🧐 Current DeFi Optimal Solution | How to Elegantly Earn PVE Dividends Through SoSo @SoSoValueCrypto When the Market Enters "Sage Time"?

The recent market downturn has triggered a new round of divergence;

Is the market going to rise or fall next? Are we in the mid-term of a bull market or already in a bear market? The debate has become quite heated;

Especially as the market declines, the cooling of MeMe and the overall visible decrease in Pump returns, the Alpha hunters who were once keen on on-chain battles have also grown weary of the endless games.

Many large holders have chosen to start selling during this phase, converting their assets into coins and USDT;

Everyone has shifted from fighting to seeking a stable and happy "gold mine," with many now just wanting to steadily earn some returns.

Today, I discovered that SoSoValue @SoSoValueCrypto has launched its second season of mining, and I am using it myself. Personally, I assess it as a "gold mine" level opportunity.

Below, I will discuss its core value, gameplay strategies, and why I think it’s worth a try—

1️⃣ What are SoSoValue and $SSI?

In simple terms, it is a "data assistant" in the Crypto field,

Providing real-time market information and ETF data, with a clean interface and fast updates, it is an essential tool for many investors.

I previously wrote a detailed tweet introducing it—

https://x.com/BTW0205/status/1883804398637494468

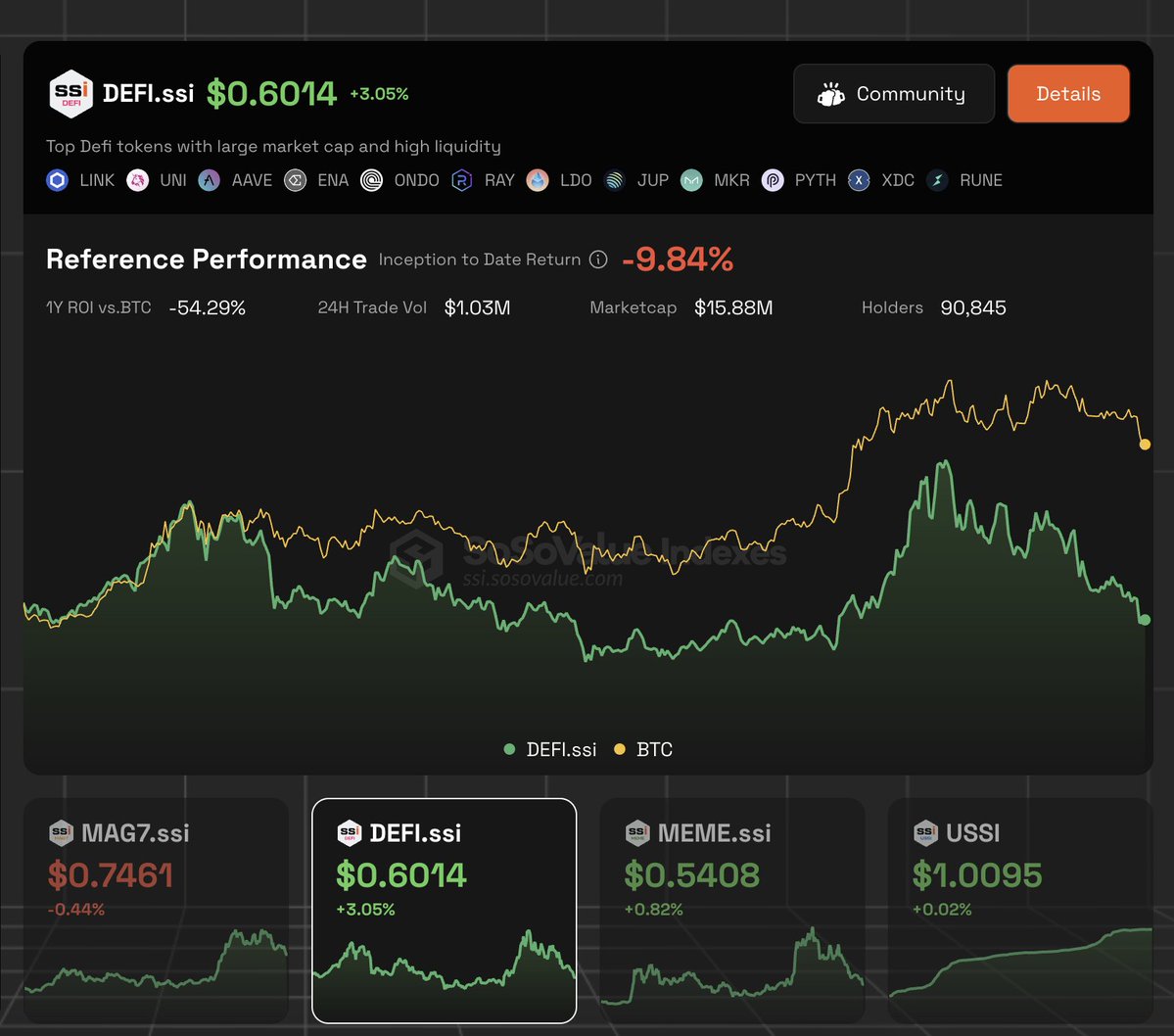

$SSI is equivalent to the S&P 500 or CSI 300 in the crypto space; buying $SSI is like buying the leading assets in the sector, capturing the growth dividends of the entire sector.

