Macroeconomic Interpretation: The global M2 money supply is expanding at an astonishing rate—U.S. money supply has doubled in a decade, and the liquidity flood seems to be shouting "let it flow!" to the market! Swyftx humorously likens this scene to Mark Baum's anxiety in "The Big Short," except this time the bet is on Bitcoin's parabolic rise. However, behind this revelry lies a hidden mystery: in February, the U.S. spot Bitcoin ETF saw a net outflow of $2.415 billion, setting a monthly record, while the fear index plummeted to 21 on February 26, marking a "extreme fear" low not seen since last September. The market appears to be split into two factions: one side is the optimists propelled by macro liquidity, while the other is the conservatives trembling at the thought of regulatory iron fists.

The "Ice" of Regulation: Policy cold waves and fraud crackdowns. The U.S. SEC recently invited crypto critics to participate in working group meetings for the first time, and the inclusion of the nonprofit organization Better Markets feels like throwing a bucket of ice into the regulatory hot pot. Although the details of the meeting have not been disclosed, the SEC's emphasis on "preventing fraud" has sent chills through the market. A more direct impact comes from Illinois Senator Dick Durbin's "Crypto ATM Fraud Prevention Act," which requires cryptocurrency ATMs to set transaction limits and provide fraud refunds, directly targeting scams that exploit ATMs to fleece the elderly. While such measures can enhance industry credibility, there are concerns that excessive regulation may turn innovation into "dancing with shackles."

On the other hand, Ohio is quietly advancing a Bitcoin strategic reserve bill, attempting to incorporate Bitcoin into government asset allocation. This "local encircling the central" strategy resembles the classic operations of U.S. states engaging in guerrilla warfare in the ambiguous territory of federal regulation. However, when local policy enthusiasm meets the cold water of federal regulation, Bitcoin's path to compliance may still face several rounds of ice bucket challenges.

The "Fire" of the Market: Shadows of economic recession and tech stock drag. In February, the U.S. consumer confidence index experienced its largest single-month drop in three years, compounded by Trump's threats to restart tariff wars with Canada and Mexico, leading to collective "colds" among risk assets. The seven tech giants of the U.S. stock market fell into a technical correction zone, with Tesla's market value dropping below $1 trillion, and the market held its breath on the eve of Nvidia's earnings report, causing the crypto market to preemptively stage a "dive performance"—Bitcoin fell below $86,000, SOL halved in a month, and the meme coin craze receded like a post-party hangover.

Interestingly, the correlation between traditional finance and the crypto market is strengthening. Against the backdrop of a weakening dollar index, gold rising and falling, and oil prices plummeting by 2%, Bitcoin's "digital gold" narrative has temporarily fallen silent, resembling more of a high-risk tech stock's difficult brother. The 4E platform took the opportunity to launch a USDT financial product with an annualized return of 8%, attempting to attract risk-averse funds with stable returns, but whether this strategy will be effective depends on the market's acceptance of the new script of "stablecoin arbitrage."

The "Swing" of Institutions: ETF bloodletting and faith replenishment. Despite the continued outflow of funds from Bitcoin ETFs, Binance's CEO calmly stated that this is a "tactical retreat." He referenced the historical script of Bitcoin's V-shaped rebound during the 2022 Fed rate hike cycle, suggesting that the current adjustment is merely a "halftime break in the bull market." The exodus of hedge funds from tech stocks revealed in a Goldman Sachs report may explain part of the logic behind the ETF fund outflows—institutions are rebalancing their risk exposure rather than abandoning crypto assets.

Arthur Hayes' prophecy adds political fuel to the market. He believes that if Trump cannot push through a budget proposal to increase spending, Bitcoin may retest $75,000. This rhetoric, which ties the price of Bitcoin to the power games in Washington, has turned the crypto market into an alternative betting ground for the U.S. elections.

