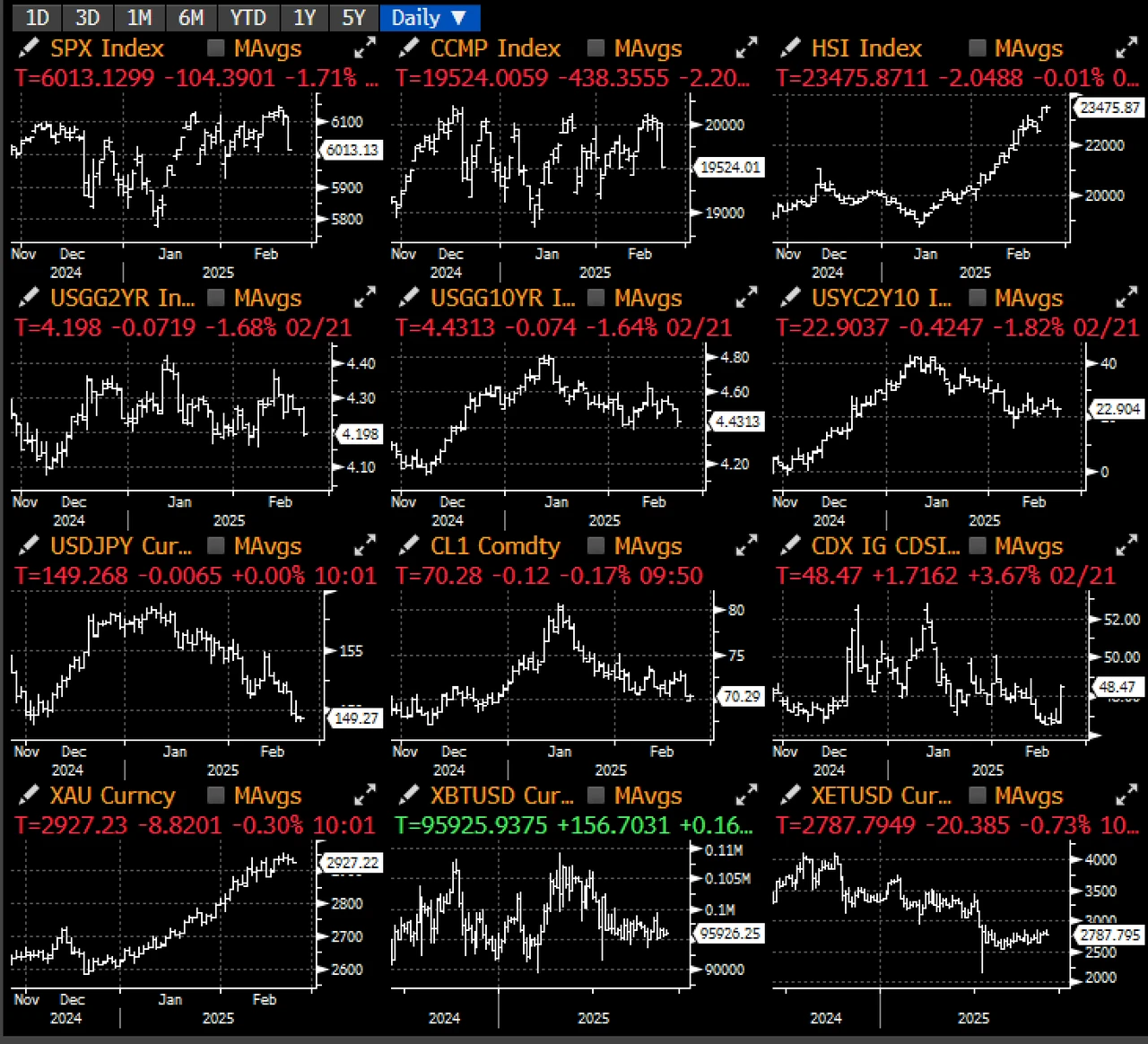

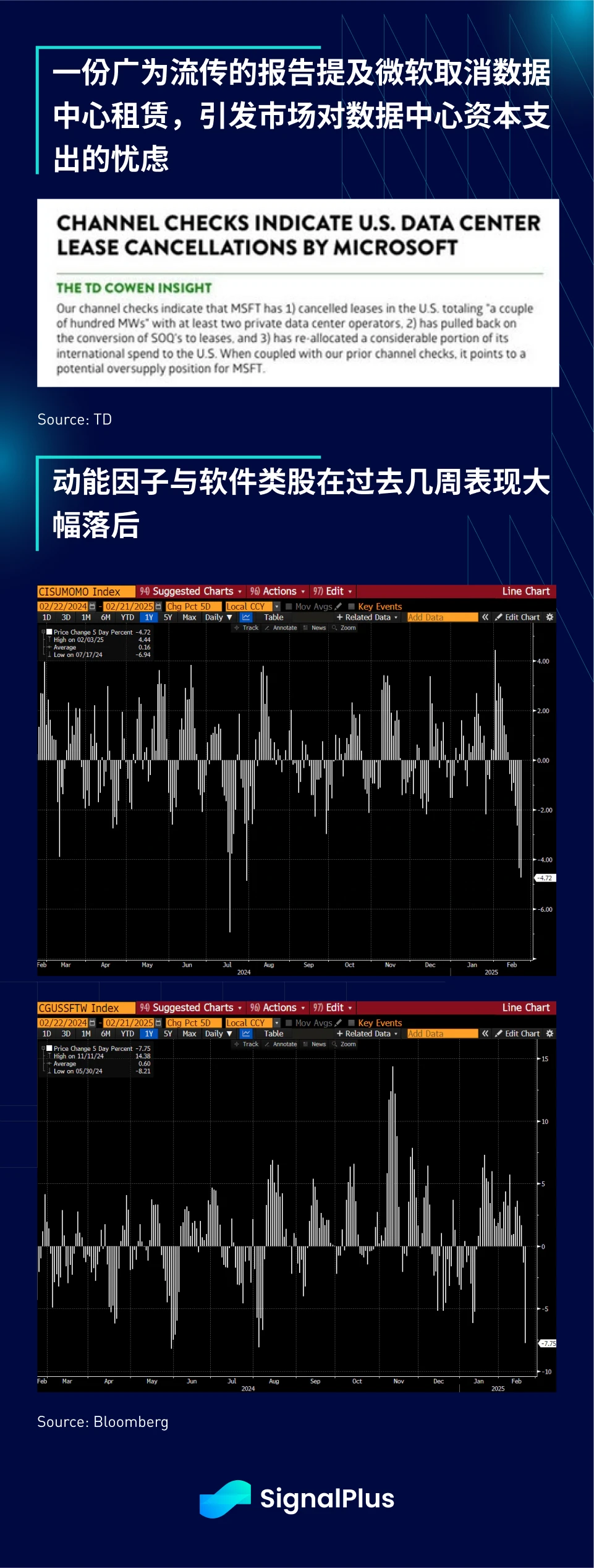

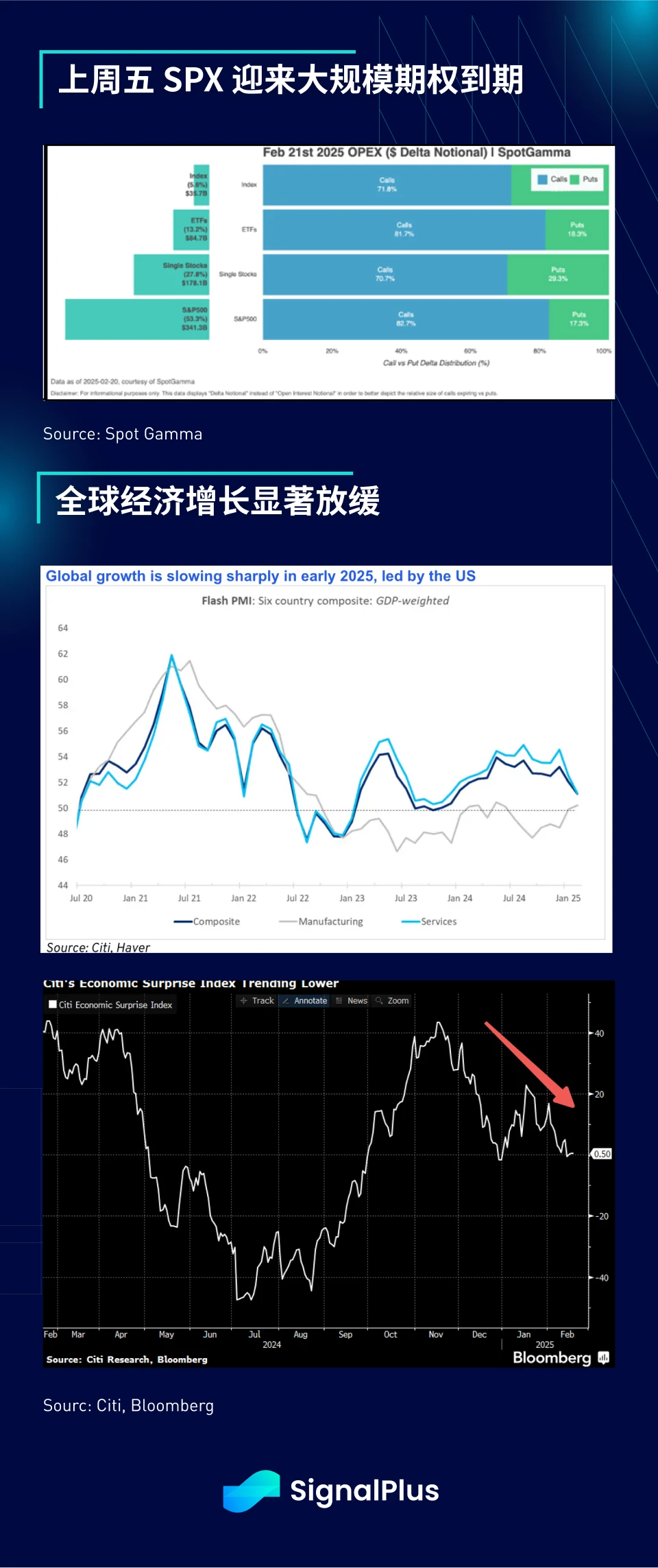

Back in TradFi, economic data was poor (Citigroup's Economic Surprise Index was weak, and the University of Michigan Consumer Confidence Index was low), Walmart's earnings were disappointing (consumer spending weakened), concerns over high data center expenditures (Microsoft canceled data center leases), $2.7 trillion in options expired, uncertainty over the fiscal adjustment bill, news of new COVID-19 variants, and worries over the German AfD (right-wing) election victory led to heavy selling pressure in the U.S. stock market last week (-1.5%).

