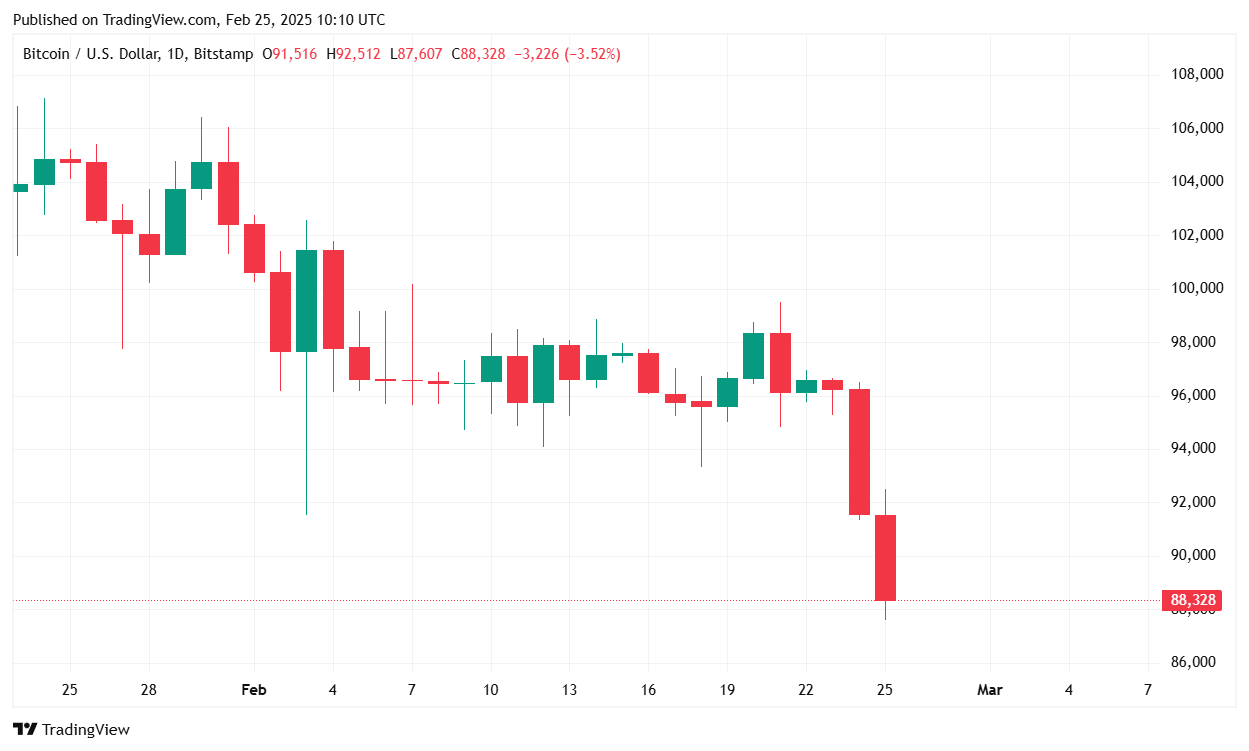

Bitcoin (BTC) plunged below $87,000 in afterhours trading but has since recovered slightly and is currently trading at $88,297, reflecting a 7.67% decrease from the previous close. Over the past 24 hours, BTC traded between $86,987 and $96,028, marking its lowest valuation since November 2024, according to data from Coinmarketcap.

(BTC price / Trading View)

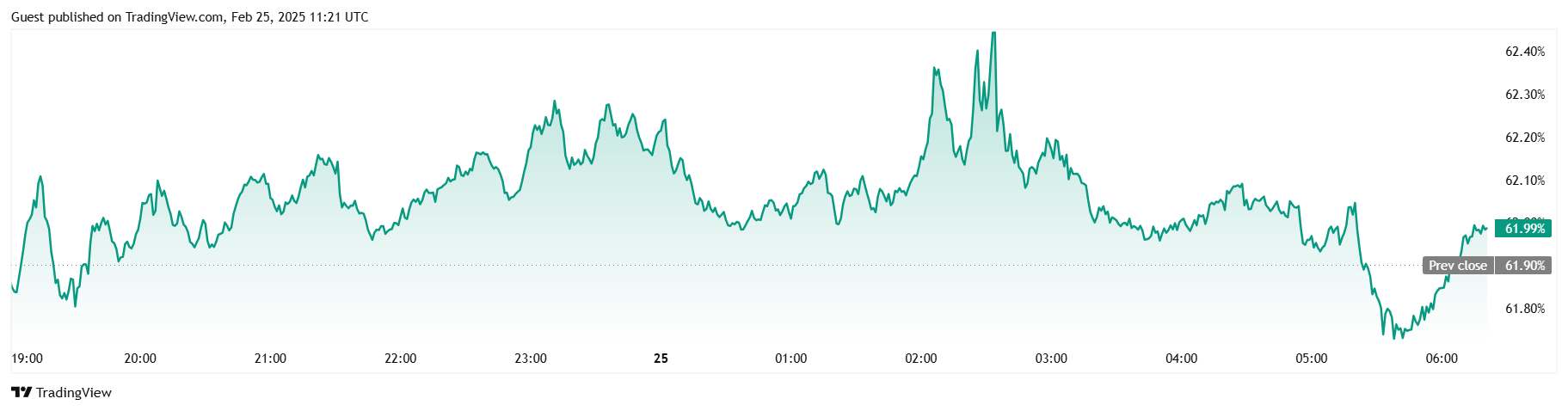

The top cryptocurrency’s 24-hour trading volume surged to $67.98 billion, a 178.52% increase, as bearish traders offloaded their holdings. Consequently, bitcoin’s market capitalization declined by 7.98%, now standing at $1.74 trillion. Despite these losses, BTC’s market dominance edged up by 0.24% to 62%, as alternative cryptocurrencies like ether (ETH) and solana (SOL) sustained more substantial losses.

(BTC dominance / Trading View)

In the derivatives market, total BTC futures open interest decreased by 3.93% to $56.82 billion. Liquidation data reveals that $589.17 million was liquidated in the past 24 hours, with long positions accounting for $561.26 million and short positions for $27.92 million.

The recent downturn appears to have been influenced by macroeconomic factors and specific events. The aftermath of Bybit’s $1.46 billion hack continues to impact the crypto markets with almost all the top twenty cryptocurrencies shedding anywhere between 7% and 15% in value. Additionally, President Donald Trump’s announcement to implement tariffs on Canada and Mexico next month has introduced economic uncertainty, potentially affecting market sentiment.

Given these developments, the short-term outlook for bitcoin remains cautious. Investors are advised to monitor macroeconomic indicators and market events closely, as they may continue to influence bitcoin’s price trajectory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。