I originally wanted to finish my homework early and go to bed, but while watching the news just now, I almost fell asleep about four or five times. I am indeed a bit tired, but after continuously sharing two news articles and analyzing the issues surrounding cryptocurrency insurance, I found that I was completely awake again. It turns out that writing can revive me.

Today, my mood is still not good. There are many reasons for this, and it's hard to give a very accurate explanation. However, it can be confirmed that the macro monetary policy and the economic outlook for the United States are the main reasons. There are too many factors affecting monetary policy: the Russia-Ukraine conflict, tariff issues, the debt ceiling, inflation, and unemployment rates. It’s a bit like what was said before: even drinking cold water can get stuck in your teeth.

But is the situation really that bad? I don't think so. A lot of it is market expectations, and in fact, the Federal Reserve has already given a clear stance. Yet the market insists on proving the Federal Reserve wrong. Interestingly, since the Federal Reserve announced interest rate hikes in 2022, the market has never won in its game against the Federal Reserve; every time, the Federal Reserve has emerged victorious. After all, they have the final say, and the ultimate decision is not based on market expectations but on the Federal Reserve.

This reminds me of something an old boss of mine used to say: "Don't always think you know; what you think you know is often wrong." This is the current game between the Federal Reserve and the market. The Federal Reserve tells the market that the expectation for 2025 is two interest rate cuts, while the market responds, "I don't believe it; I bet you will cut rates more than that."

On the other hand, I know many friends are very concerned about whether we are in a bull market or a bear market, but what it actually is doesn't matter much. The biggest situation right now is that we are in a macroeconomic tightening phase. Although it has started to shift towards easing, this transition will be very slow. Therefore, there is a significant liquidity gap for #BTC and other cryptocurrencies. A small amount of capital is concentrated in BTC, just like the concentration of capital in the "seven sisters" of the U.S. stock market, while other stocks and altcoins in the cryptocurrency industry are struggling.

So, whether the U.S. stock market is in a bull market is a mixed bag: on one hand, the Nasdaq has been rising, and the S&P has reached historical highs; on the other hand, high-quality stocks like $Nike have plummeted. Isn't it the same in the cryptocurrency industry?

In fact, whether it's a bull or bear market isn't that important. After all, for Bitcoin, there are still many positive expectations ahead. Today, traditional market maker Citadel Securities is also entering the game, claiming to be inspired by Trump. Is this good news? Yes, but can it immediately drive up prices? Probably not. Because policy-related good news is often slow and sustained, I believe BTC has great opportunities, mainly due to compliance.

But it's hard to say the same for altcoins.

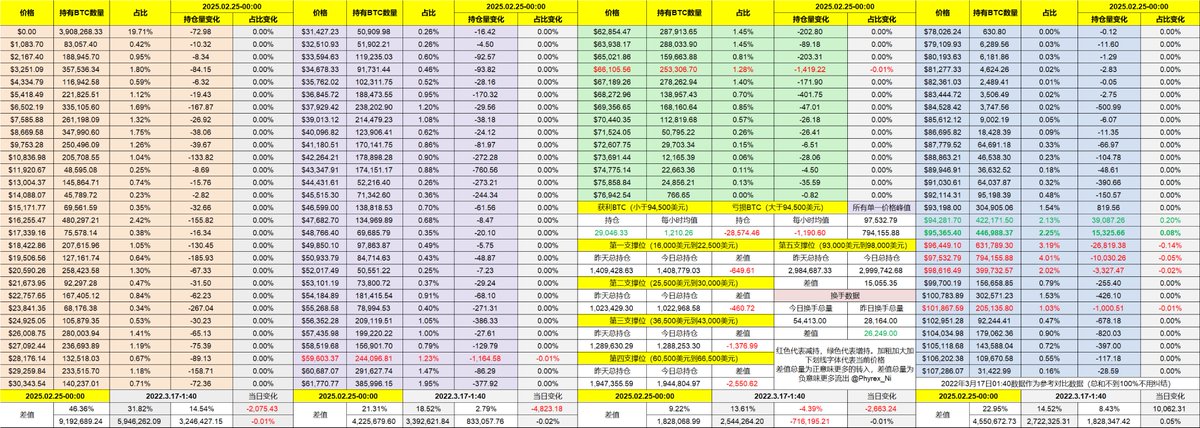

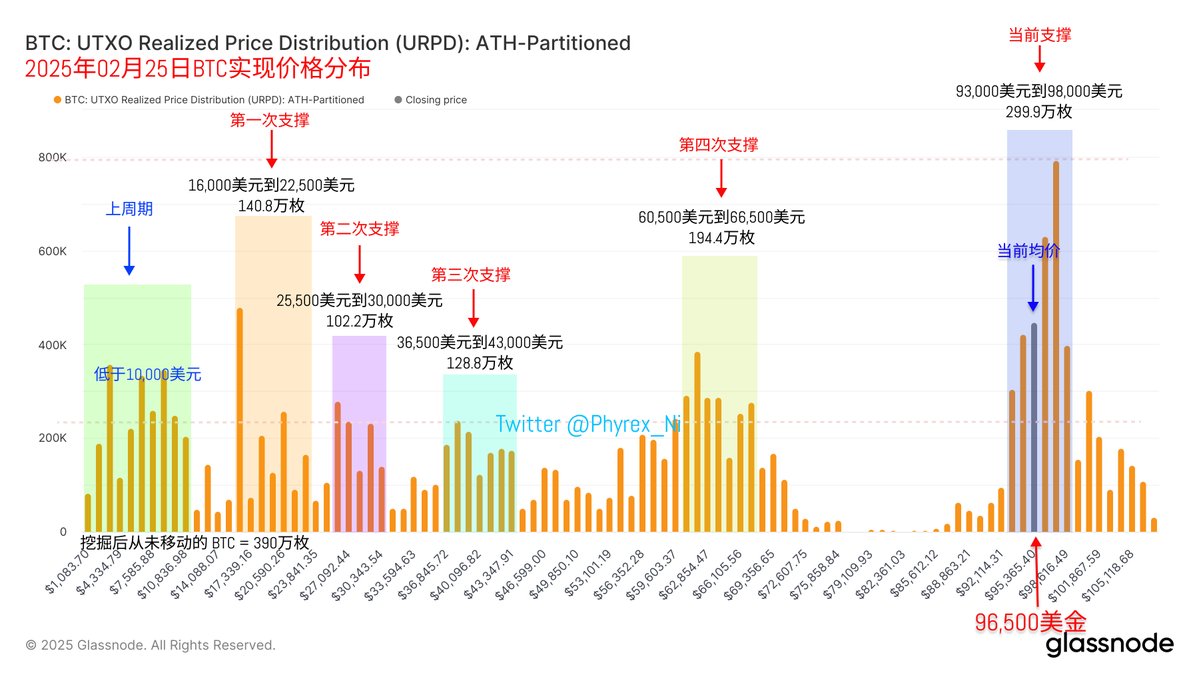

Looking back at BTC's data, the turnover rate is still very low, and most investors remain indifferent to the current price. The main participants in the turnover are still short-term investors, and even short-term loss investors are turning over more. Speaking of this, I suddenly noticed that recently there have been fewer comments claiming BTC is being manipulated by whales to harvest retail investors, which can be seen as a kind of progress.

From a support perspective, although Bitcoin's price continues to fluctuate downward, the support level between $93,000 and $98,000 is still very solid, at least there are no signs of it being broken. This also indicates that more investors do not have a strong feeling about short-term price changes.

Time to sleep. I hope to resume comments and replies tomorrow. Thank you all for your support.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。