For example, MAG7.ssi automatically tracks the seven major cryptocurrencies like Bitcoin, Ethereum, and Solana, truly a "lazy index."

Currently, there are two major cognitive biases in the market:

Misunderstanding SSI as an ordinary platform token (it actually benchmarks the crypto market index)

Underestimating the speed of incremental capital entering from Web2 (in fact, family offices have begun testing SSI as a funding channel)

This may explain why some institutions have started to use SSI as a ballast for asset allocation.

2️⃣ Why is SoSoValue S2 a "gold mine" level opportunity?

The most noteworthy aspect currently is the upcoming launch of the second season of SSI staking incentives.

The first season of mining was extremely popular, and the platform token $SOSO has successfully completed its TGE. In this second season, the project team is directly throwing 30 million $SOSO (accounting for 3% of the total supply, currently valued at 19 million USD) to reward users participating in staking, showing great sincerity.

Moreover, the tokenomics specifically allocates 30% for ecological growth incentives, which means they are not just running a short-term activity but genuinely want to expand and strengthen the ecosystem through the reward mechanism.

Additionally, $SSI itself, as a "leading index," has the potential for long-term appreciation, especially in a market downturn, which could be a good opportunity to increase positions.

After discussing with friends, we all agree that SoSoValue's incentive mechanism is quite clever. The willingness to spend money + clear long-term planning can yield immediate "gold" while also holding onto a potentially appreciating asset, attracting users to hold long-term while providing flexible arbitrage space. It feels like a win-win opportunity.

3️⃣ Core Gameplay Breakdown: Simple and Direct "Staking Mining"

The gameplay of this mining activity can be summarized in one sentence: stake assets to mine; the more you stake, the smarter the method, the higher the returns.

How to play specifically? Let me break it down—

Unlike conventional liquidity mining, the brilliance of this incentive mechanism lies in constructing a multi-dimensional revenue space:

- Basic Gameplay (3-20 times)

• Holding only $SSI: equivalent to having a "wooden shovel," with a 3x gain, decent returns but not outstanding.

• Staking $SSI: upgraded to a "silver shovel," with gains jumping to 15 times, efficiency skyrockets.

• Providing liquidity for $SSI LP: directly using a "gold shovel," with gains up to 20 times, mining speed takes off.

Weight Score = Base Score × Gain Multiplier; your weight score determines how much reward you can receive.

Tips: Participating through Curve's USSI pool can achieve nearly zero slippage for lossless exchanges.

- Acceleration Mode (1.1-2 times)

While staking SSI, locking SOSO tokens increases the yield multiplier based on the staking ratio in a tiered manner. It has been observed that when the amount of SOSO staked is ≥ 80% of the SSI holding amount, the maximum 2x gain can be activated.

For example: If you stake SSI + stake an equivalent amount of $SOSO, you can directly unlock a maximum of 40 times the yield! Originally earning 10 points daily, it suddenly becomes 400 points.

- Invite friends to earn an additional 10% bonus points.

Overall, the gameplay is simple yet layered; you can casually play for basic rewards or maximize returns through combination strategies.

With this setup, based on current TVL calculations, the theoretical APY can reach 32-39%. More importantly, due to the low volatility characteristic of SSI itself, even in extreme market conditions, the principal erosion is far less than that of high-leverage mining.

Conclusion—

There is an iron rule in mining activities: the earlier you participate, the more rewards you get.

Currently, SoSoValue has over 50 million registered users, nearly 2 million daily active users, over 340,000 on-chain wallets, and a total TVL of nearly 200 million USD, which continues to grow;

Many people have not yet noticed this wave of activity, making it a good entry opportunity.

As more people stake, the rewards will naturally be diluted.

In my view, this activity by SoSoValue is not just a short-term "money-grabbing" opportunity but more like a signal worth long-term attention.

Their gameplay is cleverly designed, allowing newcomers to easily get started while leaving room for optimization for veteran players. Furthermore, $SSI is backed by real data and asset support, unlike some hollow projects that only have concepts without foundations. Most importantly, the project team is willing to allocate so many resources to incentivize users, indicating they genuinely want to build the ecosystem.

Therefore, I believe it is worth researching and trying, suitable for those looking to make quick money in the short term as well as those who are optimistic about the platform's long-term development.

I suggest using the 433 position management method to participate: 40% of assets for staking to earn stable returns, 30% holding coins to capture index growth, and 30% flexibly allocated to respond to sudden opportunities.

After all, in the uncertain world of Crypto, finding a project that balances short-term returns and long-term potential is not easy; living long is more important than making quick profits.

Interested friends can check the official website for specific staking mining details, Dyor;

Click to Earn $SOSO Now:

https://ssi.sosovalue.com/invite/N77GE6L7

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。