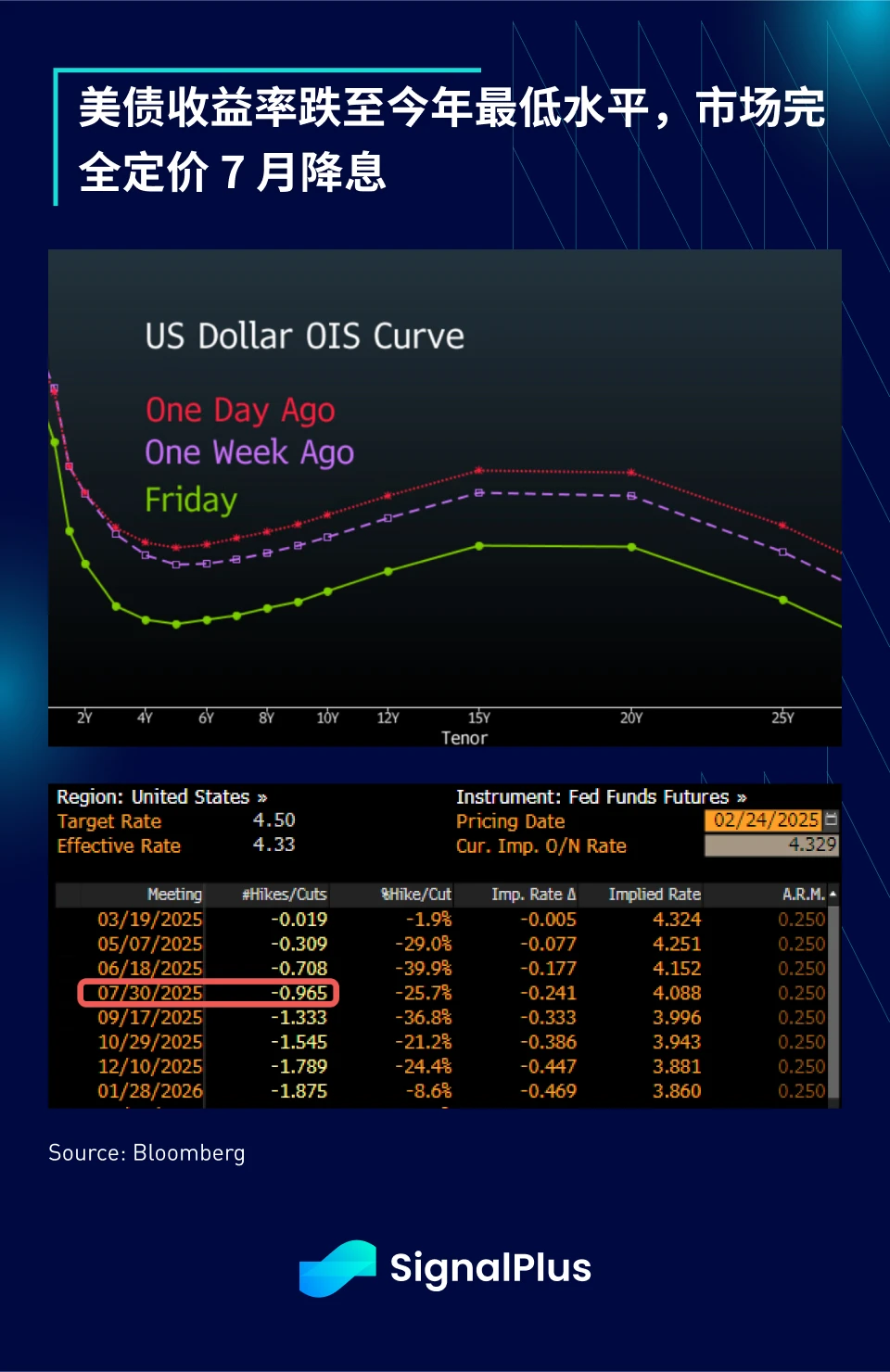

Market concerns over an economic slowdown benefited fixed-income assets, with U.S. Treasury yields falling more than 10 basis points last week. The market has now fully priced in a rate cut in July, with the possibility of a cut in June rising to 70%.

Moving forward, the narrative of "economic slowdown" may dominate market trends in the short term, with stock and bond prices rising in sync again, as their correlation approaches the highs of the past 12 months. As the market refocuses on the Federal Reserve's easing policies, the idea that "bad news is good news" will return, potentially benefiting gold and BTC.

The most important market event this week may be Nvidia's earnings report, with the market expecting its quarterly revenue to hit a record high of $38.32 billion, a 73% year-on-year increase. Wishing everyone successful trading!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between the English and numbers: SignalPlus 123), Telegram group, and Discord community to interact with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。