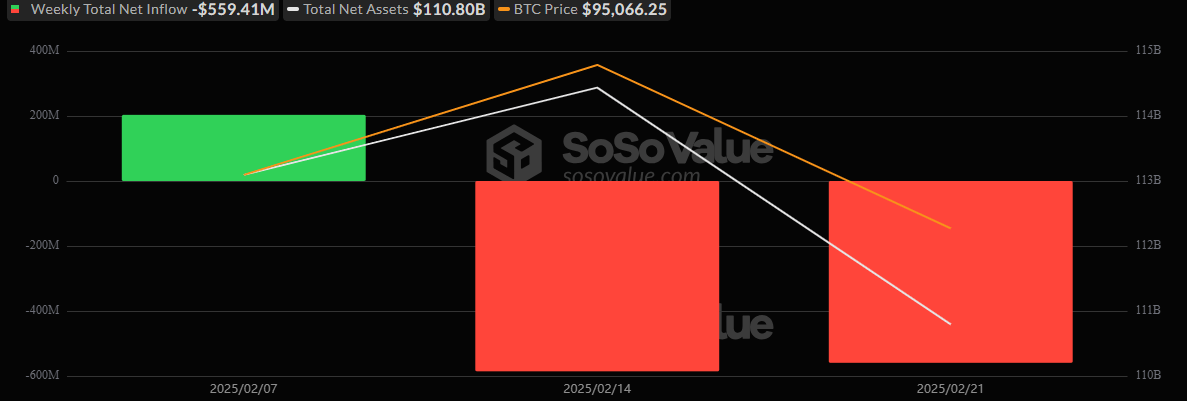

U.S. spot bitcoin exchange-traded funds (ETFs) continued to feel the market strain with another week of significant outflows. The trading week between Feb. 17 to Feb. 21 saw spot bitcoin ETFs record a net outflow of $559.41 million, marking a second consecutive week of fund declines.

Conversely, ether ETFs offered a glimmer of optimism with a modest net weekly inflow of $1.6 million, suggesting marginal investor interest in ether-based assets.

Weekly Net Inflow/Outflow for Bitcoin ETFs in Feb. 2025

Delving into the specifics, several bitcoin ETFs bore the brunt of the outflows with Fidelity’s FBTC experiencing a substantial net weekly outflow of $165.51 million. Ark 21Shares’ ARKB faced outflows totaling $107 million while Bitwise’s BITB recorded a $105 million reduction in assets.

Grayscale’s GBTC and BTC funds saw weekly net outflows amounting to $93.6 million and $61.1 million respectively. Amid these downturns, Vaneck’s HODL stood out as a rare positive, attracting a net inflow of $4.31 million.

On the ether ETFs front, the dynamics were slightly more encouraging with Fidelity’s FETH leading the pack with a net weekly inflow of $26.32 million. However, Grayscale’s ETHE experienced outflows totaling $15.79 million and Bitwise’s ETHW also faced challenges, with outflows amounting to $8.92 million.

Throughout the week, bitcoin ETFs endured outflows on four out of five days, highlighting a negative sentiment among investors. In contrast, ether ETFs managed to secure inflows on three days, suggesting a quiet but existing confidence in ether ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。