Endgame Speculation: Black swans and gray rhinos dance together. In the short term, whether Nvidia's earnings report can prove the robustness of AI computing demand may become a turning point for the sentiment in tech stocks and the crypto market; in the long term, the global M2 expansion and the regulatory framework's tug-of-war will continue to dominate Bitcoin's trajectory. When the liquidity flood collides with the regulatory iron curtain, the market may repeat the script of 2020—giving birth to a new round of explosions amid severe volatility. After all, parabolas never rise in a straight line, but every deep squat is meant to jump higher.

BTC Data Analysis:

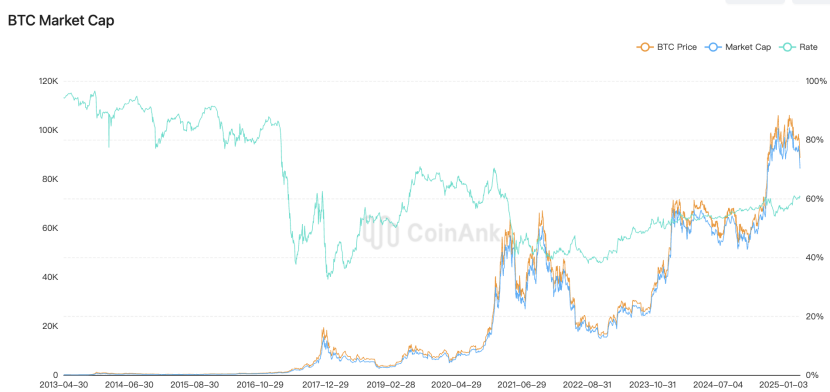

According to Coinank data, the total market capitalization of cryptocurrencies hovers above $2.7 trillion, having fallen to $1.7 trillion since peaking in December 2024, as shown in the chart. Multiple indicators suggest that Tuesday's sell-off may mark a local bottom. The crypto asset sentiment index has dropped to its lowest level since August, coinciding with the unwinding of yen carry trades, with Bitcoin bottoming around $49,000. The crypto asset sentiment index has just issued a significant number of reverse buy signals for Bitcoin. The overall bearish sentiment in capital flows, on-chain data, and derivatives indicates that downside risks are quite limited. At these price levels, the risk-reward outlook seems quite favorable.

We believe that observing from the perspective of market cycles and capital behavior, the current evaporation of nearly $1 trillion in total cryptocurrency market capitalization reflects that the market is undergoing a structural adjustment in the mid-bull market. The emergence of short-term bottom signals stems from three logical aspects:

First, extreme emotion release. The crypto asset sentiment index has fallen to its lowest point since August, combined with an increase in the proportion of bearish positions in the derivatives market, indicating that pessimistic expectations have been partially cleared, and reverse buy signals are often triggered in this context. The support level for Bitcoin around $49,000 reinforces expectations for a technical rebound, with historical data showing that this level corresponds to a dense area of ETF fund inflows in 2024, forming a psychological anchor.

Second, macro liquidity disturbances are easing. The pressure from capital inflows due to the unwinding of yen carry trades is diminishing, coupled with a marginal strengthening of expectations for Fed rate cuts (a cumulative 75bps cut since September 2024), alleviating liquidity pressures on risk assets. On-chain data shows that long-term holders' positions have not significantly loosened, with selling pressure mainly coming from short-term speculative positions, further limiting downside space.

Third, risk-reward ratio rebalancing. At the current market capitalization level, Bitcoin's risk premium has returned to a neutral range, and institutional investors may reassess its allocation value. Although the overall market leverage remains high, the negative funding rates in derivatives and the decline in perpetual contract open interest indicate that the risk of short squeezes is decreasing, and rebound momentum is gradually accumulating.

Structural contradictions still exist: regulatory uncertainties (such as the SEC's review of the ETH ETF staking mechanism) and geopolitical conflicts (Middle East situation) may suppress the height of rebounds. However, if Bitcoin can stabilize above the key psychological level of $50,000, capital may accelerate its return to high-beta assets, forming a positive feedback loop of "emotional recovery - capital inflow." At this stage, the market may enter a transitional window from "panic digestion" to "cautious optimism."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。