Correctly viewing the gains and losses in the gaming process, profit does not mean a high level, and loss does not mean being foolish. Being able to offset each other and continuously form positive growth is what we want. Just like in life, there will always be lows and highs. More importantly, you need to know where you are heading. Always remember: gains and losses come from the same source.

Hello everyone, I am trader Gege. Continuing from the last article, the price of Bitcoin has dropped to the entry price I have been thinking about for a long time. The short-term buy signal given in yesterday's article has already seen a rise of 2000-3000 dollars. The left side of the Bitcoin trend has already entered the market, with entries made in batches at 85000-84000-83000, and now we just need to wait for the market to validate. The following images show the recent trend and short-term suggestions mentioned in the articles.

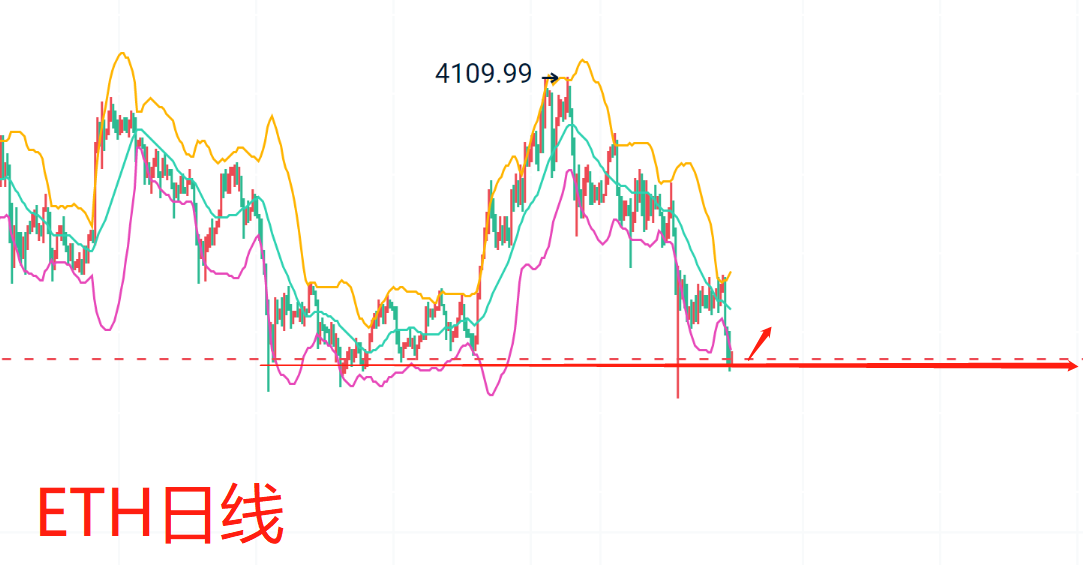

Today's article doesn't have much to say, just a simple discussion on the technical side. The daily level has seen consecutive bearish candles and is oversold, indicating a need for a rebound correction in technical indicators. The MACD double lines are below the zero axis, and there may be a prolonged period of wide fluctuations ahead. Only after the adjustment is complete can we start a bull market that sets historical highs. We need to look at the short-term resistance levels one by one: 89000-90000-92000-98000, so after entering the trend, more patience is required.

The current fear index is approaching the levels seen during the 22-year bear market and the 21-year 519 period, so Gege believes it is a good time to test the waters on the left side. I mentioned a long time ago that there is a need to fill the gap at 85000-83000. Since all estimates are in place, there is no reason not to execute. After execution, just wait for the results. Short-term and trend strategies differ in their operational methods. Currently, the short-term strategy for Bitcoin remains focused on buying the dips. For those following the trend in the article, please take care!

The short-term suggestion for Bitcoin is to buy at the 85000-84000 range, looking for a gain of 2000-3000 dollars. The short-term suggestion for Ethereum is to buy at the 2300-2270 range, looking for a gain of 80-150 dollars.

The suggestions are for reference only. Please manage your risk when entering the market, and control your profit and stop-loss spaces accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone continued success and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。