Short-term Market Volatility and Support Level Observation

Technical Support: The current Bitcoin price has fallen below $90,000, and I believe that $84,500 is a potential key support level. Everyone should pay attention to whether this level can stabilize. If it effectively breaks down, it may further drop below $80,000. It is recommended to remain cautious in the spot market, especially with altcoins, to avoid blindly bottom-fishing.

Market Sentiment Recovery: The recent crash has led to over 370,000 liquidations, and the market's panic sentiment has not yet fully released. It may be wise to wait for a decrease in trading volume and a reduction in price volatility before reassessing the entry timing.

Focus on Regulatory Policies and Geopolitical Risks

U.S. Policy Divergence: Although the Trump administration previously expressed support for Bitcoin as a reserve asset, there are significant domestic disagreements (such as South Dakota delaying a Bitcoin investment bill). It is necessary to track the market reaction after the tariff policy is implemented on March 4.

Global Regulatory Dynamics: The European Central Bank opposes Bitcoin reserves, while countries like the Czech Republic and El Salvador may expand their allocations. If more countries follow suit, it could be a long-term positive.

In summary, since Trump took office, the cryptocurrency market has indeed become more volatile, and before his inauguration, he did boost market confidence, bringing some positive news to the crypto space. However, there is a famous saying in the investment market: Buy the expectation, sell the fact! You might profit before something is finalized, but once everyone knows the news and rushes in, be cautious; the dealer's scythe has already worn down, just waiting for the "leeks" to grow strong. Therefore, always think carefully before acting, and don’t get swept up in the rhythm; otherwise, you’ll be the one crying.

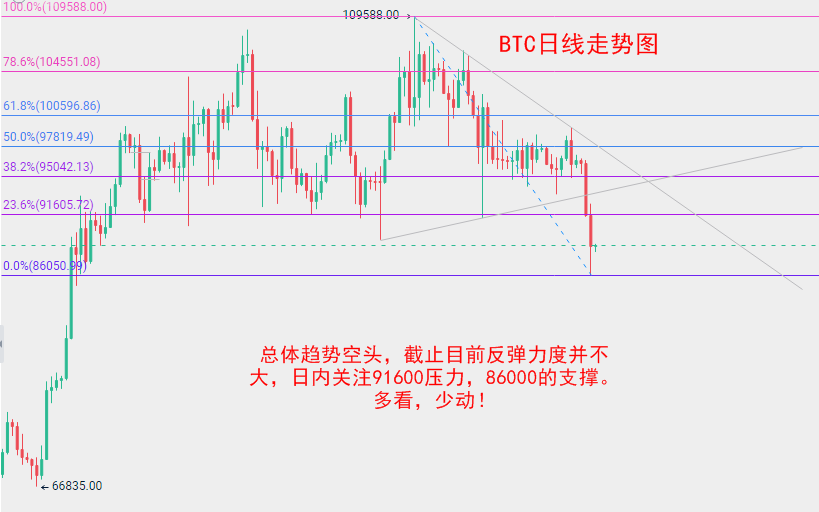

Two days ago, when BTC fell below $95,000, I warned everyone to pay attention to the risks, as this wave could drop to the $91,000—$89,000 range, which was validated in just a few hours. Yesterday, the market further declined, hitting a low near $86,000, and is currently showing a slight rebound, fluctuating around $89,000. From the Fibonacci line, we can see that the 23.6% retracement level is around $91,600. In the short-term contracts today, you can consider placing short orders near this level, with a stop loss at $92,500 and a target in the $88,000—$88,600 range, exiting at the right time.

Additionally, be aware that after a strong decline, a rebound, or even a strong rebound, is possible. Short positions in a bearish trend may not necessarily be profitable, which is why we emphasize having a good stop loss, as no one can predict if the trend will suddenly reverse. Each position should have a stop loss; even if it results in a loss, it will only be a few thousand points, which won’t be devastating, and you will have another chance to turn things around in the next trade.

Regarding ETH, it has recently shown better resilience than BTC, with a stronger rebound. Therefore, if you are trading day contracts for ETH, the reference points should also be adjusted upwards, and do not be too aggressive. For intraday operations, you can consider placing short orders around $2,580—$2,600, with a stop loss at $2,650.

Some friends may ask, "Teacher, you said to go short on the rebound, so why not go long now, wait for it to rise, and then exit the long position before going short?" I think many new friends may have doubts about this question. The answer is straightforward: trading involves probabilities. We just want to minimize the probability of losing trades, which can be said to be more stable. To put it simply, if we go short on a rebound and it doesn’t rebound but continues to drop, we simply didn’t enter that trade, which is just a missed opportunity. However, if we go long at the current price and it drops directly, that would be a real loss. So, to summarize, be more cautious when trading; it’s better to not trade than to make a wrong move!

Alright, that’s the thought process for today. If there are any changes, we will provide timely updates in the discussion group.

Market conditions change in real-time, and there may be delays in article publication. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are your own responsibility. Daily real-time market analysis, along with an experience discussion group and a practical no-chat group, are available for real-time guidance. Live explanations of real-time market conditions will be held at irregular times in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。