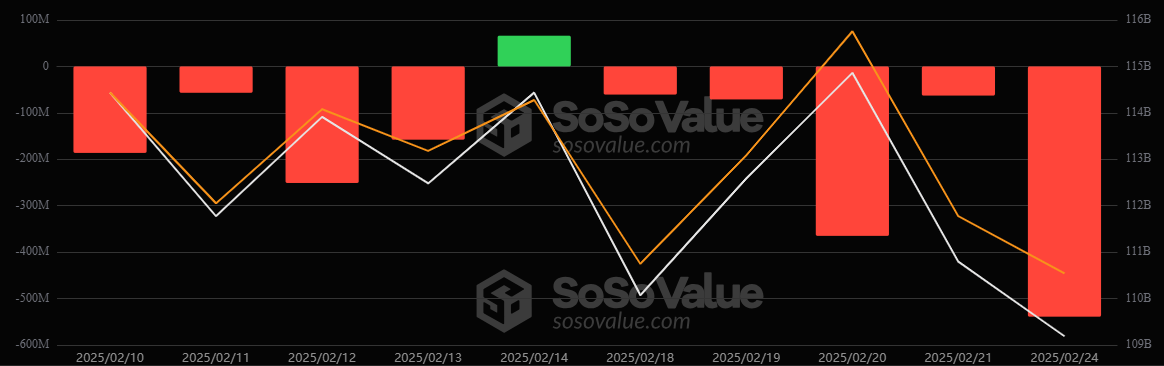

On Tuesday, Feb. 25, U.S. spot bitcoin ETFs experienced an unprecedented $1.01 billion in net outflows, marking the largest single-day withdrawal since their inception.

Data from Sosovalue showed that Fidelity’s FBTC led the mass exodus with a staggering $344.65 million withdrawn. BlackRock’s IBIT followed closely with $164.37 million in outflows, while Valkyrie’s BRRR reported $100.02 million exiting its fund.

Other notable outflows included Bitwise’s BITB at $88.3 million, Grayscale’s BTC with $85.76 million, and Franklin’s EZBC shedding $74.07 million. Grayscale’s GBTC and Invesco’s BTCO weren’t spared, experiencing outflows of $66.14 million and $62.01 million, respectively. WisdomTree’s BTWC and VanEck’s HODL also faced withdrawals of $17.3 million and $9.97 million.

Ether ETFs mirrored this downward trajectory, albeit on a smaller scale, with a collective net outflow of $50 million. Grayscale’s ETHE led the decline, losing $27.07 million, while Fidelity’s FETH saw $12.46 million withdrawn. Bitwise’s ETHW and Grayscale’s ETH reported outflows of $8.21 million and $2.35 million, respectively.

These significant outflows have markedly impacted the total net assets of crypto ETFs. Bitcoin ETFs’ total net assets have now decreased to $101.44 billion, while ether ETFs stand at $9.30 billion.

Despite the significant sell-off, crypto enthusiasts and analysts on X remain divided. On one side, the sell-off has been interpreted as a potential market bottom, suggesting that such capitulation events often precede price rebounds, while others view it as a sign of ongoing market pessimism.

A look at the overall market sentiment, as reflected by the Bitcoin Fear and Greed Index, is currently at ‘ Extreme Fear’ with BTC’s price hovering around $89,000, prompting debates on future price movements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。