Miracles do not bloom on easy paths. Perhaps behind all the choices that are not favored and not attempted, there are unseen possibilities and unknowns that have not been designed. The unknown instills fear, sparks curiosity, and thus proves your courage and builds your confidence. When there seems to be no way out, it forces you to soar, and that is the miracle!

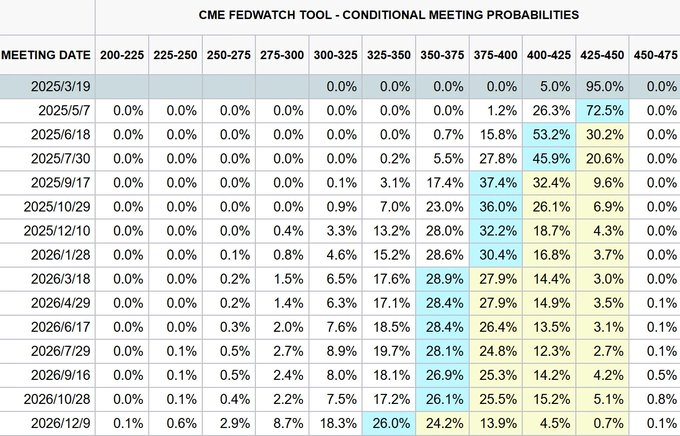

According to tools from the Chicago Mercantile Exchange, the interest rate market expects the Federal Reserve to possibly resume rate cuts in June and may cut rates again in September, betting on two more rate cuts within the year. Several reasons for the Federal Reserve's pause in rate cuts include: the core inflation rate is above the set target, and inflationary pressures remain high. "Economic data is performing strongly," at least based on the various publicly disclosed data. The goal of the Federal Reserve's rate cuts is certainly not to serve the world but to serve the recovery of the U.S. economy. The uncertainty of tariffs and Trump’s policies. After Trump took office, a series of policies were introduced, including new tariff policies, trade policies, and significant reforms in government efficiency. Especially regarding tariff policies, the Federal Reserve will only make more cautious decisions until stable expectations are established. The "temporary disappearance" of rate cut expectations will undoubtedly undermine market confidence, and the waiting time for the market may be prolonged. If there are subsequent developments regarding the passage of reserve legislation in the cryptocurrency space, then the impact on the market can still be anticipated. The more tension in the bow, the more forceful the arrow will be shot; currently, for ordinary people, there is really no better way, unless you directly liquidate and stop participating, then this round of market trends has nothing to do with you. Otherwise, apart from dollar-cost averaging and lying flat, you have no other choice!

From the current technical perspective, after a series of downward movements, the technical indicators at the large cycle level are showing signs of a death cross. The low point was refreshed again to around 82,200 early this morning, with the market experiencing a drop of over ten thousand points in recent days. Currently, the market is in a slight rebound phase after hitting the bottom, but the rebound strength has been relatively weak. From the perspective of a bottom rebound, combined with a certain bottom divergence pattern at the four-hour level, it would be best if the rebound could test the short-term resistance at the 90,000 position above. This would have a positive effect on the subsequent market trend, as the market indeed needs more confidence from the bulls at this stage. Additionally, from the perspective of previous market chips, the current position is basically in a weak chip area. In this region, liquidity is also under significant testing, and large-scale bullish movements are still quite difficult, requiring a longer waiting time.

In terms of operations, during the day, due to the demand for a rebound from oversold conditions, there is a high probability of a rebound occurring. Currently, there are two resistance levels: the smaller level around 86,000, and then up to the 90,000 level. Based on the current market sentiment, this can be used for short-term short positions.

After Ethereum's natural rebound yesterday, it spiked to around 2,250 in the evening. In the short term, the key for bulls and bears is at 2,400. If it does not break through, continue to short. If there is a significant breakthrough and pullback, then consider going long. Currently, the market background favors bearish sentiment, so prioritize short positions at this level.

In other altcoins, most cryptocurrencies have started to decouple from Bitcoin's decline, with some coins showing independent trends. Therefore, in this market, there are indeed many opportunities. For current altcoins, it is essential to identify quality coins and then hold them well.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow the public account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。